Gambaran keseluruhan

Strategi ini adalah sistem perdagangan yang mengikuti trend yang menggabungkan pelbagai purata bergerak ((SMA) dan penunjuk rawak ((KDJ)). Dengan menetapkan jarak harga dan keadaan penilaian trend, perdagangan dilakukan apabila trend pasaran jelas. Strategi ini menggunakan mekanisme berhenti rugi dinamik, menyesuaikan pengurusan pegangan mengikut pergerakan pasaran, melindungi keuntungan dan tidak keluar terlalu awal.

Prinsip Strategi

Strategi ini berdasarkan komponen teras berikut:

- Sistem dua hala: menggunakan 19 kitaran dan 74 kitaran SMA sebagai alat penilaian trend

- Julat harga: Bahagikan julat harga kepada 5 peringkat untuk menilai kekuatan dan kelemahan pasaran

- Indikator rawak: menggunakan 60 kitaran penunjuk rawak untuk membuat keputusan overbought dan oversold

- Pengesahan trend: menilai trend yang berterusan melalui pergerakan 3 garis K berturut-turut

- Syarat kemasukan: harga menembusi 74 kitaran SMA dan berada dalam julat harga yang sesuai

- Mekanisme Stop Loss: Menggunakan Stop Loss Tracking, Keluar Dari Perlawanan Apabila Trend Berubah

Kelebihan Strategik

- Integriti Sistem: Menggabungkan trend tracking dan indikator momentum untuk memberikan analisis pasaran yang menyeluruh

- Pengurusan risiko: Menggunakan pelbagai mekanisme hentian, termasuk hentian keras dan hentian yang dikesan

- Ketabahan: menyesuaikan diri dengan keadaan pasaran yang berbeza dengan menyesuaikan parameter

- Trend Capture: Mengambil Trend Jangka Menengah dan Jangka Panjang dan Mengelakkan Isyarat Palsu

- Pengurusan pegangan: menyesuaikan pegangan mengikut keadaan pasaran yang dinamik, meningkatkan kecekapan penggunaan dana

Risiko Strategik

- Risiko pasaran goyah: Peluang perdagangan yang kerap berlaku di pasaran setapak

- Risiko tergelincir: kemungkinan tergelincir yang lebih besar dalam keadaan pantas

- Kepekaan parameter: Kombinasi parameter yang berbeza boleh membawa kepada perbezaan besar dalam prestasi strategi

- Ketergantungan kepada keadaan pasaran: strategi yang lebih baik dalam pasaran yang menunjukkan trend

- Risiko pengurusan dana: Operasi penuh mungkin membawa risiko pengeluaran yang lebih besar

Arah pengoptimuman strategi

- Memperkenalkan penunjuk kadar turun naik: Pertimbangkan untuk menambah penunjuk ATR untuk menyesuaikan kedudukan hentian secara dinamik

- Optimumkan masa kemasukan: anda boleh menambah pengesahan jumlah pesanan untuk meningkatkan ketepatan kemasukan

- Pengurusan wang yang lebih baik: Cadangan untuk menambah modul pengurusan kedudukan, menyesuaikan kedudukan mengikut dinamik risiko

- Menambah penilaian keadaan pasaran: penapis isyarat perdagangan dengan penambahan penunjuk kekuatan trend

- Peningkatan mekanisme hentian kerugian: peratusan pengesanan hentian kerugian boleh dipertimbangkan untuk meningkatkan fleksibiliti

ringkaskan

Strategi ini membina sistem perdagangan yang lengkap dengan gabungan pelbagai petunjuk teknikal, dengan keupayaan untuk mengesan trend yang baik dan mekanisme pengurusan risiko. Walaupun mungkin menghadapi cabaran dalam keadaan pasaran tertentu, dengan pengoptimuman dan penyempurnaan yang berterusan, strategi ini dijangka dapat mengekalkan prestasi yang stabil dalam keadaan pasaran yang berbeza.

