Momentum Seguindo a Estratégia de Reversão da Média Móvel

Visão geral

Esta estratégia usa vários indicadores, como médias móveis, bandas de brinquedo, RSI e indicadores aleatórios, em combinação com a análise de múltiplos períodos de tempo, para projetar uma estratégia que utiliza um conjunto de indicadores de dinâmica para determinar a reversão do mercado.

Princípio da estratégia

A lógica central da estratégia é acompanhar o cruzamento de médias móveis de curto e longo prazo para determinar o fundo e o topo, além de auxiliar os valores extremos de indicadores de referência dinâmicos como o RSI, o indicador aleatório e outros para determinar o fenômeno de supercompra e supervenda.

Especificamente, ele traça uma média móvel de dois parâmetros diferentes, um mais curto para determinar a tendência atual e um mais longo para determinar a tendência principal. Quando a média móvel de curto prazo atravessa a média móvel de longo prazo a partir da parte inferior, considera-se que a tendência está invertida, gerando um sinal de compra; quando atravessa a partir da parte superior para baixo, gerando um sinal de venda.

Além disso, a estratégia também combina o indicador RSI para ver se ele está entrando em uma área de superalimento, e o indicador aleatório para ver se a linha K está entrando em uma área de superalimento, etc. Para julgar o traço inferior. Para o traço superior, também usa a lógica inversa desses dois indicadores.

Na saída, a estratégia usa simultaneamente stop, stop loss e tracking stop loss para gerenciar a posição.

Análise de vantagens

Trata-se de uma estratégia que combina o acompanhamento de tendências e a identificação de reversões, além de ser uma estratégia prática para o indicador de dinâmica. Tem as seguintes vantagens:

O sistema de cruzamento de médias móveis é uma maneira simples e eficaz de julgar a inversão. A estratégia de dupla equilíbrio é fácil de operar e tem um bom histórico.

Combine indicadores como o RSI para avaliar a confiabilidade do sinal de inversão e evite sinais enganosos em posições que não são inferiores e não superiores.

O mecanismo de stop loss, stop loss e stop loss tracking ajuda a bloquear o lucro e controlar o risco.

Análise de Riscos

Embora a estratégia tenha muitos benefícios, há alguns riscos que devem ser lembrados:

A estratégia de linha de equilíbrio dupla pode ser facilmente bloqueada em situações de turbulência. Se a situação de mercado se equilibrar por um longo período, a posição será aberta e liquidada com frequência.

Indicadores como o RSI não evitam completamente a ocorrência de sinais errados. Por exemplo, uma rápida ruptura da última onda de alta impedirá o RSI de entrar na área de supercompra.

O alargamento do ponto de parada aumenta o risco de perda. A amplitude do ponto de parada precisa ser ajustada de acordo com a variedade específica.

Direção de otimização

A estratégia também pode ser melhorada em vários aspectos:

Pode-se testar diferentes tipos de médias móveis para encontrar o indicador de média mais adequado.

Pode-se adicionar mais indicadores auxiliares, como MACD, KD, Bryn, etc., para enriquecer a lógica da estratégia.

Os parâmetros de gerenciamento de posições podem ser otimizados automaticamente por meio de aprendizado de máquina, entre outros meios, para tornar o stop loss mais inteligente.

Os parâmetros de diferentes variedades podem ser optimizados individualmente para adaptar-se às características de cada variedade.

Resumir

Em suma, a estratégia de inversão de linha de equilíbrio de acompanhamento de dinâmica é uma estratégia de quantificação simples e prática. Utiliza o sistema de equilíbrio para determinar o ponto de inversão do mercado, auxiliando a confirmação da fiabilidade do sinal com indicadores de dinâmica e usando gerenciamento de posição inteligente para bloquear os lucros e controlar o risco.

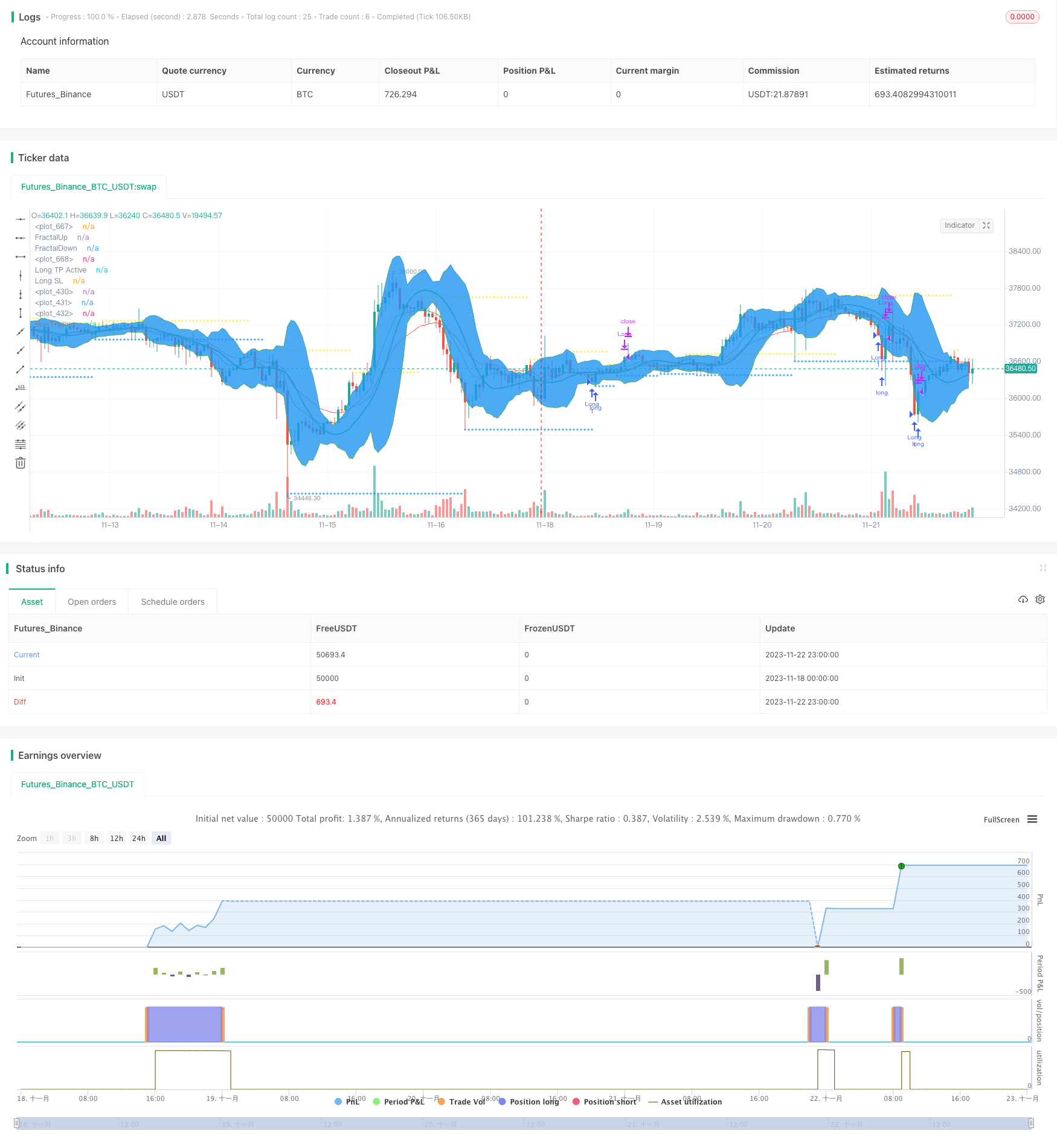

/*backtest

start: 2023-11-18 00:00:00

end: 2023-11-23 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=3

strategy("APEX - Tester - Buy/Sell Strategies - Basic - BACKTESTER", overlay = true)

//study("APEX - Tester - Buy/Sell Strategies - Basic ", overlay = true)

source_main = close

/////////////////////////////////////////////////

// BUY STRATEGIES - SELECTION

/////////////////////////////////////////////////

puppy_sep = input(false, title=" APEX Tester Buy/Sell Basic v01 ")

buy1_sep = input(false, title="▔▔▔▔▔▔▔▔▔▔▔▔▔▔▔▔▔▔▔▔" )

buy2_sep = input(false, title="******** BUY STRATEGIES ********")

ma_sep = input(false, title="⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻ MA ⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻")

ma_length_short = input(8, minval=1, title="MA length - short")

ma_length_long = input(9, minval=1, title="MA length - long")

ma_useRes = input(false, title="Check to turn ON Different Time Frame")

ma_candle_period = input("5", title="MA - Different Time Frame")

ma_type = input("T3", title="MA Type", options=["SMA", "EMA", "WMA", "DEMA", "TEMA", "TRIMA", "KAMA", "MAMA", "T3"])

ma_detector = input("Short Crosses Above Long", title="Detector", options=["Short Crosses Above Long",

