Simples transporte de dois indicadores de tradingview, teste de retest (apenas aprendizado de intercâmbio, consequências reais de autoestima)

Autora:Luqi0212, Criado: 2022-11-22 19:57:12, Atualizado: 2022-11-23 11:13:30Indicadores usados pela estratégia

1 SSL híbrido

2, STOCH RSI Indicador Os dois são indicadores no Trading View e o código-fonte é transferido diretamente para o Trading View.

Os dois são indicadores no Trading View e o código-fonte é transferido diretamente para o Trading View.

Código do SSL Hybrid, 275 linhas de código

//@version=4

//By Mihkel00

// This script is designed for the NNFX Method, so it is recommended for Daily charts only.

// Tried to implement a few VP NNFX Rules

// This script has a SSL / Baseline (you can choose between the SSL or MA), a secondary SSL for continiuation trades and a third SSL for exit trades.

// Alerts added for Baseline entries, SSL2 continuations, Exits.

// Baseline has a Keltner Channel setting for "in zone" Gray Candles

// Added "Candle Size > 1 ATR" Diamonds from my old script with the criteria of being within Baseline ATR range.

// Credits

// Strategy causecelebre https://www.tradingview.com/u/causecelebre/

// SSL Channel ErwinBeckers https://www.tradingview.com/u/ErwinBeckers/

// Moving Averages jiehonglim https://www.tradingview.com/u/jiehonglim/

// Moving Averages everget https://www.tradingview.com/u/everget/

// "Many Moving Averages" script Fractured https://www.tradingview.com/u/Fractured/

study("SSL Hybrid", overlay=true)

show_Baseline = input(title="Show Baseline", type=input.bool, defval=true)

show_SSL1 = input(title="Show SSL1", type=input.bool, defval=false)

show_atr = input(title="Show ATR bands", type=input.bool, defval=true)

//ATR

atrlen = input(14, "ATR Period")

mult = input(1, "ATR Multi", step=0.1)

smoothing = input(title="ATR Smoothing", defval="WMA", options=["RMA", "SMA", "EMA", "WMA"])

ma_function(source, atrlen) =>

if smoothing == "RMA"

rma(source, atrlen)

else

if smoothing == "SMA"

sma(source, atrlen)

else

if smoothing == "EMA"

ema(source, atrlen)

else

wma(source, atrlen)

atr_slen = ma_function(tr(true), atrlen)

////ATR Up/Low Bands

upper_band = atr_slen * mult + close

lower_band = close - atr_slen * mult

////BASELINE / SSL1 / SSL2 / EXIT MOVING AVERAGE VALUES

maType = input(title="SSL1 / Baseline Type", type=input.string, defval="HMA", options=["SMA","EMA","DEMA","TEMA","LSMA","WMA","MF","VAMA","TMA","HMA", "JMA", "Kijun v2", "EDSMA","McGinley"])

len = input(title="SSL1 / Baseline Length", defval=60)

SSL2Type = input(title="SSL2 / Continuation Type", type=input.string, defval="JMA", options=["SMA","EMA","DEMA","TEMA","WMA","MF","VAMA","TMA","HMA", "JMA","McGinley"])

len2 = input(title="SSL 2 Length", defval=5)

//

SSL3Type = input(title="EXIT Type", type=input.string, defval="HMA", options=["DEMA","TEMA","LSMA","VAMA","TMA","HMA","JMA", "Kijun v2", "McGinley", "MF"])

len3 = input(title="EXIT Length", defval=15)

src = input(title="Source", type=input.source, defval=close)

//

tema(src, len) =>

ema1 = ema(src, len)

ema2 = ema(ema1, len)

ema3 = ema(ema2, len)

(3 * ema1) - (3 * ema2) + ema3

kidiv = input(defval=1,maxval=4, title="Kijun MOD Divider")

jurik_phase = input(title="* Jurik (JMA) Only - Phase", type=input.integer, defval=3)

jurik_power = input(title="* Jurik (JMA) Only - Power", type=input.integer, defval=1)

volatility_lookback = input(10, title="* Volatility Adjusted (VAMA) Only - Volatility lookback length")

//MF

beta = input(0.8,minval=0,maxval=1,step=0.1, title="Modular Filter, General Filter Only - Beta")

feedback = input(false, title="Modular Filter Only - Feedback")

z = input(0.5,title="Modular Filter Only - Feedback Weighting",step=0.1, minval=0, maxval=1)

