Цифровые валютные фьючерсы Стратегия поворотного момента двойной EMA (учебное пособие)

Автор:FMZ~Lydia, Создано: 2022-11-09 09:44:38, Обновлено: 2023-09-20 10:25:53

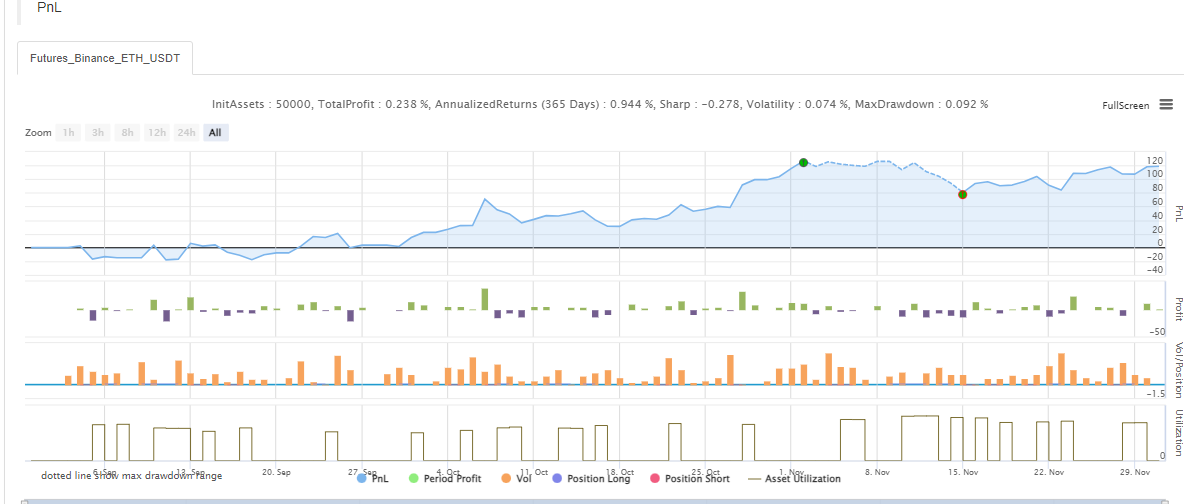

В этой статье мы объясним, как разработать простую стратегию тренда, только на уровне разработки стратегии, чтобы помочь новичкам узнать, как разработать простую стратегию и понять процесс исполнения стратегии.

Разработка стратегии

Мы используем два индикатора EMA, когда у обеих средних EMA есть поворотные точки. Поворотная точка используется в качестве сигнала для открытия позиций (или продажи открывающей позиции) для открытия длинных, открытия коротких позиций, и фиксированная целевая дифференциальная прибыль позиции закрытия разработана. Комментарии написаны непосредственно в коде стратегии для удобного чтения. Код стратегии, как правило, очень короткий и подходит для обучения новичков.

Код стратегии

/*backtest

start: 2021-09-01 00:00:00

end: 2021-12-02 00:00:00

period: 1h

basePeriod: 5m

exchanges: [{"eid":"Futures_Binance","currency":"ETH_USDT"}]

*/

// The above /**/ is the default setting for backtesting, you can reset it on the backtesting page by using the relevant controls

var LONG = 1 // Markers for holding long positions, enum constant

var SHORT = -1 // Markers for holding short positions, enum constant

var IDLE = 0 // Markers without holding positions, enum constant

// Obtain positions in the specified direction. Positions is the position data, and direction is the position direction to be obtained

function getPosition(positions, direction) {

var ret = {Price : 0, Amount : 0, Type : ""} // Define a structure when no position is held

// Iterate through the positions and find the positions that match the direction

_.each(positions, function(pos) {

if (pos.Type == direction) {

ret = pos

}

})

// Return to found positions

return ret

}

// Cancel all makers of current trading pairs and contracts

function cancellAll() {

// Dead loop, keep detecting until break is triggered

while (true) {

// Obtain the makers' data of the current trading pair and contract, i.e. orders

var orders = _C(exchange.GetOrders)

if (orders.length == 0) {

// When orders is an empty array, i.e. orders.length == 0, break is executed to exit the while loop

break

} else {

// Iterate through all current makers and cancel them one by one

for (var i = 0 ; i < orders.length ; i++) {

// The function to cancel the specific order, cancel the order with ID: orders[i].Id

exchange.CancelOrder(orders[i].Id, orders[i])