"Short Above Long","Price Cross Above Short","Price Above Short","Price Cross Above Long","Price Above Long","Price Above Both","Price Below Both"])

ma_use = input(false, title="Use Moving Average ? (On / Off)")

bb_sep = input(false, title="⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻ BB ⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻")

bb_length = input(10, minval=1, title="BB length")

bb_std = input(2.1, minval=0, type = float, title="BB std")

bb_useDifferentRes = input(false, title="Check to turn ON Different Time Frame")

bb_candle_period = input("3", title="BB - Time Frame")

bb_type = input("T3", title="MA", options=["SMA", "EMA", "WMA", "DEMA", "TEMA", "TRIMA", "KAMA", "MAMA", "T3"])

bb_detector = input("Price Cross Below", title="Detector", options=["Price Cross Below", "Price Below", "Price Cross Above", "Price Above"])

bb_use = input(true, title="Use BB ? (On / Off)")

rsi_sep = input(false, title="⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻ RSI ⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻")

rsi_length = input(2, minval=1, title="RSI length")

rsi_useDifferentRes = input(false, title="Check to turn ON Different Time Frame")

rsi_candle_period = input("3", title="STOCH - Time Frame")

rsi_oversold = input(defval = 12 , title = "RSI Oversold", minval=0)

rsi_detector = input("Signal Below Oversold", title="Detector", options=["Signal Below Oversold", "Cross Below Oversold", "Signal Above Oversold", "Cross Above Oversold"])

rsi_use = input(true, title="Use RSI ? (On / Off)")

stoch_sep = input(false, title="⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻ STOCH ⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻")

stoch_useDifferentRes = input(false, title="Check to turn ON Different Time Frame")

stoch_candle_period = input("3", title="STOCH - Time Frame")

stoch_length_fk = input(12, minval=1, title="STOCH fast K")

stoch_length_sk = input(1, minval=1, title="STOCH slow K")

stoch_type_sk = input("EMA", title="STOCH slow K", options=["SMA", "EMA", "WMA", "DEMA", "TEMA", "TRIMA", "KAMA", "MAMA", "T3"])

stoch_length_sd = input(1, minval=1, title="STOCH slow D")

stoch_type_sd = input("EMA", title="STOCH slow D", options=["SMA", "EMA", "WMA", "DEMA", "TEMA", "TRIMA", "KAMA", "MAMA", "T3"])

stoch_oversold = input(defval = 10 , title = "STOCH Oversold Treashold", minval=0)

stoch_detector = input("Signal Below Oversold", title="Detector", options=["Signal Below Oversold", "Cross Below Oversold", "Cross Above Oversold"])

stoch_use = input(true, title="Use STOCH ? (On / Off)")

srsi_sep = input(false, title="⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻ SRSI ⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻")

stochrsi_useDifferentRes= input(false, title="Check to turn ON Different Time Frame")

stochrsi_candle_period = input("3", title="SRSI - Time Frame")

stochrsi_len = input(14, minval=1, title="RSI length")

stochrsi_stoch = input(14, minval=1, title="Time Period")

stochrsi_length_fk = input(3, minval=1, title="Fast K")

stochrsi_length_sd = input(3, minval=1, title="Slow D(or Fast)")

stochrsi_oversold = input(defval = 30 , title = "STOCHRSI Oversold Treashold", minval=0)

stochrsi_detector = input("K Below Oversold", title="Detector", options=["K Cross Above D and Oversold", "K Cross Above D", "K Cross Above Oversold",

"K Cross Below Oversold","K Below Oversold","K Above Oversold"])

stochrsi_use = input(false, title="Use STOCHRSI (On / Off)?")

macd_sep = input(false, title="⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻ MACD ⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻")

macd_fast = input(12, title="MACD fast")

macd_slow = input(26, title="MACD slow")

macd_signal = input(9, title="MACD signal")

macd_useDifferentRes = input(false, title="Check to turn ON Different Time Frame")

macd_candle_period = input("3", title="MACD - Time Frame")

macd_detector = input("MACD Cross Above Signal", title="Detector", options=["MACD Cross Above Signal", "MACD Above Signal", "MACD Below Signal",

"MACD Above Treshold", "MACD Below Treshold", "Centerline Cross Upward", "Centerline Cross Downward"])

macd_treshold = input(defval = 0 , title = "Treshold", type = float)

macd_use = input(false, title="Use MACD (On / Off)?")

cci_sep = input(false, title="⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻ CCI ⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻")

cci_len = input(14, title="CCI Length")

cci_treshold = input(100, title="CCI Treshold")

cci_useDifferentRes = input(false, title="Check to turn ON Different Time Frame")

cci_candle_period = input("3", title="CCI - Time Frame")

cci_detector = input("Signal Below Treshold", title="Detector", options=["Signal Cross Above Treshold", "Signal Above Treshold", "Signal Cross Below Treshold", "Signal Below Treshold"])

cci_use = input(false, title="Use CCI (On / Off)?")

vwap_sep = input(false, title="⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻ VWAP ⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻")

vwap_useRes = input(false, title="Check to turn ON Different Time Frame")

vwap_candle_period = input("5", title="VWAP - Time Frame")

vwap_detector = input("Price Above", title="Detector", options=["Price Cross Above","Price Above","Price Cross Below","Price Below"])

vwap_use = input(false, title="Use VWAP (On / Off)?")

pc_sep = input(false, title="⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻Perc.Chan.⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻")

pc_change = input(-2, type=float, title="Drop Percent")

pc_useDifferentRes = input(false, title="Check to turn ON Different Time Frame")

pc_candle_period = input("3", title="Percent Change - Time Frame")

pc_use = input(false, title="Use Percent Change (On / Off)?")

///////////////////////////////////////////////

// SELL STRATEGIES - SELECTION

///////////////////////////////////////////////

sell0_sep = input(false, title="▔▔▔▔▔▔▔▔▔▔▔▔▔▔▔▔▔▔▔▔" )

sell1_sep = input(false, title="******** SELL STRATEGIES ********")

sell_ma_sep = input(false, title="⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻ MA ⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻")

sell_ma_length_short = input(10, minval=1, title="MA length - short")

sell_ma_length_long = input(20, minval=1, title="MA length - long")

sell_ma_useRes = input(false, title="Check to turn ON Different Time Frame")

sell_ma_candle_period = input("5", title="MA - Different Time Frame")

sell_ma_type = input("EMA", title="MA Type", options=["SMA", "EMA", "WMA", "DEMA", "TEMA", "TRIMA", "KAMA", "MAMA", "T3"])

sell_ma_detector = input("Short Crosses Below Long", title="Detector", options=["Short Crosses Below Long",

"Short Below Long","Short Above Long","Price Cross Below Short","Price Below Short","Price Cross Below Long","Price Below Long","Price Above Both MA","Price Below Both MA"])

sell_ma_use = input(true, title="Use Moving Average ? (On / Off)")

sell_bb_sep = input(false, title="⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻ BB ⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻")

sell_bb_length = input(10, minval=1, title="BB length")

sell_bb_std = input(2.1, minval=0, type = float, title="BB std")

sell_bb_useDifferentRes = input(false, title="Check to turn ON Different Time Frame")

sell_bb_candle_period = input("3", title="BB - Time Frame")

sell_bb_type = input("T3", title="MA", options=["SMA", "EMA", "WMA", "DEMA", "TEMA", "TRIMA", "KAMA", "MAMA", "T3"])

sell_bb_detector = input("Price Cross Below", title="Detector", options=["Price Cross Above", "Price Above","Price Cross Below", "Price Below"])

sell_bb_use = input(false, title="Use BB ? (On / Off)")

sell_rsi_sep = input(false, title="⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻ RSI ⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻")

sell_rsi_length = input(2, minval=1, title="RSI length")

sell_rsi_useDifferentRes = input(false, title="Check to turn ON Different Time Frame")

sell_rsi_candle_period = input("3", title="STOCH - Time Frame")

sell_rsi_overbought = input(defval = 12 , title = "RSI Overbought", minval=0)

sell_rsi_detector = input("Signal Above Overbought", title="Detector", options=["Signal Below Overbought", "Cross Below Overbought", "Signal Above Overbought", "Cross Above Overbought"])

sell_rsi_use = input(false, title="Use RSI ? (On / Off)")

sell_stoch_sep = input(false, title="⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻ STOCH ⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻")

sell_stoch_useDifferentRes = input(false, title="Check to turn ON Different Time Frame")

sell_stoch_candle_period = input("3", title="STOCH - Time Frame")

