Strategi Dagangan Dual berasaskan MACD

Penulis:ChaoZhang, Tarikh: 2023-12-07 17:11:52Tag:

Ringkasan

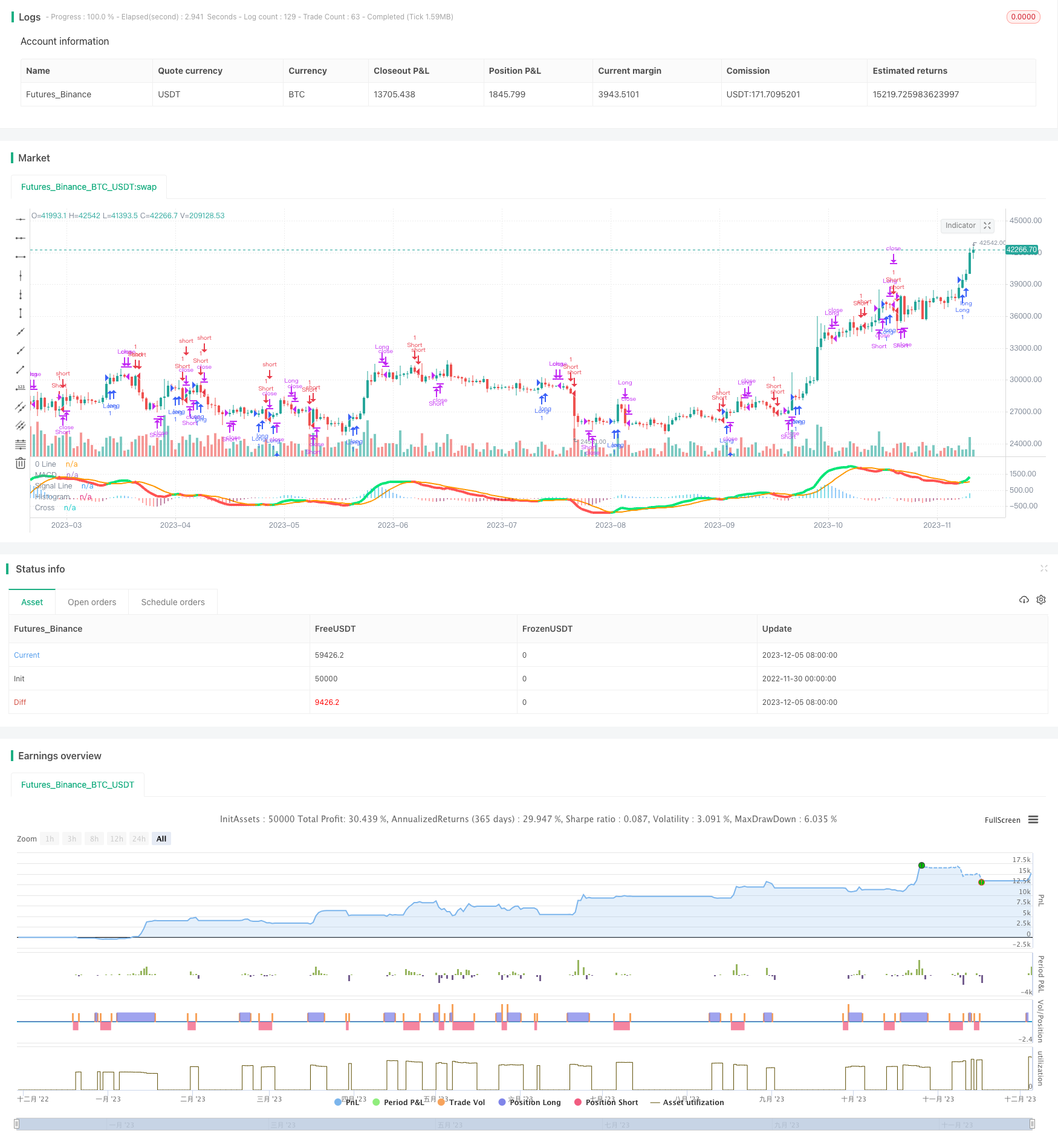

Strategi ini melaksanakan strategi perdagangan berganda berdasarkan penunjuk MACD. Ia boleh menjadi panjang apabila terdapat salib emas pada MACD dan menjadi pendek apabila terdapat salib kematian, dengan penapis tambahan berdasarkan penunjuk lain untuk menghapuskan beberapa isyarat yang tidak sah.

Prinsip Strategi

Inti strategi ini adalah menggunakan penunjuk MACD untuk merealisasikan perdagangan dua arah. Khususnya, ia mengira purata bergerak pantas, purata bergerak perlahan dan garis isyarat MACD. Apabila MA pantas melintasi MA perlahan, salib emas dihasilkan untuk pergi panjang. Apabila MA pantas melintasi di bawah MA perlahan, salib kematian dihasilkan untuk pergi pendek.

