Tendência de seguir uma estratégia baseada no crossover TEMA de vários prazos

Autora:ChaoZhang, Data: 2023-12-25 14:20:36Tags:

Resumo

Esta estratégia identifica a direção da tendência do mercado com base no cruzamento do indicador TEMA em vários prazos e usa o cruzamento do TEMA em prazos menores para encontrar pontos de entrada e saída específicos.

Estratégia lógica

A estratégia emprega dois indicadores TEMA, um com linha rápida e lenta baseada em períodos de 5 e 15, o outro baseado em um período de tempo mais longo definido pelo usuário, como diário ou semanal.

Quando a linha rápida TEMA de prazo superior cruza acima da linha lenta, uma entrada longa pode ser acionada quando a linha rápida TEMA de prazo inferior cruza acima da linha lenta; Um sinal de saída é dado quando a linha rápida cruza abaixo da linha lenta.

Vantagens

- Baseado no crossover TEMA, evita interferências de ruído

- O projeto multi-tempo combina ciclos altos e baixos, melhorando a precisão

- Configuração flexível apenas para longo, curto ou para ambas as direcções

- Regras simples, fáceis de compreender e de aplicar

Análise de riscos

- TEMA tem efeito de atraso, pode perder a mudança inicial de preço

- As correcções de curto prazo em relação a TF mais elevadas podem causar negociações reversíveis desnecessárias

- A definição incorreta de uma TF superior não reflete a tendência real

- A definição inadequada do TF inferior aumenta o risco de perda de paragem

Soluções de riscos:

- Parâmetros TEMA de ajuste fino para o equilíbrio

- Relaxar moderadamente a margem de stop loss

- Otimize as configurações de ciclo alto e baixo

- Robustez dos parâmetros de ensaio entre produtos

Oportunidades de melhoria

- Ajustar dinamicamente os parâmetros TEMA para otimização da sensibilidade

- Adicionar filtro de impulso para evitar tendências perdidas

- Adicionar índice de volatilidade para dimensionamento dinâmico do stop loss

- Aprendizagem de máquina para otimização de parâmetros

Resumo

A estratégia geral é simples e clara em lógica, identificando o viés da tendência através do crossover TEMA em vários prazos e contando com crossover adicional em entradas de tempo mais baixas do TF.

