Estratégia de Swing Trading de Fibonacci Multi-Time Frame Adaptável

Visão geral

A estratégia de negociação de segmentos de onda de Fibonacci é uma estratégia de acompanhamento de tendências que combina a linha média de adaptação, o indicador Stochastic RSI e a zona de retração de Fibonacci. A estratégia usa vários indicadores para analisar a tendência em diferentes níveis e ajustar dinamicamente a posição.

Princípio da estratégia

A estratégia de negociação do segmento de Fibonacci de Multi-Framework Adaptação utiliza os seguintes indicadores e mecanismos técnicos:

Média Adaptativa ((SMA e WMA): calcula a média móvel adaptativa de preços de diferentes períodos (minutos, horas, dias, etc.). Determine a direção da tendência de acordo com a vaga da média.

Stochastic RSI: Calcula o valor estocástico do indicador RSI para determinar se o RSI está sobrecomprando ou sobrevendendo. Combina a força e a tendência da análise da forma da curva RSI.

Zonas de retração de Fibonacci: Mapear as zonas de retração de Fibonacci com base nos últimos Swing High e Swing Low, e configurar pontos de compra e venda opcionais. Estas áreas têm características de reversão e correção de tendências potenciais.

Gerenciamento de posições: ajuste de posições de forma dinâmica de acordo com os sinais fortes e fracos do Stoch RSI e da linha de equilíbrio adaptativa.

A estratégia primeiro determina a direção da tendência, estabelecendo um ponto de compra e venda de opções quando o preço da ação entra na zona de retorno de Fibonacci. Quando a linha de equilíbrio e o Stoch RSI emitem sinais de entrada, execute o pedido perto do ponto de compra e venda de opções. O stop loss é definido fora da zona de retorno para controlar o risco.

Análise de vantagens

A estratégia de negociação de segmentos de Fibonacci adaptada a vários quadros tem as seguintes vantagens:

Análise de múltiplos quadros de tempo: avalia simultaneamente vários níveis de períodos (minutos, horas, dias), julga tendências de forma mais abrangente.

Gerenciamento dinâmico de posições: ajustar posições de acordo com a situação, controlar o risco.

Áreas de retorno de posicionamento de precisão: Áreas de Fibonacci podem ser usadas para capturar reversões de curto prazo na tendência.

Parar rigoroso: Parar de acordo com a configuração da área de retirada, evitando efetivamente grandes perdas.

Filtragem de sinais: execute transações apenas nas proximidades de pontos de venda e compra selecionados, evitando falhas.

Optimização de parâmetros: vários parâmetros de entrada podem ser ajustados de acordo com o mercado para otimizar o desempenho da estratégia.

Análise de Riscos

A estratégia tem os seguintes riscos:

Risco de falha da zona de retirada: o preço não atingiu a zona de Fibonacci ou falha da zona, não foi possível construir um depósito. Pode ser mitigado por expandir a área de alcance, aumentar o número de áreas.

Risco de rastreamento de perda: a configuração estática de parada de perda, que pode ser previamente atingida. Pode ser otimizada por meios como parada de perda mecânica e áreas de parada de reserva.

Risco de falha de sinal: linha de equilíbrio de adaptação, Stoch RSI Falha de sinal ocasional, causando transações desnecessárias. Pode filtrar adequadamente os sinais para reduzir a probabilidade de falha de ruptura.

Risco de complexidade excessiva: a combinação de vários parâmetros e indicadores técnicos aumenta a complexidade da estratégia. É mais difícil de otimizar e testar.

Direção de otimização

A estratégia de negociação de segmentos de Fibonacci adaptada a um quadro de tempo múltiplo pode ser ainda mais otimizada a partir das seguintes dimensões:

Testar mais ações e variedades de divisas, avaliar a solidez da estratégia. Ajustar os parâmetros de acordo com os diferentes mercados.

Aumentar o mecanismo de filtragem de sinais, reduzir a probabilidade de falso sinal e aumentar a taxa de ruído.

Teste e compare a eficácia dos parâmetros de diferentes tipos de médias móveis.

Tente substituir o stop-loss fixo por um stop-loss de rastreamento ou uma zona de stop-loss de reserva para ver o aumento da eficácia da estratégia.

Experimente sinais de breakout ou mecanismos de rastreamento de tendências, e conceba formas de lucrar com a linha longa.

Resumir

A estratégia de negociação de segmentos de Fibonacci, adaptada a vários quadros de tempo, usa uma variedade de ferramentas de análise para identificar tendências e posicionar posições em períodos de retorno precisos. Um mecanismo rigoroso de controle de perda e risco ajuda a otimizar os lucros em grandes tendências. A estratégia tem mais espaço e direção de otimização ajustáveis e, após a devida configuração e atualização, se tornará uma estratégia de negociação quantitativa estável e confiável.

