Estratégia dinâmica de dimensionamento das posições baseada na curva de património

Autora:ChaoZhang, Data: 2024-01-16 15:06:39Tags:

Estratégia geral

A ideia central desta estratégia é ajustar dinamicamente o tamanho da posição com base na tendência da curva de ações - aumentar o tamanho da posição durante o lucro e diminuir o tamanho da posição durante a perda para controlar o risco geral.

Nome da estratégia

Estratégia dinâmica de dimensionamento das posições baseada na curva de património

Estratégia lógica

A estratégia usa dois métodos para determinar se a curva de ações está em uma tendência de queda: 1) Calcule médias móveis simples rápidas e lentas da curva de ações, se a SMA rápida estiver abaixo da lenta, ela é considerada uma tendência de queda; 2) Calcule a curva de ações em relação à sua própria média móvel simples de período mais longo, se a ação estiver abaixo da linha média móvel, ela é considerada uma tendência de queda.

Quando a tendência de queda da curva de ações é determinada, o tamanho da posição será reduzido ou aumentado em uma certa porcentagem com base nas configurações. Por exemplo, se uma redução de 50% for definida, o tamanho da posição original de 10% será reduzido para 5%. Este mecanismo aumenta o tamanho da posição durante o lucro e diminui o tamanho da posição durante a perda para controlar o risco geral.

Vantagens

- Utiliza a curva do capital próprio para avaliar o lucro/perda global e ajusta dinamicamente o tamanho da posição para controlar o risco

- Combinar vários indicadores para identificar sinais de entrada pode melhorar a taxa de vitória

- Parâmetros personalizáveis para o ajustamento da posição adequados a diferentes apetites de risco

Riscos

- A perda pode ser amplificada com o aumento do tamanho da posição durante o lucro

- Ajuste agressivo devido a configurações de parâmetros inadequadas

- O dimensionamento da posição não pode, por si só, evitar completamente o risco do sistema

Orientações para a melhoria

- Eficácia do ensaio dos diferentes parâmetros de regulação da posição

- Tente outros indicadores para determinar a tendência da curva de ações

- Otimizar as condições de entrada para melhorar a taxa de vitória

Conclusão

A lógica geral desta estratégia é clara - ajusta dinamicamente o tamanho da posição com base na curva de ações, o que ajuda a controlar efetivamente o risco.