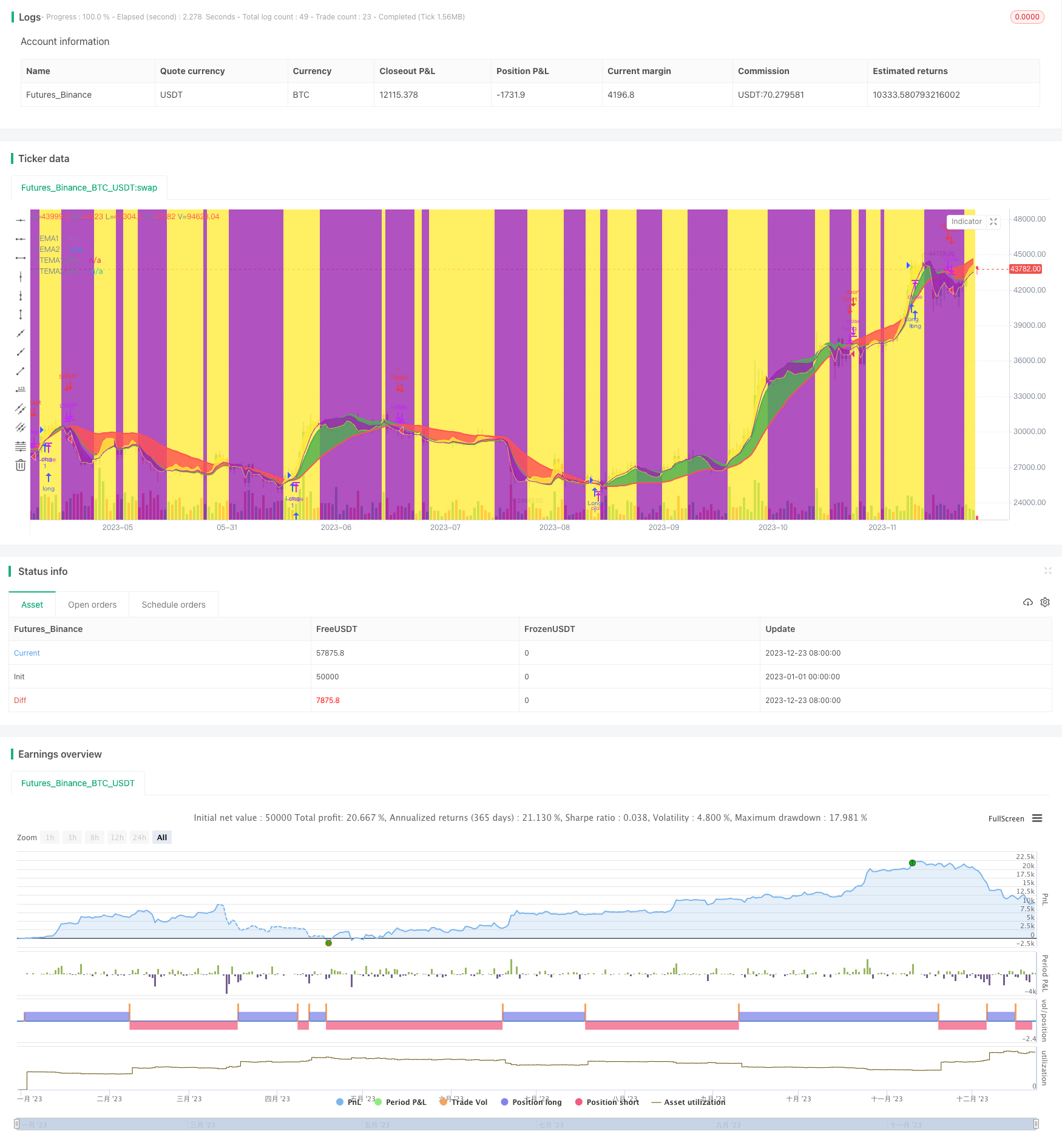

/*backtest

start: 2023-01-01 00:00:00

end: 2023-12-24 00:00:00

period: 1d

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © Seltzer_

//@version=4

strategy(title="TEMA Cross +HTF Backtest", shorttitle="TEMA_X_+HTF_BT", overlay=true)

orderType = input("Longs+Shorts",title="What type of Orders", options=["Longs+Shorts","LongsOnly","ShortsOnly"])

isLong = (orderType != "ShortsOnly")

isShort = (orderType != "LongsOnly")

// Backtest Section {

// Backtest inputs

FromMonth = input(defval=1, title="From Month", minval=1, maxval=12)

FromDay = input(defval=1, title="From Day", minval=1, maxval=31)

FromYear = input(defval=2020, title="From Year", minval=2010)

ToMonth = input(defval=1, title="To Month", minval=1, maxval=12)

ToDay = input(defval=1, title="To Day", minval=1, maxval=31)

ToYear = input(defval=9999, title="To Year", minval=2017)

// Define backtest timewindow

start = timestamp(FromYear, FromMonth, FromDay, 00, 00) // backtest start window

finish = timestamp(ToYear, ToMonth, ToDay, 23, 59) // backtest finish window

window() => true

// }

//TEMA Section {

//LTF Section

xLength = input(20, minval=1, title="Fast Length")

xPrice = close

xEMA1 = ema(xPrice, xLength)

xEMA2 = ema(xEMA1, xLength)

xEMA3 = ema(xEMA2, xLength)

xnRes = (3 * xEMA1) - (3 * xEMA2) + xEMA3

xnResP = plot(xnRes, color=color.green, linewidth=2, title="TEMA1")

yLength = input(60, minval=1, title="Slow Length")

yPrice = close

yEMA1 = ema(yPrice, yLength)

yEMA2 = ema(yEMA1, yLength)

yEMA3 = ema(yEMA2, yLength)

ynRes = (3 * yEMA1) - (3 * yEMA2) + yEMA3

ynResP = plot(ynRes, color=color.red, linewidth=2, title="TEMA2")

fill(xnResP, ynResP, color=xnRes > ynRes ? color.green : color.red, transp=65, editable=true)

