Улучшенная стратегия распознавания флага с интеграцией с SuperTrend

Автор:Чао Чжан, Дата: 2023-12-25 11:16:38Тэги:

Обзор: Эта стратегия гениально сочетает метод прорыва флага с известным индикатором SuperTrend для достижения уникального подхода распознавания флага.

Логика стратегии:

- Признание флага

- Динамически отслеживать максимумы и минимумы для выявления флагштоков и консолидаций

- Проверить, соответствуют ли глубина консолидации/ралли и длина флага требуемым критериям на основе данных, определенных пользователем

- Визуализируйте идентифицированные флаги с соответствующими цветовыми линиями

- Интеграция SuperTrend

- Используйте простой, но эффективный индикатор SuperTrend для отображения направления тренда на графике

- Подтвердить направление флага в сочетании с SuperTrend

- Предоставление потенциальных уровней стоп-лосса для сделок

Бесшовная интеграция шаблонов флага и SuperTrend с нулевым отставанием создает простую в использовании стратегию тренда, гармонично сочетающую распознавание флага и стоп-лосс SuperTrend.

Преимущества:

-

Смесь традиционных и современных методов Слияние классического анализа графических моделей и современных методов, следующих за тенденциями, делает это по-настоящему уникальной гибридной стратегией.

-

Встроенное управление рисками

SuperTrend устанавливает четкие уровни стоп-лосса для каждой сделки, повышая возможности управления рисками. -

Простой в использовании Стратегия предлагает ряд настраиваемых параметров для трейдеров, чтобы настроить ее на их предпочтения и стиль торговли.

-

Всеобъемлющая двусторонняя торговля Одновременная поддержка длинных и коротких сделок делает эту стратегию универсально применимой во всех рыночных условиях.

Риски:

-

Неудачные флаги Флаги могут не работать, когда консолидация выходит за пределы определенных параметров, что приводит к плохим сигналам.

-

СуперТренд отстает Линия SuperTrend имеет некоторое отставание в восприятии обратного тренда.

-

Зависимость от параметров

Использование стратегии значительно варьируется в зависимости от параметров. Для поиска оптимальных параметров необходима широкая оптимизация. -

Уклонение в направлении Выбор только одной направленной торговли ограничивает сферу применения.

Возможности повышения квалификации:

- Испытайте различные комбинации параметров SuperTrend, чтобы найти оптимальный набор.

- Усовершенствовать критерии флага для улучшения точности распознавания моделей.

- Включите другие индикаторы, такие как скользящие средние, шаблоны свечей и т. Д., Чтобы создать более универсальную стратегию.

- Ввести защитные остановки, размещение позиций и т. д., чтобы сделать стратегию более надежной.

Заключение:

Стратегия SuperTrend Enhanced Flag Finder уникально объединяет предсказательную мощь анализа графических моделей с своевременностью следования импульсу SuperTrend. Настраиваемые параметры обеспечивают огромную настраиваемость для трейдеров, чтобы адаптировать ее к их личным предпочтениям и торговым активам, в то время как простой в использовании дизайн делает ее доступной для широких приложений. В целом это изобретательно интегрированная, очень практичная стратегия распознавания моделей флага.