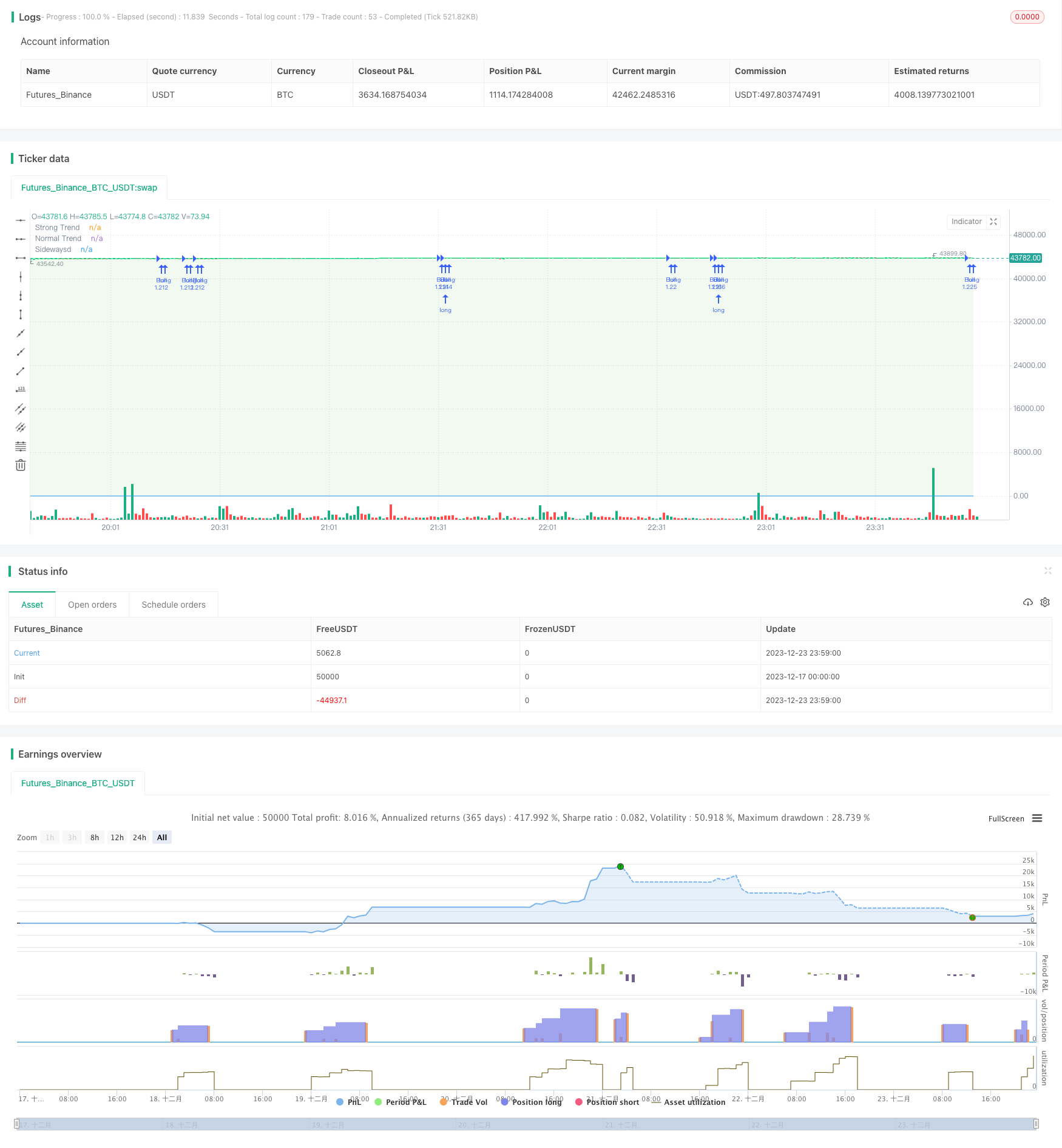

/*backtest

start: 2023-12-17 00:00:00

end: 2023-12-24 00:00:00

period: 1m

basePeriod: 1m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © imal_max

//@version=5

strategy(title="Auto Fib Golden Pocket Band - Autofib Moving Average", shorttitle="Auto Fib Golden Pocket Band", overlay=true, pyramiding=15, process_orders_on_close=true, calc_on_every_tick=true, initial_capital=10000, currency = currency.USD, default_qty_value=100, default_qty_type=strategy.percent_of_equity, commission_type=strategy.commission.percent, commission_value=0.05, slippage=2)

//indicator("Auto Fib Golden Pocket Band - Autofib Moving Average", overlay=true, shorttitle="Auto Fib Golden Pocket Band", timeframe""")