//HTF Section

HTFres = input(defval="D", type=input.resolution, title="HTF Resolution")

HTFxLength = input(5, minval=1, title="HTF Fast Length")

HTFxPrice = close

HTFxEMA1 = security(syminfo.tickerid, HTFres, ema(HTFxPrice, HTFxLength), barmerge.gaps_off, barmerge.lookahead_on)

HTFxEMA2 = security(syminfo.tickerid, HTFres, ema(HTFxEMA1, HTFxLength), barmerge.gaps_off, barmerge.lookahead_on)

HTFxEMA3 = security(syminfo.tickerid, HTFres, ema(HTFxEMA2, HTFxLength), barmerge.gaps_off, barmerge.lookahead_on)

HTFxnRes = (3 * HTFxEMA1) - (3 * HTFxEMA2) + HTFxEMA3

HTFxnResP = plot(HTFxnRes, color=color.yellow, linewidth=1,transp=30, title="TEMA1")

HTFyLength = input(15, minval=1, title="HTF Slow Length")

HTFyPrice = close

HTFyEMA1 = security(syminfo.tickerid, HTFres, ema(HTFyPrice, HTFyLength), barmerge.gaps_off, barmerge.lookahead_on)

HTFyEMA2 = security(syminfo.tickerid, HTFres, ema(HTFyEMA1, HTFyLength), barmerge.gaps_off, barmerge.lookahead_on)

HTFyEMA3 = security(syminfo.tickerid, HTFres, ema(HTFyEMA2, HTFyLength), barmerge.gaps_off, barmerge.lookahead_on)

HTFynRes = (3 * HTFyEMA1) - (3 * HTFyEMA2) + HTFyEMA3

HTFynResP = plot(HTFynRes, color=color.purple, linewidth=1, transp=30, title="TEMA2")

fill(HTFxnResP, HTFynResP, color=HTFxnRes > HTFynRes ? color.yellow : color.purple, transp=90, editable=true)

bgcolor(HTFxnRes > HTFynRes ? color.yellow : na, transp=90, editable=true)

bgcolor(HTFxnRes < HTFynRes ? color.purple : na, transp=90, editable=true)

// }

// Buy and Sell Triggers

LongEntryAlert = xnRes > ynRes and HTFxnRes > HTFynRes and window()

LongCloseAlert = xnRes < ynRes and window()

ShortEntryAlert = xnRes < ynRes and HTFxnRes < HTFynRes and window()

ShortCloseAlert = xnRes > ynRes

// Entry & Exit signals

if isLong

strategy.entry("Long", strategy.long, when = LongEntryAlert)

strategy.close("Long", when = LongCloseAlert)

if isShort

strategy.entry("Short", strategy.short, when = ShortEntryAlert)

strategy.close("Short", when = ShortCloseAlert)

- Estratégia de comércio de tartarugas

- Estratégia dupla de acompanhamento da média móvel

- Estratégia de compressão de impulso de média móvel dupla

- Estratégia de negociação cruzada da SMA

- Baseado na estratégia da média móvel ponderada

- Estratégia de cruzamento de média móvel dupla

- Estratégia de negociação de inversão de tendência baseada no crossover da EMA

- Tendência de alta baseada no RSI seguindo a estratégia

- Estratégia de acompanhamento da tendência do canal de oscilação de vários prazos

- Estratégia de negociação rápida de média móvel tripla com baixo atraso

- Estratégia de equilíbrio dinâmico com 50% de fundos e 50% de posições

- Estratégia de entrada unilateral baseada na média móvel

- Estratégia de negociação de retracementos de Fibonacci adaptativa com vários prazos

- Oscilar estratégia de troca de RSI de longo e curto prazo

- Estratégia de negociação de tendência baseada em médias móveis de Triple Hull e Ichimoku Kinko Hyo

- Médias móveis dinâmicas e estratégia de negociação do canal Keltner

- Tendência após estratégia baseada no RSI e na média móvel ponderada

- Estratégia de inversão de média móvel dupla

- Estratégia de ruptura de bandas de Bollinger duplas

- Estratégia de rastreamento do canal Keltner