Estratégia de negociação dupla baseada no MACD

Autora:ChaoZhang, Data: 2023-12-07 17:11:52Tags:

Resumo

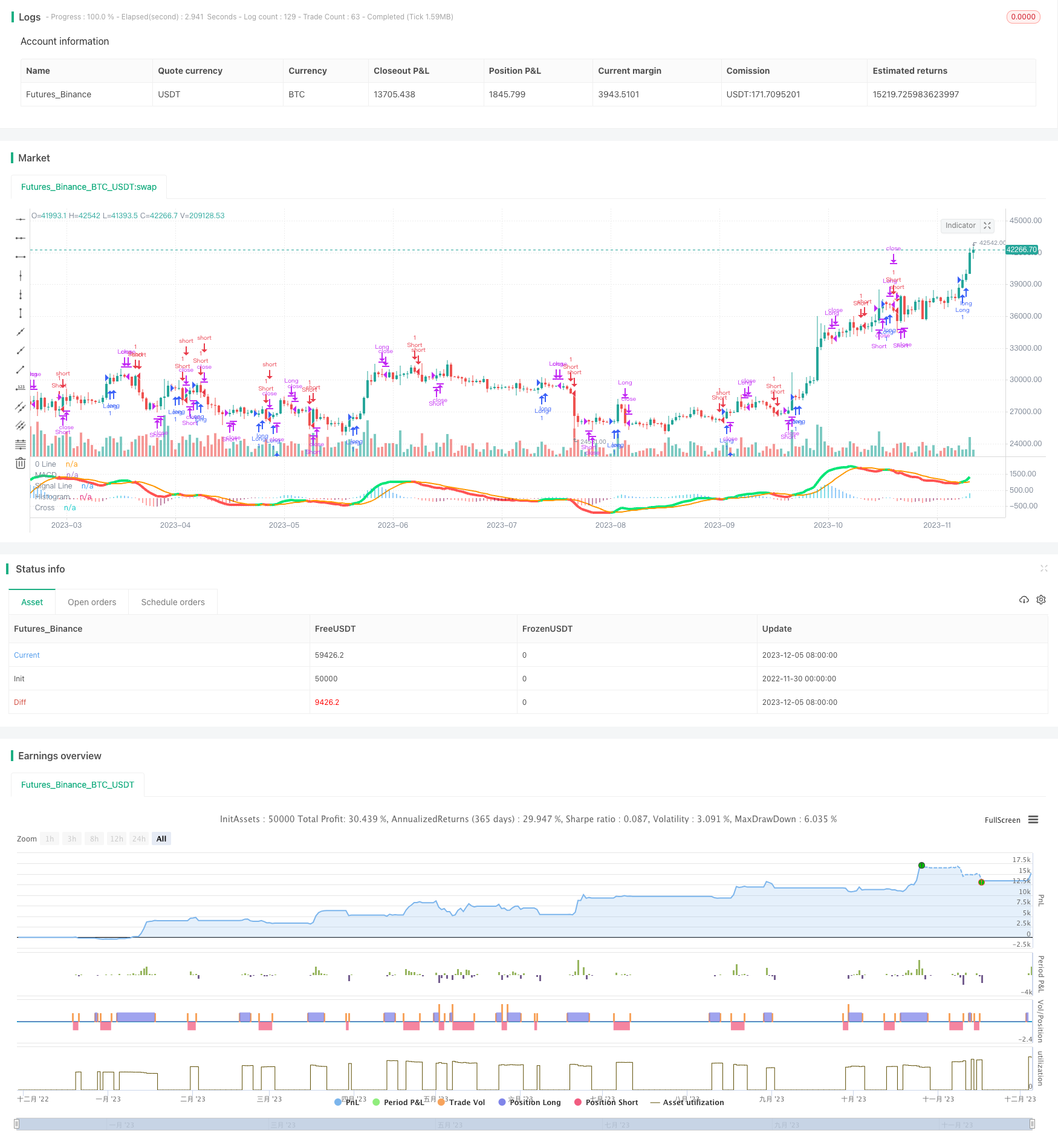

Esta estratégia implementa uma estratégia de negociação dupla baseada no indicador MACD. Pode ser longa quando há uma cruz de ouro no MACD e curta quando há uma cruz de morte, com filtros adicionais baseados em outros indicadores para eliminar alguns sinais inválidos.