sell_stoch_length_fk = input(12, minval=1, title="STOCH fast K")

sell_stoch_length_sk = input(1, minval=1, title="STOCH slow K")

sell_stoch_type_sk = input("EMA", title="STOCH slow K", options=["SMA", "EMA", "WMA", "DEMA", "TEMA", "TRIMA", "KAMA", "MAMA", "T3"])

sell_stoch_length_sd = input(1, minval=1, title="STOCH slow D")

sell_stoch_type_sd = input("EMA", title="STOCH slow D", options=["SMA", "EMA", "WMA", "DEMA", "TEMA", "TRIMA", "KAMA", "MAMA", "T3"])

sell_stoch_overbought = input(defval = 10 , title = "STOCH Overbought Treashold", minval=0)

sell_stoch_detector = input("Signal Above Overbought", title="Detector", options=["Signal Above Overbought", "Cross Below Overbought", "Cross Above Overbought"])

sell_stoch_use = input(false, title="Use STOCH ? (On / Off)")

sell_stochrsi_sep = input(false, title="⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻ SRSI ⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻")

sell_stochrsi_useDifferentRes = input(false, title="Check to turn ON Different Time Frame")

sell_stochrsi_candle_period = input("3", title="SRSI - Time Frame")

sell_stochrsi_len = input(14, minval=1, title="RSI length")

sell_stochrsi_stoch = input(14, minval=1, title="Time Period")

sell_stochrsi_length_fk = input(3, minval=1, title="Fast K")

sell_stochrsi_length_sd = input(3, minval=1, title="Slow D(or Fast)")

sell_stochrsi_overbought = input(defval = 30 , title = "STOCHRSI Overbought Treashold", minval=0)

sell_stochrsi_detector = input("K Above Overbought", title="Detector", options=["K Cross Above D and Overbought", "K Cross Above D", "K Cross Above Overbought",

"K Cross Below Overbought","K Below Overbought","K Above Overbought"])

sell_stochrsi_use = input(false, title="Use STOCHRSI (On / Off)?")

sell_macd_sep = input(false, title="⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻ MACD ⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻")

sell_macd_fast = input(12, title="MACD fast")

sell_macd_slow = input(26, title="MACD slow")

sell_macd_signal = input(9, title="MACD signal")

sell_macd_useDifferentRes = input(false, title="Check to turn ON Different Time Frame")

sell_macd_candle_period = input("3", title="MACD - Time Frame")

sell_macd_detector = input("MACD Cross Below Signal", title="Detector", options=["MACD Cross Below Signal", "MACD Above Signal", "MACD Below Signal",

"MACD Above Treshold", "MACD Below Treshold", "Centerline Cross Upward", "Centerline Cross Downward"])

sell_macd_treshold = input(defval = 0 , title = "Treshold", type = float)

sell_macd_use = input(false, title="Use MACD (On / Off)?")

sell_cci_sep = input(false, title="⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻ CCI ⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻")

sell_cci_len = input(14, title="CCI Length")

sell_cci_treshold = input(100, title="CCI Treshold")

sell_cci_useDifferentRes = input(false, title="Check to turn ON Different Time Frame")

sell_cci_candle_period = input("3", title="CCI - Time Frame")

sell_cci_detector = input("Signal Below Treshold", title="Detector", options=["Signal Cross Above Treshold", "Signal Above Treshold", "Signal Cross Below Treshold", "Signal Below Treshold"])

sell_cci_use = input(false, title="Use CCI (On / Off)?")

sell_vwap_sep = input(false, title="⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻ VWAP ⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻")

sell_vwap_useRes = input(false, title="Check to turn ON Different Time Frame")

sell_vwap_candle_period = input("5", title="VWAP - Time Frame")

sell_vwap_detector = input("Price Above", title="Detector", options=["Price Cross Above","Price Above","Price Cross Below","Price Below"])

sell_vwap_use = input(false, title="Use VWAP (On / Off)?")

sell_pc_sep = input(false, title="⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻Perc.Chan.⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻")

sell_pc_change = input(2, type=float, title="Rise Percent")

sell_pc_useDifferentRes = input(false, title="Check to turn ON Different Time Frame")

sell_pc_candle_period = input("3", title="Percent Change - Time Frame")

sell_pc_use = input(false, title="Use Percent Change (On / Off)?")

strat1_sep = input(false, title="▔▔▔▔▔▔▔▔▔▔▔▔▔▔▔▔▔▔▔▔" )

strat2_sep = input(false, title="******** STRATEGY SETTINGS ********")

///////////////////////////////////////////////

// GLOBAL FUNCTIONS

///////////////////////////////////////////////

kama(src, len)=>

xvnoise = abs(src - src[1])

nfastend = 0.666

nslowend = 0.0645

nsignal = abs(src - src[len])

nnoise = sum(xvnoise, len)

nefratio = iff(nnoise != 0, nsignal / nnoise, 0)

nsmooth = pow(nefratio * (nfastend - nslowend) + nslowend, 2)

nAMA = 0.0

nAMA := nz(nAMA[1]) + nsmooth * (src - nz(nAMA[1]))

mama(src, len)=>

fl=0.5

sl=0.05

pi = 3.1415926

sp = (4*src + 3*src[1] + 2*src[2] + src[3]) / 10.0

p = 0.0

i2 = 0.0

q2 = 0.0

dt = (.0962*sp + .5769*nz(sp[2]) - .5769*nz(sp[4])- .0962*nz(sp[6]))*(.075*nz(p[1]) + .54)

q1 = (.0962*dt + .5769*nz(dt[2]) - .5769*nz(dt[4])- .0962*nz(dt[6]))*(.075*nz(p[1]) + .54)

i1 = nz(dt[3])

jI = (.0962*i1 + .5769*nz(i1[2]) - .5769*nz(i1[4])- .0962*nz(i1[6]))*(.075*nz(p[1]) + .54)

jq = (.0962*q1 + .5769*nz(q1[2]) - .5769*nz(q1[4])- .0962*nz(q1[6]))*(.075*nz(p[1]) + .54)

i2_ = i1 - jq

q2_ = q1 + jI

i2 := .2*i2_ + .8*nz(i2[1])

q2 := .2*q2_ + .8*nz(q2[1])

re_ = i2*nz(i2[1]) + q2*nz(q2[1])

im_ = i2*nz(q2[1]) - q2*nz(i2[1])

re = 0.0

im = 0.0

re := .2*re_ + .8*nz(re[1])

im := .2*im_ + .8*nz(im[1])

p1 = iff(im!=0 and re!=0, 2*pi/atan(im/re), nz(p[1]))

p2 = iff(p1 > 1.5*nz(p1[1]), 1.5*nz(p1[1]), iff(p1 < 0.67*nz(p1[1]), 0.67*nz(p1[1]), p1))

p3 = iff(p2<6, 6, iff (p2 > 50, 50, p2))

p := .2*p3 + .8*nz(p3[1])

spp = 0.0

spp := .33*p + .67*nz(spp[1])

phase = 180/pi * atan(q1 / i1)

dphase_ = nz(phase[1]) - phase

dphase = iff(dphase_< 1, 1, dphase_)

alpha_ = fl / dphase

alpha = iff(alpha_ < sl, sl, iff(alpha_ > fl, fl, alpha_))

mama = 0.0

mama := alpha*src + (1 - alpha)*nz(mama[1])

t3(src, len)=>

xe1_1 = ema(src, len)

xe2_1 = ema(xe1_1, len)

xe3_1 = ema(xe2_1, len)

xe4_1 = ema(xe3_1, len)

xe5_1 = ema(xe4_1, len)

xe6_1 = ema(xe5_1, len)

b_1 = 0.7

c1_1 = -b_1*b_1*b_1

c2_1 = 3*b_1*b_1+3*b_1*b_1*b_1

c3_1 = -6*b_1*b_1-3*b_1-3*b_1*b_1*b_1

c4_1 = 1+3*b_1+b_1*b_1*b_1+3*b_1*b_1

nT3Average_1 = c1_1 * xe6_1 + c2_1 * xe5_1 + c3_1 * xe4_1 + c4_1 * xe3_1

variant(type, src, len) =>

v1 = sma(src, len) // Simple

v2 = ema(src, len) // Exponential

v3 = 2 * v2 - ema(v2, len) // Double Exponential

v4 = 3 * (v2 - ema(v2, len)) + ema(ema(v2, len), len) // Triple Exponential

v5 = wma(src, len) // Weighted

v6 = sma(sma(src, ceil(len / 2)), floor(len / 2) + 1) // TRIMA

v7 = kama(src, len) // KAMA

v8 = mama(src, len) // MAMA

v9 = t3(src, len) // T3

type=="EMA"?v2 : type=="DEMA"?v3 : type=="TEMA"?v4 : type=="WMA"?v5 : type=="TRIMA"?v6 : type=="KAMA"?v7 : type=="MAMA"?v8 : type=="T3"?v9 : v1

calc_cci(src, len, res) =>

cci_ma = sma(src, len)

cci = (src - cci_ma) / (0.015 * dev(src, len))

cci_res = request.security(syminfo.tickerid, res, cci)

calc_macd(macd_fast, macd_slow, src, res) =>

macd = ema(src, macd_fast) - ema(src, macd_slow)

res_macd = request.security(syminfo.tickerid, res, macd)

