Gambaran keseluruhan

Strategi ini adalah sistem perdagangan komposit berdasarkan Saluran Keltner dan tahap sokongan dan rintangan dinamik. Ia membentuk rangka kerja membuat keputusan perdagangan yang lengkap dengan menganalisis berbilang tempoh masa dan menggabungkan purata pergerakan dan petunjuk turun naik. Teras strategi adalah untuk menangkap peluang perdagangan berkemungkinan tinggi dengan mengenal pasti saat apabila harga menembusi tahap teknikal utama sambil mengambil kira arah aliran dan turun naik pasaran.

Prinsip Strategi

Strategi ini menggunakan sistem penunjuk teknikal berbilang lapisan untuk analisis:

- Gunakan saluran Kenny 21 tempoh sebagai alat penentu arah aliran utama, dan lebar saluran ditentukan oleh nilai ATR.

- Kira tahap sokongan dan rintangan utama menggunakan 21 batang lilin di sebelah kiri dan 8 batang lilin di sebelah kanan

- Memperkenalkan purata bergerak tempoh masa peringkat tinggi sebagai penapis arah aliran

- Menggabungkan purata bergerak jangka pendek (5-tempoh) dan jangka panjang (30-tempoh) untuk menentukan masa kemasukan

- Gunakan ATR untuk melaraskan kedudukan stop loss secara dinamik

Kelebihan Strategik

- Penunjuk teknikal berbilang dimensi mengesahkan satu sama lain dan mengurangkan isyarat palsu dengan berkesan

- Tahap sokongan dan rintangan dinamik dikemas kini dalam masa nyata untuk menyesuaikan diri dengan perubahan pasaran

- Tapis trend pasaran sekunder melalui analisis tempoh masa peringkat tinggi

- Laraskan parameter stop loss secara fleksibel mengikut tempoh masa yang berbeza

- Gunakan pengurusan kedudukan peratusan untuk mengawal risiko dengan berkesan

Risiko Strategik

- Isyarat dagangan yang kerap mungkin dijana dalam pasaran yang tidak menentu

- Pengesahan penunjuk berbilang boleh menyebabkan kehilangan beberapa peluang dagangan

- Pengoptimuman parameter mempunyai risiko overfitting

- Perhentian mungkin terlalu luas dalam persekitaran turun naik yang tinggi

- Tahap sokongan dan rintangan mungkin menjadi tidak sah apabila pasaran berubah secara drastik

Arah pengoptimuman strategi

- Memperkenalkan penunjuk volum untuk membantu dalam menilai keberkesanan kejayaan

- Tambah modul analisis turun naik pasaran dan laraskan parameter secara dinamik

- Optimumkan kaedah pengiraan tahap sokongan dan rintangan untuk meningkatkan ketepatan

- Tambahkan pertimbangan kekuatan aliran dan perhalusi syarat kemasukan

- Menambah baik sistem pengurusan jawatan untuk mencapai kawalan risiko yang lebih canggih

ringkaskan

Ini adalah strategi perdagangan kuantitatif dengan struktur lengkap dan logik yang ketat. Melalui penggunaan berbilang lapisan penunjuk teknikal yang diselaraskan, kebolehpercayaan isyarat dagangan terjamin dan kawalan risiko yang berkesan dicapai. Strategi ini mempunyai kebolehskalaan yang kukuh dan dijangka mengekalkan prestasi yang stabil dalam persekitaran pasaran yang berbeza melalui pengoptimuman dan penambahbaikan berterusan.