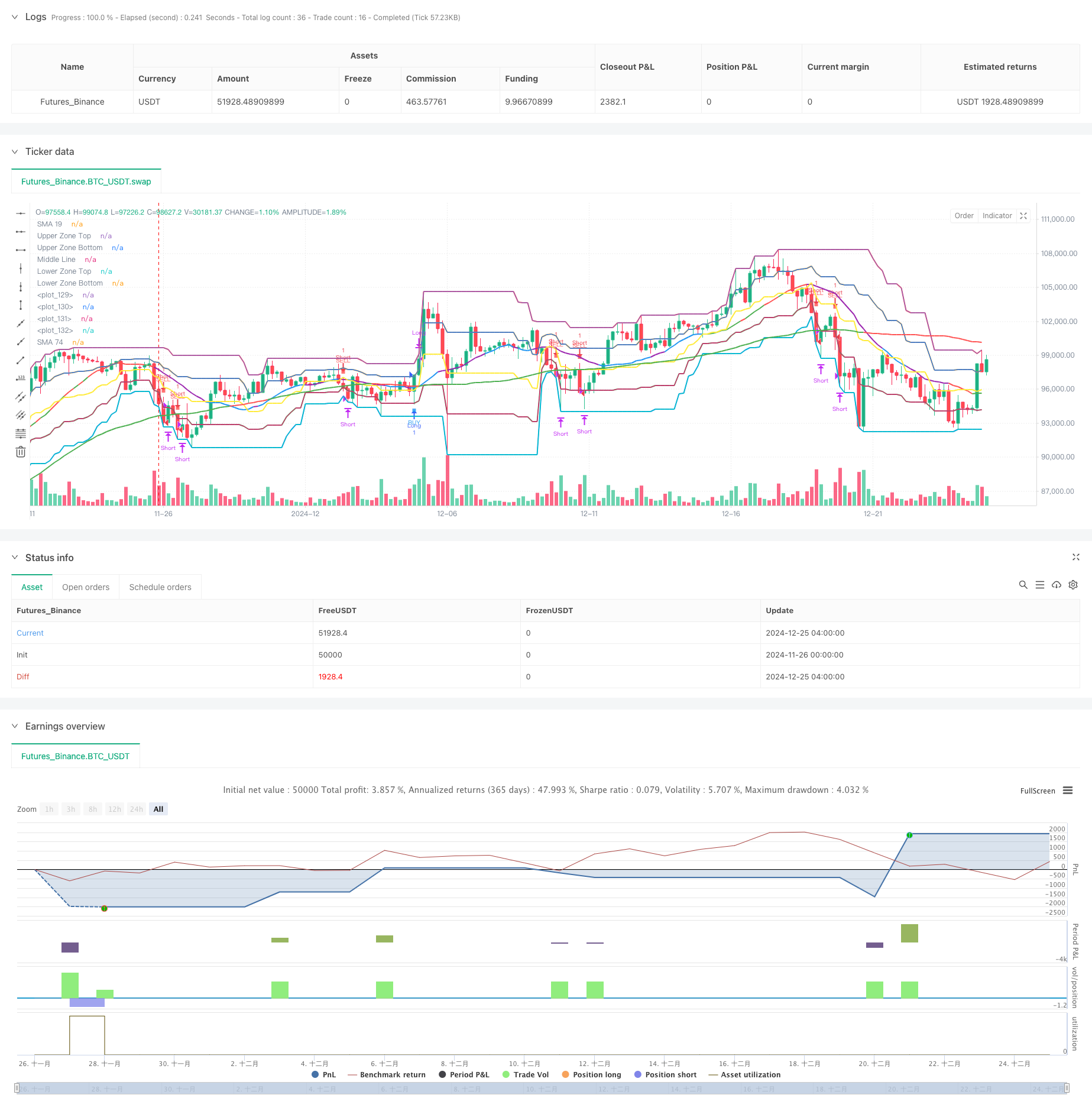

/*backtest

start: 2024-11-26 00:00:00

end: 2024-12-25 08:00:00

period: 4h

basePeriod: 4h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("Purple SMA Strategy", overlay=true)

// === INPUTS ===

zoneLength = input.int(20, "Price Zone Length", minval=5)

tickSize = input.float(1.0, "Tick Size for Hard Stop")

hardStopTicks = input.int(50, "Hard Stop Loss in Ticks")

// === CALCULATE ZONES ===

h = ta.highest(high, zoneLength)

l = ta.lowest(low, zoneLength)

priceRange = h - l

lvl5 = h

lvl4 = l + (priceRange * 0.75) // Orange line

lvl3 = l + (priceRange * 0.50) // Yellow line

lvl2 = l + (priceRange * 0.25) // Green line

lvl1 = l

// === INDICATORS ===

sma19 = ta.sma(close, 19)

sma74 = ta.sma(close, 74)