// Fibs

// auto fib ranges

// fib band Strong Trend

enable_StrongBand_Bull = input.bool(title='enable Upper Bullish Band . . . Fib Level', defval=true, group='══════ Strong Trend Levels ══════', inline="0")

select_StrongBand_Fib_Bull = input.float(0.236, title=" ", options=[-0.272, 0, 0.236, 0.382, 0.5, 0.618, 0.702, 0.71, 0.786, 0.83, 0.886, 1, 1.272], group='══════ Strong Trend Levels ══════', inline="0")

enable_StrongBand_Bear = input.bool(title='enable Lower Bearish Band . . . Fib Level', defval=false, group='══════ Strong Trend Levels ══════', inline="1")

select_StrongBand_Fib_Bear = input.float(0.382, '', options=[-0.272, 0, 0.236, 0.382, 0.5, 0.618, 0.702, 0.71, 0.786, 0.83, 0.886, 1, 1.272], group='══════ Strong Trend Levels ══════', inline="1")

StrongBand_Lookback = input.int(title='Pivot Look Back', minval=1, defval=400, group='══════ Strong Trend Levels ══════', inline="2")

StrongBand_EmaLen = input.int(title='Fib EMA Length', minval=1, defval=120, group='══════ Strong Trend Levels ══════', inline="2")

// fib middle Band regular Trend

enable_MiddleBand_Bull = input.bool(title='enable Middle Bullish Band . . . Fib Level', defval=true, group='══════ Regular Trend Levels ══════', inline="0")

select_MiddleBand_Fib_Bull = input.float(0.618, '', options=[-0.272, 0, 0.236, 0.382, 0.5, 0.6, 0.618, 0.702, 0.71, 0.786, 0.83, 0.886, 1, 1.272], group='══════ Regular Trend Levels ══════', inline="0")

enable_MiddleBand_Bear = input.bool(title='enable Middle Bearish Band . . . Fib Level', defval=true, group='══════ Regular Trend Levels ══════', inline="1")

select_MiddleBand_Fib_Bear = input.float(0.382, '', options=[-0.272, 0, 0.236, 0.382, 0.5, 0.618, 0.702, 0.71, 0.786, 0.83, 0.886, 1, 1.272], group='══════ Regular Trend Levels ══════', inline="1")

MiddleBand_Lookback = input.int(title='Pivot Look Back', minval=1, defval=900, group='══════ Regular Trend Levels ══════', inline="2")

MiddleBand_EmaLen = input.int(title='Fib EMA Length', minval=1, defval=400, group='══════ Regular Trend Levels ══════', inline="2")

// fib Sideways Band

enable_SidewaysBand_Bull = input.bool(title='enable Lower Bullish Band . . . Fib Level', defval=true, group='══════ Sideways Trend Levels ══════', inline="0")

select_SidewaysBand_Fib_Bull = input.float(0.6, '', options=[-0.272, 0, 0.236, 0.382, 0.5, 0.6, 0.618, 0.702, 0.71, 0.786, 0.83, 0.886, 1, 1.272], group='══════ Sideways Trend Levels ══════', inline="0")

enable_SidewaysBand_Bear = input.bool(title='enable Upper Bearish Band . . . Fib Level', defval=true, group='══════ Sideways Trend Levels ══════', inline="1")

select_SidewaysBand_Fib_Bear = input.float(0.5, '', options=[-0.272, 0, 0.236, 0.382, 0.5, 0.618, 0.702, 0.71, 0.786, 0.83, 0.886, 1, 1.272], group='══════ Sideways Trend Levels ══════', inline="1")

SidewaysBand_Lookback = input.int(title='Pivot Look Back', minval=1, defval=4000, group='══════ Sideways Trend Levels ══════', inline="2")

SidewaysBand_EmaLen = input.int(title='Fib EMA Length', minval=1, defval=150, group='══════ Sideways Trend Levels ══════', inline="2")

// Strong Band

isBelow_StrongBand_Bull = true

isBelow_StrongBand_Bear = true

StrongBand_Price_of_Low = float(na)

StrongBand_Price_of_High = float(na)

StrongBand_Bear_Fib_Price = float(na)

StrongBand_Bull_Fib_Price = float(na)

/// Middle Band

isBelow_MiddleBand_Bull = true

isBelow_MiddleBand_Bear = true

MiddleBand_Price_of_Low = float(na)

MiddleBand_Price_of_High = float(na)

MiddleBand_Bear_Fib_Price = float(na)

MiddleBand_Bull_Fib_Price = float(na)

// Sideways Band

isBelow_SidewaysBand_Bull = true

isBelow_SidewaysBand_Bear = true

SidewaysBand_Price_of_Low = float(na)

SidewaysBand_Price_of_High = float(na)

SidewaysBand_Bear_Fib_Price = float(na)

SidewaysBand_Bull_Fib_Price = float(na)

// get Fib Levels

if enable_StrongBand_Bull

StrongBand_Price_of_High := ta.highest(high, StrongBand_Lookback)

StrongBand_Price_of_Low := ta.lowest(low, StrongBand_Lookback)