///////////////////////////////////////////////

// BUY STRATEGIES LOGIC

///////////////////////////////////////////////

//RSI

rsi = rsi(source_main, rsi_length)

per_rsi = rsi_useDifferentRes?request.security(syminfo.tickerid, rsi_candle_period, rsi):rsi

rsiBelow = false

rsiCrossBelow = false

rsiCrossAbove = false

rsiAbove = false

rsiBelow := per_rsi<rsi_oversold

rsiCrossBelow := crossunder(per_rsi, rsi_oversold)

rsiCrossAbove := crossover(per_rsi, rsi_oversold)

rsiAbove := per_rsi>rsi_oversold

rsiBuy = rsi_use ? (

rsi_detector=="Signal Below Oversold"?rsiBelow:

rsi_detector=="Cross Below Oversold"?rsiCrossBelow:

rsi_detector=="Cross Above Oversold"?rsiCrossAbove:

rsi_detector=="Signal Above Oversold"?rsiAbove:

false ) : true

//STOCH

stoch_k = variant(stoch_type_sk, stoch(source_main, high, low, stoch_length_fk), stoch_length_sk)

stoch_d = variant(stoch_type_sd, stoch_k, stoch_length_sd)

per_stoch_k = stoch_useDifferentRes?request.security(syminfo.tickerid, stoch_candle_period, stoch_k):stoch_k

per_stoch_d = stoch_useDifferentRes?request.security(syminfo.tickerid, stoch_candle_period, stoch_d):stoch_d

stochBelow = false

stochCrossBelow = false

stochCrossAbove = false

stochBelow := per_stoch_k<stoch_oversold

stochCrossBelow := crossunder(per_stoch_k, stoch_oversold)

stochCrossAbove := crossover(per_stoch_k, stoch_oversold)

stochBuy = stoch_use ? (

stoch_detector=="Signal Below Oversold"?stochBelow:

stoch_detector=="Cross Below Oversold"?stochCrossBelow:

stoch_detector=="Cross Above Oversold"?stochCrossAbove:

false ) : true

//STOCHRSI

stochrsi_rsi = rsi(source_main, stochrsi_len)

stochrsi_stoch_k = sma(stoch(stochrsi_rsi, stochrsi_rsi, stochrsi_rsi, stochrsi_stoch), stochrsi_length_fk)

stochrsi_stoch_d = sma(stochrsi_stoch_k, stochrsi_length_sd)

per_stochrsi_k = stochrsi_useDifferentRes?request.security(syminfo.tickerid, stochrsi_candle_period, stochrsi_stoch_k):stochrsi_stoch_k

per_stochrsi_d = stochrsi_useDifferentRes?request.security(syminfo.tickerid, stochrsi_candle_period, stochrsi_stoch_d):stochrsi_stoch_d

stochrsiKDCrossOversold = false

stochrsiKDCross = false

stochrsiKCrossAboveOversold = false

stochrsiKCrossBelowOversold = false

stochrsiKBelowOversold = false

stochrsiKAboveOversold = false

stochrsiKDCrossOversold := crossover(per_stochrsi_k, per_stochrsi_d) and per_stochrsi_k<stochrsi_oversold

stochrsiKDCross := crossover(per_stochrsi_k, per_stochrsi_d)

stochrsiKCrossAboveOversold := crossover(per_stochrsi_k, stochrsi_oversold)

stochrsiKCrossBelowOversold := crossunder(per_stochrsi_k, stochrsi_oversold)

stochrsiKBelowOversold := per_stochrsi_k<stochrsi_oversold

stochrsiKAboveOversold := per_stochrsi_k>stochrsi_oversold

stochrsiBuy = stochrsi_use ? (

stochrsi_detector=="K Cross Above D and Oversold"?stochrsiKDCrossOversold:

stochrsi_detector=="K Cross Above D"?stochrsiKDCross:

stochrsi_detector=="K Cross Above Oversold"?stochrsiKCrossAboveOversold:

stochrsi_detector=="K Cross Below Oversold"?stochrsiKCrossBelowOversold:

stochrsi_detector=="K Below Oversold"?stochrsiKBelowOversold:

stochrsi_detector=="K Above Oversold"?stochrsiKAboveOversold:

false ) : true

//CCI

per_cci = calc_cci(hlc3, cci_len, cci_candle_period)

cciBelow = false

cciCrossBelow = false

cciCrossAbove = false

cciAbove = false

cciBelow := per_cci<cci_treshold

cciCrossBelow := crossover(per_cci, cci_treshold)

cciCrossAbove := crossunder(cci_treshold, per_cci)

cciAbove := per_cci>cci_treshold

cciBuy = cci_use ? (

cci_detector=="Signal Below Treshold"?cciBelow:

cci_detector=="Signal Cross Belove Treshold"?cciCrossBelow:

cci_detector=="Signal Cross Above Treshold"?cciCrossAbove:

cci_detector=="Signal Above Treshold"?cciAbove:

false ) : true

//MACD

fastMA = ema(source_main, macd_fast)

slowMA = ema(source_main, macd_slow)

macd = fastMA - slowMA

signal = sma(macd, macd_signal)

delta = macd - signal

outmacd = request.security(syminfo.tickerid, macd_candle_period, macd)

outsignal = request.security(syminfo.tickerid, macd_candle_period, signal)

outdelta = request.security(syminfo.tickerid, macd_candle_period, delta)

plot_macd = macd_useDifferentRes?outmacd:macd

plot_signal = macd_useDifferentRes?outsignal:signal

plot_delta = macd_useDifferentRes?outdelta:delta

MACDCrossAboveSignal = false

CenterlineCrossUpwards = false

CenterlineCrossDownwards = false

MACDAboveSignal = false

MACDBelowSignal = false

MACDAboveTreshold = false

MACDBelowTreshold = false

MACDCrossAboveSignal := crossunder(plot_signal, plot_macd)

CenterlineCrossUpwards := crossover(plot_delta, 0)

CenterlineCrossDownwards := crossunder(plot_delta, 0)

MACDAboveSignal := plot_macd > plot_signal

MACDBelowSignal := plot_macd < plot_signal

MACDAboveTreshold := plot_macd > macd_treshold

MACDBelowTreshold := plot_macd < macd_treshold

macdBuy=macd_use ? (

macd_detector=="MACD Cross Above Signal"?MACDCrossAboveSignal:

macd_detector=="Centerline Cross Upwards"?CenterlineCrossUpwards:

macd_detector=="Centerline Cross Downwards"?CenterlineCrossDownwards:

macd_detector=="MACD above Signal"?MACDAboveSignal:

macd_detector=="MACD below Signal"?MACDBelowSignal:

macd_detector=="MACD above Treshold"?MACDAboveTreshold:

macd_detector=="MACD below Treshold"?MACDBelowTreshold:

false ) : true

//BB

bb_basis = variant(bb_type, source_main, bb_length)

bb_dev = bb_std * stdev(source_main, bb_length)

bb_upper = bb_basis + bb_dev

bb_lower = bb_basis - bb_dev

per_lower_bb = bb_useDifferentRes?request.security(syminfo.tickerid, bb_candle_period, bb_lower):bb_lower

per_upper_bb = bb_useDifferentRes?request.security(syminfo.tickerid, bb_candle_period, bb_upper):bb_upper

per_bb_basis = bb_useDifferentRes?request.security(syminfo.tickerid, bb_candle_period, bb_basis):bb_basis

bbBelow = false

bbCrossBelow = false

bbCrossAbove = false

bbAbove = false

bbBelow := per_lower_bb>close or per_lower_bb>low

bbAbove := per_lower_bb<high or per_lower_bb<close

bbCrossAbove := crossover(source_main, per_lower_bb)

bbCrossBelow := crossunder(source_main, per_lower_bb)

bbBuy = stochrsi_use ? (

bb_detector=="Price Cross Below"?bbCrossBelow:

bb_detector=="Price Below"?bbBelow:

bb_detector=="Price Cross Above"?bbCrossAbove:

bb_detector=="Price Above"?bbAbove:false ) : true

plot(per_bb_basis, color=green, linewidth=2)

p1 = plot(per_upper_bb, color=green)

p2 = plot(per_lower_bb, color=green)

fill(p1, p2)