// === CANDLE COLOR CONDITIONS ===

isGreenCandle = close > open

isRedCandle = close < open

// === CONTINUOUS TREND DETECTION ===

isThreeGreenCandles = close > open and close[1] > open[1] and close[2] > open[2]

isThreeRedCandles = close < open and close[1] < open[1] and close[2] < open[2]

var bool inGreenTrend = false

var bool inRedTrend = false

// Update trends

if isThreeGreenCandles

inGreenTrend := true

inRedTrend := false

if isThreeRedCandles

inRedTrend := true

inGreenTrend := false

if (inGreenTrend and isRedCandle) or (inRedTrend and isGreenCandle)

inGreenTrend := false

inRedTrend := false

// === STOCHASTIC CONDITIONS ===

k = ta.stoch(close, high, low, 60)

d = ta.sma(k, 10)

isOverbought = d >= 80

isOversold = d <= 20

stochUp = d > d[1]

stochDown = d < d[1]

// === SMA COLOR LOGIC ===

sma19Color = if isOverbought and stochUp

color.green

else if isOverbought and stochDown

color.red

else if isOversold and stochUp

color.green

else if isOversold and stochDown

color.red

else if stochUp

color.blue

else if stochDown

color.purple

else

color.gray

sma74Color = sma74 < sma19 ? color.green : color.red

// === CROSSING CONDITIONS ===

crossUpSMA = ta.crossover(close, sma74)

crossDownSMA = ta.crossunder(close, sma74)

// === ENTRY CONDITIONS ===

buyCondition = crossUpSMA and close > lvl4

sellCondition = crossDownSMA and close < lvl2

// === POSITION MANAGEMENT ===

var float stopLevel = na

var bool xMode = false

// Entry and Stop Loss

if buyCondition

strategy.entry(id="Long", direction=strategy.long)

stopLevel := close - (hardStopTicks * tickSize)

xMode := false

if sellCondition

strategy.entry(id="Short", direction=strategy.short)

stopLevel := close + (hardStopTicks * tickSize)

xMode := false

// Update stops based on X's

if strategy.position_size != 0 and (inGreenTrend or inRedTrend)

xMode := true

if strategy.position_size > 0 // Long position

stopLevel := low

else // Short position

stopLevel := high

// Exit logic

if strategy.position_size > 0 // Long position

if low <= stopLevel

strategy.close(id="Long")

else if xMode and not (inGreenTrend or inRedTrend)

strategy.close(id="Long")

if strategy.position_size < 0 // Short position

if high >= stopLevel

strategy.close(id="Short")

else if xMode and not (inGreenTrend or inRedTrend)

strategy.close(id="Short")

// === PLOTTING ===

plot(sma19, "SMA 19", color=sma19Color, linewidth=2)

plot(sma74, "SMA 74", color=sma74Color, linewidth=2)

plot(lvl5, "Upper Zone Top", color=color.red, linewidth=2)

plot(lvl4, "Upper Zone Bottom", color=color.orange, linewidth=2)

plot(lvl3, "Middle Line", color=color.yellow, linewidth=2)

plot(lvl2, "Lower Zone Top", color=color.green, linewidth=2)

plot(lvl1, "Lower Zone Bottom", color=color.blue, linewidth=2)

// Plot X signals

plotshape(inGreenTrend, title="Bullish Line", style=shape.xcross, location=location.belowbar, color=color.white, size=size.tiny)

plotshape(inRedTrend, title="Bearish Line", style=shape.xcross, location=location.abovebar, color=color.white, size=size.tiny)

// Zone fills

var p1 = plot(lvl5, display=display.none)

var p2 = plot(lvl4, display=display.none)

var p3 = plot(lvl2, display=display.none)

var p4 = plot(lvl1, display=display.none)

fill(p1, p2, color=color.new(color.red, 90))

fill(p3, p4, color=color.new(color.green, 90))

// Plot entry signals

plotshape(buyCondition, title="Buy", style=shape.square, location=location.belowbar, color=color.new(color.blue, 20), size=size.tiny, text="BUY", textcolor=color.blue)

plotshape(sellCondition, title="Sell", style=shape.square, location=location.abovebar, color=color.new(color.red, 20), size=size.tiny, text="SELL", textcolor=color.red)