Gambaran keseluruhan

Strategi ini adalah sistem perdagangan bertingkat berdasarkan momentum dan trend. Ia mengenal pasti peluang berbilang peluang yang berkemungkinan tinggi dengan menggabungkan Indeks Williams Shark, Indeks Williams Split, Indeks Magic Shock (AO) dan Indeks Moving Average (EMA). Strategi ini menggunakan mekanisme pelaburan bertingkat dana, meningkatkan kedudukan secara beransur-ansur apabila trend meningkat, dan maksimum 5 kedudukan boleh dipegang pada masa yang sama, dengan setiap kedudukan menggunakan 10% dana.

Prinsip Strategi

Strategi menggunakan mekanisme penapisan berganda untuk memastikan ketepatan arah perdagangan. Pertama, melalui EMA untuk membuat keputusan mengenai trend jangka panjang, mencari peluang untuk melakukan lebih banyak hanya apabila harga berada di atas EMA. Kedua, melalui kombinasi William’s Shark Indicator dan Segmentation untuk menilai trend jangka pendek, dan mengesahkan trend naik apabila pecah Segmentation berlaku di atas garis gigi Shark.

Kelebihan Strategik

- Mekanisme penapisan berlapis berkesan mengurangkan gangguan isyarat palsu

- Sains Pengurusan Wang, Menggunakan Kaedah Peningkatan Peranan Beransur-ansur

- Ciri trend-following membolehkan ia menangkap trend besar

- Tidak ada stop loss tetap, tetapi menilai pergerakan trend melalui penunjuk teknikal

- Sistem ini mempunyai konfigurasi yang baik untuk menyesuaikan parameter mengikut keadaan pasaran yang berbeza

- Hasil kajian menunjukkan bahawa terdapat faktor keuntungan yang baik dan pendapatan purata.

Risiko Strategik

- Isyarat palsu berkesinambungan mungkin muncul dalam pasaran yang bergolak

- Anjakan yang lebih besar mungkin berlaku apabila arah aliran berbalik

- Keadaan penapisan berganda boleh menyebabkan beberapa peluang perdagangan terlepas

- Pengurusan wang: Peningkatan terus-menerus boleh membawa risiko semasa turun naik yang teruk

- Pilihan parameter EMA mempunyai kesan besar terhadap prestasi strategi

Untuk mengurangkan risiko ini, disyorkan untuk:

- Mengoptimumkan parameter dalam keadaan pasaran yang berbeza

- Pertimbangkan untuk menambah penapis kadar turun naik

- Menetapkan syarat-syarat tambahan yang lebih ketat

- Tetapkan had pengeluaran maksimum

Arah pengoptimuman strategi

- Memperkenalkan penapis kadar turun naik untuk ATR

- Tambah analisis volum dagangan untuk meningkatkan kebolehpercayaan isyarat

- Membangunkan mekanisme penyesuaian parameter dinamik

- Memperbaiki mekanisme penangguhan untuk menamatkan keuntungan tepat pada masanya apabila trend melemah

- Tambah modul pengenalan status pasaran, menggunakan parameter yang berbeza dalam persekitaran pasaran yang berbeza

ringkaskan

Ini adalah strategi trend-tracking yang direka dengan munasabah, dengan penggunaan gabungan pelbagai petunjuk teknikal, dengan jaminan keselamatan, prestasi keuntungan yang baik dicapai. Inovasi strategi adalah mekanisme pengesahan trend bertingkat dan kaedah pengurusan dana yang beransur-ansur. Walaupun terdapat beberapa tempat yang perlu dioptimumkan, secara keseluruhan sistem perdagangan yang patut dicuba.