//MA Calculation

ma_short = variant(ma_type, source_main, ma_length_short)

ma_long = variant(ma_type, source_main, ma_length_long)

per_ma_short = ma_useRes?request.security(syminfo.tickerid, ma_candle_period, ma_short):ma_short

per_ma_long = ma_useRes?request.security(syminfo.tickerid, ma_candle_period, ma_long ):ma_long

p1ma = plot(ma_use?per_ma_short:na, color=green)

p2ma = plot(ma_use?per_ma_long:na , color=red)

ShortCrossesAboveLong = false

ShortAboveLong = false

PriceCrossesAboveShort = false

PriceAboveShort = false

PriceCrossesAboveLong = false

PriceAboveLong = false

PriceAboveBoth = false

PriceBelowBoth = false

ShortCrossesAboveLong := crossover(per_ma_short, per_ma_long)

ShortAboveLong := per_ma_short > per_ma_long

PriceCrossesAboveShort := ( close > per_ma_short or high > per_ma_short ) and low < per_ma_short

PriceAboveShort := close > per_ma_short or high > per_ma_short

PriceCrossesAboveLong := ( close > per_ma_long or high > per_ma_long ) and low < per_ma_long

PriceAboveLong := close > per_ma_long or high > per_ma_long

PriceAboveBoth := ( close > per_ma_long or high > per_ma_long ) and (close > per_ma_short or high > per_ma_short )

PriceBelowBoth := ( close < per_ma_long or low < per_ma_long ) and (close < per_ma_short or low < per_ma_short )

maBuy = ma_use ? ( ma_detector=="Short Crosses Above Long"?ShortCrossesAboveLong:

ma_detector=="Short Above Long"?ShortAboveLong:

ma_detector=="Price Cross Above Short"?PriceCrossesAboveShort:

ma_detector=="Price Above Short"?PriceAboveShort:

ma_detector=="Price Crosses Above Long"?PriceCrossesAboveLong:

ma_detector=="Price Above Long"?PriceAboveLong:

ma_detector=="Price Above Both"?PriceAboveBoth:

ma_detector=="Price Below Both"?PriceBelowBoth:

false ) : true

//VWAP

var_vwap = vwap(hlc3)

per_vwap = vwap_useRes?request.security(syminfo.tickerid,vwap_candle_period,var_vwap):var_vwap

PriceCrossAbove = false

PriceAbove = false

PriceCrossBelow = false

PriceBelow = false

PriceCrossAbove := ( close > per_vwap or high > per_vwap ) and low < per_vwap

PriceAbove := close > per_vwap or high > per_vwap

PriceCrossBelow := ( close < per_vwap or low < per_vwap ) and high > per_vwap

PriceBelow := close < per_vwap or low < per_vwap

vwapBuy = false

vwapBuy := vwap_use ?(

vwap_detector=="Price Cross Above"?PriceCrossAbove:

vwap_detector=="Price Above"?PriceAbove:

vwap_detector=="Price Cross Below"?PriceCrossBelow:

vwap_detector=="Price Below"?PriceBelow:false ) : true

//PC

price_change = (close - close[1])/close[1]*100

per_price_change = pc_useDifferentRes?request.security(syminfo.tickerid, pc_candle_period, price_change):price_change

pcBuy = false

pcBuy := pc_use ? ( per_price_change < pc_change ) : true

///////////////////////////////////////////////

// SELL STRATEGIES LOGIC

///////////////////////////////////////////////

//SELL RSI

sell_rsi = rsi(source_main, sell_rsi_length)

sell_per_rsi = sell_rsi_useDifferentRes?request.security(syminfo.tickerid, sell_rsi_candle_period, sell_rsi):sell_rsi

sell_rsiBelow = false

sell_rsiCrossBelow = false

sell_rsiCrossAbove = false

sell_rsiAbove = false

sell_rsiBelow := sell_per_rsi<sell_rsi_overbought

sell_rsiCrossBelow := crossunder(sell_per_rsi, sell_rsi_overbought)

sell_rsiCrossAbove := crossover(sell_per_rsi, sell_rsi_overbought)

sell_rsiAbove := sell_per_rsi>sell_rsi_overbought

sell_rsiBuy = sell_rsi_use ? (

sell_rsi_detector=="Signal Below Overbought"?sell_rsiBelow:

sell_rsi_detector=="Cross Below Overbought"?sell_rsiCrossBelow:

sell_rsi_detector=="Cross Above Overbought"?sell_rsiCrossAbove:

sell_rsi_detector=="Signal Above Overbought"?sell_rsiAbove:

false ) : true

//SELL STOCH

sell_stoch_k = variant(sell_stoch_type_sk, stoch(source_main, high, low, sell_stoch_length_fk), sell_stoch_length_sk)

sell_stoch_d = variant(sell_stoch_type_sd, sell_stoch_k, sell_stoch_length_sd)

sell_per_stoch_k = sell_stoch_useDifferentRes?request.security(syminfo.tickerid, sell_stoch_candle_period, sell_stoch_k):sell_stoch_k

sell_per_stoch_d = sell_stoch_useDifferentRes?request.security(syminfo.tickerid, sell_stoch_candle_period, sell_stoch_d):sell_stoch_d

sell_stochAbove = false

sell_stochBelow = false

sell_stochCrossAbove = false

sell_stochAbove := sell_per_stoch_k>sell_stoch_overbought

sell_stochBelow := sell_per_stoch_k<sell_stoch_overbought

sell_stochCrossAbove := crossover(sell_per_stoch_k, sell_stoch_overbought)

sell_stochBuy = sell_stoch_use ? (

sell_stoch_detector=="Signal Above Overbought"?sell_stochAbove:

sell_stoch_detector=="Signal Below Overbought"?sell_stochBelow:

sell_stoch_detector=="Cross Above Overbought"?sell_stochCrossAbove:

false ) : true

//SELL STOCHRSI

sell_stochrsi_rsi = rsi(source_main, sell_stochrsi_len)

sell_stochrsi_stoch_k = sma(stoch(sell_stochrsi_rsi, sell_stochrsi_rsi, sell_stochrsi_rsi, sell_stochrsi_stoch), sell_stochrsi_length_fk)

sell_stochrsi_stoch_d = sma(sell_stochrsi_stoch_k, sell_stochrsi_length_sd)

sell_per_stochrsi_k = sell_stochrsi_useDifferentRes?request.security(syminfo.tickerid, sell_stochrsi_candle_period, sell_stochrsi_stoch_k):sell_stochrsi_stoch_k

sell_per_stochrsi_d = sell_stochrsi_useDifferentRes?request.security(syminfo.tickerid, sell_stochrsi_candle_period, sell_stochrsi_stoch_d):sell_stochrsi_stoch_d

sell_stochrsiKDCrossOverbought = false

sell_stochrsiKDCross = false

sell_stochrsiKCrossAboveOverbought = false

sell_stochrsiKCrossBelowOverbought = false

sell_stochrsiKBelowOverbought = false

sell_stochrsiKAboveOverbought = false

sell_stochrsiKDCrossOverbought := crossover(sell_per_stochrsi_k, sell_per_stochrsi_d) and sell_per_stochrsi_k>sell_stochrsi_overbought

sell_stochrsiKDCross := crossover(sell_per_stochrsi_k, sell_per_stochrsi_d)

sell_stochrsiKCrossAboveOverbought := crossover(sell_per_stochrsi_k, sell_stochrsi_overbought)

sell_stochrsiKCrossBelowOverbought := crossunder(sell_per_stochrsi_k, sell_stochrsi_overbought)

sell_stochrsiKBelowOverbought := sell_per_stochrsi_k<sell_stochrsi_overbought

sell_stochrsiKAboveOverbought := sell_per_stochrsi_k>sell_stochrsi_overbought

sell_stochrsiBuy = sell_stochrsi_use ? (

sell_stochrsi_detector=="K Cross Below D and Overbought"?sell_stochrsiKDCrossOverbought:

sell_stochrsi_detector=="K Cross Below D"?sell_stochrsiKDCross:

sell_stochrsi_detector=="K Cross Above Overbought"?sell_stochrsiKCrossAboveOverbought:

sell_stochrsi_detector=="K Cross Below Overbought"?sell_stochrsiKCrossBelowOverbought:

sell_stochrsi_detector=="K Below Overbought"?sell_stochrsiKBelowOverbought:

sell_stochrsi_detector=="K Above Overbought"?sell_stochrsiKAboveOverbought:

false ) : true

//SELL CCI

sell_per_cci = calc_cci(hlc3, sell_cci_len, sell_cci_candle_period)

