Стратегия торговли с адаптивной волатильностью

Автор:Чао Чжан, Дата: 2023-12-04 14:34:13Тэги:

Обзор

Эта стратегия идентифицирует рыночные тенденции на основе точек прорыва цен и использует адаптивные индикаторы для определения общей тенденции с целью захвата краткосрочных возможностей переворота цен.

Логика стратегии

- Когда цены достигают новых максимумов или минимумов, устанавливайте эти точки как границы канала.

- Вычислить индикатор адаптивной волатильности MA для определения общего направления тренда.

- Сгенерировать сигналы покупки, когда цены проходят через верхний канал, и сигналы продажи, когда цены проходят под нижним каналом.

- Установка точек остановки потери. Точки остановки потери по длинной позиции устанавливаются на 1% ниже цены входа.

Анализ преимуществ

- Ценовой канал адаптивен и может точно определять точки переворота тренда.

- Показатель волатильности оценивает общую тенденцию и не позволяет упустить общую картину волатильных рынков.

- В качестве обратной стратегии она подходит для отслеживания краткосрочных скачков цен.

Анализ рисков

- При длительном понижающемся тренде могут возникать несколько точек остановки потерь, что приводит к большим потерям.

- Частые сделки по покупке и продаже на различных рынках увеличивают затраты на транзакции.

- Полностью автоматизированная торговля сопряжена с рисками перегрузки.

Руководство по оптимизации

- Оптимизировать параметры MA для лучшего определения общих тенденций.

- Включить показатели объема, чтобы избежать сигналов обратного движения в сценариях истощения объема.

- Добавить модели машинного обучения для оптимизации динамических параметров.

Резюме

Общая логика этой стратегии ясна и имеет некоторую практическую ценность. Тем не менее, торговые риски все еще должны контролироваться, чтобы предотвратить большие потери в определенных рыночных условиях. Следующие шаги включают оптимизацию нескольких аспектов, таких как общая структура, параметры индикаторов и контроль рисков, чтобы сделать параметры стратегии и торговые сигналы более надежными.