StrongBand_Bull_Fib_Price := (StrongBand_Price_of_High - StrongBand_Price_of_Low) * (1 - select_StrongBand_Fib_Bull) + StrongBand_Price_of_Low //+ fibbullHighDivi

isBelow_StrongBand_Bull := StrongBand_Bull_Fib_Price > ta.lowest(low, 2) or not enable_StrongBand_Bull

if enable_StrongBand_Bear

StrongBand_Price_of_High := ta.highest(high, StrongBand_Lookback)

StrongBand_Price_of_Low := ta.lowest(low, StrongBand_Lookback)

StrongBand_Bear_Fib_Price := (StrongBand_Price_of_High - StrongBand_Price_of_Low) * (1 - select_StrongBand_Fib_Bear) + StrongBand_Price_of_Low// + fibbullLowhDivi

isBelow_StrongBand_Bear := StrongBand_Bear_Fib_Price < ta.highest(low, 2) or not enable_StrongBand_Bear

if enable_MiddleBand_Bull

MiddleBand_Price_of_High := ta.highest(high, MiddleBand_Lookback)

MiddleBand_Price_of_Low := ta.lowest(low, MiddleBand_Lookback)

MiddleBand_Bull_Fib_Price := (MiddleBand_Price_of_High - MiddleBand_Price_of_Low) * (1 - select_MiddleBand_Fib_Bull) + MiddleBand_Price_of_Low //+ fibbullHighDivi

isBelow_MiddleBand_Bull := MiddleBand_Bull_Fib_Price > ta.lowest(low, 2) or not enable_MiddleBand_Bull

if enable_MiddleBand_Bear

MiddleBand_Price_of_High := ta.highest(high, MiddleBand_Lookback)

MiddleBand_Price_of_Low := ta.lowest(low, MiddleBand_Lookback)

MiddleBand_Bear_Fib_Price := (MiddleBand_Price_of_High - MiddleBand_Price_of_Low) * (1 - select_MiddleBand_Fib_Bear) + MiddleBand_Price_of_Low// + fibbullLowhDivi

isBelow_MiddleBand_Bear := MiddleBand_Bear_Fib_Price < ta.highest(low, 2) or not enable_MiddleBand_Bear

if enable_SidewaysBand_Bull

SidewaysBand_Price_of_High := ta.highest(high, SidewaysBand_Lookback)

SidewaysBand_Price_of_Low := ta.lowest(low, SidewaysBand_Lookback)

SidewaysBand_Bull_Fib_Price := (SidewaysBand_Price_of_High - SidewaysBand_Price_of_Low) * (1 - select_SidewaysBand_Fib_Bull) + SidewaysBand_Price_of_Low //+ fibbullHighDivi

isBelow_SidewaysBand_Bull := SidewaysBand_Bull_Fib_Price > ta.lowest(low, 2) or not enable_SidewaysBand_Bull

if enable_SidewaysBand_Bear

SidewaysBand_Price_of_High := ta.highest(high, SidewaysBand_Lookback)

SidewaysBand_Price_of_Low := ta.lowest(low, SidewaysBand_Lookback)

SidewaysBand_Bear_Fib_Price := (SidewaysBand_Price_of_High - SidewaysBand_Price_of_Low) * (1 - select_SidewaysBand_Fib_Bear) + SidewaysBand_Price_of_Low// + fibbullLowhDivi

isBelow_SidewaysBand_Bear := SidewaysBand_Bear_Fib_Price < ta.highest(low, 2) or not enable_SidewaysBand_Bear

// Fib EMAs

// fib ema Strong Trend

StrongBand_current_Trend_EMA = float(na)

StrongBand_Bull_EMA = ta.ema(StrongBand_Bull_Fib_Price, StrongBand_EmaLen)

StrongBand_Bear_EMA = ta.ema(StrongBand_Bear_Fib_Price, StrongBand_EmaLen)

StrongBand_Ema_in_Uptrend = ta.change(StrongBand_Bull_EMA) > 0 or ta.change(StrongBand_Bear_EMA) > 0

StrongBand_Ema_Sideways = ta.change(StrongBand_Bull_EMA) == 0 or ta.change(StrongBand_Bear_EMA) == 0

StrongBand_Ema_in_Downtrend = ta.change(StrongBand_Bull_EMA) < 0 or ta.change(StrongBand_Bear_EMA) < 0

if StrongBand_Ema_in_Uptrend or StrongBand_Ema_Sideways

StrongBand_current_Trend_EMA := StrongBand_Bull_EMA

if StrongBand_Ema_in_Downtrend

StrongBand_current_Trend_EMA := StrongBand_Bear_EMA

// fib ema Normal Trend

MiddleBand_current_Trend_EMA = float(na)

MiddleBand_Bull_EMA = ta.ema(MiddleBand_Bull_Fib_Price, MiddleBand_EmaLen)

MiddleBand_Bear_EMA = ta.ema(MiddleBand_Bear_Fib_Price, MiddleBand_EmaLen)

MiddleBand_Ema_in_Uptrend = ta.change(MiddleBand_Bull_EMA) > 0 or ta.change(MiddleBand_Bear_EMA) > 0