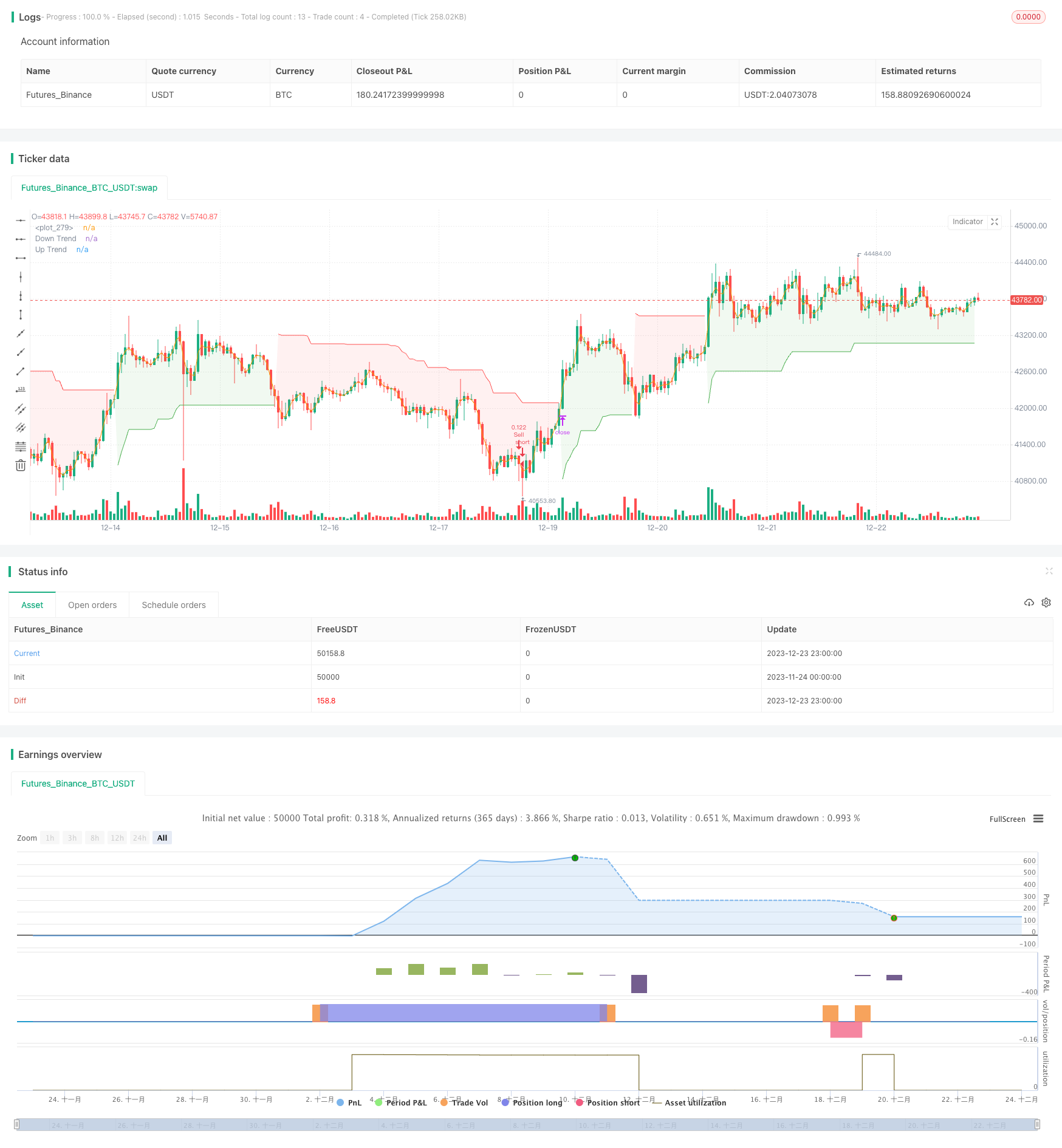

/*backtest

start: 2023-11-24 00:00:00

end: 2023-12-24 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © Amphibiantrading

//@version=5

strategy("TrendGuard Flag Finder - Strategy [presentTrading]", overlay = true, precision=3, default_qty_type=strategy.cash,

commission_value= 0.1, commission_type=strategy.commission.percent, slippage= 1,

currency=currency.USD, default_qty_type = strategy.percent_of_equity, default_qty_value = 10, initial_capital= 10000)

//inputs

//user controlled settings for the indicator, separated into 4 different groups

// Add a button to choose the trading direction

tradingDirection = input.string("Both","Trading Direction", options=["Long", "Short", "Both"])

// Supertrend parameters

SupertrendPeriod = input(10, "Supertrend Length",group ='SuperTrend Criteria')

SupertrendFactor = input.float(4.0, "Supertrend Factor", step = 0.01,group ='SuperTrend Criteria')