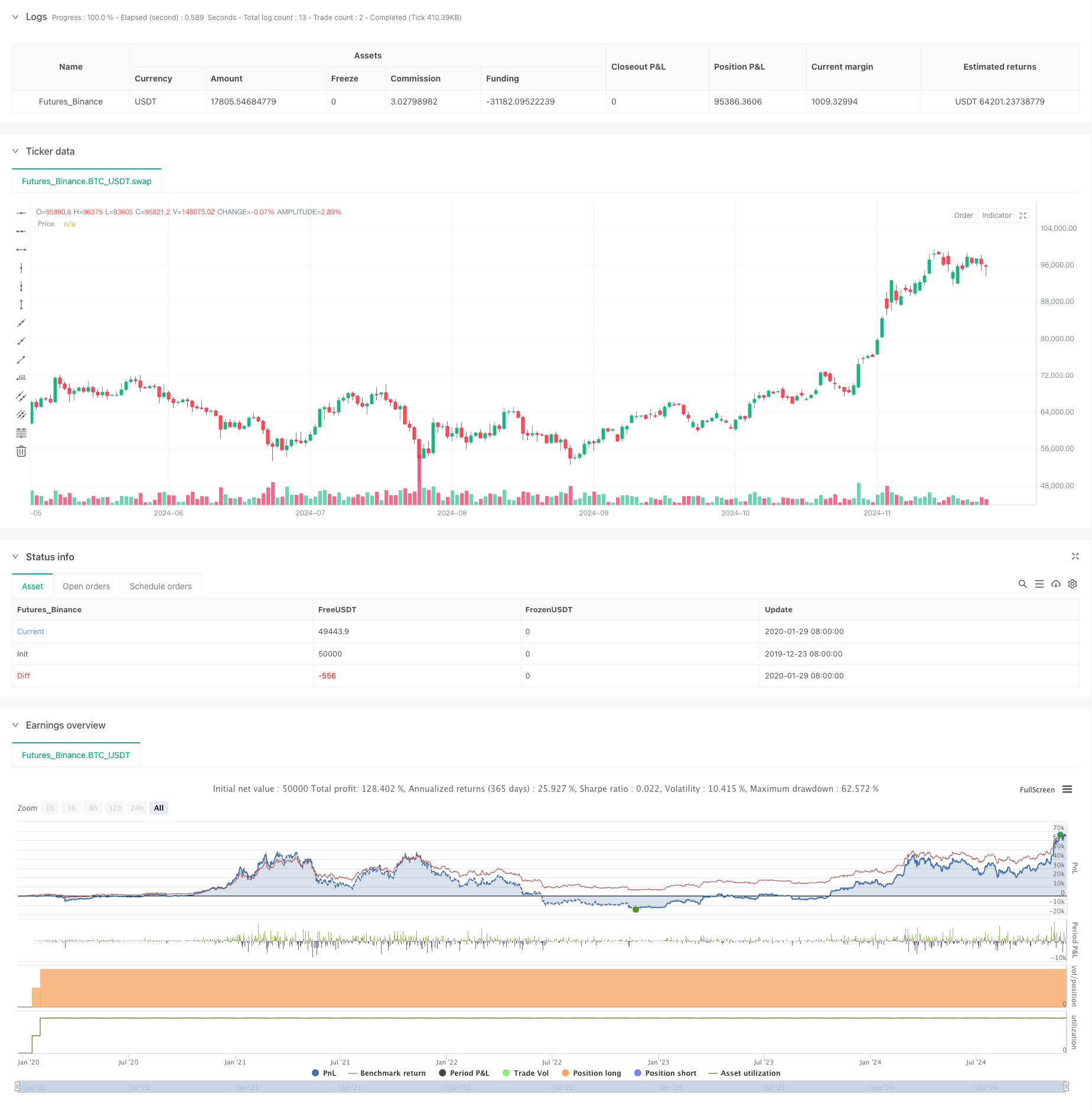

/*backtest

start: 2019-12-23 08:00:00

end: 2024-12-04 00:00:00

period: 1d

basePeriod: 1d

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This Pine Script™ code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © Skyrexio

//@version=6

//_______ <licence>

strategy(title = "MultiLayer Awesome Oscillator Saucer Strategy [Skyrexio]",

shorttitle = "AO Saucer",

overlay = true,

format = format.inherit,

pyramiding = 5,

calc_on_order_fills = false,

calc_on_every_tick = false,

default_qty_type = strategy.percent_of_equity,

default_qty_value = 10,

initial_capital = 10000,

currency = currency.NONE,

commission_type = strategy.commission.percent,

commission_value = 0.1,

slippage = 5,

use_bar_magnifier = true)

//_______ <constant_declarations>

var const color skyrexGreen = color.new(#2ECD99, 0)

var const color skyrexGray = color.new(#F2F2F2, 0)

var const color skyrexWhite = color.new(#FFFFFF, 0)