MiddleBand_Ema_Sideways = ta.change(MiddleBand_Bull_EMA) == 0 or ta.change(MiddleBand_Bear_EMA) == 0

MiddleBand_Ema_in_Downtrend = ta.change(MiddleBand_Bull_EMA) < 0 or ta.change(MiddleBand_Bear_EMA) < 0

if MiddleBand_Ema_in_Uptrend or MiddleBand_Ema_Sideways

MiddleBand_current_Trend_EMA := MiddleBand_Bull_EMA

if MiddleBand_Ema_in_Downtrend

MiddleBand_current_Trend_EMA := MiddleBand_Bear_EMA

// fib ema Sideways Trend

SidewaysBand_current_Trend_EMA = float(na)

SidewaysBand_Bull_EMA = ta.ema(SidewaysBand_Bull_Fib_Price, SidewaysBand_EmaLen)

SidewaysBand_Bear_EMA = ta.ema(SidewaysBand_Bear_Fib_Price, SidewaysBand_EmaLen)

SidewaysBand_Ema_in_Uptrend = ta.change(SidewaysBand_Bull_EMA) > 0 or ta.change(SidewaysBand_Bear_EMA) > 0

SidewaysBand_Ema_Sideways = ta.change(SidewaysBand_Bull_EMA) == 0 or ta.change(SidewaysBand_Bear_EMA) == 0

SidewaysBand_Ema_in_Downtrend = ta.change(SidewaysBand_Bull_EMA) < 0 or ta.change(SidewaysBand_Bear_EMA) < 0

if SidewaysBand_Ema_in_Uptrend or SidewaysBand_Ema_Sideways

SidewaysBand_current_Trend_EMA := SidewaysBand_Bull_EMA

if SidewaysBand_Ema_in_Downtrend

SidewaysBand_current_Trend_EMA := SidewaysBand_Bear_EMA

// trend states and colors

all_Fib_Emas_Trending = StrongBand_Ema_in_Uptrend and MiddleBand_Ema_in_Uptrend and SidewaysBand_Ema_in_Uptrend

all_Fib_Emas_Downtrend = MiddleBand_Ema_in_Downtrend and StrongBand_Ema_in_Downtrend and SidewaysBand_Ema_in_Downtrend

all_Fib_Emas_Sideways = MiddleBand_Ema_Sideways and StrongBand_Ema_Sideways and SidewaysBand_Ema_Sideways

all_Fib_Emas_Trend_or_Sideways = (MiddleBand_Ema_Sideways or StrongBand_Ema_Sideways or SidewaysBand_Ema_Sideways) or (StrongBand_Ema_in_Uptrend or MiddleBand_Ema_in_Uptrend or SidewaysBand_Ema_in_Uptrend) and not (MiddleBand_Ema_in_Downtrend or StrongBand_Ema_in_Downtrend or SidewaysBand_Ema_in_Downtrend)

allFibsUpAndDownTrend = (MiddleBand_Ema_in_Downtrend or StrongBand_Ema_in_Downtrend or SidewaysBand_Ema_in_Downtrend) and (MiddleBand_Ema_Sideways or SidewaysBand_Ema_Sideways or StrongBand_Ema_Sideways or StrongBand_Ema_in_Uptrend or MiddleBand_Ema_in_Uptrend or SidewaysBand_Ema_in_Uptrend)

Middle_and_Sideways_Emas_Trending = MiddleBand_Ema_in_Uptrend and SidewaysBand_Ema_in_Uptrend

Middle_and_Sideways_Fib_Emas_Downtrend = MiddleBand_Ema_in_Downtrend and SidewaysBand_Ema_in_Downtrend

Middle_and_Sideways_Fib_Emas_Sideways = MiddleBand_Ema_Sideways and SidewaysBand_Ema_Sideways

Middle_and_Sideways_Fib_Emas_Trend_or_Sideways = (MiddleBand_Ema_Sideways or SidewaysBand_Ema_Sideways) or (MiddleBand_Ema_in_Uptrend or SidewaysBand_Ema_in_Uptrend) and not (MiddleBand_Ema_in_Downtrend or SidewaysBand_Ema_in_Downtrend)

Middle_and_Sideways_UpAndDownTrend = (MiddleBand_Ema_in_Downtrend or SidewaysBand_Ema_in_Downtrend) and (MiddleBand_Ema_Sideways or SidewaysBand_Ema_Sideways or MiddleBand_Ema_in_Uptrend or SidewaysBand_Ema_in_Uptrend)

UpperBand_Ema_Color = all_Fib_Emas_Trend_or_Sideways ? color.lime : all_Fib_Emas_Downtrend ? color.red : allFibsUpAndDownTrend ? color.white : na

MiddleBand_Ema_Color = Middle_and_Sideways_Fib_Emas_Trend_or_Sideways ? color.lime : Middle_and_Sideways_Fib_Emas_Downtrend ? color.red : Middle_and_Sideways_UpAndDownTrend ? color.white : na

