Estratégia do rácio MA do filtro de dupla tendência premium

Autora:ChaoZhang, Data: 2023-12-28 17:37:14Tags:

Resumo

Esta estratégia é baseada no indicador de taxa média móvel dupla combinada com o filtro de bandas de Bollinger e o indicador de filtro de tendência dupla. Adota mecanismos de saída encadeados para seguir a tendência. Esta estratégia visa identificar a direção da tendência de médio a longo prazo através do indicador de taxa média móvel.

Estratégia lógica

- Calcule a média móvel rápida (10 dias) e a média móvel lenta (50 dias), obtenha sua relação chamada proporção média móvel de preços.

- Converter o rácio médio móvel do preço em percentil, que representa a força relativa do rácio atual em períodos anteriores.

- Quando o oscilador cruza acima do limiar de entrada de compra (10), o sinal longo é acionado. Quando cruza abaixo do limiar de venda (90), o sinal curto é acionado para a tendência.

- Combine com o índice de largura das bandas de Bollinger para filtragem de sinal.

- Use o indicador de filtro de tendência duplo, levando apenas muito tempo quando o preço está no canal de tendência de alta e curto quando está em tendência de queda para evitar a negociação reversa.

- As estratégias de saída da cadeia são definidas, incluindo take profit, stop loss e saída combinada.

Vantagens

- O duplo filtro de tendência garante a fiabilidade na identificação da tendência principal, evitando a negociação reversa.

- O indicador do rácio de MA detecta melhor a alteração da tendência do que a MA única.

- A largura BB localiza efetivamente períodos de baixa volatilidade para sinais mais confiáveis.

- O mecanismo de saída em cadeia maximiza o lucro global.

Riscos e soluções

- A solução é combinar com o filtro de largura BB para sinais mais apertados.

- A solução é encurtar os parâmetros da MA adequadamente.

- A solução é definir vagamente o parâmetro de stop loss.

Orientações de otimização

- Optimização de parâmetros em períodos de MA, limiares de oscilador, parâmetros BB através de testes exaustivos para encontrar a melhor combinação.

- Incorporar outros indicadores que julgam a inversão da tendência, como KD, MACD para melhorar a precisão.

- Treinamento de modelos de aprendizagem de máquina com dados históricos para otimização de parâmetros dinâmicos.

Resumo

Esta estratégia integra o indicador de proporção de MA dupla e BB para determinar a tendência de médio a longo prazo. Ele entra no mercado no melhor momento após a confirmação da tendência com mecanismos de captação de lucro encadeados. É altamente confiável e eficiente. Mais melhorias podem ser alcançadas através da otimização de parâmetros, adicionando indicadores de reversão de tendência e aprendizado de máquina.