//EDSMA

ssfLength = input(title="EDSMA - Super Smoother Filter Length", type=input.integer, minval=1, defval=20)

ssfPoles = input(title="EDSMA - Super Smoother Filter Poles", type=input.integer, defval=2, options=[2, 3])

//----

//EDSMA

get2PoleSSF(src, length) =>

PI = 2 * asin(1)

arg = sqrt(2) * PI / length

a1 = exp(-arg)

b1 = 2 * a1 * cos(arg)

c2 = b1

c3 = -pow(a1, 2)

c1 = 1 - c2 - c3

ssf = 0.0

ssf := c1 * src + c2 * nz(ssf[1]) + c3 * nz(ssf[2])

get3PoleSSF(src, length) =>

PI = 2 * asin(1)

arg = PI / length

a1 = exp(-arg)

b1 = 2 * a1 * cos(1.738 * arg)

c1 = pow(a1, 2)

coef2 = b1 + c1

coef3 = -(c1 + b1 * c1)

coef4 = pow(c1, 2)

coef1 = 1 - coef2 - coef3 - coef4

ssf = 0.0

ssf := coef1 * src + coef2 * nz(ssf[1]) + coef3 * nz(ssf[2]) + coef4 * nz(ssf[3])

ma(type, src, len) =>

float result = 0

if type=="TMA"

result := sma(sma(src, ceil(len / 2)), floor(len / 2) + 1)

if type=="MF"

ts=0.,b=0.,c=0.,os=0.

//----

alpha = 2/(len+1)

a = feedback ? z*src + (1-z)*nz(ts[1],src) : src

//----

b := a > alpha*a+(1-alpha)*nz(b[1],a) ? a : alpha*a+(1-alpha)*nz(b[1],a)

c := a < alpha*a+(1-alpha)*nz(c[1],a) ? a : alpha*a+(1-alpha)*nz(c[1],a)

os := a == b ? 1 : a == c ? 0 : os[1]

//----

upper = beta*b+(1-beta)*c

lower = beta*c+(1-beta)*b

ts := os*upper+(1-os)*lower

result := ts

if type=="LSMA"

result := linreg(src, len, 0)

if type=="SMA" // Simple

result := sma(src, len)

if type=="EMA" // Exponential

result := ema(src, len)

if type=="DEMA" // Double Exponential

e = ema(src, len)

result := 2 * e - ema(e, len)

if type=="TEMA" // Triple Exponential

e = ema(src, len)

result := 3 * (e - ema(e, len)) + ema(ema(e, len), len)

if type=="WMA" // Weighted

result := wma(src, len)

if type=="VAMA" // Volatility Adjusted

/// Copyright © 2019 to present, Joris Duyck (JD)

mid=ema(src,len)

dev=src-mid

vol_up=highest(dev,volatility_lookback)

vol_down=lowest(dev,volatility_lookback)

result := mid+avg(vol_up,vol_down)

if type=="HMA" // Hull

result := wma(2 * wma(src, len / 2) - wma(src, len), round(sqrt(len)))

if type=="JMA" // Jurik

/// Copyright © 2018 Alex Orekhov (everget)

/// Copyright © 2017 Jurik Research and Consulting.

phaseRatio = jurik_phase < -100 ? 0.5 : jurik_phase > 100 ? 2.5 : jurik_phase / 100 + 1.5

beta = 0.45 * (len - 1) / (0.45 * (len - 1) + 2)

alpha = pow(beta, jurik_power)

jma = 0.0

e0 = 0.0

e0 := (1 - alpha) * src + alpha * nz(e0[1])

e1 = 0.0

e1 := (src - e0) * (1 - beta) + beta * nz(e1[1])

e2 = 0.0

e2 := (e0 + phaseRatio * e1 - nz(jma[1])) * pow(1 - alpha, 2) + pow(alpha, 2) * nz(e2[1])

jma := e2 + nz(jma[1])

result := jma

if type=="Kijun v2"

kijun = avg(lowest(len), highest(len))//, (open + close)/2)

conversionLine = avg(lowest(len/kidiv), highest(len/kidiv))

delta = (kijun + conversionLine)/2

result :=delta

if type=="McGinley"

mg = 0.0

mg := na(mg[1]) ? ema(src, len) : mg[1] + (src - mg[1]) / (len * pow(src/mg[1], 4))

result :=mg

if type=="EDSMA"

zeros = src - nz(src[2])

avgZeros = (zeros + zeros[1]) / 2

// Ehlers Super Smoother Filter

ssf = ssfPoles == 2

? get2PoleSSF(avgZeros, ssfLength)