// Flag parameters

var g1 = 'Bull Flag Criteria'

max_depth = input.float(5, 'Max Flag Depth', step = .25, minval = 2.0, group = g1, tooltip = 'Maximum pullback allowed from flag high to flag low')

max_flag = input.int(7, 'Max Flag Length', group = g1, tooltip = 'The maximum number of bars the flag can last')

min_flag = input.int(3, 'Min Flag Length', group = g1, tooltip = 'The minimum number of bars required for the flag')

poleMin = input.float(3.0, 'Prior Uptrend Minimum', group = g1, tooltip = 'The minimum percentage gain required before a flag forms')

poleMaxLen = input.int(13, 'Max Flag Pole Length', minval = 1, group = g1, tooltip = 'The maximum number of bars the flagpole can be')

poleMinLen = input.int(7, 'Min Flag Pole Length', minval = 1, group = g1, tooltip = 'The minimum number of bars required for the flag pole')

var g2 = 'Bear Flag Criteria'

max_rally = input.float(5, 'Max Flag Rally', step = .25, minval = 2.0, group = g2, tooltip = 'Maximum rally allowed from flag low to flag low')

max_flagBear = input.int(7, 'Max Flag Length', group = g2, tooltip = 'The maximum number of bars the flag can last')

min_flagBear = input.int(3, 'Min Flag Length', group = g2, tooltip = 'The minimum number of bars required for the flag')

poleMinBear = input.float(3.0, 'Prior Downtrend Minimum', group = g2, tooltip = 'The minimum percentage loss required before a flag forms')

poleMaxLenBear = input.int(13, 'Max Flag Pole Length', minval = 1, group = g2, tooltip = 'The maximum number of bars the flagpole can be')

poleMinLenBear = input.int(7, 'Min Flag Pole Length', minval = 1, group = g2, tooltip = 'The minimum number of bars required for the flag pole')

var g3 = 'Bull Flag Display Options'

showF = input.bool(true, 'Show Bull Flags', group = g3)

showBO = input.bool(true,'Show Bull Flag Breakouts', group = g3)

lineColor = input.color(color.green, 'Bull Line Color', group = g3)

lineWidth = input.int(2, 'Bull Line Width', minval = 1, maxval = 5, group = g3)

var g4 = 'Bear Flag Display Options'

showBF = input.bool(true, 'Show Bear Flags', group = g4)

showBD = input.bool(true,'Show Bear Flag Breakdowns', group = g4)

lineColorBear = input.color(color.red, 'Bear Flag Line Color', group = g4)

lineWidthBear = input.int(2, 'Bear Flag Line Width', minval = 1, maxval = 5, group = g4)

//variables

//declare starting variables used for identfying flags

var baseHigh = high, var startIndex = 0, var flagLength = 0, var baseLow = low

var lowIndex = 0, var flagBool = false, var poleLow = 0.0, var poleLowIndex = 0

var line flagHLine = na, var line flagLLine = na, var line flagPLine = na

// bear flag variables

var flagLowBear = high, var startIndexBear = 0, var flagLengthBear = 0, var flagHigh = low

var highIndex = 0, var flagBoolBear = false, var poleHigh = 0.0, var polehighIndex = 0

var line flagBearHLine = na, var line flagBearLLine = na, var line flagBearPLine = na

//find bull flag highs

// check to see if the current bars price is higher than the previous base high or na and then sets the variables needed for flag detection

if high > baseHigh or na(baseHigh)

baseHigh := high

startIndex := bar_index

flagLength := 0

baseLow := low

lowIndex := bar_index

// check to see if the low of the current bar is lower than the base low, if it is set the base low to the low

if high <= baseHigh and low < baseLow

baseLow := low

lowIndex := bar_index

// moves the base low from the base high bar_index to prevent the high and low being the same bar

if high <= baseHigh and lowIndex == startIndex

baseLow := low

lowIndex := bar_index

//find bear flag lows

// check to see if the current bars price is lower than the previous flag low or na and then sets the variables needed for flag detection

