سپر ٹرینڈ کے ساتھ مربوط ایک بہتر پرچم پیٹرن کی شناخت کی حکمت عملی

مصنف:چاؤ ژانگ، تاریخ: 2023-12-25 11:16:38ٹیگز:

جائزہ: یہ حکمت عملی ایک منفرد پرچم کی شناخت کے نقطہ نظر کو حاصل کرنے کے لئے پرچم پیٹرن بریک آؤٹ کے طریقہ کار کو مشہور سپر ٹرینڈ اشارے کے ساتھ ذہین طور پر جوڑتی ہے۔ یہ نہ صرف روایتی پرچم کے نمونوں کی نشاندہی کرسکتا ہے ، بلکہ رجحان کی سمت کا تعین کرنے اور ممکنہ اسٹاپ نقصان کی سطح مقرر کرنے کے لئے سپر ٹرینڈ اشارے کا بھی استعمال کرسکتا ہے۔

حکمت عملی منطق:

- پرچم کے نمونوں کی پہچان

- فلیگ اسٹولز اور کنسولیڈیشنز کی نشاندہی کرنے کے لئے متحرک طور پر اونچائیوں اور نچلی سطحوں کا سراغ لگائیں

- چیک کریں کہ کیا کنسولیڈیشن کی گہرائی/ریلی اور پرچم کی لمبائی صارف کے متعین ان پٹ کی بنیاد پر مطلوبہ معیار پر پورا اترتی ہے

- متعلقہ رنگ لائنوں کے ساتھ شناخت پرچم پیٹرن کو دیکھنے کے

- سپر ٹرینڈ انٹیگریشن

- چارٹ پر غالب رجحان کی سمت ظاہر کرنے کے لئے سادہ لیکن موثر سپر ٹرینڈ اشارے کا اطلاق کریں

- سپر ٹرینڈ کے ساتھ مل کر پرچم پیٹرن سمت کی تصدیق کریں

- تجارت کے لئے ممکنہ سٹاپ نقصان کی سطح فراہم کریں

فلیگ پیٹرن اور صفر لیگ سپر ٹرینڈ کے ہموار انضمام سے استعمال میں آسان رجحان کی پیروی کی حکمت عملی پیدا ہوتی ہے ، جس میں فلیگ کی شناخت اور سپر ٹرینڈ اسٹاپ نقصان کو ہم آہنگ طور پر جوڑتا ہے۔

فوائد:

-

روایتی اور جدید تکنیکوں کا امتزاج کلاسیکی چارٹ پیٹرن تجزیہ اور جدید رجحانات کی پیروی کرنے والی تکنیکوں کا امتزاج اس کو واقعی ایک منفرد ہائبرڈ حکمت عملی بناتا ہے۔

-

بلٹ ان رسک مینجمنٹ

سپر ٹرینڈ ہر تجارت کے لئے واضح سٹاپ نقصان کی سطح مقرر کرتا ہے، خطرے کے انتظام کی صلاحیتوں کو بڑھانے. -

استعمال میں آسان یہ حکمت عملی تاجروں کو اپنی ترجیحات اور تجارتی طرز پر اپنی مرضی کے مطابق کرنے کے لئے اپنی مرضی کے مطابق پیرامیٹرز کی ایک حد پیش کرتی ہے۔ سادہ لیکن طاقتور۔

-

جامع دو طرفہ تجارت طویل اور مختصر تجارتوں کے لئے بیک وقت حمایت اس حکمت عملی کو تمام مارکیٹ کے ماحول میں عالمگیر طور پر قابل اطلاق بناتی ہے۔

خطرات:

-

ناکام پرچم جب کنسلٹیشن مقرر کردہ پیرامیٹرز سے زیادہ ہو تو پرچم ناکام ہوسکتے ہیں ، جس کے نتیجے میں خراب سگنل ہوتے ہیں۔