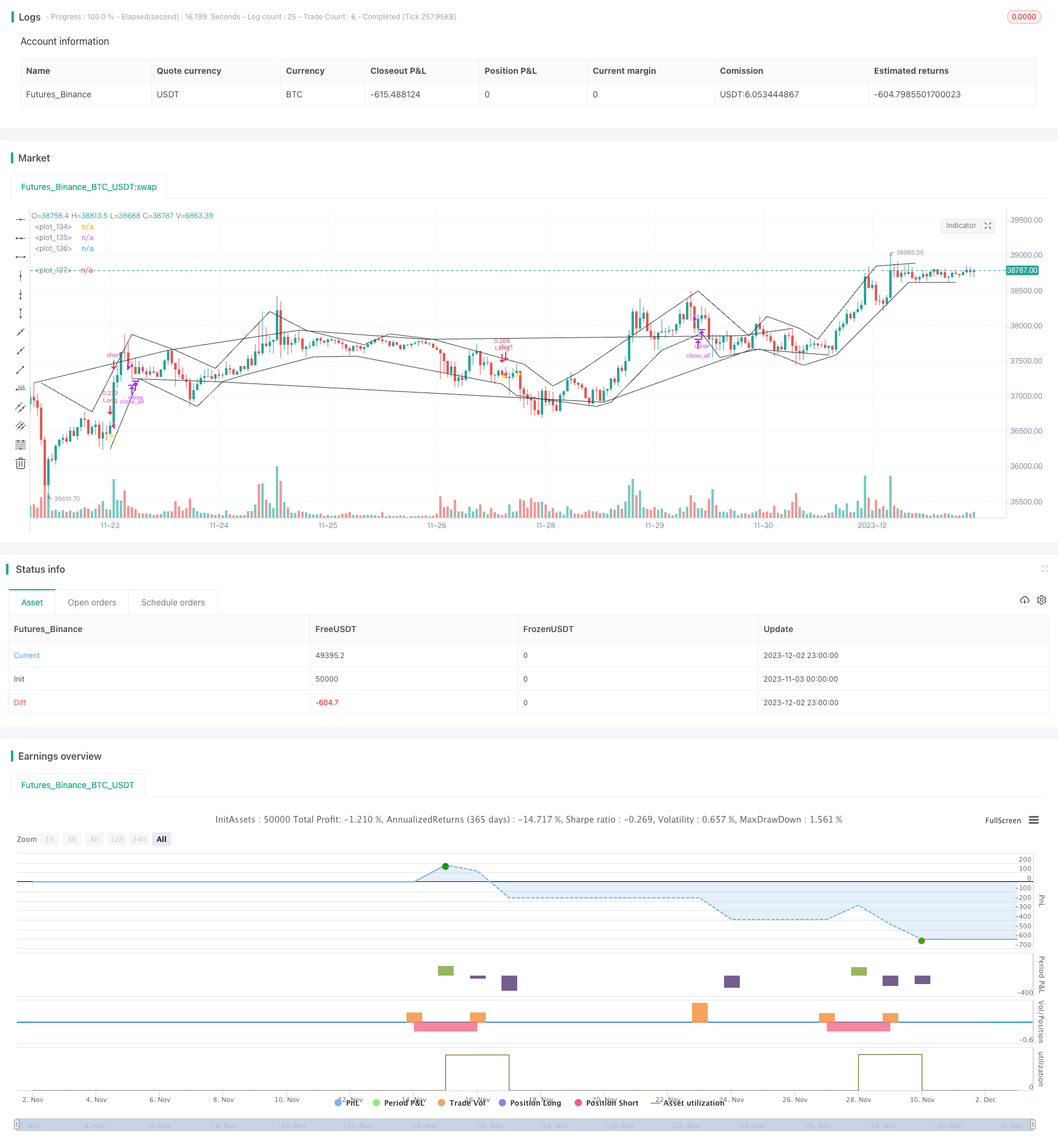

/*backtest

start: 2023-11-03 00:00:00

end: 2023-12-03 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// @version = 4

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © TradingGroundhog

// ||--- Cash & Date:

cash_amout = 10000

pyramid_val = 1

cash_given_per_lot = cash_amout/pyramid_val

startDate = input(title="Start Date",defval=13)

startMonth = input(title="Start Month",defval=9)

startYear = input(title="Start Year",defval=2021)

afterStartDate = (time >= timestamp(syminfo.timezone,startYear, startMonth, startDate, 0, 0))

// ||------------------------------------------------------------------------------------------------------

// ||--- Strategy:

strategy(title="TradingGroundhog - Strategy & Fractal V1 - Short term", overlay=true, max_bars_back = 4000, max_labels_count=500, commission_type=strategy.commission.percent, commission_value=0.00,default_qty_type=strategy.cash, default_qty_value= cash_given_per_lot, pyramiding=pyramid_val)

// ||------------------------------------------------------------------------------------------------------

// ||--- Fractal Recognition:

filterBW = input(true, title="filter Bill Williams Fractals:")

filterFractals = input(true, title="Filter fractals using extreme method:")

length = input(2, title="Extreme Window:")

regulartopfractal = high[4] < high[3] and high[3] < high[2] and high[2] > high[1] and high[1] > high[0]

regularbotfractal = low[4] > low[3] and low[3] > low[2] and low[2] < low[1] and low[1] < low[0]

billwtopfractal = filterBW ? false : (high[4] < high[2] and high[3] < high[2] and high[2] > high[1] and high[2] > high[0] ? true : false)

billwbotfractal = filterBW ? false : (low[4] > low[2] and low[3] > low[2] and low[2] < low[1] and low[2] < low[0] ? true : false)

ftop = filterBW ? regulartopfractal : regulartopfractal or billwtopfractal

fbot = filterBW ? regularbotfractal : regularbotfractal or billwbotfractal

topf = ftop ? high[2] >= highest(high, length) ? true : false : false

botf = fbot ? low[2] <= lowest(low, length) ? true : false : false

filteredtopf = filterFractals ? topf : ftop

filteredbotf = filterFractals ? botf : fbot

// ||------------------------------------------------------------------------------------------------------

// ||--- V1 : Added Swing High/Low Option

ShowSwingsHL = input(true)

highswings = filteredtopf == false ? na : valuewhen(filteredtopf == true, high[2], 2) < valuewhen(filteredtopf == true, high[2], 1) and valuewhen(filteredtopf == true, high[2], 1) > valuewhen(filteredtopf == true, high[2], 0)

lowswings = filteredbotf == false ? na : valuewhen(filteredbotf == true, low[2], 2) > valuewhen(filteredbotf == true, low[2], 1) and valuewhen(filteredbotf == true, low[2], 1) < valuewhen(filteredbotf == true, low[2], 0)

//---------------------------------------------------------------------------------------------------------

// ||--- V2 : Plot Lines based on the fractals.

showchannel = input(true)

//---------------------------------------------------------------------------------------------------------

// ||--- ZigZag:

showZigZag = input(true)

//----------------------------------------------------------------------------------------------------------

// ||--- Fractal computation:

istop = filteredtopf ? true : false

isbot = filteredbotf ? true : false

topcount = barssince(istop)

botcount = barssince(isbot)

vamp = input(title="VolumeMA", defval=2)

vam = sma(volume, vamp)

fractalup = 0.0

fractaldown = 0.0

up = high[3]>high[4] and high[4]>high[5] and high[2]<high[3] and high[1]<high[2] and volume[3]>vam[3]

down = low[3]<low[4] and low[4]<low[5] and low[2]>low[3] and low[1]>low[2] and volume[3]>vam[3]

fractalup := up ? high[3] : fractalup[1]

fractaldown := down ? low[3] : fractaldown[1]