if low < flagLowBear or na(flagLowBear)

flagLowBear := low

startIndexBear := bar_index

flagLengthBear := 0

flagHigh := high

highIndex := bar_index

// check to see if the high of the current bar is higher than the flag high, if it is set the flag high to the high

if low >= flagLowBear and high > flagHigh

flagHigh := high

highIndex := bar_index

// moves the flag high from the flag low bar_index to prevent the high and low being the same bar

if low >= flagLowBear and highIndex == startIndexBear

flagHigh := high

highIndex := bar_index

//calulations bullish

findDepth = math.abs(((baseLow / baseHigh) - 1) * 100) //calculate the depth of the flag

poleDepth = ((baseHigh / poleLow)- 1) * 100 // calculate the low of the flag pole to the base high

lower_close = close < close[1] // defines a lower close

//calculations bearish

findRally = math.abs(((flagHigh / flagLowBear) - 1) * 100) //calculate the rally of the flag

poleDepthBear = ((flagLowBear / poleHigh)- 1) * 100 // calculate the high of the flag pole to the low high

higher_close = close > close[1] // defines a higher close

//start the counters

// begins starting bars once a high is less than the flag high

if high < baseHigh and findDepth <= max_depth or (high == baseHigh and lower_close)

flagLength += 1

else

flagLength := 0

// begins starting bars once a low is higher than the flag low

if low > flagLowBear and findRally <= max_rally or (low == flagLowBear and higher_close)

flagLengthBear += 1

else

flagLengthBear := 0

// check for prior uptrend / downtrend to meet requirements

// loops through all the bars from the minimum pole length to the maximum pole length to check if the prior uptrend requirements are met and sets the variables to their new values

if high == baseHigh

for i = poleMinLen to poleMaxLen

if ((high / low[i]) - 1) * 100 >= poleMin

flagBool := true

poleLow := low[i]

poleLowIndex := bar_index[i]

break

// loops through all the bars from the minimum pole length to the maximum pole length to check if the prior downtrend requirements are met and sets the variables to their new values

if low == flagLowBear

for i = poleMinLenBear to poleMaxLenBear

if math.abs(((low / high[i]) - 1) * 100) >= poleMinBear

flagBoolBear := true

poleHigh := high[i]

polehighIndex := bar_index[i]

break

// reset variables if criteria for a flag is broken

// if the depth of the bull flag is greater than the maximum depth limit or the flag lasts longer than the maximum length everything is reset to beging looking for a new flag

if findDepth >= max_depth or flagLength > max_flag

flagBool := false

flagLength := 0

baseHigh := na

startIndex := na

lowIndex := na

baseLow := na

// if the rally of the bear flag is greater than the maximum rally limit or the flag lasts longer than the maximum length everything is reset to beging looking for a new flag

if findRally >= max_rally or flagLengthBear > max_flagBear

flagBoolBear := false

flagLengthBear := 0

flagLowBear := na

startIndexBear := na

highIndex := na

flagHigh := na

// reset the variables and begin looking for a new bull flag if price continues higher before the minimum flag length requirement is met

if high > baseHigh[1] and flagLength < min_flag

baseHigh := high

flagLength := 0

startIndex := bar_index

lowIndex := bar_index

baseLow := low

// reset the variables and begin looking for a new bear flag if price continues lower before the minimum bear flag length requirement is met

if low < flagLowBear[1] and flagLengthBear < min_flagBear

flagLowBear := low

flagLengthBear := 0

startIndexBear := bar_index

highIndex := bar_index

flagHigh := high

//define the flags

// if all requirements are met a bull flag is true, flagBool is true, flag length is less than maximum set length and more than miminum required. The prior run up also meets the requirements for length and price

flag = flagBool == true and flagLength < max_flag and findDepth < max_depth and flagLength >= min_flag and startIndex - poleLowIndex <= poleMaxLen