-

سپر ٹرینڈ پسماندگی سپر ٹرینڈ لائن میں رجحان کی تبدیلیوں کو پکڑنے میں کچھ تاخیر ہوتی ہے۔ موڑ کے مقامات کے ارد گرد بڑی سلائپنگ ہوسکتی ہے۔

-

پیرامیٹر انحصار

حکمت عملی کی کارکردگی مختلف پیرامیٹرز کی ترتیبات کے ساتھ نمایاں طور پر مختلف ہوتی ہے۔ زیادہ سے زیادہ پیرامیٹرز تلاش کرنے کے لئے وسیع پیمانے پر اصلاح کی ضرورت ہے۔ -

سمتی تعصب صرف ایک سمت کی تجارت کا انتخاب درخواست کے دائرہ کار کو محدود کرتا ہے۔ دو طرفہ تجارت کی سفارش کی جاتی ہے۔

ترقی کے مواقع:

- بہترین سیٹ تلاش کرنے کے لئے سپر ٹرینڈ پیرامیٹرز کے مختلف مجموعوں کا تجربہ کریں۔

- نمونہ کی شناخت کی درستگی کو بہتر بنانے کے لئے پرچم کے معیار کو بہتر بنائیں.

- ایک زیادہ ورسٹائل حکمت عملی پیدا کرنے کے لئے دیگر اشارے جیسے چلتی اوسط، موم بتی پیٹرن وغیرہ شامل کریں.

- حفاظتی رکاوٹوں، پوزیشن سائزنگ وغیرہ کو متعارف کرانے کے لئے حکمت عملی کو زیادہ مضبوط بنانے کے لئے.

نتیجہ:

سپر ٹرینڈ بہتر فلیگ فائنڈر حکمت عملی منفرد طور پر چارٹ پیٹرن تجزیہ کی پیش گوئی کی طاقت کو سپر ٹرینڈ رفتار کے بعد کی بروقتیت کے ساتھ جوڑتی ہے۔ ٹن قابل پیرامیٹرز تاجروں کو اپنی ذاتی ترجیحات اور تجارتی اثاثوں کے مطابق ڈھالنے کے لئے زبردست حسب ضرورت فراہم کرتے ہیں ، جبکہ استعمال میں آسان ڈیزائن اسے وسیع ایپلی کیشنز کے لئے قابل رسائی بناتا ہے۔ مجموعی طور پر ایک ذہین طور پر مربوط ، انتہائی عملی فلیگ پیٹرن کی شناخت کی حکمت عملی۔