: get3PoleSSF(avgZeros, ssfLength)

// Rescale filter in terms of Standard Deviations

stdev = stdev(ssf, len)

scaledFilter = stdev != 0

? ssf / stdev

: 0

alpha = 5 * abs(scaledFilter) / len

edsma = 0.0

edsma := alpha * src + (1 - alpha) * nz(edsma[1])

result := edsma

result

///SSL 1 and SSL2

emaHigh = ma(maType, high, len)

emaLow = ma(maType, low, len)

maHigh = ma(SSL2Type, high, len2)

maLow = ma(SSL2Type, low, len2)

///EXIT

ExitHigh = ma(SSL3Type, high, len3)

ExitLow = ma(SSL3Type, low, len3)

///Keltner Baseline Channel

BBMC = ma(maType, close, len)

useTrueRange = input(true)

multy = input(0.2, step=0.05, title="Base Channel Multiplier")

Keltma = ma(maType, src, len)

range = useTrueRange ? tr : high - low

rangema = ema(range, len)

upperk =Keltma + rangema * multy

lowerk = Keltma - rangema * multy

//Baseline Violation Candle

open_pos = open*1

close_pos = close*1

difference = abs(close_pos-open_pos)

atr_violation = difference > atr_slen

InRange = upper_band > BBMC and lower_band < BBMC

candlesize_violation = atr_violation and InRange

plotshape(candlesize_violation, color=color.white, size=size.tiny,style=shape.diamond, location=location.top, transp=0,title="Candle Size > 1xATR")

//SSL1 VALUES

Hlv = int(na)

Hlv := close > emaHigh ? 1 : close < emaLow ? -1 : Hlv[1]

sslDown = Hlv < 0 ? emaHigh : emaLow

//SSL2 VALUES

Hlv2 = int(na)

Hlv2 := close > maHigh ? 1 : close < maLow ? -1 : Hlv2[1]

sslDown2 = Hlv2 < 0 ? maHigh : maLow

//EXIT VALUES

Hlv3 = int(na)

Hlv3 := close > ExitHigh ? 1 : close < ExitLow ? -1 : Hlv3[1]

sslExit = Hlv3 < 0 ? ExitHigh : ExitLow

base_cross_Long = crossover(close, sslExit)

base_cross_Short = crossover(sslExit, close)

codiff = base_cross_Long ? 1 : base_cross_Short ? -1 : na

//COLORS

show_color_bar = input(title="Color Bars", type=input.bool, defval=true)

color_bar = close > upperk ? #00c3ff : close < lowerk ? #ff0062 : color.gray

color_ssl1 = close > sslDown ? #00c3ff : close < sslDown ? #ff0062 : na

//PLOTS

plotarrow(codiff, colorup=#00c3ff, colordown=#ff0062,title="Exit Arrows", transp=20, maxheight=20, offset=0)

p1 = plot(show_Baseline ? BBMC : na, color=color_bar, linewidth=4,transp=0, title='MA Baseline')

DownPlot = plot( show_SSL1 ? sslDown : na, title="SSL1", linewidth=3, color=color_ssl1, transp=10)

barcolor(show_color_bar ? color_bar : na)

up_channel = plot(show_Baseline ? upperk : na, color=color_bar, title="Baseline Upper Channel")

low_channel = plot(show_Baseline ? lowerk : na, color=color_bar, title="Basiline Lower Channel")

fill(up_channel, low_channel, color=color_bar, transp=90)

////SSL2 Continiuation from ATR

atr_crit = input(0.9, step=0.1, title="Continuation ATR Criteria")

upper_half = atr_slen * atr_crit + close

lower_half = close - atr_slen * atr_crit

buy_inatr = lower_half < sslDown2

sell_inatr = upper_half > sslDown2

sell_cont = close < BBMC and close < sslDown2

buy_cont = close > BBMC and close > sslDown2

sell_atr = sell_inatr and sell_cont

buy_atr = buy_inatr and buy_cont

atr_fill = buy_atr ? color.green : sell_atr ? color.purple : color.white

LongPlot = plot(sslDown2, title="SSL2", linewidth=2, color=atr_fill, style=plot.style_circles, transp=0)

u = plot(show_atr ? upper_band : na, "+ATR", color=color.white, transp=80)

l = plot(show_atr ? lower_band : na, "-ATR", color=color.white, transp=80)