SidewaysBand_Ema_Color = SidewaysBand_Ema_in_Uptrend ? color.lime : SidewaysBand_Ema_in_Downtrend ? color.red : (SidewaysBand_Ema_in_Downtrend and (SidewaysBand_Ema_Sideways or SidewaysBand_Ema_in_Uptrend)) ? color.white : na

plotStrong_Ema = plot(StrongBand_current_Trend_EMA, color=UpperBand_Ema_Color, title="Strong Trend")

plotMiddle_Ema = plot(MiddleBand_current_Trend_EMA, color=MiddleBand_Ema_Color, title="Normal Trend")

plotSideways_Ema = plot(SidewaysBand_current_Trend_EMA, color=SidewaysBand_Ema_Color, title="Sidewaysd")

Strong_Middle_fillcolor = color.new(color.green, 90)

if all_Fib_Emas_Trend_or_Sideways

Strong_Middle_fillcolor := color.new(color.green, 90)

if all_Fib_Emas_Downtrend

Strong_Middle_fillcolor := color.new(color.red, 90)

if allFibsUpAndDownTrend

Strong_Middle_fillcolor := color.new(color.white, 90)

Middle_Sideways_fillcolor = color.new(color.green, 90)

if Middle_and_Sideways_Fib_Emas_Trend_or_Sideways

Middle_Sideways_fillcolor := color.new(color.green, 90)

if Middle_and_Sideways_Fib_Emas_Downtrend

Middle_Sideways_fillcolor := color.new(color.red, 90)

if Middle_and_Sideways_UpAndDownTrend

Middle_Sideways_fillcolor := color.new(color.white, 90)

fill(plotStrong_Ema, plotMiddle_Ema, color=Strong_Middle_fillcolor, title="fib band background")

fill(plotMiddle_Ema, plotSideways_Ema, color=Middle_Sideways_fillcolor, title="fib band background")

// buy condition

StrongBand_Price_was_below_Bull_level = ta.lowest(low, 1) < StrongBand_current_Trend_EMA

StrongBand_Price_is_above_Bull_level = close > StrongBand_current_Trend_EMA

StronBand_Price_Average_above_Bull_Level = ta.ema(low, 10) > StrongBand_current_Trend_EMA

StrongBand_Low_isnt_toLow = (ta.lowest(StrongBand_current_Trend_EMA, 15) - ta.lowest(low, 15)) < close * 0.005

StronBand_Trend_isnt_fresh = ta.barssince(StrongBand_Ema_in_Downtrend) > 50 or na(ta.barssince(StrongBand_Ema_in_Downtrend))

MiddleBand_Price_was_below_Bull_level = ta.lowest(low, 1) < MiddleBand_current_Trend_EMA

MiddleBand_Price_is_above_Bull_level = close > MiddleBand_current_Trend_EMA

MiddleBand_Price_Average_above_Bull_Level = ta.ema(close, 20) > MiddleBand_current_Trend_EMA

MiddleBand_Low_isnt_toLow = (ta.lowest(MiddleBand_current_Trend_EMA, 10) - ta.lowest(low, 10)) < close * 0.0065

MiddleBand_Trend_isnt_fresh = ta.barssince(MiddleBand_Ema_in_Downtrend) > 50 or na(ta.barssince(MiddleBand_Ema_in_Downtrend))

SidewaysBand_Price_was_below_Bull_level = ta.lowest(low, 1) < SidewaysBand_current_Trend_EMA

SidewaysBand_Price_is_above_Bull_level = close > SidewaysBand_current_Trend_EMA

SidewaysBand_Price_Average_above_Bull_Level = ta.ema(low, 80) > SidewaysBand_current_Trend_EMA

SidewaysBand_Low_isnt_toLow = (ta.lowest(SidewaysBand_current_Trend_EMA, 150) - ta.lowest(low, 150)) < close * 0.0065

SidewaysBand_Trend_isnt_fresh = ta.barssince(SidewaysBand_Ema_in_Downtrend) > 50 or na(ta.barssince(SidewaysBand_Ema_in_Downtrend))

StrongBand_Buy_Alert = StronBand_Trend_isnt_fresh and StrongBand_Low_isnt_toLow and StronBand_Price_Average_above_Bull_Level and StrongBand_Price_was_below_Bull_level and StrongBand_Price_is_above_Bull_level and all_Fib_Emas_Trend_or_Sideways

MiddleBand_Buy_Alert = MiddleBand_Trend_isnt_fresh and MiddleBand_Low_isnt_toLow and MiddleBand_Price_Average_above_Bull_Level and MiddleBand_Price_was_below_Bull_level and MiddleBand_Price_is_above_Bull_level and Middle_and_Sideways_Fib_Emas_Trend_or_Sideways