/*backtest

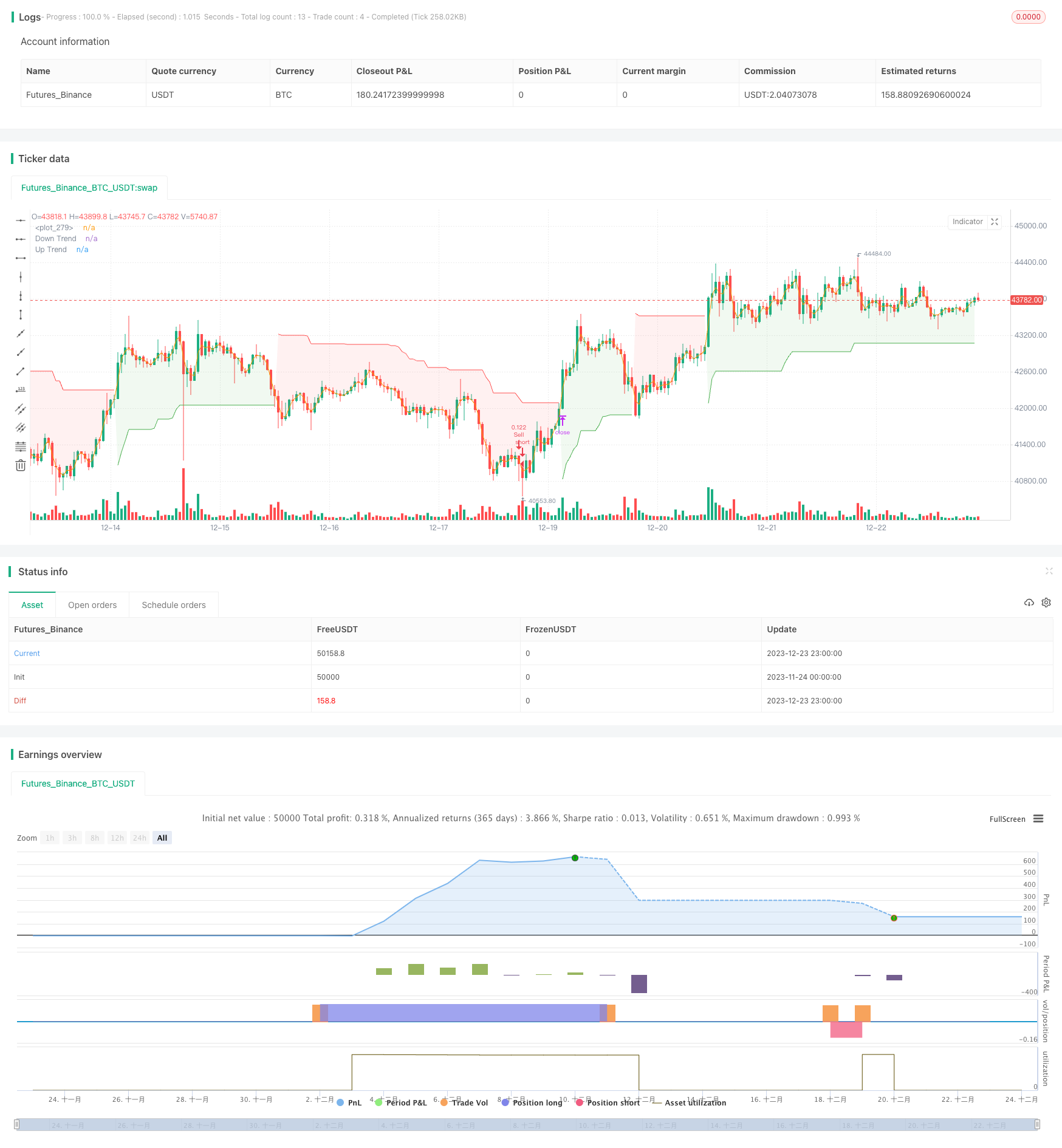

start: 2023-11-24 00:00:00

end: 2023-12-24 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © Amphibiantrading

//@version=5

strategy("TrendGuard Flag Finder - Strategy [presentTrading]", overlay = true, precision=3, default_qty_type=strategy.cash,

commission_value= 0.1, commission_type=strategy.commission.percent, slippage= 1,

currency=currency.USD, default_qty_type = strategy.percent_of_equity, default_qty_value = 10, initial_capital= 10000)

//inputs

//user controlled settings for the indicator, separated into 4 different groups

// Add a button to choose the trading direction

tradingDirection = input.string("Both","Trading Direction", options=["Long", "Short", "Both"])

// Supertrend parameters

SupertrendPeriod = input(10, "Supertrend Length",group ='SuperTrend Criteria')

SupertrendFactor = input.float(4.0, "Supertrend Factor", step = 0.01,group ='SuperTrend Criteria')

// Flag parameters

var g1 = 'Bull Flag Criteria'

max_depth = input.float(5, 'Max Flag Depth', step = .25, minval = 2.0, group = g1, tooltip = 'Maximum pullback allowed from flag high to flag low')

max_flag = input.int(7, 'Max Flag Length', group = g1, tooltip = 'The maximum number of bars the flag can last')

min_flag = input.int(3, 'Min Flag Length', group = g1, tooltip = 'The minimum number of bars required for the flag')

poleMin = input.float(3.0, 'Prior Uptrend Minimum', group = g1, tooltip = 'The minimum percentage gain required before a flag forms')