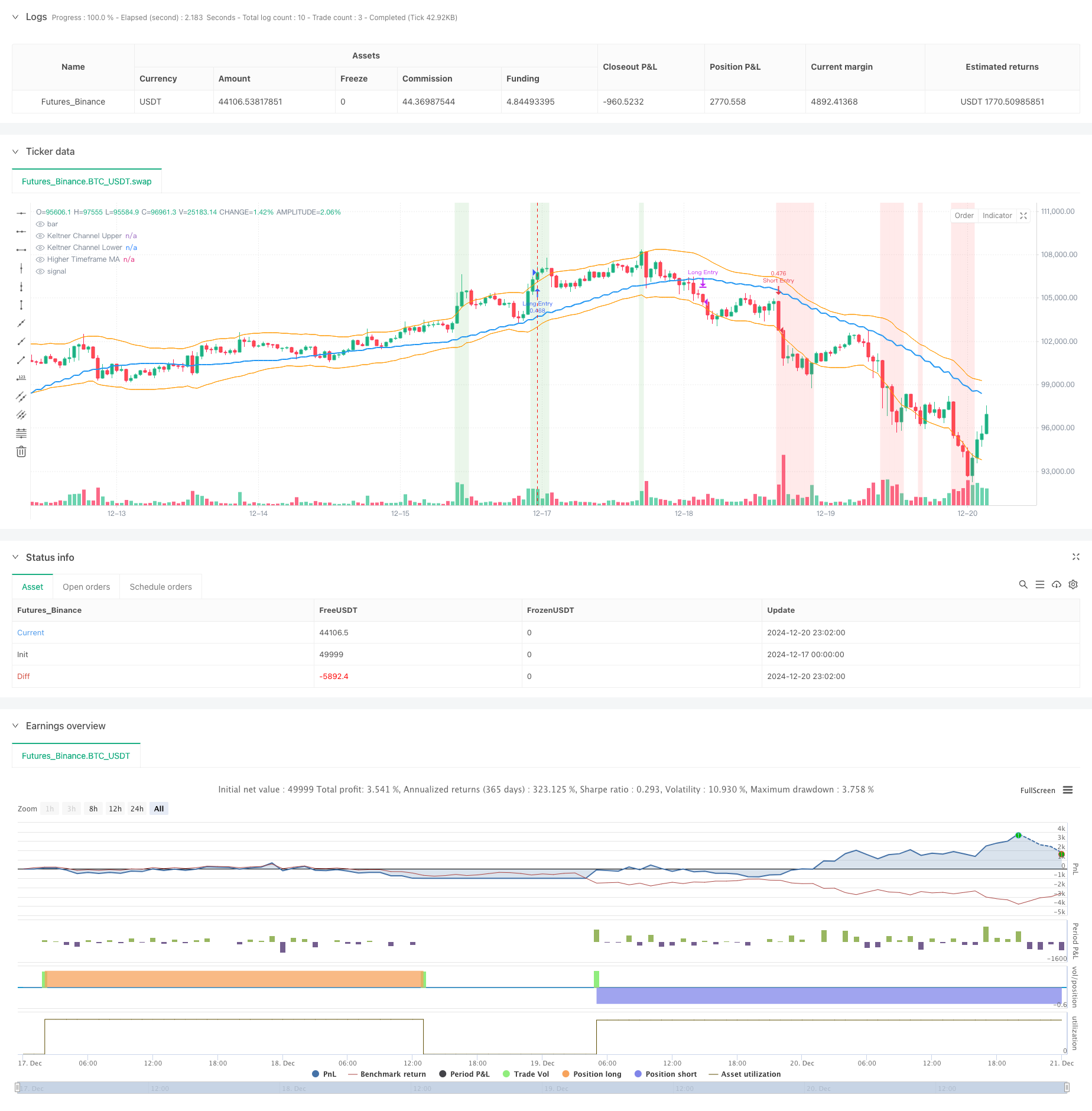

/*backtest

start: 2024-12-17 00:00:00

end: 2024-12-21 00:00:00

period: 1h

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT","balance":49999}]

*/

// This Pine Script™ code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © sathcm

//@version=5

strategy("KMS", overlay=true, initial_capital=100000, default_qty_type=strategy.percent_of_equity, default_qty_value=100, commission_type=strategy.commission.percent, commission_value=0.05, slippage=3)

// Inputs for Keltner Channels

kcLength = input.int(21, title="Keltner Channel Length", minval=1) // Length for Keltner Channel calculation

kcMultiplier = input.float(2.0, title="Keltner Channel Multiplier", minval=0.1) // Multiplier for Keltner Channel width

// Calculate Keltner Channels using best practices

kcBasis = ta.ema(close, kcLength) // Use EMA for a smoother basis line

atrValue = ta.atr(kcLength) // Use ATR for channel width calculation

kcUpper = kcBasis + kcMultiplier * atrValue // Upper Keltner Channel

kcLower = kcBasis - kcMultiplier * atrValue // Lower Keltner Channel

// Inputs for Pivot Point Calculation

leftBars = input.int(21, title="Left Bars", minval=1) // Number of bars to the left for pivot calculation

rightBars = input.int(8, title="Right Bars", minval=1, tooltip="Number of bars to the right for pivot calculation") // Number of bars to the right for pivot calculation