Sleep(500)

}

}

Sleep(500)

}

}

// The closing function, used for closing positions according to the trading function-tradeFunc and direction passed in

function cover(tradeFunc, direction) {

var mapDirection = {"closebuy": PD_LONG, "closesell": PD_SHORT}

var positions = _C(exchange.GetPosition) //Obtain the position data of the current trading pair and contract

var pos = getPosition(positions, mapDirection[direction]) // Find the position information in the specified closing position direction

// When the position is greater than 0 (the position can be closed only when there is a position)

if (pos.Amount > 0) {

// Cancel all possible makers

cancellAll()

// Set the trading direction

exchange.SetDirection(direction)

// Execute closing position trade functions

if (tradeFunc(-1, pos.Amount)) {

// Return to true if the order is placed

return true

} else {

// Return to false if the order is failed to place

return false

}

}

// Return to true if there is no position

return true

}

// Strategy main functions

function main() {

// For switching to OKEX V5 Demo

if (okexSimulate) {

exchange.IO("simulate", true) // Switch to OKEX V5 Demo for a test

Log("Switch to OKEX V5 Demo")

}

// Set the contract code, if ct is swap, set the current contract to be a perpetual contract

exchange.SetContractType(ct)

// Initialization status is open position

var state = IDLE

// The initialized position price is 0

var holdPrice = 0

// Timestamp for initialization comparison, used to compare whether the current K-Line BAR has changed

var preTime = 0

// Strategy main loop

while (true) {

// Obtain the K-line data for current trading pairs and contracts

var r = _C(exchange.GetRecords)

// Obtain the length of the K-line data, i.e. l

var l = r.length

// Judge the K-line length that l must be greater than the indicator period (if not, the indicator function cannot calculate valid indicator data), or it will be recycled

if (l < Math.max(ema1Period, ema2Period)) {

// Wait for 1,000 milliseconds, i.e. 1 second, to avoid rotating too fast

Sleep(1000)

// Ignore the code after the current if, and execute while loop again

continue

}

// Calculate ema indicator data

var ema1 = TA.EMA(r, ema1Period)

var ema2 = TA.EMA(r, ema2Period)

// Drawing chart

$.PlotRecords(r, 'K-Line') // Drawing the K-line chart

// When the last BAR timestamp changes, i.e. when a new K-line BAR is created

if(preTime !== r[l - 1].Time){

// The last update of the last BAR before the new BAR appears

$.PlotLine('ema1', ema1[l - 2], r[l - 2].Time)

$.PlotLine('ema2', ema2[l - 2], r[l - 2].Time)

// Draw the indicator line of the new BAR, i.e. the indicator data on the current last BAR

$.PlotLine('ema1', ema1[l - 1], r[l - 1].Time)

$.PlotLine('ema2', ema2[l - 1], r[l - 1].Time)

// Update the timestamp used for comparison

preTime = r[l - 1].Time

} else {

// When no new BARs are generated, only the indicator data of the last BAR on the chart is updated

$.PlotLine('ema1', ema1[l - 1], r[l - 1].Time)

$.PlotLine('ema2', ema2[l - 1], r[l - 1].Time)

}

// Conditions for opening long positions, turning points

var up = (ema1[l - 2] > ema1[l - 3] && ema1[l - 4] > ema1[l - 3]) && (ema2[l - 2] > ema2[l - 3] && ema2[l - 4] > ema2[l - 3])

// Conditions for opening short positions, turning points

var down = (ema1[l - 2] < ema1[l - 3] && ema1[l - 4] < ema1[l - 3]) && (ema2[l - 2] < ema2[l - 3] && ema2[l - 4] < ema2[l - 3])

// The condition of opening a long position is triggered and the current short position is held, or the condition of opening a long position is triggered and no position is held

if (up && (state == SHORT || state == IDLE)) {

// If you have a short position, close it first

if (state == SHORT && cover(exchange.Buy, "closesell")) {

// Mark open positions after closing them

state = IDLE

// The price of reset position is 0

holdPrice = 0

// Mark on the chart

$.PlotFlag(r[l - 1].Time, 'coverShort', 'CS')