// if all requirements are met a bear flag is true, flagBoolBear is true, flag length is less than maximum set length and more than miminum required. The prior downtrend also meets the requirements for length and price

bearFlag = flagBoolBear == true and flagLengthBear < max_flagBear and findRally < max_rally and flagLengthBear >= min_flagBear and startIndexBear - polehighIndex <= poleMaxLen

//define flags, breakouts, breadowns

// a breakout is defined as the high going above the flag high and the length of the flag is greater than the minimum requirement. The flag boolean must also be true

breakout = high > baseHigh[1] and flagLength >= min_flag and flagBool == true

//a breakdown is defined as the depth of the flag being larger than user set parameter or the length of the flag exceeded the maximum flag length

breakdown = findDepth >= max_depth or flagLength > max_flag

// a separate variable to have breakouts only plot once using a plotshape

plotBO = flag[1] and high > baseHigh[1] and flagLength[1] >= min_flag and flagBool == true

// a bear flag breakout is defined as the low going below the flag low and the length of the flag is greater than the minimum requirement. The flag boolean must also be true

breakoutBear = low < flagLowBear[1] and flagLengthBear >= min_flagBear and flagBoolBear == true

//a breakdown is defined as the rally of the flag being larger than user set parameter or the length of the flag exceeded the maximum flag length

breakdownBear = findRally >= max_rally or flagLengthBear > max_flagBear

// a separate variable to have breakouts only plot once using a plotshape

plotBD = bearFlag[1] and low < flagLowBear[1] and flagLengthBear[1] >= min_flagBear and flagBoolBear == true

// // if a bul flag is detected and the user has bull flags selected from the settings menu draw it on the chart

// if flag and showF

// //if a flag was detected on the previous bar, delete those lines and allow for new lines to be drawn

// if flag[1]

// line.delete(flagHLine[1]), line.delete(flagLLine[1]), line.delete(flagPLine[1])

// //draw new lines

// flagHLine := line.new(startIndex, baseHigh, bar_index, baseHigh, color=lineColor, width = lineWidth)

// flagLLine := line.new(startIndex, baseLow, bar_index, baseLow, color=lineColor, width = lineWidth)

// flagPLine := line.new(poleLowIndex +1, poleLow, startIndex , baseLow, color=lineColor, width = lineWidth)

// // if a bear flag is detected and the user has bear flags selected from the settings menu draw it on the chart

// if bearFlag and showBF

// //if a bear flag was detected on the previous bar, delete those lines and allow for new lines to be drawn

// if bearFlag[1]

// line.delete(flagBearHLine[1]), line.delete(flagBearLLine[1]), line.delete(flagBearPLine[1])

// //draw new lines

// flagBearHLine := line.new(startIndexBear, flagHigh, bar_index, flagHigh, color=lineColorBear, width = lineWidthBear)

// flagBearLLine := line.new(startIndexBear, flagLowBear, bar_index, flagLowBear, color=lineColorBear, width = lineWidthBear)

// flagBearPLine := line.new(polehighIndex + 1, poleHigh, startIndexBear , flagHigh, color=lineColorBear, width = lineWidthBear)

//reset variables if a breakout occurs

if breakout // bull flag - high gets above flag high

flagLength := 0

baseHigh := high

startIndex := bar_index

lowIndex := bar_index

baseLow := low

if breakoutBear // bear flag - low gets below flag low

flagLengthBear := 0

flagLowBear := low

startIndexBear := bar_index

highIndex := bar_index

flagHigh := high

//reset the variables and highs from a failed bull flag. This allows stocks below previous highs to find new flags

highest = ta.highest(high, 10) // built in variable that finds the highest high lookingback the past 10 bars

if breakdown or flagLength == max_flag

flagBool := false

baseHigh := highest

startIndex := bar_index

lowIndex := bar_index

baseLow := low

//reset the variables and lows from a failed bear flag. This allows stocks above previous lows to find new flags

lowest = ta.lowest(low, 10) // built in variable that finds the lowest low lookingback the past 10 bars

if breakdownBear or flagLengthBear == max_flagBear

flagBoolBear := false

flagLowBear := lowest

startIndexBear := bar_index

highIndex := bar_index

flagHigh := high

// if a flag breakdowns remove the lines from the chart

// if (breakdown and flag[1])