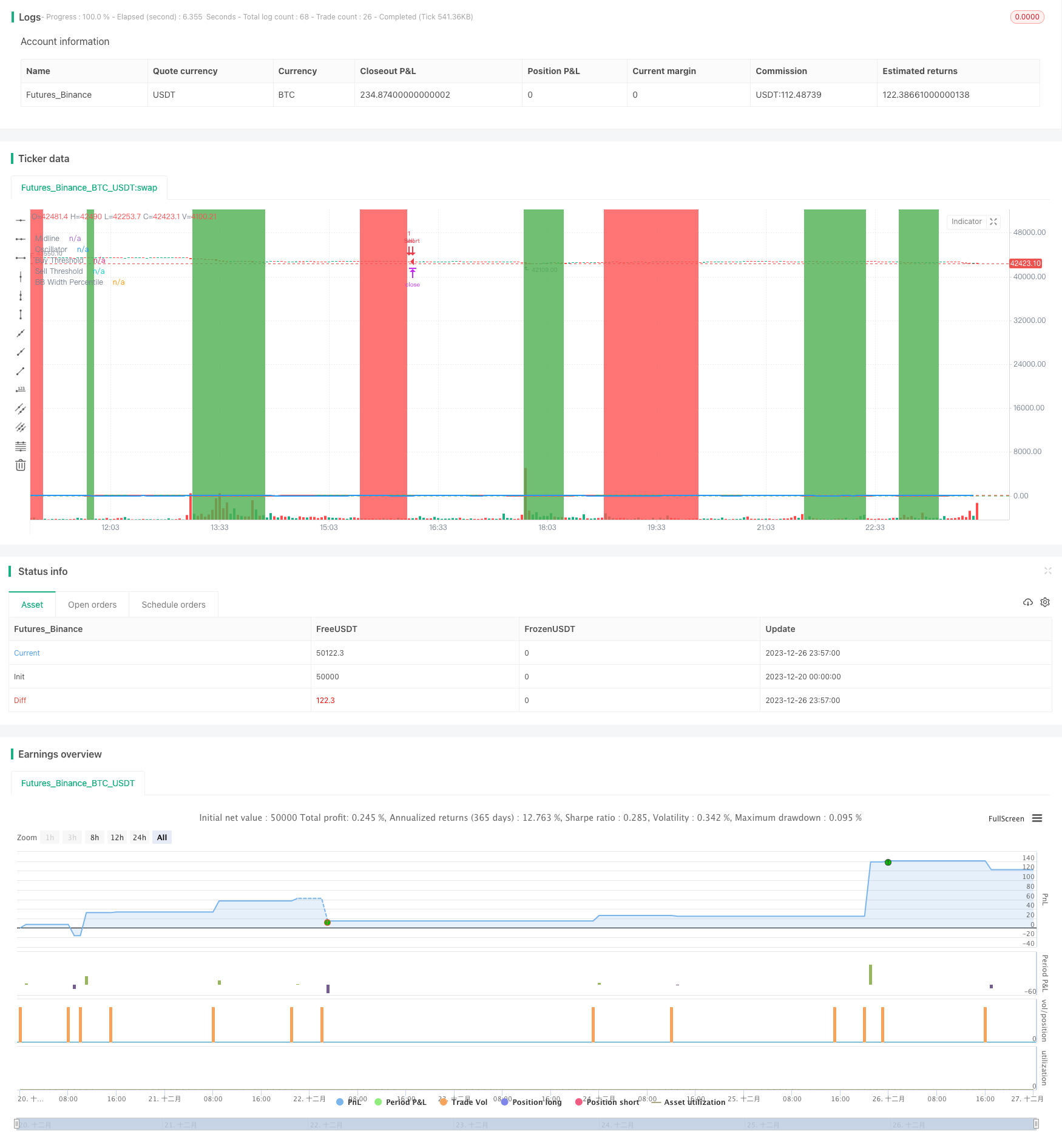

/*backtest

start: 2023-12-20 00:00:00

end: 2023-12-27 00:00:00

period: 3m

basePeriod: 1m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=4

strategy("Premium MA Ratio Strategy", overlay = true)

// Input: Adjustable parameters for Premium MA Ratio

fast_length = input(10, title = "Fast MA Length")

slow_length = input(50, title = "Slow MA Length")

oscillator_threshold_buy = input(10, title = "Oscillator Buy Threshold")

oscillator_threshold_sell = input(90, title = "Oscillator Sell Threshold")

// Input: Adjustable parameters for Bollinger Bands

bb_length = input(20, title = "Bollinger Bands Length")

bb_source = input(close, title = "Bollinger Bands Source")

bb_deviation = input(2.0, title = "Bollinger Bands Deviation")

bb_width_threshold = input(30, title = "BB Width Threshold")

use_bb_filter = input(true, title = "Use BB Width Filter?")

// Input: Adjustable parameters for Trend Filter

use_trend_filter = input(true, title = "Use Trend Filter?")

trend_filter_period_1 = input(50, title = "Trend Filter Period 1")

trend_filter_period_2 = input(200, title = "Trend Filter Period 2")

use_second_trend_filter = input(true, title = "Use Second Trend Filter?")

// Input: Adjustable parameters for Exit Strategies

use_exit_strategies = input(true, title = "Use Exit Strategies?")

use_take_profit = input(true, title = "Use Take Profit?")

take_profit_ticks = input(150, title = "Take Profit in Ticks")

use_stop_loss = input(true, title = "Use Stop Loss?")

stop_loss_ticks = input(100, title = "Stop Loss in Ticks")

use_combined_exit = input(true, title = "Use Combined Exit Strategy?")

combined_exit_ticks = input(50, title = "Combined Exit Ticks")

// Input: Adjustable parameters for Time Filter

use_time_filter = input(false, title = "Use Time Filter?")

start_hour = input(8, title = "Start Hour")

end_hour = input(16, title = "End Hour")

// Calculate moving averages

fast_ma = sma(close, fast_length)

slow_ma = sma(close, slow_length)

// Calculate the premium price moving average ratio

premium_ratio = fast_ma / slow_ma * 100

// Calculate the percentile rank of the premium ratio

percentile_rank(src, length) =>

rank = 0.0

for i = 1 to length

if src > src[i]

rank := rank + 1.0

percentile = rank / length * 100

// Calculate the percentile rank for the premium ratio using slow_length periods

premium_ratio_percentile = percentile_rank(premium_ratio, slow_length)

// Calculate the oscillator based on the percentile rank

oscillator = premium_ratio_percentile

// Dynamic coloring for the oscillator line

oscillator_color = oscillator > 50 ? color.green : color.red

// Plot the oscillator on a separate subplot as a line

hline(50, "Midline", color = color.gray)

plot(oscillator, title = "Oscillator", color = oscillator_color, linewidth = 2)