// Calculate Smoothed Pivot Highs and Lows using Weighted Moving Average

pivotHigh = ta.pivothigh(high, leftBars, rightBars) // Apply WMA for smoothing

pivotLow = ta.pivotlow(low, leftBars, rightBars) // Apply WMA for smoothing

// Convert Pivot Highs and Lows to Boolean Conditions

isPivotHigh = not na(pivotHigh) // True when a pivot high exists

isPivotLow = not na(pivotLow) // True when a pivot low exists

// Get Recent Support and Resistance Levels

recentResistance = ta.valuewhen(isPivotHigh, high, 0) // Most recent resistance level

recentSupport = ta.valuewhen(isPivotLow, low, 0) // Most recent support level

// Plot Smoothed Support and Resistance Levels

//plot(recentResistance, color=color.red, title="Recent Resistance", linewidth=2, style=plot.style_line)

//plot(recentSupport, color=color.green, title="Recent Support", linewidth=2, style=plot.style_line)

// Store Entry Price into a Variable

var float entryPrice = na // Declare a variable to store the entry price

// Input for Higher Timeframe

higherTimeframeInput = input.timeframe('W', title="Higher Timeframe for MA Calculation")

if (timeframe.period == "240") or (timeframe.period == "120")

higherTimeframeInput := "D"

if (timeframe.period == "60") or (timeframe.period == "30") or (timeframe.period == "15")

higherTimeframeInput := "120"

if (timeframe.period == "10") or (timeframe.period == "5")

higherTimeframeInput := "30"

if (timeframe.period == "1")

higherTimeframeInput := "10"

prd = input.int(defval=10, title='Pivot Period', minval=4, maxval=30, group='Settings 🔨', tooltip='Used while calculating Pivot Points, checks left&right bars')

ppsrc = input.string(defval='High/Low', title='Source', options=['High/Low', 'Close/Open'], group='Settings 🔨', tooltip='Source for Pivot Points')

ChannelW = input.int(defval=5, title='Maximum Channel Width %', minval=1, maxval=8, group='Settings 🔨', tooltip='Calculated using Highest/Lowest levels in 300 bars')

minstrength = input.int(defval=1, title='Minimum Strength', minval=1, group='Settings 🔨', tooltip='Channel must contain at least 2 Pivot Points')

maxnumsr = input.int(defval=4, title='Maximum Number of S/R', minval=1, maxval=10, group='Settings 🔨', tooltip='Maximum number of Support/Resistance Channels to Show') - 1

loopback = input.int(defval=150, title='Loopback Period', minval=100, maxval=400, group='Settings 🔨', tooltip='While calculating S/R levels it checks Pivots in Loopback Period')

res_col = input.color(defval=color.new(color.red, 75), title='Resistance Color', group='Colors 🟡🟢🟣')

sup_col = input.color(defval=color.new(color.lime, 75), title='Support Color', group='Colors 🟡🟢🟣')

inch_col = input.color(defval=color.new(color.gray, 75), title='Color When Price in Channel', group='Colors 🟡🟢🟣')

// Get Pivot High/Low

src1 = ppsrc == 'High/Low' ? high : math.max(close, open)

src2 = ppsrc == 'High/Low' ? low : math.min(close, open)

ph = ta.pivothigh(src1, prd, prd)

pl = ta.pivotlow(src2, prd, prd)

// Calculate maximum S/R channel width

prdhighest = ta.highest(300)

prdlowest = ta.lowest(300)

cwidth = (prdhighest - prdlowest) * ChannelW / 100

// Get/keep Pivot levels

var pivotvals = array.new_float(0)

var pivotlocs = array.new_float(0)

if ph or pl

array.unshift(pivotvals, ph ? ph : pl)

array.unshift(pivotlocs, bar_index)

for x = array.size(pivotvals) - 1 to 0 by 1

if bar_index - array.get(pivotlocs, x) > loopback // remove old pivot points

array.pop(pivotvals)

array.pop(pivotlocs)

continue

break

// Find/create SR channel of a pivot point

get_sr_vals(ind) =>

float lo = array.get(pivotvals, ind)

float hi = lo

int numpp = 0

for y = 0 to array.size(pivotvals) - 1 by 1

float cpp = array.get(pivotvals, y)

float wdth = cpp <= hi ? hi - cpp : cpp - lo

if wdth <= cwidth // fits the max channel width?