Princípio da estratégia

O núcleo desta estratégia é utilizar o indicador MACD para realizar a negociação bidirecional. Especificamente, ele calcula a média móvel rápida, a média móvel lenta e a linha de sinal MACD. Quando o MA rápido atravessa o MA lento, uma cruz de ouro é gerada para ir longo. Quando o MA rápido atravessa abaixo do MA lento, uma cruz de morte é gerada para ir curto.

Para filtrar alguns sinais inválidos, a estratégia também define um intervalo de ±30 como um filtro, de modo que os sinais de negociação só são acionados quando o histograma MACD excede esse intervalo.

Vantagens

- O indicador MACD é utilizado como o principal sinal de negociação, que é sensível aos movimentos de preços em ambas as direcções.

- Filtros adicionados ajudam a eliminar alguns sinais inválidos

- A lógica direccional de duas barras para o fechamento de posições evita alguns falsos breakouts até certo ponto

Riscos

- O indicador MACD tende a gerar sinais comerciais frequentes, o que leva a uma alta frequência de negociação

- O recurso a um único indicador torna a estratégia vulnerável a atrasos de sinalização

- A lógica de fechamento baseada na direcção do histograma não é suficientemente rigorosa, o risco de perder alguns sinais

Orientações de otimização

- Considerar a combinação com outros indicadores de confirmação de sinal, como KDJ, Bandas de Bollinger, etc.

- Pesquise indicadores mais avançados para substituir o MACD, como o KD

- Otimizar a lógica de fechamento definindo stop loss e take profit para controlar a perda de uma única transação

Conclusão

Em resumo, esta é basicamente uma estratégia de negociação bidirecional viável. Utiliza as vantagens do indicador MACD e também adiciona alguns filtros para controlar a qualidade do sinal. No entanto, o próprio MACD também tem alguns problemas. Ainda é necessário mais testes e otimização na negociação ao vivo para tornar a estratégia mais confiável.

]

/*backtest

start: 2022-11-30 00:00:00

end: 2023-12-06 00:00:00

period: 1d

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=3

//Created by user ChrisMoody updated 4-10-2014

//Regular MACD Indicator with Histogram that plots 4 Colors Based on Direction Above and Below the Zero Line

//Update allows Check Box Options, Show MacD & Signal Line, Show Change In color of MacD Line based on cross of Signal Line.

//Show Dots at Cross of MacD and Signal Line, Histogram can show 4 colors or 1, Turn on and off Histogram.

//Special Thanks to that incredible person in Tech Support whoem I won't say you r name so you don't get bombarded with emails

//Note the feature Tech Support showed me on how to set the default timeframe of the indicator to the chart Timeframe, but also allow you to choose a different timeframe.

//By the way I fully disclose that I completely STOLE the Dots at the MAcd Cross from "TheLark"

strategy("MACD Strategy", overlay=false)

// study(title="CM_MacD_Ult_MTF", shorttitle="CM_Ult_MacD_MTF")

source = close

useCurrentRes = input(true, title="Use Current Chart Resolution?")

resCustom = input(title="Use Different Timeframe? Uncheck Box Above", defval="60")

smd = input(true, title="Show MacD & Signal Line? Also Turn Off Dots Below")

sd = input(true, title="Show Dots When MacD Crosses Signal Line?")

sh = input(true, title="Show Histogram?")

macd_colorChange = input(true,title="Change MacD Line Color-Signal Line Cross?")

hist_colorChange = input(true,title="MacD Histogram 4 Colors?")

res = useCurrentRes ? timeframe.period : resCustom

fastLength = input(12, minval=1), slowLength=input(26,minval=1)

signalLength=input(9,minval=1)

fastMA = ema(source, fastLength)

slowMA = ema(source, slowLength)

macd = fastMA - slowMA

signal = sma(macd, signalLength)

hist = macd - signal

outMacD = request.security(syminfo.tickerid, res, macd)

outSignal = request.security(syminfo.tickerid, res, signal)

outHist = request.security(syminfo.tickerid, res, hist)

histA_IsUp = outHist > outHist[1] and outHist > 0

histA_IsDown = outHist < outHist[1] and outHist > 0

histB_IsDown = outHist < outHist[1] and outHist <= 0

histB_IsUp = outHist > outHist[1] and outHist <= 0

//MacD Color Definitions

macd_IsAbove = outMacD >= outSignal

macd_IsBelow = outMacD < outSignal

// strategy.entry("Long", strategy.long, 1, when = shouldPlaceLong)

// strategy.close("Long", shouldExitLong)

// strategy.entry("Short", strategy.short, 1, when = shouldPlaceShort)