// line.delete(flagHLine)

// line.delete(flagLLine)

// line.delete(flagPLine)

// if (breakdownBear and bearFlag[1])

// line.delete(flagBearHLine)

// line.delete(flagBearLLine)

// line.delete(flagBearPLine)

//plot breakouts

// use a plotshape to check if there is a breakout and the show breakout option is selected. If both requirements are met plot a shape at the breakout bar

plotshape(plotBO and showBO and showF, 'Breakout', shape.triangleup, location.belowbar, color.green)

// use a plotshape to check if there is a breakout and the show breakout option is selected. If both requirements are met plot a shape at the breakout bar

plotshape(plotBD and showBD and showBF, 'Breakout', shape.triangledown, location.abovebar, color.red)

// Define entry and exit conditions based on the indicator

bullishEntryFlag = plotBO and showBO and showF

bearishEntryFlag = plotBD and showBD and showBF

// Calculate Supertrend

[supertrend, direction] = ta.supertrend(SupertrendFactor, SupertrendPeriod)

bodyMiddle = plot((open + close) / 2, display=display.none)

upTrend = plot(direction < 0 ? supertrend : na, "Up Trend", color = color.green, style=plot.style_linebr)

downTrend = plot(direction < 0? na : supertrend, "Down Trend", color = color.red, style=plot.style_linebr)

fill(bodyMiddle, upTrend, color.new(color.green, 90), fillgaps=false)

fill(bodyMiddle, downTrend, color.new(color.red, 90), fillgaps=false)

// Define entry and exit conditions based on the indicator

bullishEntryST = direction < 0

bearishEntryST = direction > 0

// Entry

bullishEntry = bullishEntryFlag and bullishEntryST

bearishEntry = bearishEntryFlag and bearishEntryST

// Modify entry and exit conditions based on the selected trading direction

if (bullishEntry and (tradingDirection == "Long" or tradingDirection == "Both"))

strategy.entry("Buy", strategy.long)

strategy.exit("Sell", "Buy", stop=supertrend)

if (bearishEntry and (tradingDirection == "Short" or tradingDirection == "Both"))

strategy.entry("Sell", strategy.short)

strategy.exit("Cover", "Sell", stop=supertrend)

// Exit conditions

if (strategy.position_size > 0 and bearishEntry and (tradingDirection == "Long" or tradingDirection == "Both")) // If in a long position and bearish entry condition is met

strategy.close("Buy")

if (strategy.position_size < 0 and bullishEntry and (tradingDirection == "Short" or tradingDirection == "Both")) // If in a short position and bullish entry condition is met

strategy.close("Sell")

- Двойные полосы Боллинджера

- Стратегия отслеживания канала Келтнера

- Стратегия развития объема цен

- Стратегия KST

- Три стратегии перехода SMA

- Стратегия торговли с индексом двойной обратной импульсивности

- Стратегия отслеживания волатильности двойных полос Боллинджера

- Стратегия гистограммы MACD RSI

- Количественная стратегия торговли, основанная на индикаторе RSI и скользящей средней

- Прорывная стратегия BBMA

- Динамическая стратегия торговли фильтром

- Стратегия перекрестного использования двойного МО

- Стратегия торговли процентной интерполяцией Хайкина Аши

- Стратегия торговли черепахами на основе Дончианских каналов

- Кроссоверная стратегия внутридневного трейдинга EMA на основе осциллятора AO

- Индикатор Ichimoku Oscillator [График Prime]

- FRAMA и стратегия перекрестной торговли скользящими средними на основе двойной скользящей средней

- Длинная краткосрочная трейдинговая стратегия с перемещающейся средней перекрестностью

- Стратегия быстрого скальпирования RSI v1.7

- Количественная стратегия перекрестного использования скользящей средней