//----------------------------------------------------------------------------------------------------------

// ||--- Fractal save:

fractaldown_save = array.new_float(0)

for i = 0 to 4000

if array.size(fractaldown_save) < 3

if array.size(fractaldown_save) == 0

array.push(fractaldown_save, fractaldown[i])

else

if fractaldown[i] != array.get(fractaldown_save, array.size(fractaldown_save)-1)

array.push(fractaldown_save, fractaldown[i])

if array.size(fractaldown_save) < 3

array.push(fractaldown_save, fractaldown)

array.push(fractaldown_save, fractaldown)

fractalup_save = array.new_float(0)

for i = 0 to 4000

if array.size(fractalup_save) < 3

if array.size(fractalup_save) == 0

array.push(fractalup_save, fractalup[i])

else

if fractalup[i] != array.get(fractalup_save, array.size(fractalup_save)-1)

array.push(fractalup_save, fractalup[i])

if array.size(fractalup_save) < 3

array.push(fractalup_save, fractalup)

array.push(fractalup_save, fractalup)

Bottom_1 = array.get(fractaldown_save, 0)

Bottom_2 = array.get(fractaldown_save, 1)

Bottom_3 = array.get(fractaldown_save, 2)

Top_1 = array.get(fractalup_save, 0)

Top_2 = array.get(fractalup_save, 1)

Top_3 = array.get(fractalup_save, 2)

//----------------------------------------------------------------------------------------------------------

// ||--- Fractal Buy Sell Signal:

bool Signal_Test = false

bool Signal_Test_OUT_TEMP = false

var Signal_Test_TEMP = false

longLossPerc = input(title="Long Stop Loss (%)", minval=0.0, step=0.1, defval=0.01) * 0.01

if filteredbotf and open < Bottom_1 and (Bottom_1 - open) / Bottom_1 >= longLossPerc

Signal_Test := true

if filteredtopf and open > Top_1

Signal_Test_TEMP := true

if filteredtopf and Signal_Test_TEMP

Signal_Test_TEMP := false

Signal_Test_OUT_TEMP := true

//----------------------------------------------------------------------------------------------------------

// ||--- Plotting:

//plotshape(filteredtopf, style=shape.triangledown, location=location.abovebar, color=color.red, text="•", offset=0)

//plotshape(filteredbotf, style=shape.triangleup, location=location.belowbar, color=color.lime, text="•", offset=0)

//plotshape(ShowSwingsHL ? highswings : na, style=shape.triangledown, location=location.abovebar, color=color.maroon, text="H", offset=0)

//plotshape(ShowSwingsHL ? lowswings : na, style=shape.triangleup, location=location.belowbar, color=color.green, text="L", offset=0)

plot(showchannel ? (filteredtopf ? high[2] : na) : na, color=color.black, offset=0)

plot(showchannel ? (filteredbotf ? low[2] : na) : na, color=color.black, offset=0)

plot(showchannel ? (highswings ? high[2] : na) : na, color=color.black, offset=-2)

plot(showchannel ? (lowswings ? low[2] : na) : na, color=color.black, offset=-2)

plotshape(Signal_Test, style=shape.flag, location=location.belowbar, color=color.yellow, offset=0)

plotshape(Signal_Test_OUT_TEMP, style=shape.flag, location=location.abovebar, color=color.white, offset=0)

//----------------------------------------------------------------------------------------------------------

// ||--- Buy And Sell:

strategy.entry(id="Long", long=true, when = Signal_Test and afterStartDate)

strategy.close_all(when = Signal_Test_OUT_TEMP and afterStartDate)

//----------------------------------------------------------------------------------------------------------

Больше

- Стратегия торговли с двойной перемещающейся средней реверсией

- Стратегия адаптивного ценового канала

- Стратегия выхода черепахи

- Стратегия среднего обратного конверта скользящего среднего

- Моментальный прорыв в движущейся средней торговой стратегии

- Стратегия управления динамическими сетями торговли

- Динамическая стратегия отслеживания скользящей средней

- Стратегия торговли двойной скользящей средней колебанием

- Показатели EMA + Leledc + Bollinger Bands в соответствии с тенденцией стратегии

- Быстрый анализ стратегии RSI

- Стратегия высоких минус экспоненциальных скользящих средних акций

- Стратегия прорыва на Дончианском канале.

- Биткоин - стратегия перекрестного использования

- Стратегия обратного теста Fisher Transform

- 123 Стратегия комбинирования реверсионных и STARC полос

- Стратегия прекращения потерь на основе TFO и ATR

- Многофакторная количественная стратегия великого удовольствия

- Следующая стратегия линии

- Стратегия торговли четырёхкратной экспоненциальной скользящей средней

- Моментальная экспоненциальная скользящая средняя кроссоверная стратегия торговли