SidewaysBand_Buy_Alert = SidewaysBand_Trend_isnt_fresh and SidewaysBand_Low_isnt_toLow and SidewaysBand_Price_Average_above_Bull_Level and SidewaysBand_Price_was_below_Bull_level and SidewaysBand_Price_is_above_Bull_level and (SidewaysBand_Ema_Sideways or SidewaysBand_Ema_in_Uptrend and ( not SidewaysBand_Ema_in_Downtrend))

// Sell condition

StrongBand_Price_was_above_Bear_level = ta.highest(high, 1) > StrongBand_current_Trend_EMA

StrongBand_Price_is_below_Bear_level = close < StrongBand_current_Trend_EMA

StronBand_Price_Average_below_Bear_Level = ta.sma(high, 10) < StrongBand_current_Trend_EMA

StrongBand_High_isnt_to_High = (ta.highest(high, 15) - ta.highest(StrongBand_current_Trend_EMA, 15)) < close * 0.005

StrongBand_Bear_Trend_isnt_fresh = ta.barssince(StrongBand_Ema_in_Uptrend) > 50

MiddleBand_Price_was_above_Bear_level = ta.highest(high, 1) > MiddleBand_current_Trend_EMA

MiddleBand_Price_is_below_Bear_level = close < MiddleBand_current_Trend_EMA

MiddleBand_Price_Average_below_Bear_Level = ta.sma(high, 9) < MiddleBand_current_Trend_EMA

MiddleBand_High_isnt_to_High = (ta.highest(high, 10) - ta.highest(MiddleBand_current_Trend_EMA, 10)) < close * 0.0065

MiddleBand_Bear_Trend_isnt_fresh = ta.barssince(MiddleBand_Ema_in_Uptrend) > 50

SidewaysBand_Price_was_above_Bear_level = ta.highest(high, 1) > SidewaysBand_current_Trend_EMA

SidewaysBand_Price_is_below_Bear_level = close < SidewaysBand_current_Trend_EMA

SidewaysBand_Price_Average_below_Bear_Level = ta.sma(high, 20) < SidewaysBand_current_Trend_EMA

SidewaysBand_High_isnt_to_High = (ta.highest(high, 20) - ta.highest(SidewaysBand_current_Trend_EMA, 15)) < close * 0.0065

SidewaysBand_Bear_Trend_isnt_fresh = ta.barssince(SidewaysBand_Ema_in_Uptrend) > 50

StrongBand_Sell_Alert = StronBand_Price_Average_below_Bear_Level and StrongBand_High_isnt_to_High and StrongBand_Bear_Trend_isnt_fresh and StrongBand_Price_was_above_Bear_level and StrongBand_Price_is_below_Bear_level and all_Fib_Emas_Downtrend and not all_Fib_Emas_Trend_or_Sideways

MiddleBand_Sell_Alert = MiddleBand_Price_Average_below_Bear_Level and MiddleBand_High_isnt_to_High and MiddleBand_Bear_Trend_isnt_fresh and MiddleBand_Price_was_above_Bear_level and MiddleBand_Price_is_below_Bear_level and Middle_and_Sideways_Fib_Emas_Downtrend and not Middle_and_Sideways_Fib_Emas_Trend_or_Sideways

SidewaysBand_Sell_Alert = SidewaysBand_Price_Average_below_Bear_Level and SidewaysBand_High_isnt_to_High and SidewaysBand_Bear_Trend_isnt_fresh and SidewaysBand_Price_was_above_Bear_level and SidewaysBand_Price_is_below_Bear_level and SidewaysBand_Ema_in_Downtrend and not (SidewaysBand_Ema_Sideways or SidewaysBand_Ema_in_Uptrend and ( not SidewaysBand_Ema_in_Downtrend))

// Backtester

////////////////// Stop Loss

// Stop loss

enableSL = input.bool(true, title='enable Stop Loss', group='══════════ Stop Loss Settings ══════════')

whichSL = input.string(defval='low/high as SL', title='SL based on static % or based on the low/high', options=['low/high as SL', 'static % as SL'], group='══════════ Stop Loss Settings ══════════')

whichOffset = input.string(defval='% as offset', title='choose offset from the low/high', options=['$ as offset', '% as offset'], group='Stop Loss at the low/high')

lowPBuffer = input.float(1.4, title='SL Offset from the Low/high in %', group='Stop Loss at the low/high') / 100

lowDBuffer = input.float(100, title='SL Offset from the Low/high in $', group='Stop Loss at the low/high')

SlLowLookback = input.int(title='SL lookback for Low/high', defval=5, minval=1, maxval=50, group='Stop Loss at the low/high')

longSlLow = float(na)

shortSlLow = float(na)

if whichOffset == "% as offset" and whichSL == "low/high as SL" and enableSL

longSlLow := ta.lowest(low, SlLowLookback) * (1 - lowPBuffer)

shortSlLow := ta.highest(high, SlLowLookback) * (1 + lowPBuffer)

if whichOffset == "$ as offset" and whichSL == "low/high as SL" and enableSL

longSlLow := ta.lowest(low, SlLowLookback) - lowDBuffer

shortSlLow := ta.highest(high, SlLowLookback) + lowDBuffer

//plot(shortSlLow, title="stoploss", color=color.new(#00bcd4, 0))