//ALERTS

alertcondition(crossover(close, sslDown), title='SSL Cross Alert', message='SSL1 has crossed.')

alertcondition(crossover(close, sslDown2), title='SSL2 Cross Alert', message='SSL2 has crossed.')

alertcondition(sell_atr, title='Sell Continuation', message='Sell Continuation.')

alertcondition(buy_atr, title='Buy Continuation', message='Buy Continuation.')

alertcondition(crossover(close, sslExit), title='Exit Sell', message='Exit Sell Alert.')

alertcondition(crossover(sslExit, close), title='Exit Buy', message='Exit Buy Alert.')

alertcondition(crossover(close, upperk ), title='Baseline Buy Entry', message='Base Buy Alert.')

alertcondition(crossover(lowerk, close ), title='Baseline Sell Entry', message='Base Sell Alert.')

// Este é o código do Stoch RSI, que também foi copiado.

//@version=5

indicator(title="Stochastic RSI", shorttitle="Stoch RSI", format=format.price, precision=2, timeframe="", timeframe_gaps=true)

smoothK = input.int(3, "K", minval=1)

smoothD = input.int(3, "D", minval=1)

lengthRSI = input.int(14, "RSI Length", minval=1)

lengthStoch = input.int(14, "Stochastic Length", minval=1)

src1 = input(close, title="RSI Source") //src重名了,改为src1

rsi1 = ta.rsi(src1, lengthRSI) //src重名了,改为src1

k = ta.sma(ta.stoch(rsi1, rsi1, rsi1, lengthStoch), smoothK)

d = ta.sma(k, smoothD)

plot(k, "K", color=#2962FF)

plot(d, "D", color=#FF6D00)

h0 = hline(80, "Upper Band", color=#787B86)

hline(50, "Middle Band", color=color.new(#787B86, 50))

h1 = hline(20, "Lower Band", color=#787B86)

fill(h0, h1, color=color.rgb(33, 150, 243, 90), title="Background")

// Um problema aqui é que uma variávelsrc foi renomeada em ambos os indicadores, sendo que as duas vezes em que o stoch rsi foi renomeado parasrc1 // no final da estratégia, mais a função de transação

BASEMONEY = input(50, '开仓数量') //开仓数量,回测50000u开50eth还是很靠谱的,如果是btc当然不能这么多

prof = input(10, '止盈') //止盈止损百分比,回测不带止盈止损,直接设置10000

los = input(5,'止损')

if base_cross_Long and k < 20 and d <20 //base_cross_Long ,ssl hybird指标里向上的买入箭头

strategy.entry("Enter Long", strategy.long, BASEMONEY) //k,d <20 ,stoch rsi 超卖信号。同时出现这两个指标,买入

strategy.exit("exit", profit = prof, loss = los )

if base_cross_Short and k > 80 and d > 80 //base_cross_Long ,ssl hybird指标里向下的卖出箭头

strategy.entry("Enter Short", strategy.short, BASEMONEY) //k,d >80 ,stoch rsi 超买信号。同时出现这两个指标,卖出

strategy.exit("exit", profit = prof, loss = los)

// concluído, o código acima pode ser copiado diretamente para a nova política de código em pine