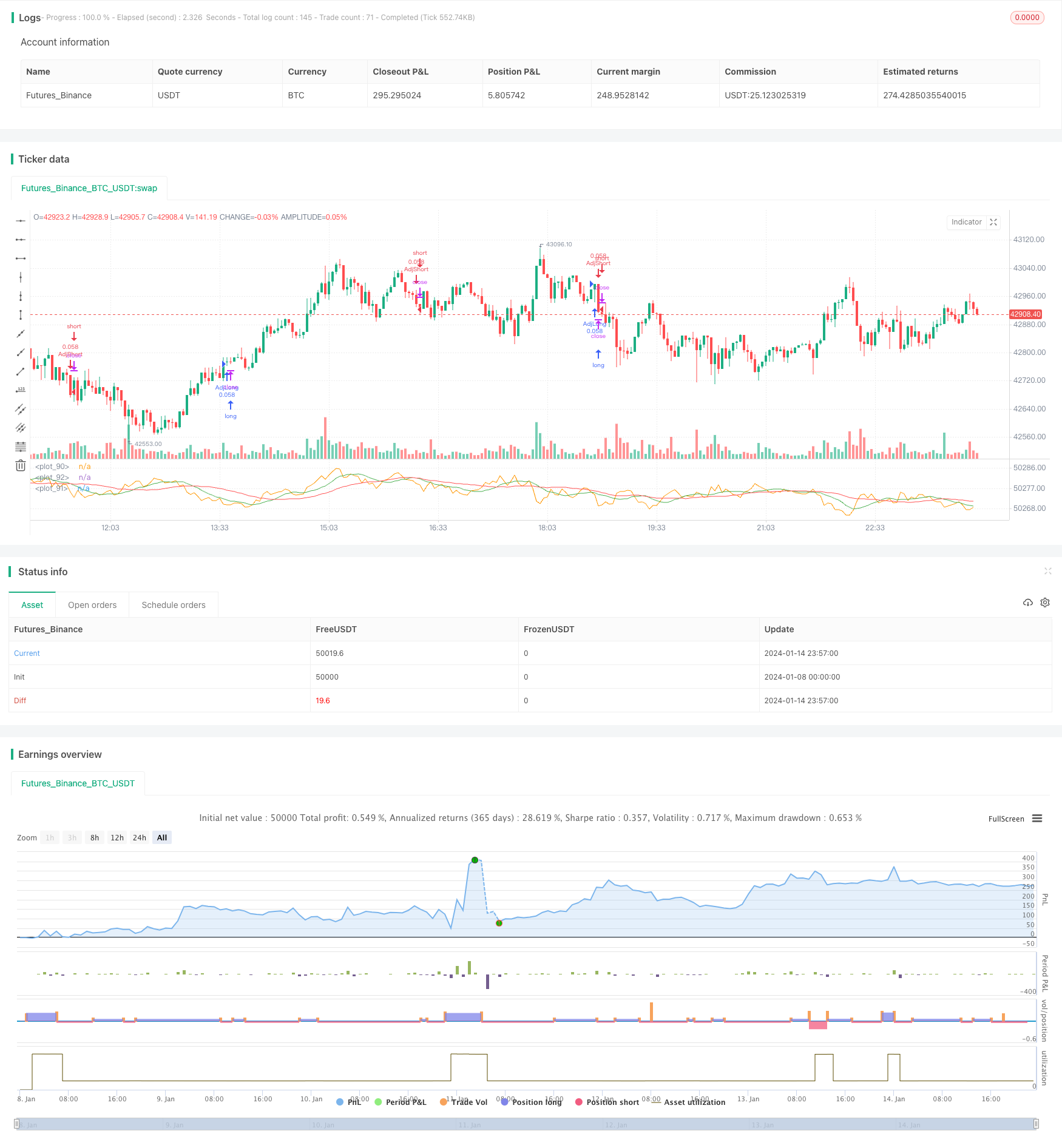

/*backtest

start: 2024-01-08 00:00:00

end: 2024-01-15 00:00:00

period: 3m

basePeriod: 1m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © shardison

//@version=5

//EXPLANATION

//"Trading the equity curve" as a risk management method is the

//process of acting on trade signals depending on whether a system’s performance

//is indicating the strategy is in a profitable or losing phase.

//The point of managing equity curve is to minimize risk in trading when the equity curve is in a downtrend.

//This strategy has two modes to determine the equity curve downtrend:

//By creating two simple moving averages of a portfolio's equity curve - a short-term

//and a longer-term one - and acting on their crossings. If the fast SMA is below

//the slow SMA, equity downtrend is detected (smafastequity < smaslowequity).

//The second method is by using the crossings of equity itself with the longer-period SMA (equity < smasloweequity).

//When "Reduce size by %" is active, the position size will be reduced by a specified percentage

//if the equity is "under water" according to a selected rule. If you're a risk seeker, select "Increase size by %"

//- for some robust systems, it could help overcome their small drawdowns quicker.

strategy("Use Trading the Equity Curve Postion Sizing", shorttitle="TEC", default_qty_type = strategy.percent_of_equity, default_qty_value = 10, initial_capital = 100000)

//TRADING THE EQUITY CURVE INPUTS

useTEC = input.bool(true, title="Use Trading the Equity Curve Position Sizing")

defulttraderule = useTEC ? false: true

initialsize = input.float(defval=10.0, title="Initial % Equity")

slowequitylength = input.int(25, title="Slow SMA Period")

fastequitylength = input.int(9, title="Fast SMA Period")

seedequity = 100000 * .10

if strategy.equity == 0

seedequity

else

strategy.equity

slowequityseed = strategy.equity > seedequity ? strategy.equity : seedequity

fastequityseed = strategy.equity > seedequity ? strategy.equity : seedequity

smaslowequity = ta.sma(slowequityseed, slowequitylength)

smafastequity = ta.sma(fastequityseed, fastequitylength)

equitycalc = input.bool(true, title="Use Fast/Slow Avg", tooltip="Fast Equity Avg is below Slow---otherwise if unchecked uses Slow Equity Avg below Equity")