// long settings - 🔥 uncomment the 6 lines below to disable the alerts and enable the backtester

longStopLoss = input.float(0.5, title='Long Stop Loss in %', group='static % Stop Loss', inline='Input 1') / 100

// short settings - 🔥 uncomment the 6 lines below to disable the alerts and enable the backtester

shortStopLoss = input.float(0.5, title='Short Stop Loss in %', group='static % Stop Loss', inline='Input 1') / 100

/////// Take profit

longTakeProfit1 = input.float(4, title='Long Take Profit in %', group='Take Profit', inline='Input 1') / 100

/////// Take profit

shortTakeProfit1 = input.float(1.6, title='Short Take Profit in %', group='Take Profit', inline='Input 1') / 100

////////////////// SL TP END

/////////////////// alerts

selectalertFreq = input.string(defval='once per bar close', title='Alert Options', options=['once per bar', 'once per bar close', 'all'], group='═══════════ alert settings ═══════════')

BuyAlertMessage = input.string(defval="Bullish Divergence detected, put your SL @", title='Buy Alert Message', group='═══════════ alert settings ═══════════')

enableSlMessage = input.bool(true, title='enable Stop Loss Value at the end of "buy Alert message"', group='═══════════ alert settings ═══════════')

AfterSLMessage = input.string(defval="", title='Buy Alert message after SL Value', group='═══════════ alert settings ═══════════')

////////////////// Backtester

// 🔥 uncomment the all lines below for the backtester and revert for alerts

shortTrading = enable_MiddleBand_Bear or enable_StrongBand_Bear or enable_SidewaysBand_Bear

longTrading = enable_StrongBand_Bull or enable_MiddleBand_Bull or enable_SidewaysBand_Bull

longTP1 = strategy.position_size > 0 ? strategy.position_avg_price * (1 + longTakeProfit1) : strategy.position_size < 0 ? strategy.position_avg_price * (1 - longTakeProfit1) : na

longSL = strategy.position_size > 0 ? strategy.position_avg_price * (1 - longStopLoss) : strategy.position_size < 0 ? strategy.position_avg_price * (1 + longStopLoss) : na

shortTP = strategy.position_size > 0 ? strategy.position_avg_price * (1 + shortTakeProfit1) : strategy.position_size < 0 ? strategy.position_avg_price * (1 - shortTakeProfit1) : na

shortSL = strategy.position_size > 0 ? strategy.position_avg_price * (1 - shortStopLoss) : strategy.position_size < 0 ? strategy.position_avg_price * (1 + shortStopLoss) : na

strategy.risk.allow_entry_in(longTrading == true and shortTrading == true ? strategy.direction.all : longTrading == true ? strategy.direction.long : shortTrading == true ? strategy.direction.short : na)

strategy.entry('Bull', strategy.long, comment='Upper Band Long', when=StrongBand_Buy_Alert)

strategy.entry('Bull', strategy.long, comment='Lower Band Long', when=MiddleBand_Buy_Alert)

strategy.entry('Bull', strategy.long, comment='Lower Band Long', when=SidewaysBand_Buy_Alert)

strategy.entry('Bear', strategy.short, comment='Upper Band Short', when=StrongBand_Sell_Alert)

strategy.entry('Bear', strategy.short, comment='Lower Band Short', when=MiddleBand_Sell_Alert)

strategy.entry('Bear', strategy.short, comment='Lower Band Short', when=SidewaysBand_Sell_Alert)

// check which SL to use

if enableSL and whichSL == 'static % as SL'

strategy.exit(id='longTP-SL', from_entry='Bull', limit=longTP1, stop=longSL)

strategy.exit(id='shortTP-SL', from_entry='Bear', limit=shortTP, stop=shortSL)

// get bars since last entry for the SL at low to work

barsSinceLastEntry()=>

strategy.opentrades > 0 ? (bar_index - strategy.opentrades.entry_bar_index(strategy.opentrades-1)) : na

if enableSL and whichSL == 'low/high as SL' and ta.barssince(StrongBand_Buy_Alert or MiddleBand_Buy_Alert or SidewaysBand_Buy_Alert) < 2 and barsSinceLastEntry() < 2

strategy.exit(id='longTP-SL', from_entry='Bull', limit=longTP1, stop=longSlLow)

if enableSL and whichSL == 'low/high as SL' and ta.barssince(StrongBand_Sell_Alert or MiddleBand_Sell_Alert or SidewaysBand_Sell_Alert) < 2 and barsSinceLastEntry() < 2

strategy.exit(id='shortTP-SL', from_entry='Bear', limit=shortTP, stop=shortSlLow)

if not enableSL

strategy.exit(id='longTP-SL', from_entry='Bull', limit=longTP1)

strategy.exit(id='shortTP-SL', from_entry='Bear', limit=shortTP)