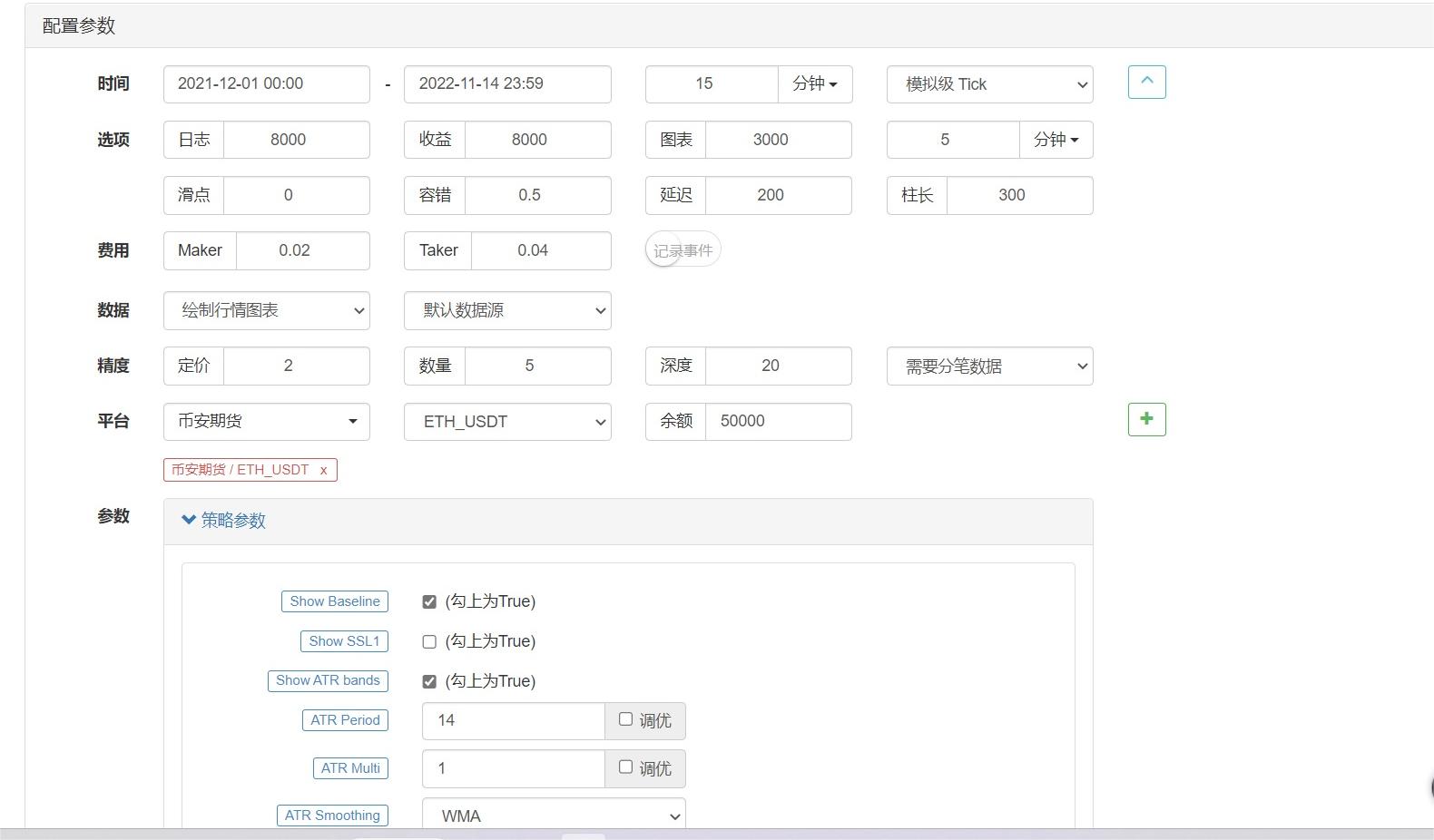

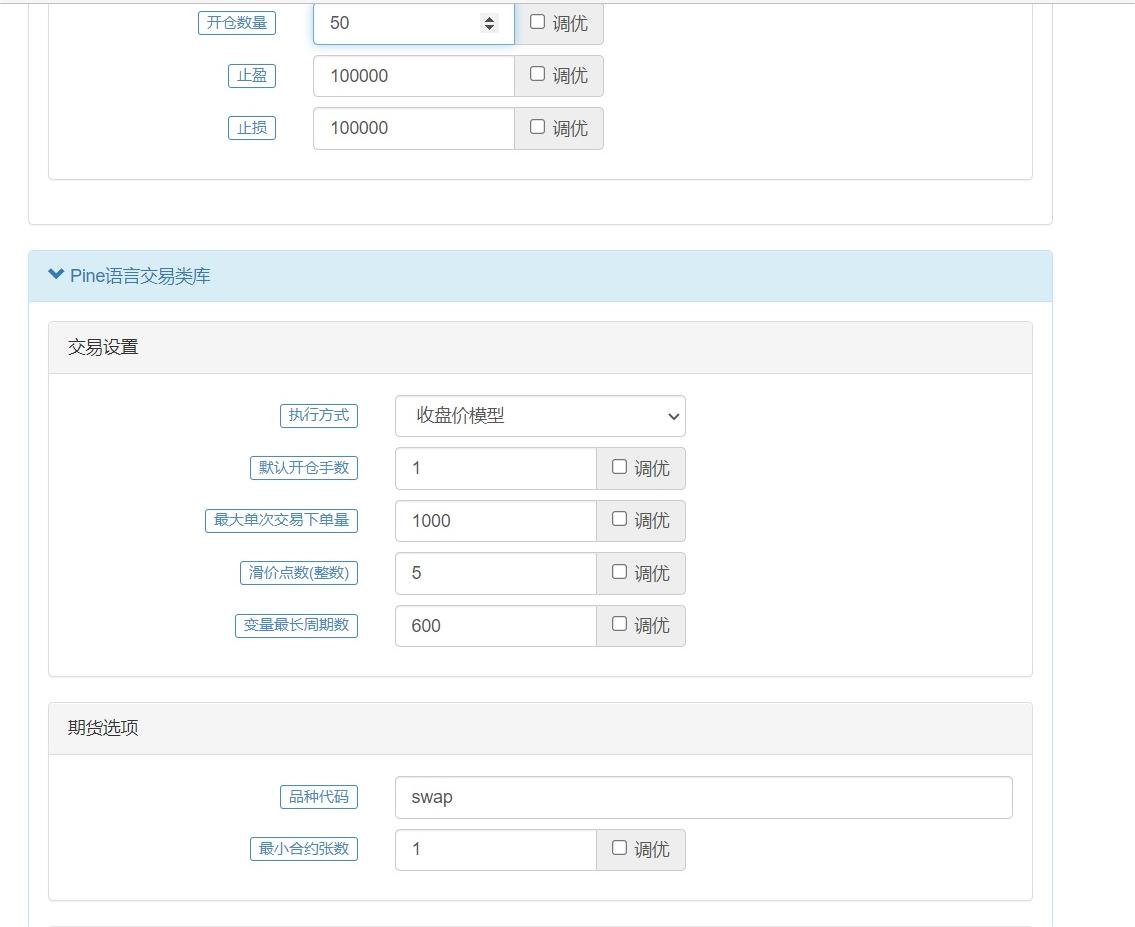

ETH 15 minutos retestado, alavancagem por defeito de 10 vezes, stop stop stop loss de 10.000, restantes indicadores totalmente por defeito