if cpp <= hi

lo := math.min(lo, cpp)

else

hi := math.max(hi, cpp)

numpp += 20 // each pivot point added as 20

[hi, lo, numpp]

// Keep old SR channels and calculate/sort new channels if we met new pivot point

var suportresistance = array.new_float(20, 0) // min/max levels

changeit(x, y) =>

tmp = array.get(suportresistance, y * 2)

array.set(suportresistance, y * 2, array.get(suportresistance, x * 2))

array.set(suportresistance, x * 2, tmp)

tmp := array.get(suportresistance, y * 2 + 1)

array.set(suportresistance, y * 2 + 1, array.get(suportresistance, x * 2 + 1))

array.set(suportresistance, x * 2 + 1, tmp)

if ph or pl

supres = array.new_float(0) // number of pivot, strength, min/max levels

stren = array.new_float(10, 0)

// Get levels and strengths

for x = 0 to array.size(pivotvals) - 1 by 1

[hi, lo, strength] = get_sr_vals(x)

array.push(supres, strength)

array.push(supres, hi)

array.push(supres, lo)

// Add each HL to strength

for x = 0 to array.size(pivotvals) - 1 by 1

h = array.get(supres, x * 3 + 1)

l = array.get(supres, x * 3 + 2)

s = 0

for y = 0 to loopback by 1

if high[y] <= h and high[y] >= l or low[y] <= h and low[y] >= l

s += 1

array.set(supres, x * 3, array.get(supres, x * 3) + s)

// Reset SR levels

array.fill(suportresistance, 0)

// Get strongest SRs

src = 0

for x = 0 to array.size(pivotvals) - 1 by 1

stv = -1. // value

stl = -1 // location

for y = 0 to array.size(pivotvals) - 1 by 1

if array.get(supres, y * 3) > stv and array.get(supres, y * 3) >= minstrength * 20

stv := array.get(supres, y * 3)

stl := y

if stl >= 0

// Get SR level

hh = array.get(supres, stl * 3 + 1)

ll = array.get(supres, stl * 3 + 2)

array.set(suportresistance, src * 2, hh)

array.set(suportresistance, src * 2 + 1, ll)

array.set(stren, src, array.get(supres, stl * 3))

// Make included pivot points' strength zero

for y = 0 to array.size(pivotvals) - 1 by 1

if array.get(supres, y * 3 + 1) <= hh and array.get(supres, y * 3 + 1) >= ll or array.get(supres, y * 3 + 2) <= hh and array.get(supres, y * 3 + 2) >= ll

array.set(supres, y * 3, -1)

src += 1

if src >= 10

break

for x = 0 to 8 by 1

for y = x + 1 to 9 by 1

if array.get(stren, y) > array.get(stren, x)

tmp = array.get(stren, y)

array.set(stren, y, array.get(stren, x))

changeit(x, y)

get_level(ind) =>

float ret = na

if ind < array.size(suportresistance)

if array.get(suportresistance, ind) != 0

ret := array.get(suportresistance, ind)

ret

get_color(ind) =>

color ret = na

if ind < array.size(suportresistance)

if array.get(suportresistance, ind) != 0

ret := array.get(suportresistance, ind) > close and array.get(suportresistance, ind + 1) > close ? res_col : array.get(suportresistance, ind) < close and array.get(suportresistance, ind + 1) < close ? sup_col : inch_col

ret

// var srchannels = array.new_box(10)

// for x = 0 to math.min(9, maxnumsr) by 1

// box.delete(array.get(srchannels, x))

// srcol = get_color(x * 2)

// if not na(srcol)

// array.set(srchannels, x, box.new(left=bar_index, top=get_level(x * 2), right=bar_index + 1, bottom=get_level(x * 2 + 1), border_color=srcol, border_width=1, extend=extend.both, bgcolor=srcol))

// Improved dynamic support detection

float recentSupport1 = na

float previousSupport = na

float currentsupport = na

if na(previousSupport) or currentsupport != previousSupport

if array.size(suportresistance) > 1

for i = 0 to math.floor(array.size(suportresistance) / 2) - 1 // Iterate through support levels

currentsupport := array.get(suportresistance, i * 2 + 1) // Support is stored at odd indices

if currentsupport < close and (na(recentSupport1) or math.abs(close - currentsupport) < math.abs(close - recentSupport1))

previousSupport := currentsupport // Store the newly detected support

// Set the most recent support to the new support

recentSupport1 := na(recentSupport1) ? ta.lowest(low, 10) : currentsupport

// Moving averages for entry and exit

maShort = ta.sma(close, 5)

maLong = ta.sma(close, 30) + ta.atr(14)