sizeadjstring = input.string("Reduce size by (%)", title="Position Size Adjustment", options=["Reduce size by (%)","Increase size by (%)"])

sizeadjint = input.int(50, title="Increase/Decrease % Equity by:")

equitydowntrendavgs = smafastequity < smaslowequity

slowequitylessequity = strategy.equity < smaslowequity

equitymethod = equitycalc ? equitydowntrendavgs : slowequitylessequity

if sizeadjstring == ("Reduce size by (%)")

sizeadjdown = initialsize * (1 - (sizeadjint/100))

else

sizeadjup = initialsize * (1 + (sizeadjint/100))

c = close

qty = 100000 * (initialsize / 100) / c

if useTEC and equitymethod

if sizeadjstring == "Reduce size by (%)"

qty := (strategy.equity * (initialsize / 100) * (1 - (sizeadjint/100))) / c

else

qty := (strategy.equity * (initialsize / 100) * (1 + (sizeadjint/100))) / c

//EXAMPLE TRADING STRATEGY INPUTS

CMO_Length = input.int(defval=9, minval=1, title='Chande Momentum Length')

CMO_Signal = input.int(defval=10, minval=1, title='Chande Momentum Signal')

chandeMO = ta.cmo(close, CMO_Length)

cmosignal = ta.sma(chandeMO, CMO_Signal)

SuperTrend_atrPeriod = input.int(10, "SuperTrend ATR Length")

SuperTrend_Factor = input.float(3.0, "SuperTrend Factor", step = 0.01)

Momentum_Length = input.int(12, "Momentum Length")

price = close

mom0 = ta.mom(price, Momentum_Length)

mom1 = ta.mom( mom0, 1)

[supertrend, direction] = ta.supertrend(SuperTrend_Factor, SuperTrend_atrPeriod)

stupind = (direction < 0 ? supertrend : na)

stdownind = (direction < 0? na : supertrend)

//TRADING CONDITIONS

longConditiondefault = ta.crossover(chandeMO, cmosignal) and (mom0 > 0 and mom1 > 0 and close > stupind) and defulttraderule

if (longConditiondefault)

strategy.entry("DefLong", strategy.long, qty=qty)

shortConditiondefault = ta.crossunder(chandeMO, cmosignal) and (mom0 < 0 and mom1 < 0 and close < stdownind) and defulttraderule

if (shortConditiondefault)

strategy.entry("DefShort", strategy.short, qty=qty)

longCondition = ta.crossover(chandeMO, cmosignal) and (mom0 > 0 and mom1 > 0 and close > stupind) and useTEC

if (longCondition)

strategy.entry("AdjLong", strategy.long, qty = qty)

shortCondition = ta.crossunder(chandeMO, cmosignal) and (mom0 < 0 and mom1 < 0 and close < stdownind) and useTEC

if (shortCondition)

strategy.entry("AdjShort", strategy.short, qty = qty)

plot(strategy.equity)

plot(smaslowequity, color=color.new(color.red, 0))

plot(smafastequity, color=color.new(color.green, 0))

- Ichimoku Kinko Hyo estratégia de fuga

- Estratégia de tendência de impulso do ADX

- Estratégia de combinação de 123 pontos de inversão e de pivô

- Estratégia de negociação de combinação de média móvel e RSI estocástico

- Estratégia de inversão de tendência dinâmica

- Estratégia diária de DCA com ligação às EMA

- Força da tendência Confirm Bares Strategy

- Estratégia de média móvel dupla de supertrend

- Estratégia de negociação swing baseada na WaveTrend e na DER

- Hull Fisher Adaptativa Inteligente Estratégia Multifator

- Estratégia dupla de acompanhamento de tendências

- Estratégia de negociação de redes inteligentes adaptativas

- Estratégia de inversão de tendência de rastreamento

- Estratégia de ruptura do canal de preços

- Estratégia de negociação SAR de prazo alternado

- Estratégia de negociação de opções cruzadas EMA/MA

- Estratégia de sincronização de tendências RMI

- Estratégia de negociação de média móvel MACD multi-tempo

- Estratégia de tendência dinâmica do ADX

- Tendência seguindo a estratégia baseada na média móvel do casco e no intervalo verdadeiro