// strategy.close("Short", shouldExitShort)

isWithinZeroMacd = outHist < 30 and outHist > -30

delta = hist

// shouldExitShort = false//crossover(delta, 0)

// shouldExitLong = false//crossunder(delta, 0)

// if(crossover(delta, 0))// and not isWithinZeroMacd)

// strategy.entry("Long", strategy.long, comment="Long")

// if (crossunder(delta, 0))// and not isWithinZeroMacd)

// strategy.entry("Short", strategy.short, comment="Short")

shouldPlaceLong = crossover(delta, 0)

strategy.entry("Long", strategy.long, 1, when = shouldPlaceLong)

shouldExitLong = not histA_IsUp and histA_IsDown

shouldExitShort = not histA_IsUp and not histA_IsDown and not histB_IsDown and histB_IsUp

shouldPlaceShort = crossunder(delta, 0)

strategy.entry("Short", strategy.short, 1, when = shouldPlaceShort)

// plot_color = gray

plot_color = if(hist_colorChange)

if(histA_IsUp)

aqua

else

if(histA_IsDown)

//need to sell

// if(not isWithinZeroMacd)

// shouldExitLong = true

// strategy.entry("Short", strategy.short, comment="Short")

blue

else

if(histB_IsDown)

red

else

if(histB_IsUp)

//need to buy

// if(not isWithinZeroMacd)

// shouldExitShort = true

// strategy.entry("Long", strategy.long, comment="Long")

maroon

else

yellow

else

gray

// plot_color = hist_colorChange ? histA_IsUp ? aqua : histA_IsDown ? blue : histB_IsDown ? red : histB_IsUp ? maroon :yellow :gray

macd_color = macd_colorChange ? macd_IsAbove ? lime : red : red

signal_color = macd_colorChange ? macd_IsAbove ? orange : orange : lime

circleYPosition = outSignal

plot(smd and outMacD ? outMacD : na, title="MACD", color=macd_color, linewidth=4)

plot(smd and outSignal ? outSignal : na, title="Signal Line", color=signal_color, style=line ,linewidth=2)

plot(sh and outHist ? outHist : na, title="Histogram", color=plot_color, style=histogram, linewidth=4)

plot(sd and cross(outMacD, outSignal) ? circleYPosition : na, title="Cross", style=circles, linewidth=4, color=macd_color)

// plot( isWithinZeroMacd ? outHist : na, title="CheckSmallHistBars", style=circles, linewidth=4, color=black)

hline(0, '0 Line', linewidth=2, color=white)

strategy.close("Short", shouldExitShort)

strategy.close("Long", shouldExitLong)

// fastLength = input(12)

// slowlength = input(26)

// MACDLength = input(9)

// MACD = ema(close, fastLength) - ema(close, slowlength)

// aMACD = ema(MACD, MACDLength)

// delta = MACD - aMACD

// if (crossover(delta, 0))

// strategy.entry("MacdLE", strategy.long, comment="MacdLE")

//if last two macd bars are higher than current, close long position

// if (crossunder(delta, 0))

// strategy.entry("MacdSE", strategy.short, comment="MacdSE")

//if last two macd bars are higher than current, close long position

// plot(strategy.equity, title="equity", color=red, linewidth=2, style=areabr)

- Estratégia de negociação de reversão quantitativa de fundo inteligente

- Bollinger + RSI Estratégia dupla (apenas longa) v1.2

- A estratégia de negociação cruzada zero da CCI

- Estratégia de ruptura de reversão de preço de média móvel dupla

- Estratégia de negociação de retração da média móvel

- Agregação de média móvel Williams Commercial Bid-Ask Pressure Indicator Strategy

- Estratégia de acompanhamento da inversão da média móvel dupla

- Estratégia MACD de agregação da média móvel

- Estratégia do EMA

- Estratégia de negociação quantitativa baseada em números aleatórios

- Parabólica SAR e CCI estratégia com saída da EMA para negociação de ouro

- Estratégia de cruzamento da média móvel do momento da EMA

- Camarilla Pivot Points Breakthrough e Momentum Reversal Estratégia de Baixa Absorção Golden Cross

- Canal de Donchian com estratégia de stop loss

- A tendência do oscilador de vórtice seguindo a estratégia

- Estratégia de negociação de pontos pivot intradiários

- Comb Reverse EMA Volume Weighting Optimization Estratégias de negociação

- Estratégia DCA da Zona de Fibonacci

- Estratégia de reversão da tendência das bandas de Bollinger

- Estratégia de negociação quantitativa baseada no StochRSI