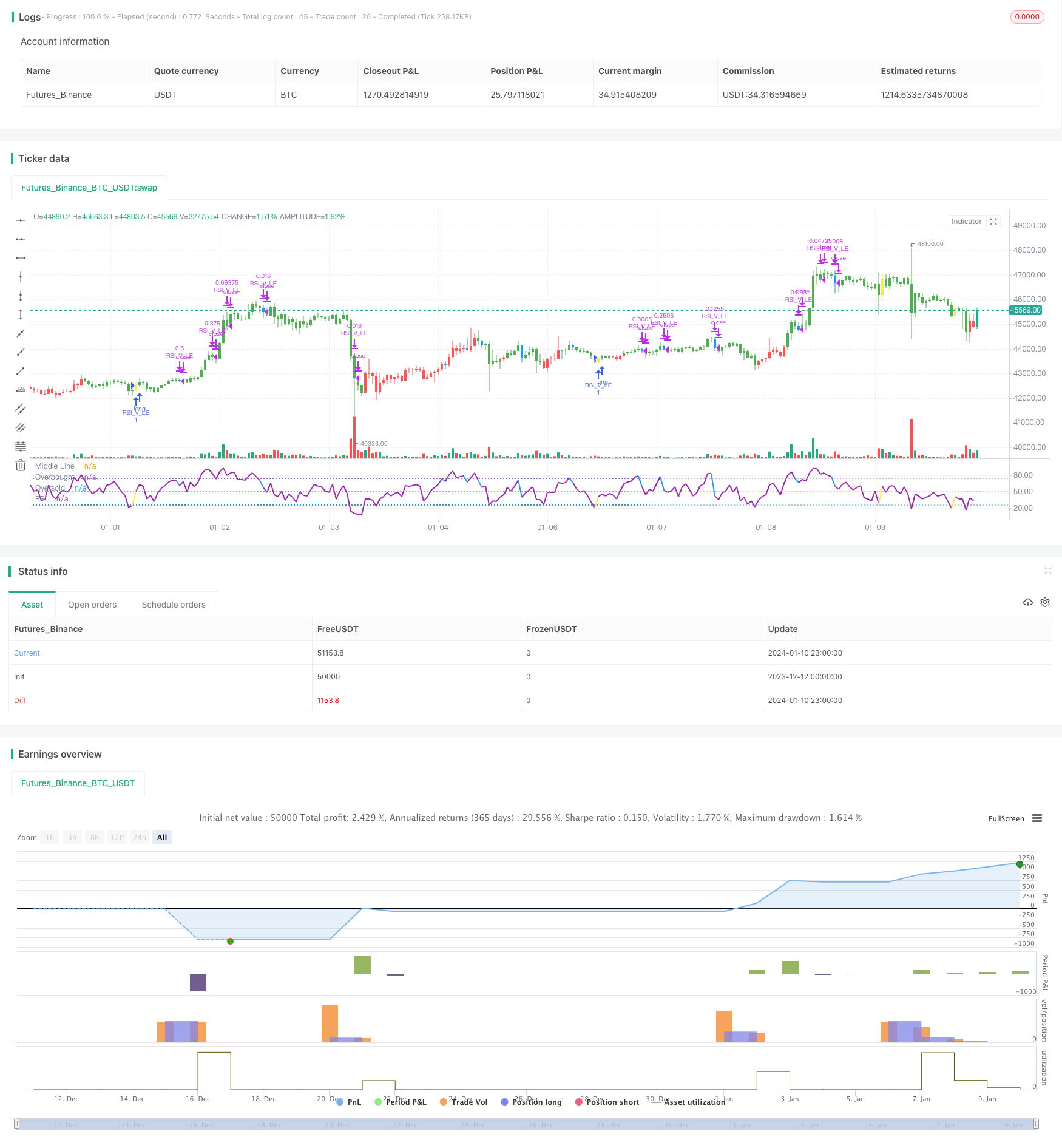

Estratégia de negociação de balanço de padrão em forma de V do RSI

Autora:ChaoZhang, Data: 2024-01-12 13:52:55Tags:

Resumo

Esta estratégia baseia-se no padrão em forma de V formado pelo indicador RSI, combinado com filtros EMA, para desenvolver uma estratégia de negociação lucrativa de curto prazo confiável.

Estratégia lógica

- Utilize a EMA de 20 dias acima da EMA de 50 dias como julgamento da tendência de alta a longo prazo

- O RSI forma um padrão em forma de V, indicando oportunidades de rebote de sobrevenda

- Baixo da barra anterior é inferior ao anterior 2 bares

baixo - O RSI da barra atual é superior ao RSI das 2 barras anteriores

- Baixo da barra anterior é inferior ao anterior 2 bares

- O RSI cruza acima de 30 como o sinal de conclusão do padrão em forma de V para ir longo

- Estabelecer um stop loss a 8% abaixo do preço de entrada

- Quando o RSI cruzar 70, começar a fechar posições e mover o stop loss para o preço de entrada

- Quando o RSI cruzar 90, feche 3/4 posições

- Quando o RSI for abaixo de 10 / stop loss desencadeado, feche todas as posições

Análise das vantagens

- Usar a EMA para julgar a direcção geral do mercado, evitar a negociação contra a tendência

- O padrão em forma de V do RSI capta oportunidades de reversão da média quando a sobrevenda

- Mecanismos múltiplos de stop loss para controlar os riscos

Análise de riscos

- Uma forte tendência de queda pode acarretar perdas irreparáveis

- Os sinais RSI em forma de V podem dar sinais falsos, levando a perdas desnecessárias

Orientações de otimização

- Otimizar os parâmetros do RSI para encontrar padrões em forma de V mais confiáveis

- Incorporar outros indicadores para aumentar a fiabilidade dos sinais de reversão

- Refinar a estratégia de stop loss, equilíbrio entre a prevenção da agressividade excessiva e a pontualidade da stop loss

Resumo

Esta estratégia integra o filtro EMA e o julgamento do padrão em forma de RSI V para formar uma estratégia de negociação de curto prazo confiável. Pode efetivamente aproveitar as oportunidades de rebote quando sobrevendido. Com otimização contínua em parâmetros e modelos, melhorando os mecanismos de stop loss, esta estratégia pode ser ainda melhorada em estabilidade e lucratividade.