// Highlight the overbought and oversold areas

bgcolor(oscillator > oscillator_threshold_sell ? color.red : na, transp = 80)

bgcolor(oscillator < oscillator_threshold_buy ? color.green : na, transp = 80)

// Plot horizontal lines for threshold levels

hline(oscillator_threshold_buy, "Buy Threshold", color = color.green)

hline(oscillator_threshold_sell, "Sell Threshold", color = color.red)

// Calculate Bollinger Bands width

bb_upper = sma(bb_source, bb_length) + bb_deviation * stdev(bb_source, bb_length)

bb_lower = sma(bb_source, bb_length) - bb_deviation * stdev(bb_source, bb_length)

bb_width = bb_upper - bb_lower

// Calculate the percentile rank of Bollinger Bands width

bb_width_percentile = percentile_rank(bb_width, bb_length)

// Plot the Bollinger Bands width percentile line

plot(bb_width_percentile, title = "BB Width Percentile", color = color.blue, linewidth = 2)

// Calculate the trend filters

trend_filter_1 = sma(close, trend_filter_period_1)

trend_filter_2 = sma(close, trend_filter_period_2)

// Strategy logic

longCondition = crossover(premium_ratio_percentile, oscillator_threshold_buy)

shortCondition = crossunder(premium_ratio_percentile, oscillator_threshold_sell)

// Apply Bollinger Bands width filter if enabled

if (use_bb_filter)

longCondition := longCondition and bb_width_percentile < bb_width_threshold

shortCondition := shortCondition and bb_width_percentile < bb_width_threshold

// Apply trend filters if enabled

if (use_trend_filter)

longCondition := longCondition and (close > trend_filter_1)

shortCondition := shortCondition and (close < trend_filter_1)

// Apply second trend filter if enabled

if (use_trend_filter and use_second_trend_filter)

longCondition := longCondition and (close > trend_filter_2)

shortCondition := shortCondition and (close < trend_filter_2)

// Apply time filter if enabled

if (use_time_filter)

longCondition := longCondition and (hour >= start_hour and hour <= end_hour)

shortCondition := shortCondition and (hour >= start_hour and hour <= end_hour)

// Generate trading signals with exit strategies

if (use_exit_strategies)

strategy.entry("Buy", strategy.long, when = longCondition)

strategy.entry("Sell", strategy.short, when = shortCondition)

// Define unique exit names for each order

buy_take_profit_exit = "Buy Take Profit"

buy_stop_loss_exit = "Buy Stop Loss"

sell_take_profit_exit = "Sell Take Profit"

sell_stop_loss_exit = "Sell Stop Loss"

combined_exit = "Combined Exit"

// Exit conditions for take profit

if (use_take_profit)

strategy.exit(buy_take_profit_exit, from_entry = "Buy", profit = take_profit_ticks)

strategy.exit(sell_take_profit_exit, from_entry = "Sell", profit = take_profit_ticks)

// Exit conditions for stop loss

if (use_stop_loss)

strategy.exit(buy_stop_loss_exit, from_entry = "Buy", loss = stop_loss_ticks)

strategy.exit(sell_stop_loss_exit, from_entry = "Sell", loss = stop_loss_ticks)

// Combined exit strategy

if (use_combined_exit)

strategy.exit(combined_exit, from_entry = "Buy", loss = combined_exit_ticks, profit = combined_exit_ticks)

- Estratégia de negociação quantitativa de médias móveis duplas

- Estratégia de RSI alavancada em Pine Script

- Estratégia de reversão da tendência quantitativa de negociação combo T3-CCI

- Estratégia dinâmica de suspensão de perdas

- Estratégia OB/OS RSI lenta

- Estratégia de negociação de tendência adaptativa com vários indicadores

- Estratégia de preços de volume relativo

- Tendência estocástica lenta seguindo a estratégia

- Estratégia de negociação quantitativa abrangente baseada em múltiplos indicadores

- Parabólica Stop and Reserve Multi-Indicator Trading Strategy (Estratégia de negociação parabólica de paragem e reserva)

- Estratégia de acompanhamento da tendência de convergência da média móvel dupla

- Estratégia de ruptura da tripla EMA

- Estratégia de negociação quantitativa baseada em bandas de Bollinger

- Super estratégia de tendência reversa

- Estratégia de rastreamento da tendência da média móvel de avanço

- Estratégia de retrospecção do centro mais alto/mais baixo

- Estratégia de recuperação da média móvel

- Estratégia de cruzamento do MACD e do EMA

- Estratégia de negociação da lacuna de impulso

- Ichimoku Estratégia de Curto e Longo Prazo com Gestão de Dinheiro