// Track entry price

entryPrice1 = strategy.position_avg_price // Get the price of the currently open position

currentTimeFrame = timeframe.period

exitPrice = entryPrice1 * 0.99

if currentTimeFrame == "1H" or currentTimeFrame == "30" or currentTimeFrame == "15" or currentTimeFrame == "5"

exitPrice := entryPrice1 * 0.99 // Set the exit price at 99% of the entry price

if currentTimeFrame == "120" or currentTimeFrame == "180" or currentTimeFrame == "240" or currentTimeFrame == "D"

exitPrice := entryPrice1 * 0.98 // Set the exit price at 95% of the entry price

// Calculate Moving Average based on higher timeframe for length of 20 bars

higherTimeframeMA = request.security(syminfo.tickerid, higherTimeframeInput, ta.sma(close, 20), barmerge.gaps_off, barmerge.lookahead_on) // Calculate MA with adjusted timeframe

// Entry and Exit Conditions for Long

entryLong = (close > kcUpper) and (close > recentResistance) and (close > higherTimeframeMA) // Long entry when price breaks above KC upper, recent resistance, and higher timeframe MA

exitLong = (close < recentResistance - 1.5*atrValue) // Long exit when price falls below recent resistance with cushion of one ATR

// Entry and Exit Conditions for Short

entryShort = (close < kcLower) and (close < recentSupport) and (close < higherTimeframeMA+atrValue) // Add RSI filter to reduce false signals by confirming momentum // Short entry when price breaks below KC lower, recent support, and higher timeframe MA

exitShort = (close > recentSupport + atrValue) // Short exit when price rises above recent support with cushion of one ATR(close > recentSupport + atrValue) // Short exit when price rises above recent support with cushion of one ATR(close > recentSupport + atrValue) // Short exit when price rises above recent support with cushion of one ATR

// Strategy Execution for Long

if not na(recentSupport1) and (close <= recentSupport1 +(close*0.01) or close >= recentSupport1 - (close*0.0075)) and (maShort > maLong) and entryLong

strategy.entry("Long Entry", strategy.long)

//entryPrice := strategy.position_avg_price // Store the entry price when a position is opened

if ((maShort < maLong + 3*ta.atr(14)) or close < exitPrice) and exitLong

strategy.close("Long Entry")

// Strategy Execution for Short

if entryShort

strategy.entry("Short Entry", strategy.short)

entryPrice := strategy.position_avg_price // Store the entry price when a position is opened

if exitShort

strategy.close("Short Entry")

// Plot Keltner Channels

plot(kcUpper, color=color.orange, title="Keltner Channel Upper", linewidth=1)

plot(kcLower, color=color.orange, title="Keltner Channel Lower", linewidth=1)

// Plot Moving Averages

plot(higherTimeframeMA, color=color.blue, title="Higher Timeframe MA", linewidth=2)

//plot(recentSupport1, color=#04313f, title="Recent Support1")

//plot(recentResistance, color=color.purple, title="Recent Resistance")

//plot(entryPrice1, color=color.lime, title="Entry Price 1")

//plot(exitPrice, color=color.maroon, title="Exit Price")

//plot(maShort, color=color.green, title="MA Short")

//plot(maLong, color=color.blue, title="MA Long Plus ATR")

// Highlight Entry Zones

bgcolor(entryLong ? color.new(color.green, 85) : na, title="Long Entry Zone")

bgcolor(entryShort ? color.new(color.red, 85) : na, title="Short Entry Zone")

// Alerts

alertcondition(entryLong, title="Long Entry", message="Price broke above the Keltner Channel and recent resistance for Long Entry")

alertcondition(exitLong, title="Long Exit", message="Price fell below recent resistance with cushion of one ATR - Long Exit")

alertcondition(entryShort, title="Short Entry", message="Price broke below the Keltner Channel and recent support for Short Entry")

alertcondition(exitShort, title="Short Exit", message="Price rose above recent support with cushion of one ATR - Short Exit")