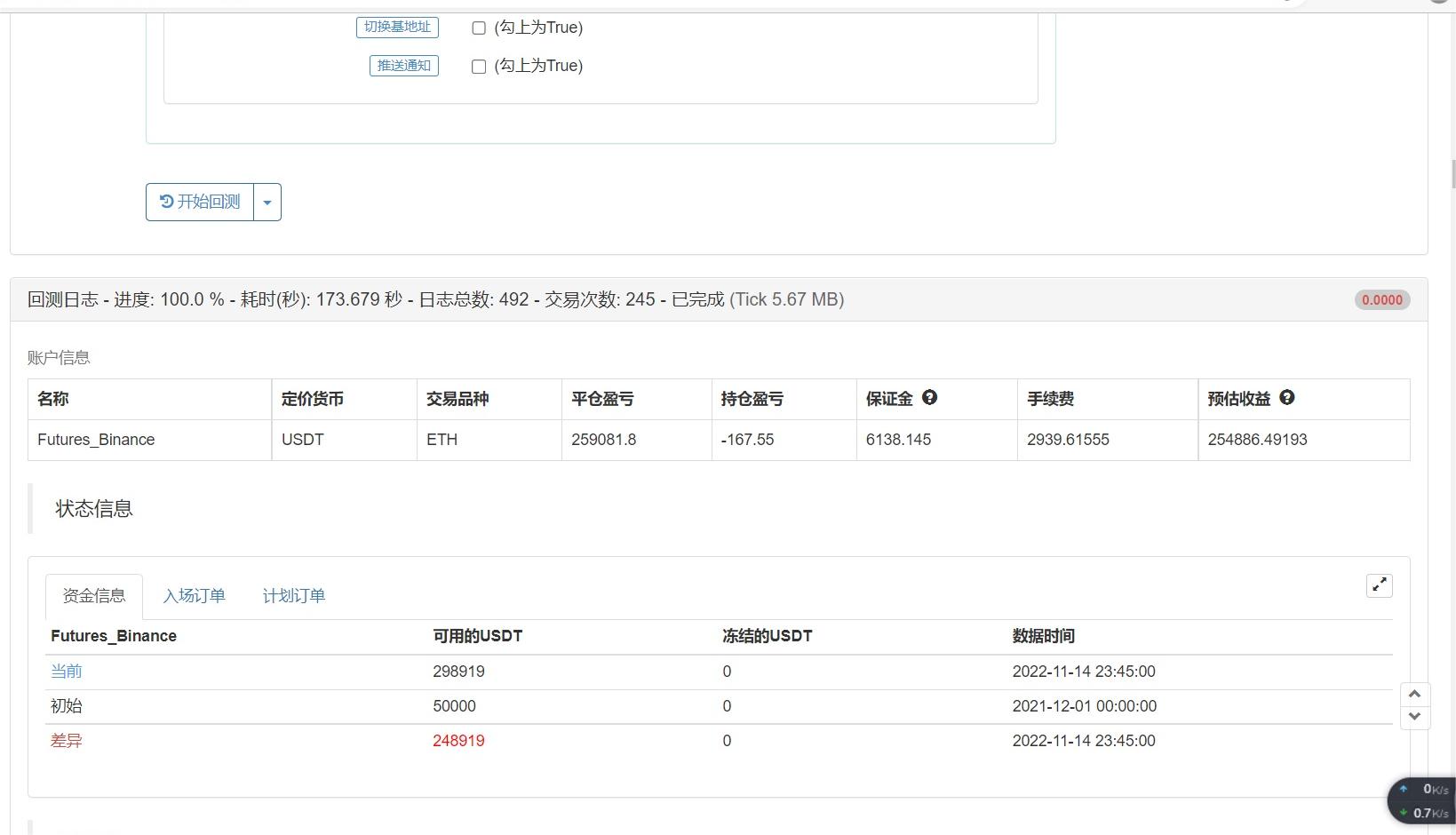

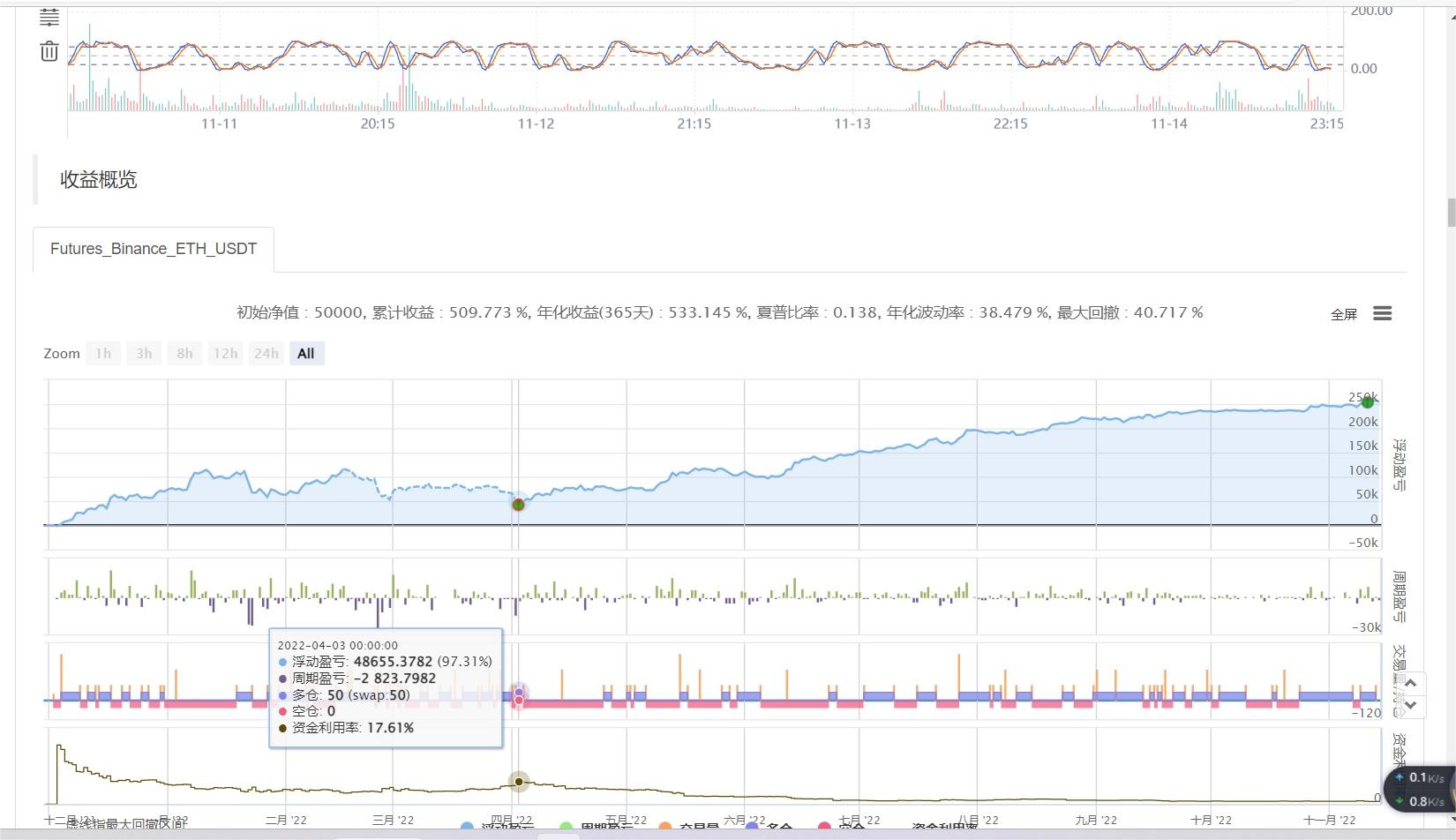

Tempo de retrospecção 2021.12.1-2022.11.14, incluindo 124,512,618,119 eventos importantes

O resultado do teste explodiu, apenas para o prazer do teste, e as consequências reais são arrogantes.

O resultado do teste explodiu, apenas para o prazer do teste, e as consequências reais são arrogantes.

- Como é que se pode negociar vários pares de transações ao mesmo tempo numa mesma estratégia?

- O que você está procurando no Coinmarketcap para obter 100 bobinas mais baratas?

- Interface de intercâmbio localização rápida pesquisa quando pendurar escada Max retries exceed with url

- O Bitcoin é uma moeda de alta precisão, com um preço mínimo de compra.

- Sistema de acompanhamento

- A proposta de revisão do contrato da YFII é que, se a estratégia sobreviver na YFII, o mercado não terá medo.

- Como o FMZ entrou na Bolsa de Valores

- Pedido de ajuda, erro no mercado de futuros de Bitcoin

- Por favor, por favor, por favor, por favor.

- Resolvido

- Por favor, por que o Bitcoin BTCUSDT GetDepth () só pode retornar uma pequena quantidade de dados, não há profundidade suficiente?

- Qualquer um dos patrões pode dar um exemplo de uma versão do KDJ?