poleMaxLen = input.int(13, 'Max Flag Pole Length', minval = 1, group = g1, tooltip = 'The maximum number of bars the flagpole can be')

poleMinLen = input.int(7, 'Min Flag Pole Length', minval = 1, group = g1, tooltip = 'The minimum number of bars required for the flag pole')

var g2 = 'Bear Flag Criteria'

max_rally = input.float(5, 'Max Flag Rally', step = .25, minval = 2.0, group = g2, tooltip = 'Maximum rally allowed from flag low to flag low')

max_flagBear = input.int(7, 'Max Flag Length', group = g2, tooltip = 'The maximum number of bars the flag can last')

min_flagBear = input.int(3, 'Min Flag Length', group = g2, tooltip = 'The minimum number of bars required for the flag')

poleMinBear = input.float(3.0, 'Prior Downtrend Minimum', group = g2, tooltip = 'The minimum percentage loss required before a flag forms')

poleMaxLenBear = input.int(13, 'Max Flag Pole Length', minval = 1, group = g2, tooltip = 'The maximum number of bars the flagpole can be')

poleMinLenBear = input.int(7, 'Min Flag Pole Length', minval = 1, group = g2, tooltip = 'The minimum number of bars required for the flag pole')

var g3 = 'Bull Flag Display Options'

showF = input.bool(true, 'Show Bull Flags', group = g3)

showBO = input.bool(true,'Show Bull Flag Breakouts', group = g3)

lineColor = input.color(color.green, 'Bull Line Color', group = g3)

lineWidth = input.int(2, 'Bull Line Width', minval = 1, maxval = 5, group = g3)

var g4 = 'Bear Flag Display Options'

showBF = input.bool(true, 'Show Bear Flags', group = g4)

showBD = input.bool(true,'Show Bear Flag Breakdowns', group = g4)

lineColorBear = input.color(color.red, 'Bear Flag Line Color', group = g4)

lineWidthBear = input.int(2, 'Bear Flag Line Width', minval = 1, maxval = 5, group = g4)

//variables

//declare starting variables used for identfying flags

var baseHigh = high, var startIndex = 0, var flagLength = 0, var baseLow = low

var lowIndex = 0, var flagBool = false, var poleLow = 0.0, var poleLowIndex = 0

var line flagHLine = na, var line flagLLine = na, var line flagPLine = na

// bear flag variables

var flagLowBear = high, var startIndexBear = 0, var flagLengthBear = 0, var flagHigh = low

var highIndex = 0, var flagBoolBear = false, var poleHigh = 0.0, var polehighIndex = 0

var line flagBearHLine = na, var line flagBearLLine = na, var line flagBearPLine = na

//find bull flag highs

// check to see if the current bars price is higher than the previous base high or na and then sets the variables needed for flag detection

if high > baseHigh or na(baseHigh)

baseHigh := high

startIndex := bar_index

flagLength := 0

baseLow := low

lowIndex := bar_index

// check to see if the low of the current bar is lower than the base low, if it is set the base low to the low

if high <= baseHigh and low < baseLow

baseLow := low

lowIndex := bar_index

// moves the base low from the base high bar_index to prevent the high and low being the same bar

if high <= baseHigh and lowIndex == startIndex

baseLow := low

lowIndex := bar_index

//find bear flag lows

// check to see if the current bars price is lower than the previous flag low or na and then sets the variables needed for flag detection

if low < flagLowBear or na(flagLowBear)

flagLowBear := low

startIndexBear := bar_index

flagLengthBear := 0

flagHigh := high

highIndex := bar_index

// check to see if the high of the current bar is higher than the flag high, if it is set the flag high to the high

if low >= flagLowBear and high > flagHigh

flagHigh := high

highIndex := bar_index

// moves the flag high from the flag low bar_index to prevent the high and low being the same bar

