Strategi Gabungan 123 Pembalikan dan Titik Pivot

Penulis:ChaoZhang, Tarikh: 2024-01-16 15:48:44Tag:

Ringkasan

Strategi ini menggabungkan strategi corak pembalikan 123 dan strategi titik pusingan untuk mencapai kadar kemenangan yang lebih tinggi. Strategi corak pembalikan 123 mengenal pasti titik pembalikan trend, sementara strategi titik pusingan menentukan tahap sokongan dan rintangan utama. Dengan menggabungkan keduanya, ia dapat menangkap trend sambil mengenal pasti harga kemasukan dan keluar tertentu.

Logika Strategi

123 Strategi corak pembalikan

Strategi ini mengenal pasti titik pembalikan trend menggunakan penunjuk Stochastic Oscillator. Ia pergi lama apabila harga penutupan lebih tinggi daripada penutupan sebelumnya selama 2 hari berturut-turut dan STO perlahan 9 tempoh adalah di bawah 50; Ia pergi pendek apabila harga penutupan lebih rendah daripada penutupan sebelumnya selama 2 hari berturut-turut dan STO cepat 9 tempoh adalah di atas 50.

Strategi Titik Pivot

Strategi ini mengira 3 tahap sokongan dan 3 tahap rintangan berdasarkan harga tinggi, rendah dan dekat hari sebelumnya.

Titik Pivot = (tinggi + rendah + dekat) / 3

Sokongan 1 = 2Titik Pivot

Kelebihan

- Menggabungkan kekuatan dua jenis strategi yang berbeza untuk mencapai kadar kemenangan yang lebih tinggi

- corak 123 berkesan mengenal pasti pembalikan trend jangka pendek

- Titik pusingan menggunakan tahap S / R utama untuk menapis pecah palsu

Risiko dan lindung nilai

- STO berganda mungkin tertinggal dan terlepas pembalikan jangka pendek

- Titik pusingan mungkin tidak sentiasa memegang, breakouts boleh terus

- Parameter boleh diselaraskan atau digabungkan dengan penunjuk lain untuk lindung nilai risiko

Arahan pengoptimuman

- Kesan ujian set parameter yang berbeza

- Gabungkan dengan penunjuk/pola lain untuk meningkatkan prestasi

- Menggabungkan pembelajaran mesin untuk mengoptimumkan parameter secara dinamik

Ringkasan

Strategi ini dengan bijak menggabungkan pengenalan trend dan tahap harga utama, yang membolehkannya untuk melihat pembalikan sambil menggunakan S / R untuk menapis isyarat. Penambahbaikan lanjut boleh dibuat melalui penyesuaian parameter dan kombinasi dengan strategi lain.