//________<variables declarations>

var int trend = 0

var float upFractalLevel = na

var float upFractalActivationLevel = na

var float downFractalLevel = na

var float downFractalActivationLevel = na

var float saucerActivationLevel = na

bool highCrossesUpfractalLevel = ta.crossover(high, upFractalActivationLevel)

bool lowCrossesDownFractalLevel = ta.crossunder(low, downFractalActivationLevel)

var int signalsQtyInRow = 0

//_______ <inputs>

// Trading bot settings

sourceUuid = input.string(title = "sourceUuid:", defval = "yourBotSourceUuid", group = "🤖Trading Bot Settings🤖")

secretToken = input.string(title = "secretToken:", defval = "yourBotSecretToken", group = "🤖Trading Bot Settings🤖")

// Trading period settings

lookBackPeriodStart = input(title = "Trade Start Date/Time", defval = timestamp('2023-01-01T00:00:00'), group = "🕐Trading Period Settings🕐")

lookBackPeriodStop = input(title = "Trade Stop Date/Time", defval = timestamp('2025-01-01T00:00:00'), group = "🕐Trading Period Settings🕐")

// Strategy settings

EMaLength = input.int(100, minval = 10, step = 10, title = "EMA Length", group = "📈Strategy settings📈")

//_______ <function_declarations>

//@function Used to calculate Simple moving average for Alligator

//@param src Sourse for smma Calculations

//@param length Number of bars to calculate smma

//@returns The calculated smma value

smma(src, length) =>

var float smma = na

sma_value = ta.sma(src, length)

smma := na(smma) ? sma_value : (smma * (length - 1) + src) / length

smma

//_______ <calculations>

//Upfractal calculation

upFractalPrice = ta.pivothigh(2, 2)

upFractal = not na(upFractalPrice)

//Downfractal calculation

downFractalPrice = ta.pivotlow(2, 2)

downFractal = not na(downFractalPrice)

//Calculating Alligator's teeth

teeth = smma(hl2, 8)[5]

//Calculating upfractal and downfractal levels

if upFractal

upFractalLevel := upFractalPrice

else

upFractalLevel := upFractalLevel[1]

if downFractal

downFractalLevel := downFractalPrice

else

downFractalLevel := downFractalLevel[1]

//Calculating upfractal activation level, downfractal activation level to approximate the trend and this current trend

if upFractalLevel > teeth

upFractalActivationLevel := upFractalLevel

if highCrossesUpfractalLevel

trend := 1

upFractalActivationLevel := na

downFractalActivationLevel := downFractalLevel

if downFractalLevel < teeth

downFractalActivationLevel := downFractalLevel

if lowCrossesDownFractalLevel

trend := -1

downFractalActivationLevel := na

upFractalActivationLevel := upFractalLevel

if trend == 1

upFractalActivationLevel := na

if trend == -1

downFractalActivationLevel := na

//Calculating filter EMA

filterEMA = ta.ema(close, EMaLength)

//Сalculating AO saucer signal

ao = ta.sma(hl2,5) - ta.sma(hl2,34)

diff = ao - ao[1]

saucerSignal = ao > ao[1] and ao[1] < ao[2] and ao > 0 and ao[1] > 0 and ao[2] > 0 and trend == 1 and close > filterEMA

//Calculating sauser activation level

if saucerSignal

saucerActivationLevel := high

else

saucerActivationLevel := saucerActivationLevel[1]

if not na(saucerActivationLevel[1]) and high < saucerActivationLevel[1] and diff > 0

saucerActivationLevel := high

saucerSignal := true

if (high > saucerActivationLevel[1] and not na(saucerActivationLevel)) or diff < 0

saucerActivationLevel := na

//Calculating number of valid saucer signal in current trading cycle

if saucerSignal and not saucerSignal[1]

signalsQtyInRow := signalsQtyInRow + 1

if not na(saucerActivationLevel[1]) and diff < 0 and na(saucerActivationLevel) and not (strategy.opentrades[1] <= strategy.opentrades - 1)

signalsQtyInRow := signalsQtyInRow - 1

if trend == -1 and trend[1] == 1

signalsQtyInRow := 0

//_______ <strategy_calls>

//Defining trade close condition

closeCondition = trend[1] == 1 and trend == -1

//Cancel stop buy order if current Awesome oscillator column lower, than prevoius

if diff < 0

strategy.cancel_all()