if low >= flagLowBear and highIndex == startIndexBear

flagHigh := high

highIndex := bar_index

//calulations bullish

findDepth = math.abs(((baseLow / baseHigh) - 1) * 100) //calculate the depth of the flag

poleDepth = ((baseHigh / poleLow)- 1) * 100 // calculate the low of the flag pole to the base high

lower_close = close < close[1] // defines a lower close

//calculations bearish

findRally = math.abs(((flagHigh / flagLowBear) - 1) * 100) //calculate the rally of the flag

poleDepthBear = ((flagLowBear / poleHigh)- 1) * 100 // calculate the high of the flag pole to the low high

higher_close = close > close[1] // defines a higher close

//start the counters

// begins starting bars once a high is less than the flag high

if high < baseHigh and findDepth <= max_depth or (high == baseHigh and lower_close)

flagLength += 1

else

flagLength := 0

// begins starting bars once a low is higher than the flag low

if low > flagLowBear and findRally <= max_rally or (low == flagLowBear and higher_close)

flagLengthBear += 1

else

flagLengthBear := 0

// check for prior uptrend / downtrend to meet requirements

// loops through all the bars from the minimum pole length to the maximum pole length to check if the prior uptrend requirements are met and sets the variables to their new values

if high == baseHigh

for i = poleMinLen to poleMaxLen

if ((high / low[i]) - 1) * 100 >= poleMin

flagBool := true

poleLow := low[i]

poleLowIndex := bar_index[i]

break

// loops through all the bars from the minimum pole length to the maximum pole length to check if the prior downtrend requirements are met and sets the variables to their new values

if low == flagLowBear

for i = poleMinLenBear to poleMaxLenBear

if math.abs(((low / high[i]) - 1) * 100) >= poleMinBear

flagBoolBear := true

poleHigh := high[i]

polehighIndex := bar_index[i]

break

// reset variables if criteria for a flag is broken

// if the depth of the bull flag is greater than the maximum depth limit or the flag lasts longer than the maximum length everything is reset to beging looking for a new flag

if findDepth >= max_depth or flagLength > max_flag

flagBool := false

flagLength := 0

baseHigh := na

startIndex := na

lowIndex := na

baseLow := na

// if the rally of the bear flag is greater than the maximum rally limit or the flag lasts longer than the maximum length everything is reset to beging looking for a new flag

if findRally >= max_rally or flagLengthBear > max_flagBear

flagBoolBear := false

flagLengthBear := 0

flagLowBear := na

startIndexBear := na

highIndex := na

flagHigh := na

// reset the variables and begin looking for a new bull flag if price continues higher before the minimum flag length requirement is met

if high > baseHigh[1] and flagLength < min_flag

baseHigh := high

flagLength := 0

startIndex := bar_index

lowIndex := bar_index

baseLow := low

// reset the variables and begin looking for a new bear flag if price continues lower before the minimum bear flag length requirement is met

if low < flagLowBear[1] and flagLengthBear < min_flagBear

flagLowBear := low

flagLengthBear := 0

startIndexBear := bar_index

highIndex := bar_index

flagHigh := high

//define the flags

// if all requirements are met a bull flag is true, flagBool is true, flag length is less than maximum set length and more than miminum required. The prior run up also meets the requirements for length and price

flag = flagBool == true and flagLength < max_flag and findDepth < max_depth and flagLength >= min_flag and startIndex - poleLowIndex <= poleMaxLen

// if all requirements are met a bear flag is true, flagBoolBear is true, flag length is less than maximum set length and more than miminum required. The prior downtrend also meets the requirements for length and price

bearFlag = flagBoolBear == true and flagLengthBear < max_flagBear and findRally < max_rally and flagLengthBear >= min_flagBear and startIndexBear - polehighIndex <= poleMaxLen