}

// Open a long position after closing the position

exchange.SetDirection("buy")

if (exchange.Buy(-1, amount)) {

// Mark the current status

state = LONG

// Record the current price

holdPrice = r[l - 1].Close

$.PlotFlag(r[l - 1].Time, 'openLong', 'L')

}

} else if (down && (state == LONG || state == IDLE)) {

// The same as the judgment of up condition

if (state == LONG && cover(exchange.Sell, "closebuy")) {

state = IDLE

holdPrice = 0

$.PlotFlag(r[l - 1].Time, 'coverLong', 'CL')

}

exchange.SetDirection("sell")

if (exchange.Sell(-1, amount)) {

state = SHORT

holdPrice = r[l - 1].Close

$.PlotFlag(r[l - 1].Time, 'openShort', 'S')

}

}

// Stop profits

if (state == LONG && r[l - 1].Close - holdPrice > profitTarget && cover(exchange.Sell, "closebuy")) {

state = IDLE

holdPrice = 0

$.PlotFlag(r[l - 1].Time, 'coverLong', 'CL')

} else if (state == SHORT && holdPrice - r[l - 1].Close > profitTarget && cover(exchange.Buy, "closesell")) {

state = IDLE

holdPrice = 0

$.PlotFlag(r[l - 1].Time, 'coverShort', 'CS')

}

// Display time on the status bar

LogStatus(_D())

Sleep(500)

}

}

Источник стратегии:https://www.fmz.com/strategy/333269

Стратегия предназначена только для обучения программированию, пожалуйста, не используйте ее в реальном боте.

- Количественная практика DEX-бирж (2) -- Гипержидкое руководство пользователя

- ДЕКС (DEX Exchange) Количественная практика ((2) -- Гиперликвид (Hyperliquid)

- Количественная практика обмена DEX (1) -- руководство пользователя dYdX v4

- Введение в арбитраж с задержкой свинца в криптовалюте (3)

- DEX обмены количественные практики ((1) -- dYdX v4 Руководство пользователя

- Презентация о своде Lead-Lag в цифровой валюте (3)

- Введение в арбитраж с задержкой свинца в криптовалюте (2)

- Презентация о своде Lead-Lag в цифровой валюте (2)

- Обсуждение по внешнему приему сигналов платформы FMZ: полное решение для приема сигналов с встроенным сервисом Http в стратегии

- Обзор приема внешних сигналов на платформе FMZ: стратегию полного решения приема сигналов встроенного сервиса HTTP

- Введение в арбитраж с задержкой свинца в криптовалюте (1)

- [Binance Championship] Стратегия контракта поставки Binance 3 - хеджирование бабочек

- Использование серверов в количественной торговле

- Решение для получения сообщения запроса http, отправленного Docker

- Краткое объяснение того, почему невозможно достичь движения активов на OKEX с помощью стратегии хеджирования контрактов

- Подробное объяснение фьючерсов Backhand Doubling Algorithm

- Заработать 80 раз за 5 дней, сила высокочастотной стратегии

- Исследования и примеры разработки стратегии хеджирования Maker Spots и фьючерсов

- Создание количественной базы данных FMZ с SQLite

- Как назначить данные различных версий арендованной стратегии с помощью метаданных кода аренды стратегии

- Процентный арбитраж ставки постоянного финансирования Binance (текущий бычий рынок годовых 100%)

- Подпишитесь на новую стратегию акций для цифровой валюты спот (учебное пособие)

- Реализовать идею с помощью 60 строк кода - Контрактная рыболовная стратегия

- Стратегия двойной EMA для цифровой валюты на рынке наличных валют с многообразием (учебное пособие)

- Проектирование системы управления синхронизацией заказов на основе FMZ Quant (2)

- Фьючерсы на цифровую валюту многовидовая стратегия ATR (учебное пособие)

- Написать полуавтоматический торговый инструмент с использованием языка Pine

- Исследуйте высокочастотный дизайн стратегии из волшебной перемены LeeksReaper

- Анализ стратегии LeeksReaper (2)

- "Волшебная двойная стратегия EMA" от ветеранов YouTube

- Внедрение языка JavaScript показателей Фишера и использование FMZ