/*backtest

start: 2023-12-12 00:00:00

end: 2024-01-11 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © mohanee

//@version=4

//strategy("RSI V Pattern", overlay=true)

strategy(title="RSI V Pattern", overlay=false )

//Strategy Rules

//ema20 is above ema50 --- candles are colored green on the chart

//RSI value sharply coming up which makes a V shape , colored in yellow on the chart

//RSI V pattern should occur from below 30

len = input(title="RSI Period", minval=1, defval=5)

stopLoss = input(title="Stop Loss %", minval=1, defval=8)

myRsi = rsi(close,len)

longEmaVal=ema(close,50)

shortEmaVal=ema(close,20)

//plot emas

//plot(longEmaVal, title="Long EMA" ,linewidth=2, color=color.orange, trackprice=true)

//plot(shortEmaVal, title="Short EMA" ,linewidth=2, color=color.green, trackprice=true)

longCondition = ema(close,20)>ema(close,50) and (low[1]<low[2] and low[1]<low[3]) and (myRsi>myRsi[1] and myRsi>myRsi[2] ) and crossover(myRsi,30) // ( and myRsi<60)

//(myRsi<60 and myRsi>30) and myRsi>myRsi[1] and (myRsi[1]<myRsi[2] or myRsi[1]<myRsi[3]) and (myRsi[2]<30) and (myRsi[3]<30 and myRsi[4]>=30)

barcolor(shortEmaVal>longEmaVal?color.green:color.red)

//longCondition = crossover(sma(close, 14), sma(close, 28))

barcolor(longCondition?color.yellow:na)

strategy.entry("RSI_V_LE", strategy.long, when=longCondition )

//stoploss value at 10%

stopLossValue=strategy.position_avg_price - (strategy.position_avg_price*stopLoss/100)

//stopLossValue=valuewhen(longCondition,low,3)

//takeprofit at RSI highest reading

//at RSI75 move the stopLoss to entry price

moveStopLossUp=strategy.position_size>0 and crossunder(myRsi,70)

barcolor(moveStopLossUp?color.blue:na)

stopLossValue:=crossover(myRsi,70) ? strategy.position_avg_price:stopLossValue

//stopLossValue:=moveStopLossUp?strategy.position_avg_price:stopLossValue

rsiPlotColor=longCondition ?color.yellow:color.purple

rsiPlotColor:= moveStopLossUp ?color.blue:rsiPlotColor

plot(myRsi, title="RSI", linewidth=2, color=rsiPlotColor)

//longCondition?color.yellow:#8D1699)

hline(50, title="Middle Line", linestyle=hline.style_dotted)

obLevel = hline(75, title="Overbought", linestyle=hline.style_dotted)

osLevel = hline(25, title="Oversold", linestyle=hline.style_dotted)

fill(obLevel, osLevel, title="Background", color=#9915FF, transp=90)

//when RSI crossing down 70 , close 1/2 position and move stop loss to average entry price

strategy.close("RSI_V_LE", qty=strategy.position_size*1/2, when=strategy.position_size>0 and crossunder(myRsi,70))

//when RSI reaches high reading 90 and crossing down close 3/4 position

strategy.close("RSI_V_LE", qty=strategy.position_size*3/4, when=strategy.position_size>0 and crossunder(myRsi,90))

//close everything when Rsi goes down below to 10 or stoploss hit

//just keeping RSI cross below 10 , can work as stop loss , which also keeps you long in the trade ... however sharp declines could make large loss

//so I combine RSI goes below 10 OR stoploss hit , whichever comes first - whole posiition closed

longCloseCondition=crossunder(myRsi,10) or close<stopLossValue

strategy.close("RSI_V_LE", qty=strategy.position_size,when=longCloseCondition )

Mais.

- Tendência seguindo uma estratégia baseada na diferença da média móvel

- Estratégia de negociação de inércia de inversão quantitativa de dois fatores

- Estratégia de ruptura da EMA

- Estratégia Quant Trading Baseada na Nuvem Ichimoku

- Estratégia de reversão de tendências criptográficas baseada em pontos altos e baixos de oscilação pivot

- Estratégia de negociação do oscilador de saldo final

- Estratégia de cruzamento da média móvel exponencial

- Estratégia dupla de obtenção de lucros da EMA Golden Cross

- Estratégia de regressão dinâmica do Pai Natal

- Estratégia de negociação quantitativa do índice RSI

- A estratégia de volatilidade do ATR para o impulso de ruptura

- Estratégia de Momentum RSI Baseada em Interpolação Polinomial

- Estratégia combinada de inversão de impulso

- Estratégia de Hash Ribbons BTC

- Estratégia de cruzamento de médias móveis de vários níveis para mestres quant

- Estratégia de negociação de reversão do rácio de volume

- Estratégia de cruzamento da média móvel ponderada do momento dinâmico

- Estratégia de negociação de poder de touro

- Estratégia de acompanhamento da média móvel diária para o valor do ouro

- Média móvel de vários prazos combinada com as horas de negociação Estratégia quantitativa de negociação