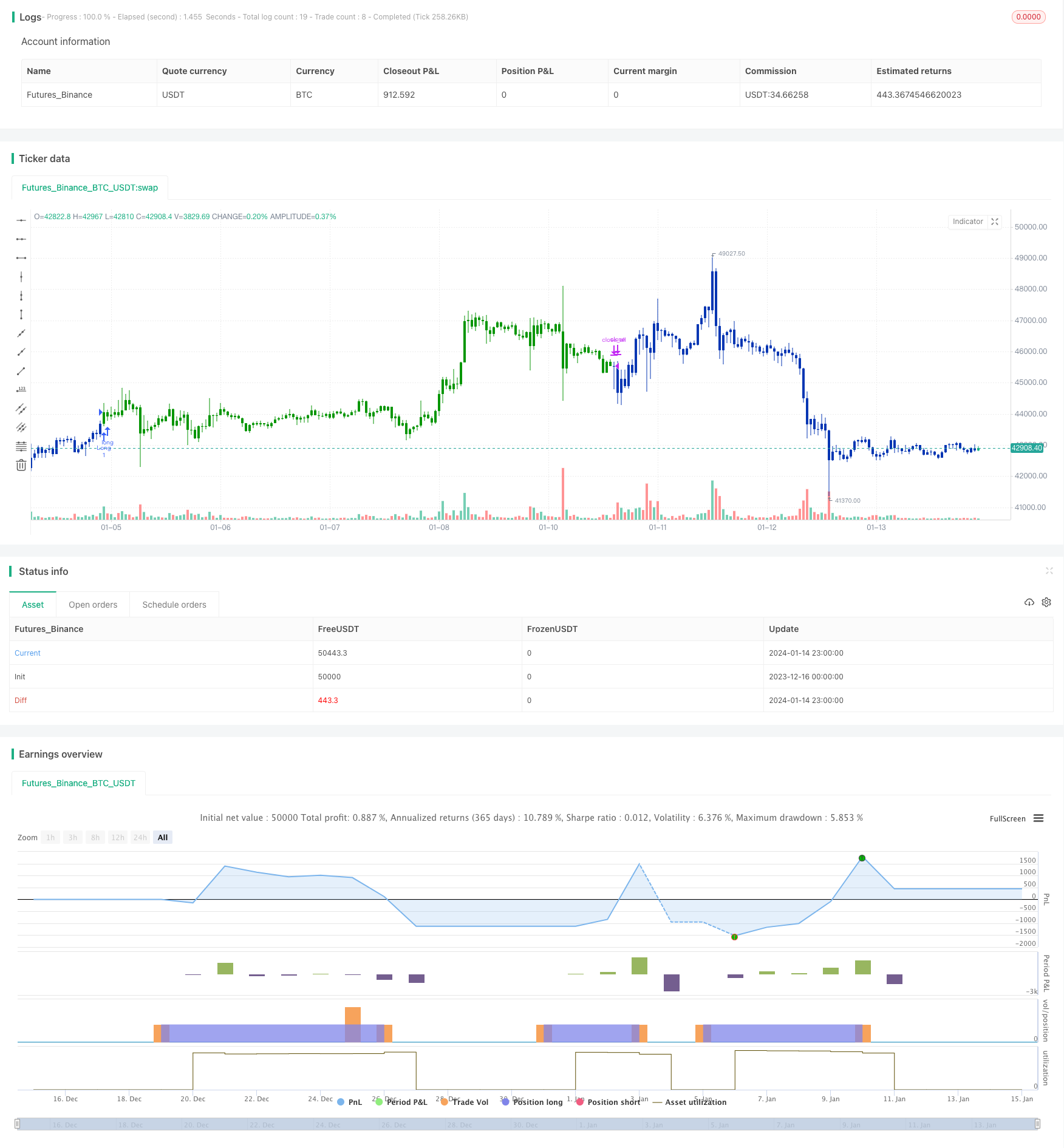

/*backtest

start: 2023-12-16 00:00:00

end: 2024-01-15 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=4

////////////////////////////////////////////////////////////

// Copyright by HPotter v1.0 21/04/2021

// This is combo strategies for get a cumulative signal.

//

// First strategy

// This System was created from the Book "How I Tripled My Money In The

// Futures Market" by Ulf Jensen, Page 183. This is reverse type of strategies.

// The strategy buys at market, if close price is higher than the previous close

// during 2 days and the meaning of 9-days Stochastic Slow Oscillator is lower than 50.

// The strategy sells at market, if close price is lower than the previous close price

// during 2 days and the meaning of 9-days Stochastic Fast Oscillator is higher than 50.

//

// Second strategy

// Pivot points simply took the high, low, and closing price from the previous period and

// divided by 3 to find the pivot. From this pivot, traders would then base their

// calculations for three support, and three resistance levels. The calculation for the most

// basic flavor of pivot points, known as ‘floor-trader pivots’, along with their support and

// resistance levels.

//

// WARNING:

// - For purpose educate only

// - This script to change bars colors.