//Strategy entry

if (signalsQtyInRow == 1 and not na(saucerActivationLevel))

strategy.entry(id = "entry1", direction = strategy.long, stop = saucerActivationLevel + syminfo.mintick, alert_message = '{\n"base": "' + syminfo.basecurrency + '",\n"quote": "' + syminfo.currency + '",\n"position": "entry1",\n"price": "' + str.tostring(close) + '",\n"sourceUuid": "' + sourceUuid + '",\n"secretToken": "' + secretToken + '",\n"timestamp": "' + str.tostring(timenow) + '"\n}')

if (signalsQtyInRow == 2 and not na(saucerActivationLevel))

strategy.entry(id = "entry2", direction = strategy.long, stop = saucerActivationLevel + syminfo.mintick, alert_message = '{\n"base": "' + syminfo.basecurrency + '",\n"quote": "' + syminfo.currency + '",\n"position": "entry2",\n"price": "' + str.tostring(close) + '",\n"sourceUuid": "' + sourceUuid + '",\n"secretToken": "' + secretToken + '",\n"timestamp": "' + str.tostring(timenow) + '"\n}')

if (signalsQtyInRow == 3 and not na(saucerActivationLevel))

strategy.entry(id = "entry3", direction = strategy.long, stop = saucerActivationLevel + syminfo.mintick, alert_message = '{\n"base": "' + syminfo.basecurrency + '",\n"quote": "' + syminfo.currency + '",\n"position": "entry3",\n"price": "' + str.tostring(close) + '",\n"sourceUuid": "' + sourceUuid + '",\n"secretToken": "' + secretToken + '",\n"timestamp": "' + str.tostring(timenow) + '"\n}')

if (signalsQtyInRow == 4 and not na(saucerActivationLevel))

strategy.entry(id = "entry4", direction = strategy.long, stop = saucerActivationLevel + syminfo.mintick, alert_message = '{\n"base": "' + syminfo.basecurrency + '",\n"quote": "' + syminfo.currency + '",\n"position": "entry4",\n"price": "' + str.tostring(close) + '",\n"sourceUuid": "' + sourceUuid + '",\n"secretToken": "' + secretToken + '",\n"timestamp": "' + str.tostring(timenow) + '"\n}')

if (signalsQtyInRow == 5 and not na(saucerActivationLevel))

strategy.entry(id = "entry5", direction = strategy.long, stop = saucerActivationLevel + syminfo.mintick, alert_message = '{\n"base": "' + syminfo.basecurrency + '",\n"quote": "' + syminfo.currency + '",\n"position": "entry5",\n"price": "' + str.tostring(close) + '",\n"sourceUuid": "' + sourceUuid + '",\n"secretToken": "' + secretToken + '",\n"timestamp": "' + str.tostring(timenow) + '"\n}')

//Strategy exit

if (closeCondition)

strategy.close_all(alert_message = '{\n"base": "' + syminfo.basecurrency + '",\n"quote": "' + syminfo.currency + '",\n"position": "close",\n"price": "' + str.tostring(close) + '",\n"sourceUuid": "' + sourceUuid + '",\n"secretToken": "' + secretToken + '",\n"timestamp": "' + str.tostring(timenow) + '"\n}')

//_______ <visuals>

//Plotting shapes for adding to current long trades

gradPercent = if strategy.opentrades == 2

90

else if strategy.opentrades == 3

80

else if strategy.opentrades == 4

70

else if strategy.opentrades == 5

60

pricePlot = plot(close, title="Price", color=color.new(color.blue, 100))

teethPlot = plot(strategy.opentrades > 1 ? teeth : na, title="Teeth", color= skyrexGreen, style=plot.style_linebr, linewidth = 2)

fill(pricePlot, teethPlot, color = color.new(skyrexGreen, gradPercent))

if strategy.opentrades != 1 and strategy.opentrades[1] == strategy.opentrades - 1

label.new(bar_index, teeth, style = label.style_label_up, color = color.lime, size = size.tiny, text="Buy More", textcolor = color.black, text_formatting = text.format_bold)

//_______ <alerts>