Untuk menapis beberapa isyarat yang tidak sah, strategi ini juga menetapkan julat ±30 sebagai penapis, supaya isyarat perdagangan hanya dicetuskan apabila histogram MACD melebihi julat ini.

Kelebihan

- Indikator MACD digunakan sebagai isyarat perdagangan utama yang sensitif terhadap pergerakan harga dalam kedua-dua arah

- Penapis tambahan membantu menghapuskan beberapa isyarat yang tidak sah

- Logik arah dua bar untuk menutup kedudukan mengelakkan beberapa pecah palsu ke tahap tertentu

Risiko

- Indikator MACD cenderung menghasilkan isyarat perdagangan yang kerap, yang membawa kepada kekerapan perdagangan yang tinggi

- Mengandalkan hanya satu penunjuk menjadikan strategi terdedah kepada kelewatan isyarat

- Logik penutupan berdasarkan arah histogram tidak cukup ketat, risiko kehilangan beberapa isyarat

Arahan pengoptimuman

- Pertimbangkan untuk menggabungkan dengan penunjuk lain untuk pengesahan isyarat, seperti KDJ, Bollinger Bands dll.

- Penyelidikan penunjuk yang lebih maju untuk menggantikan MACD, seperti KD

- Mengoptimumkan logik penutupan dengan menetapkan stop loss dan mengambil keuntungan untuk mengawal kerugian perdagangan tunggal

Kesimpulan

Ringkasnya, ini adalah strategi perdagangan dua arah yang pada dasarnya boleh dilaksanakan. Ia menggunakan kelebihan penunjuk MACD dan juga menambah beberapa penapis untuk mengawal kualiti isyarat. Walau bagaimanapun, MACD itu sendiri mempunyai beberapa masalah juga. Ujian dan pengoptimuman lanjut dalam perdagangan langsung masih diperlukan untuk menjadikan strategi lebih boleh dipercayai. Secara keseluruhan, strategi ini meletakkan asas untuk strategi perdagangan dua arah, dan dapat dioptimumkan lebih lanjut secara beransur-ansur untuk menjadi strategi perdagangan kuantitatif yang kuat.

]

/*backtest

start: 2022-11-30 00:00:00

end: 2023-12-06 00:00:00

period: 1d

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=3

//Created by user ChrisMoody updated 4-10-2014

//Regular MACD Indicator with Histogram that plots 4 Colors Based on Direction Above and Below the Zero Line

//Update allows Check Box Options, Show MacD & Signal Line, Show Change In color of MacD Line based on cross of Signal Line.

//Show Dots at Cross of MacD and Signal Line, Histogram can show 4 colors or 1, Turn on and off Histogram.

//Special Thanks to that incredible person in Tech Support whoem I won't say you r name so you don't get bombarded with emails

//Note the feature Tech Support showed me on how to set the default timeframe of the indicator to the chart Timeframe, but also allow you to choose a different timeframe.

//By the way I fully disclose that I completely STOLE the Dots at the MAcd Cross from "TheLark"

strategy("MACD Strategy", overlay=false)

// study(title="CM_MacD_Ult_MTF", shorttitle="CM_Ult_MacD_MTF")

source = close

useCurrentRes = input(true, title="Use Current Chart Resolution?")

resCustom = input(title="Use Different Timeframe? Uncheck Box Above", defval="60")

smd = input(true, title="Show MacD & Signal Line? Also Turn Off Dots Below")

sd = input(true, title="Show Dots When MacD Crosses Signal Line?")

sh = input(true, title="Show Histogram?")

macd_colorChange = input(true,title="Change MacD Line Color-Signal Line Cross?")

hist_colorChange = input(true,title="MacD Histogram 4 Colors?")

res = useCurrentRes ? timeframe.period : resCustom

fastLength = input(12, minval=1), slowLength=input(26,minval=1)

signalLength=input(9,minval=1)

fastMA = ema(source, fastLength)

slowMA = ema(source, slowLength)

macd = fastMA - slowMA

signal = sma(macd, signalLength)

hist = macd - signal

outMacD = request.security(syminfo.tickerid, res, macd)

outSignal = request.security(syminfo.tickerid, res, signal)

outHist = request.security(syminfo.tickerid, res, hist)

histA_IsUp = outHist > outHist[1] and outHist > 0

histA_IsDown = outHist < outHist[1] and outHist > 0

histB_IsDown = outHist < outHist[1] and outHist <= 0

histB_IsUp = outHist > outHist[1] and outHist <= 0

//MacD Color Definitions

macd_IsAbove = outMacD >= outSignal

macd_IsBelow = outMacD < outSignal

// strategy.entry("Long", strategy.long, 1, when = shouldPlaceLong)