- Resolvido

- A multitransação é um erro de retorno: subscrição de variedades falha

- A função TRADE_REF não existe aqui, há outra forma de escrever que realize essa função?

- Como é que o pine escreve para várias bolsas?

- Pedir ajuda sobre o uso da piramidagem

- A estratégia de entrega gratuita do concurso de negociação de contratos OKX

- Solicitação de ajuda: error bad operand type for unary +:'str' 111

- Por favor, como é que a estratégia da linguagem pine consegue fazer o ciclo da ordem abaixo, agora só podemos fazer a seguinte ordem sem seguir.

Q102133Como é que a cópia não funciona depois, ou há outros problemas?

Perseguidor.Afinal, o que aconteceu com o retrato?

Luqi0212Se vocês encontrarem indicadores úteis na tv, se forem fáceis de entender e de mudar, eu posso mudar a estratégia da FMZ gratuitamente e aprender a conversar juntos!

Luqi0212Não sei se o código de cópia de um mouse veio, se a frase de execução abaixo deveria ter sido comprimida, neste caso, não há compressão.

Inventor quantificado - sonho pequenoOK~ Obrigado pela quantificação do FMZ.

Luqi0212O código está a funcionar.

Inventor quantificado - sonho pequenoO formato do código no FMZ é: Não, não, não. Código Não, não, não.