////////////////////////////////////////////////////////////

Reversal123(Length, KSmoothing, DLength, Level) =>

vFast = sma(stoch(close, high, low, Length), KSmoothing)

vSlow = sma(vFast, DLength)

pos = 0.0

pos := iff(close[2] < close[1] and close > close[1] and vFast < vSlow and vFast > Level, 1,

iff(close[2] > close[1] and close < close[1] and vFast > vSlow and vFast < Level, -1, nz(pos[1], 0)))

pos

PP2(res,SellFrom,BuyFrom) =>

pos = 0.0

xHigh = security(syminfo.tickerid,res, high)

xLow = security(syminfo.tickerid,res, low)

xClose = security(syminfo.tickerid,res, close)

vPP = (xHigh+xLow+xClose) / 3

vS1 = 2*vPP - xHigh

vR1 = 2*vPP-xLow

vS2 = vPP - (vR1 - vS1)

vR2 = vPP + (vR1 - vS1)

vS3 = xLow - 2 * (xHigh - vPP)

vR3 = xHigh + 2 * (vPP - xLow)

S = iff(BuyFrom == "S1", vS1,

iff(BuyFrom == "S2", vS2,

iff(BuyFrom == "S3", vS3,0)))

B = iff(SellFrom == "R1", vR1,

iff(SellFrom == "R2", vR2,

iff(SellFrom == "R3", vR3,0)))

pos := iff(close > B, 1,

iff(close < S, -1, nz(pos[1], 0)))

pos

strategy(title="Combo Backtest 123 Reversal & Pivot Point V2)", shorttitle="Combo", overlay = true)

line1 = input(true, "---- 123 Reversal ----")

Length = input(14, minval=1)

KSmoothing = input(1, minval=1)

DLength = input(3, minval=1)

Level = input(50, minval=1)

//-------------------------

line2 = input(true, "---- Pivot Point V2 ----")

res = input(title="Resolution", type=input.resolution, defval="D")

SellFrom = input(title="Sell from ", defval="R1", options=["R1", "R2", "R3"])

BuyFrom = input(title="Buy from ", defval="S1", options=["S1", "S2", "S3"])

reverse = input(false, title="Trade reverse")

posReversal123 = Reversal123(Length, KSmoothing, DLength, Level)

posPP2 = PP2(res,SellFrom,BuyFrom)

pos = iff(posReversal123 == 1 and posPP2 == 1 , 1,

iff(posReversal123 == -1 and posPP2 == -1, -1, 0))

possig = iff(reverse and pos == 1, -1,

iff(reverse and pos == -1 , 1, pos))

if (possig == 1 )

strategy.entry("Long", strategy.long)

if (possig == -1 )

strategy.entry("Short", strategy.short)

if (possig == 0)

strategy.close_all()

barcolor(possig == -1 ? #b50404: possig == 1 ? #079605 : #0536b3 )

- Pergerakan purata dan Super Trend Tracking Stop Loss Strategy

- Strategi Saluran Regresi Linear

- Strategi Dagangan Gabungan Berdasarkan EMA Berganda dan Penapis Bandpass

- Trend Tracking Trailing Stop Strategi

- Strategi Ujian Kembali Pembalikan Kunci

- Strategi Dagangan Crossover Purata Bergerak Segitiga

- Strategi Dagangan Kuantitatif Berdasarkan Purata Bergerak

- Trend Mengikuti Strategi Berdasarkan Tindakan Harga dan Volume

- Ichimoku Kinko Hyo Strategi Pencegahan

- Strategi Trend Momentum ADX

- Strategi Dagangan Gabungan RSI Moving Average dan Stochastic

- Strategi Pembalikan Trend Pengesanan Dinamik

- Strategi harian DCA dengan menyentuh EMA

- Trend Kekuatan mengesahkan Bar Strategi

- Strategi purata bergerak berganda Super Trend

- Strategi Dagangan Swing Berasaskan WaveTrend dan DER

- Hull Fisher Adaptive Pintar Multi-faktor Strategi

- Strategi Pengukuran Posisi Dinamis Berdasarkan Lorong Ekuiti

- Strategi Pengesanan Trend Berganda

- Strategi Perdagangan Grid Pintar Beradaptasi