sell_cciBelow = false

sell_cciCrossBelow = false

sell_cciCrossAbove = false

sell_cciAbove = false

sell_cciBelow := sell_per_cci<sell_cci_treshold

sell_cciCrossBelow := crossunder(sell_per_cci, sell_cci_treshold)

sell_cciCrossAbove := crossover(sell_cci_treshold, sell_per_cci)

sell_cciAbove := sell_per_cci>sell_cci_treshold

sell_cciBuy = sell_cci_use ? (

sell_cci_detector=="Signal Below Treshold"?sell_cciBelow:

sell_cci_detector=="Signal Cross Belove Treshold"?sell_cciCrossBelow:

sell_cci_detector=="Signal Cross Above Treshold"?sell_cciCrossAbove:

sell_cci_detector=="Signal Above Treshold"?sell_cciAbove:

false ) : true

//SELL MACD

sell_fastMA = ema(close, sell_macd_fast)

sell_slowMA = ema(close, sell_macd_slow)

sell_macd = sell_fastMA - sell_slowMA

sell_signal = sma(sell_macd, sell_macd_signal)

sell_delta = sell_macd - sell_signal

sell_outmacd = request.security(syminfo.tickerid, sell_macd_candle_period, sell_macd)

sell_outsignal = request.security(syminfo.tickerid, sell_macd_candle_period, sell_signal)

sell_outdelta = request.security(syminfo.tickerid, sell_macd_candle_period, sell_delta)

sell_plot_macd = sell_macd_useDifferentRes?sell_outmacd:sell_macd

sell_plot_signal = sell_macd_useDifferentRes?sell_outsignal:sell_signal

sell_plot_delta = sell_macd_useDifferentRes?sell_outdelta:sell_delta

sell_MACDCrossBelowSignal = false

sell_CenterlineCrossUpwards = false

sell_CenterlineCrossDownwards = false

sell_MACDAboveSignal = false

sell_MACDBelowSignal = false

sell_MACDAboveTreshold = false

sell_MACDBelowTreshold = false

sell_MACDCrossBelowSignal := crossover(sell_plot_signal, sell_plot_macd)

sell_CenterlineCrossUpwards := crossover(sell_plot_delta, 0.0)

sell_CenterlineCrossDownwards := crossunder(sell_plot_delta, 0.0)

sell_MACDAboveSignal := sell_plot_macd > sell_plot_signal

sell_MACDBelowSignal := sell_plot_macd < sell_plot_signal

sell_MACDAboveTreshold := sell_plot_macd > sell_macd_treshold

sell_MACDBelowTreshold := sell_plot_macd < sell_macd_treshold

sell_macdBuy=sell_macd_use ? (

sell_macd_detector=="MACD Cross Below Signal"?sell_MACDCrossBelowSignal:

sell_macd_detector=="Centerline Cross Upwards"?sell_CenterlineCrossUpwards:

sell_macd_detector=="Centerline Cross Downwards"?sell_CenterlineCrossDownwards:

sell_macd_detector=="MACD above Signal"?sell_MACDAboveSignal:

sell_macd_detector=="MACD below Signal"?sell_MACDBelowSignal:

sell_macd_detector=="MACD above Treshold"?sell_MACDAboveTreshold:

sell_macd_detector=="MACD below Treshold"?sell_MACDBelowTreshold:

false ) : true

//SELL BB

sell_bb_basis = variant(bb_type, source_main, sell_bb_length)

sell_bb_dev = sell_bb_std * stdev(source_main, sell_bb_length)

sell_bb_upper = sell_bb_basis + sell_bb_dev

sell_bb_lower = sell_bb_basis - sell_bb_dev

sell_per_lower_bb = sell_bb_useDifferentRes?request.security(syminfo.tickerid, sell_bb_candle_period, sell_bb_lower):sell_bb_lower

sell_per_upper_bb = sell_bb_useDifferentRes?request.security(syminfo.tickerid, sell_bb_candle_period, sell_bb_upper):sell_bb_upper

sell_per_bb_basis = sell_bb_useDifferentRes?request.security(syminfo.tickerid, sell_bb_candle_period, sell_bb_basis):sell_bb_basis

sell_bbBelow = false

sell_bbCrossBelow = false

sell_bbCrossAbove = false

sell_bbAbove = false

sell_bbBelow := sell_per_upper_bb>close or sell_per_upper_bb>low

sell_bbAbove := sell_per_upper_bb<high or sell_per_upper_bb<close

sell_bbCrossAbove := crossover(source_main, sell_per_upper_bb)

sell_bbCrossBelow := crossunder(source_main, sell_per_upper_bb)

sell_bbBuy = sell_bb_use ? (

sell_bb_detector=="Price Cross Below"?sell_bbCrossBelow:

sell_bb_detector=="Price Below"?sell_bbBelow:

sell_bb_detector=="Price Cross Above"?sell_bbCrossAbove:

sell_bb_detector=="Price Above"?sell_bbAbove:false ) : true

//SELL MA Calculation

sell_ma_short = variant(sell_ma_type, source_main, sell_ma_length_short)

sell_ma_long = variant(sell_ma_type, source_main, sell_ma_length_long)

sell_per_ma_short = sell_ma_useRes?request.security(syminfo.tickerid, sell_ma_candle_period, sell_ma_short):sell_ma_short

sell_per_ma_long = sell_ma_useRes?request.security(syminfo.tickerid, sell_ma_candle_period, sell_ma_long ):sell_ma_long

sell_p1ma = plot(sell_ma_use?sell_per_ma_short:na, color=green)

sell_p2ma = plot(sell_ma_use?sell_per_ma_long:na , color=red)

sell_ShortCrossesBelowLong = false

sell_ShortBelowLong = false

sell_ShortAboveLong = false

sell_PriceCrossesBelowShort = false

sell_PriceBelowShort = false

sell_PriceCrossesBelowLong = false

sell_PriceBelowLong = false

sell_PriceAboveBoth = false

sell_PriceBelowBoth = false

sell_ShortCrossesBelowLong := crossunder(sell_per_ma_short, sell_per_ma_long)

sell_ShortBelowLong := sell_per_ma_short < sell_per_ma_long

sell_ShortAboveLong := sell_per_ma_short > sell_per_ma_long

sell_PriceCrossesBelowShort := ( close > sell_per_ma_short or high > sell_per_ma_short ) and low < sell_per_ma_short

sell_PriceBelowShort := close > sell_per_ma_short or high > sell_per_ma_short

sell_PriceCrossesBelowLong := ( close > sell_per_ma_long or high > sell_per_ma_long ) and low < sell_per_ma_long

sell_PriceBelowLong := close > sell_per_ma_long or high > sell_per_ma_long

sell_PriceAboveBoth := ( close > sell_per_ma_long or high > sell_per_ma_long ) and (close > sell_per_ma_short or high > sell_per_ma_short )

sell_PriceBelowBoth := ( close < sell_per_ma_long or low < sell_per_ma_long ) and (close < sell_per_ma_short or low < sell_per_ma_short )

sell_maBuy = sell_ma_use ? (

sell_ma_detector=="Short Crosses Below Long"?sell_ShortCrossesBelowLong:

sell_ma_detector=="Short Below Long"?sell_ShortBelowLong :

sell_ma_detector=="Price Cross Below Short"?sell_PriceCrossesBelowShort:

sell_ma_detector=="Price Below Short"?sell_PriceBelowShort:

sell_ma_detector=="Price Cross Below Long"?sell_PriceBelowShort:

sell_ma_detector=="Price Below Long"?sell_PriceCrossesBelowLong:

sell_ma_detector=="Price Above Both"?sell_PriceAboveBoth:

sell_ma_detector=="Price Below Both"?sell_PriceBelowBoth:

false ) : true

//SELL VWAP

sell_var_vwap = vwap(hlc3)

sell_per_vwap = sell_vwap_useRes?request.security(syminfo.tickerid,sell_vwap_candle_period,sell_var_vwap):sell_var_vwap

sell_PriceCrossAbove = false

sell_PriceAbove = false

sell_PriceCrossBelow = false

sell_PriceBelow = false

sell_PriceCrossAbove := ( close > sell_per_vwap or high > sell_per_vwap ) and low < sell_per_vwap

sell_PriceAbove := close > sell_per_vwap or high > sell_per_vwap

sell_PriceCrossBelow := ( close < sell_per_vwap or low < sell_per_vwap ) and high > sell_per_vwap

sell_PriceBelow := close < sell_per_vwap or low < sell_per_vwap

sell_vwapBuy = false

sell_vwapBuy := sell_vwap_use ?(

sell_vwap_detector=="Price Cross Above"?sell_PriceCrossAbove:

sell_vwap_detector=="Price Above"?sell_PriceAbove:

sell_vwap_detector=="Price Cross Below"?sell_PriceCrossBelow:

sell_vwap_detector=="Price Below"?sell_PriceBelow:false ) : true

//PC

sell_price_change = (close - close[1])/close[1]*100

sell_per_price_change = sell_pc_useDifferentRes?request.security(syminfo.tickerid, sell_pc_candle_period, sell_price_change):sell_price_change

sell_pcBuy = false

sell_pcBuy := sell_pc_use ? ( sell_per_price_change > sell_pc_change ) : true

///////////////////////////////////////////////

// MAIN LOGIC

///////////////////////////////////////////////

allBuy = false

allBuy := rsiBuy and bbBuy and stochBuy and stochrsiBuy and cciBuy and macdBuy and maBuy and vwapBuy and pcBuy

allSell = false

allSell := sell_rsiBuy and sell_bbBuy and sell_stochBuy and sell_stochrsiBuy and sell_cciBuy and sell_macdBuy and sell_maBuy and sell_vwapBuy and sell_pcBuy

buy = allBuy

sell = (

sell_pc_use?sell_pcBuy:false or

sell_vwap_use?sell_vwapBuy:false or

sell_rsi_use?sell_rsiBuy:false or

sell_ma_use?sell_maBuy:false or

sell_bb_use?sell_bbBuy:false or

sell_cci_use?sell_cciBuy:false or

sell_macd_use?sell_macdBuy:false or

sell_stoch_use?sell_stochBuy:false or

sell_stochrsi_use?sell_stochrsiBuy:false ) ? true : false

//////////////////////////////////////////////////////////////////////////////////////////

//*** This Trade Management Section of code is a modified version of that found in ***//

//*** "How to automate this strategy for free using a chrome extension" by CryptoRox ***//

//*** Modifications and tradeState engine by JustUncleL. ***//

//////////////////////////////////////////////////////////////////////////////////////////

//

///////////////////////////////////////////////

//* Backtesting Period Selector | Component *//

///////////////////////////////////////////////

// * https://www.tradingview.com/script/eCC1cvxQ-Backtesting-Period-Selector-Component *//

// * https://www.tradingview.com/u/pbergden/ *//

// * Modifications made by JustUncleL*//

testStartYear = input(2018, "Backtest Start Year",minval=1980)

testStartMonth = input(9, "Backtest Start Month",minval=1,maxval=12)

testStartDay = input(20, "Backtest Start Day",minval=1,maxval=31)

testPeriodStart = timestamp(testStartYear,testStartMonth,testStartDay,0,0)

testStopYear = 9999 //input(9999, "Backtest Stop Year",minval=1980)

testStopMonth = 12 // input(12, "Backtest Stop Month",minval=1,maxval=12)

testStopDay = 31 //input(31, "Backtest Stop Day",minval=1,maxval=31)

testPeriodStop = timestamp(testStopYear,testStopMonth,testStopDay,0,0)

testPeriod() => time >= testPeriodStart and time <= testPeriodStop ? true : false

//////////////////////////

//* Strategy Component *//

//////////////////////////

high_ = high

low_ = low

AQUA = #00FFFFFF

BLUE = #0000FFFF

RED = #FF0000FF

LIME = #00FF00FF

GRAY = #808080FF

DARKRED = #8B0000FF

DARKGREEN = #006400FF

//

//fastExit = input(false,title="Use Opposite Trade as a Close Signal")

//clrBars = input(true,title="Colour Candles to Trade Order state")

fastExit = true

clrBars = false

//orderType = input("LongsOnly",title="What type of Orders", options=["Longs+Shorts","LongsOnly","ShortsOnly","Flip"])

orderType = "LongsOnly"

//

isLong = (orderType != "ShortsOnly")

isShort = (orderType != "LongsOnly")

//////////////////////////////////////////////////

//* Put Entry and special Exit conditions here *//

//////////////////////////////////////////////////

//////////////////////////

//* tradeState Engine *//

INACTIVE = 0 // No trades open

ACTIVELONG = 1 // Long Trade Started

ACTIVESHORT = -1 // Short Trade Started

//

//////////////////////////

// Keep track of current trade state

longClose = false, longClose := nz(longClose[1],false)

shortClose = false, shortClose := nz(shortClose[1],false)

tradeState = INACTIVE, tradeState := nz(tradeState[1])

tradeState := tradeState==INACTIVE ? buy==1 and (barstate.isconfirmed or barstate.ishistory) and isLong and not longClose and not shortClose? ACTIVELONG :

sell==1 and (barstate.isconfirmed or barstate.ishistory) and isShort and not longClose and not shortClose? ACTIVESHORT :

tradeState : tradeState

//Entry Triggers, this happens when tradeState changes from neutral to active

longCondition = false

shortCondition = false

longCondition := change(tradeState) and tradeState==ACTIVELONG

shortCondition := change(tradeState) and tradeState==ACTIVESHORT

if orderType=="Flip"

temp = longCondition

longCondition := shortCondition

shortCondition := temp

//end if

//SPECIAL Exit Condition.

// Exit on Average Fast/Slow MA cross over, force no repaint

longExitC = sell ? 1 : 0

shortExitC = 0

// Exit Trigger without SL set and trade Actine

longExit = change(longExitC) and longExitC==1 and tradeState==1

shortExit = change(shortExitC) and shortExitC==1 and tradeState==-1

// -- debugs

//plotchar(tradeState,"tradeState at Event",location=location.bottom, color=na)

//plotchar(longCondition, title="longCondition",color=na)

//plotchar(shortCondition, title="shortCondition",color=na)

//plotchar(tradeState, title="tradeState",color=na)

// -- /debugs

/////////////////////////////////////

//======[ Deal Entry Prices ]======//

/////////////////////////////////////

last_open_longCondition = na

last_open_shortCondition = na

last_open_longCondition := longCondition ? close : nz(last_open_longCondition[1])

last_open_shortCondition := shortCondition ? close : nz(last_open_shortCondition[1])

//////////////////////////////////

//======[ Position State ]======//

//////////////////////////////////

in_longCondition = tradeState == ACTIVELONG

in_shortCondition = tradeState == ACTIVESHORT

/////////////////////////////////

//======[ Trailing Stop ]======//

/////////////////////////////////

// This Trailing Stop Starts as soon as trade is Started

isTS = input(false, "Trailing Stop")

ts = input(3.0, "Trailing Stop (%)", minval=0,step=0.1, type=float) /100

// Initialise and track highs and lows

short_ts = false, long_ts = false

last_high = 0.0, last_high := nz(last_high[1],na)

last_low = 0.0, last_low := nz(last_low[1],na)

last_high_short = 0.0, last_high_short := nz(last_high_short[1],na)

last_low_long = 0.0, last_low_long := nz(last_low_long[1],na)

// LONGS TSL

if in_longCondition == true

last_high := (na(last_high) or high_ > last_high) ? high_ : last_high

last_low_long := (na(last_low_long) or low_ < last_low_long) ? low_ : last_low_long

long_ts := isTS and (low_ <= last_high - last_high * ts)

//else

if in_longCondition == false

long_ts := false

last_high := na

last_low_long := na

//end if

//SHORTS TSL

if in_shortCondition == true

last_low := (na(last_low) or low_ < last_low) ? low_ : last_low

last_high_short := (na(last_high_short) or high_ > last_high_short) ? high_ : last_high_short

short_ts := isTS and (high_ >= last_low + last_low * ts)

if in_shortCondition == false

short_ts := false

last_low := na

last_high_short := na

//end if

///////////////////////////////

//======[ Take Profit ]======//

///////////////////////////////

isTP = input(true, "Take Profit")

tp = input(1.0, "Take Profit (%)",minval=0,step=0.1,type=float) / 100

ttp = input(0.0, "Trailing Profit (%)",minval=0,step=0.1,type=float) / 100

ttp := ttp>tp ? tp : ttp

long_tp = isTP and in_longCondition and (last_high >= last_open_longCondition + last_open_longCondition * tp) and (low_ <= last_high - last_high * ttp)

short_tp = isTP and in_shortCondition and (last_low <= last_open_shortCondition - last_open_shortCondition * tp) and (high_ >= last_low + last_low * ttp)

/////////////////////////////

//======[ Stop Loss ]======//

/////////////////////////////

isSL = input(true, "Stop Loss")

sl = input(2.0, "Stop Loss (%)", minval=0,step=0.1, type=float) / 100

long_sl = isSL and in_longCondition and (low_ <= last_open_longCondition - last_open_longCondition * sl)

short_sl = isSL and in_shortCondition and (high_ >= last_open_shortCondition + last_open_shortCondition * sl)