// strategy.close("Long", shouldExitLong)

// strategy.entry("Short", strategy.short, 1, when = shouldPlaceShort)

// strategy.close("Short", shouldExitShort)

isWithinZeroMacd = outHist < 30 and outHist > -30

delta = hist

// shouldExitShort = false//crossover(delta, 0)

// shouldExitLong = false//crossunder(delta, 0)

// if(crossover(delta, 0))// and not isWithinZeroMacd)

// strategy.entry("Long", strategy.long, comment="Long")

// if (crossunder(delta, 0))// and not isWithinZeroMacd)

// strategy.entry("Short", strategy.short, comment="Short")

shouldPlaceLong = crossover(delta, 0)

strategy.entry("Long", strategy.long, 1, when = shouldPlaceLong)

shouldExitLong = not histA_IsUp and histA_IsDown

shouldExitShort = not histA_IsUp and not histA_IsDown and not histB_IsDown and histB_IsUp

shouldPlaceShort = crossunder(delta, 0)

strategy.entry("Short", strategy.short, 1, when = shouldPlaceShort)

// plot_color = gray

plot_color = if(hist_colorChange)

if(histA_IsUp)

aqua

else

if(histA_IsDown)

//need to sell

// if(not isWithinZeroMacd)

// shouldExitLong = true

// strategy.entry("Short", strategy.short, comment="Short")

blue

else

if(histB_IsDown)

red

else

if(histB_IsUp)

//need to buy

// if(not isWithinZeroMacd)

// shouldExitShort = true

// strategy.entry("Long", strategy.long, comment="Long")

maroon

else

yellow

else

gray

// plot_color = hist_colorChange ? histA_IsUp ? aqua : histA_IsDown ? blue : histB_IsDown ? red : histB_IsUp ? maroon :yellow :gray

macd_color = macd_colorChange ? macd_IsAbove ? lime : red : red

signal_color = macd_colorChange ? macd_IsAbove ? orange : orange : lime

circleYPosition = outSignal

plot(smd and outMacD ? outMacD : na, title="MACD", color=macd_color, linewidth=4)

plot(smd and outSignal ? outSignal : na, title="Signal Line", color=signal_color, style=line ,linewidth=2)

plot(sh and outHist ? outHist : na, title="Histogram", color=plot_color, style=histogram, linewidth=4)

plot(sd and cross(outMacD, outSignal) ? circleYPosition : na, title="Cross", style=circles, linewidth=4, color=macd_color)

// plot( isWithinZeroMacd ? outHist : na, title="CheckSmallHistBars", style=circles, linewidth=4, color=black)

hline(0, '0 Line', linewidth=2, color=white)

strategy.close("Short", shouldExitShort)

strategy.close("Long", shouldExitLong)

// fastLength = input(12)

// slowlength = input(26)

// MACDLength = input(9)

// MACD = ema(close, fastLength) - ema(close, slowlength)

// aMACD = ema(MACD, MACDLength)

// delta = MACD - aMACD

// if (crossover(delta, 0))

// strategy.entry("MacdLE", strategy.long, comment="MacdLE")

//if last two macd bars are higher than current, close long position

// if (crossunder(delta, 0))

// strategy.entry("MacdSE", strategy.short, comment="MacdSE")

//if last two macd bars are higher than current, close long position

// plot(strategy.equity, title="equity", color=red, linewidth=2, style=areabr)

- Strategi Dagangan Pembalikan Dasar Kuantitatif Pintar

- Bollinger + RSI Strategi Ganda (Hanya Lama) v1.2

- CCI Zero Cross Trading Strategy

- Strategi Penembusan Peralihan Harga Purata Bergerak Berganda

- Strategi Perdagangan Pullback Purata Bergerak

- Pergerakan purata agregasi Williams Komersial Bid-Ask Tekanan Indikator Strategi

- Strategi Pengesanan Pembalikan Purata Bergerak Berganda

- Strategi agregasi purata bergerak MACD

- Strategi EMAskeleton

- Strategi Dagangan Kuantitatif Berdasarkan Nombor Rawak

- Parabolik SAR dan CCI Strategi dengan EMA Exit untuk Perdagangan Emas

- EMA Momentum Moving Average Crossover Strategi

- Camarilla Pivot Points Penembusan dan Pembalikan Momentum Strategi Golden Cross

- Saluran Donchian Dengan Strategi Stop Loss Trailing

- Trend Osilator Vortex Mengikut Strategi

- Strategi Perdagangan Titik Pivot Intraday

- Comb Reverse EMA Volume Weighting Optimization Strategi Dagangan

- Fibonacci Zon DCA Strategi

- Strategi Pembalikan Trend Bollinger Bands

- Strategi Dagangan Kuantitatif Berasaskan StochRSI