////////////////////////////////////

//======[ Stop on Opposite ]======//

////////////////////////////////////

//NOTE Short exit signal is non-repainting, no need to force it, if Pyramiding keep going

long_sos = (fastExit or (not isTS and not isSL)) and longExit and in_longCondition

short_sos = (fastExit or (not isTS and not isSL)) and shortExit and in_shortCondition

/////////////////////////////////

//======[ Close Signals ]======//

/////////////////////////////////

// Create a single close for all the different closing conditions, all conditions here are non-repainting

longClose := isLong and (long_tp or long_sl or long_ts or long_sos) and not longCondition

shortClose := isShort and (short_tp or short_sl or short_ts or short_sos) and not shortCondition

///////////////////////////////

//======[ Plot Colors ]======//

///////////////////////////////

longCloseCol = na

shortCloseCol = na

longCloseCol := long_tp ? green : long_sl ? maroon : long_ts ? purple : long_sos ? orange :longCloseCol[1]

shortCloseCol := short_tp ? green : short_sl ? maroon : short_ts ? purple : short_sos ? orange : shortCloseCol[1]

//

tpColor = isTP and in_longCondition ? lime : isTP and in_shortCondition ? lime : na

slColor = isSL and in_longCondition ? red : isSL and in_shortCondition ? red : na

//////////////////////////////////

//======[ Strategy Plots ]======//

//////////////////////////////////

//LONGS

plot(isTS and in_longCondition?

last_high - last_high * ts : na, "Buy Trailing", fuchsia, style=2, linewidth=1,offset=1)

plot(isTP and in_longCondition and last_high < last_open_longCondition + last_open_longCondition * tp ?

last_open_longCondition + last_open_longCondition * tp : na, "Long TP Active", tpColor, style=3,join=false, linewidth=1,offset=1)

plot(isTP and in_longCondition and last_high >= last_open_longCondition + last_open_longCondition * tp ?

last_high - last_high * ttp : na, "Buy Trailing", black, style=2, linewidth=1,offset=1)

plot(isSL and in_longCondition and last_low_long > last_open_longCondition - last_open_longCondition * sl ?

last_open_longCondition - last_open_longCondition * sl : na, "Long SL", slColor, style=3,join=false, linewidth=1,offset=1)

//SHORTS

plot(isTS and in_shortCondition?

last_low + last_low * ts : na, "Short Trailing", fuchsia, style=2, linewidth=1,offset=1)

plot(isTP and in_shortCondition and last_low > last_open_shortCondition - last_open_shortCondition * tp ?

last_open_shortCondition - last_open_shortCondition * tp : na, "Short TP Active", tpColor, style=3,join=false, linewidth=1,offset=1)

plot(isTP and in_shortCondition and last_low <= last_open_shortCondition - last_open_shortCondition * tp ?

last_low + last_low * ttp : na, "Short Trailing", black, style=2, linewidth=1,offset=1)

plot(isSL and in_shortCondition and last_high_short < last_open_shortCondition + last_open_shortCondition * sl ?

last_open_shortCondition + last_open_shortCondition * sl : na, "Short SL", slColor, style=3,join=false, linewidth=1,offset=1)

// Colour code the candles for Profit/Loss: Profit=LIGHT colour, Loss=DARK colour

bclr = not clrBars ? na : tradeState==INACTIVE ? GRAY :

in_longCondition ? close<last_open_longCondition? DARKGREEN : LIME :

in_shortCondition ? close>last_open_shortCondition? DARKRED : RED : GRAY

barcolor(bclr,title="Trade State Bar Colouring")

///////////////////////////////

//======[ Alert Plots ]======//

///////////////////////////////

// //LONGS

// plotshape(longCondition?close:na, title="Buy", color=green, textcolor=green, transp=0,

// style=shape.triangleup, location=location.belowbar, size=size.small,text="Buy",offset=0)

// plotshape(longClose?close:na, title="Sell", color=longCloseCol, textcolor=white, transp=0,

// style=shape.labeldown, location=location.abovebar, size=size.small,text="Sell",offset=0)

// //SHORTS

// plotshape(shortCondition?close:na, title="Short", color=red, textcolor=red, transp=0,

// style=shape.triangledown, location=location.abovebar, size=size.small,text="SHORT",offset=0)

// plotshape(shortClose?close:na, title="Short Close", color=shortCloseCol, textcolor=white, transp=0,

// style=shape.labelup, location=location.belowbar, size=size.small,text="Short",offset=0)

// Autoview alert syntax - This assumes you are trading coins BUY and SELL on Binance Exchange

// WARNING*** Only use Autoview to automate a strategy after you've sufficiently backtested and forward tested the strategy.

// You can learn more about the syntax here:

// http://autoview.with.pink/#syntax and you can watch this video here: https://www.youtube.com/watch?v=epN5Tjinuxw

// For the opens you will want to trigger BUY orders on LONGS (eg ETHBTC) with alert option "Once Per Bar Close"

// and SELL orders on SHORTS (eg BTCUSDT)

// b=buy q=0.001 e=binance s=ethbtc u=currency t=market ( LONG )

// or b=sell q=0.001 e=binance s=btcusdt t=market ( SHORT )

//alertcondition(longCondition, "Open Long", "LONG")

//alertcondition(shortCondition, "Open Short", "SHORT")

// For the closes you will want to trigger these alerts on condition with alert option "Once Per Bar"

// (NOTE: with Renko you can only use "Once Per Bar Close" option)

// b=sell q=99% e=binance s=ethbtc t=market ( CLOSE LONGS )

// or b=buy q=99% e=binance s=btcusdt u=currency t=market ( CLOSE SHORTS )

// This gets it as it happens and typically results in a better exit live than in the backtest.

// It works really well for counteracting some market slippage

//alertcondition(longClose, "Close Longs", "CLOSE LONGS")

//alertcondition(shortClose, "Close Shorts", "CLOSE SHORTS")

////////////////////////////////////////////

//======[ Strategy Entry and Exits ]======//

////////////////////////////////////////////

if testPeriod() and isLong

strategy.entry("Long", 1, when=longCondition)

strategy.close("Long", when=longClose )

//if testPeriod() and isShort

// strategy.entry("Short", 0, when=shortCondition)

// strategy.close("Short", when=shortClose )

// --- Debugs

//plotchar(longExit,title="longExit",location=location.bottom,color=na)

//plotchar(longCondition,title="longCondition",location=location.bottom,color=na)

//plotchar(in_longCondition,title="in_longCondition",location=location.bottom,color=na)

//plotchar(longClose,title="longClose",location=location.bottom,color=na,color=na)

//plotchar(buy,title="buy",location=location.bottom,color=na)

// --- /Debugs

///////////////////////////////////

//======[ Reset Variables ]======//

///////////////////////////////////

if longClose or shortClose

tradeState := INACTIVE

in_longCondition := false

in_shortCondition := false

last_low := na

last_low_long := na

last_high := na

last_high_short := na

// EOF

//-- SUPPORT/RESISTANCE LINES by:ByDipsOnly -----------------------------------------------------------------------------

sr_sep = input(false, title="⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻ S/R Lines ⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻")

show_SPlines_input = input(true, "Show S/R Lines")

tf = timeframe.period

vamp = input(title="VolumeMA", defval=6)

vam = sma(volume, vamp)

upside = high[3]>high[4] and high[4]>high[5] and high[2]<high[3] and high[1]<high[2] and volume[3]>vam[3]

downside = low[3]<low[4] and low[4]<low[5] and low[2]>low[3] and low[1]>low[2] and volume[3]>vam[3]

calcup() =>

fractalup = na

fractalup := upside ? high[3] : fractalup[1]

calcdown() =>

fractaldown = na

fractaldown := downside ? low[3] : fractaldown[1]

fuptf = request.security(syminfo.tickerid,tf == "current" ? timeframe.period : tf, calcup())

fdowntf = request.security(syminfo.tickerid,tf == "current" ? timeframe.period : tf, calcdown())

plotup = show_SPlines_input==true?fuptf:na

plotdown = show_SPlines_input==true?fdowntf:na

plot(plotup, "FractalUp", color=yellow, linewidth=1, style=cross, transp=0, offset =-3, join=false)

plot(plotdown, "FractalDown", color=blue, linewidth=1, style=cross, transp=0, offset=-3, join=false)

fractalupalert = na

fractalup = na

fractalup := upside ? high[3] : fractalup[1]

fractalupalert := high[3] > open or fractalup[1] > open

alertcondition(show_SPlines_input?fractalupalert:na, title="R Line", message='R Line')

//-- END SUPPORT/RESISTANCE LINES -------------------------------------------------------------------------------------------