//define flags, breakouts, breadowns

// a breakout is defined as the high going above the flag high and the length of the flag is greater than the minimum requirement. The flag boolean must also be true

breakout = high > baseHigh[1] and flagLength >= min_flag and flagBool == true

//a breakdown is defined as the depth of the flag being larger than user set parameter or the length of the flag exceeded the maximum flag length

breakdown = findDepth >= max_depth or flagLength > max_flag

// a separate variable to have breakouts only plot once using a plotshape

plotBO = flag[1] and high > baseHigh[1] and flagLength[1] >= min_flag and flagBool == true

// a bear flag breakout is defined as the low going below the flag low and the length of the flag is greater than the minimum requirement. The flag boolean must also be true

breakoutBear = low < flagLowBear[1] and flagLengthBear >= min_flagBear and flagBoolBear == true

//a breakdown is defined as the rally of the flag being larger than user set parameter or the length of the flag exceeded the maximum flag length

breakdownBear = findRally >= max_rally or flagLengthBear > max_flagBear

// a separate variable to have breakouts only plot once using a plotshape

plotBD = bearFlag[1] and low < flagLowBear[1] and flagLengthBear[1] >= min_flagBear and flagBoolBear == true

// // if a bul flag is detected and the user has bull flags selected from the settings menu draw it on the chart

// if flag and showF

// //if a flag was detected on the previous bar, delete those lines and allow for new lines to be drawn

// if flag[1]

// line.delete(flagHLine[1]), line.delete(flagLLine[1]), line.delete(flagPLine[1])

// //draw new lines

// flagHLine := line.new(startIndex, baseHigh, bar_index, baseHigh, color=lineColor, width = lineWidth)

// flagLLine := line.new(startIndex, baseLow, bar_index, baseLow, color=lineColor, width = lineWidth)

// flagPLine := line.new(poleLowIndex +1, poleLow, startIndex , baseLow, color=lineColor, width = lineWidth)

// // if a bear flag is detected and the user has bear flags selected from the settings menu draw it on the chart

// if bearFlag and showBF

// //if a bear flag was detected on the previous bar, delete those lines and allow for new lines to be drawn

// if bearFlag[1]

// line.delete(flagBearHLine[1]), line.delete(flagBearLLine[1]), line.delete(flagBearPLine[1])

// //draw new lines

// flagBearHLine := line.new(startIndexBear, flagHigh, bar_index, flagHigh, color=lineColorBear, width = lineWidthBear)

// flagBearLLine := line.new(startIndexBear, flagLowBear, bar_index, flagLowBear, color=lineColorBear, width = lineWidthBear)

// flagBearPLine := line.new(polehighIndex + 1, poleHigh, startIndexBear , flagHigh, color=lineColorBear, width = lineWidthBear)

//reset variables if a breakout occurs

if breakout // bull flag - high gets above flag high

flagLength := 0

baseHigh := high

startIndex := bar_index

lowIndex := bar_index

baseLow := low

if breakoutBear // bear flag - low gets below flag low

flagLengthBear := 0

flagLowBear := low

startIndexBear := bar_index

highIndex := bar_index

flagHigh := high

//reset the variables and highs from a failed bull flag. This allows stocks below previous highs to find new flags

highest = ta.highest(high, 10) // built in variable that finds the highest high lookingback the past 10 bars

if breakdown or flagLength == max_flag

flagBool := false

baseHigh := highest

startIndex := bar_index

lowIndex := bar_index

baseLow := low

//reset the variables and lows from a failed bear flag. This allows stocks above previous lows to find new flags

lowest = ta.lowest(low, 10) // built in variable that finds the lowest low lookingback the past 10 bars

if breakdownBear or flagLengthBear == max_flagBear

flagBoolBear := false

flagLowBear := lowest

startIndexBear := bar_index

highIndex := bar_index

flagHigh := high

// if a flag breakdowns remove the lines from the chart

// if (breakdown and flag[1])

// line.delete(flagHLine)

// line.delete(flagLLine)

// line.delete(flagPLine)

// if (breakdownBear and bearFlag[1])

// line.delete(flagBearHLine)

// line.delete(flagBearLLine)

// line.delete(flagBearPLine)

//plot breakouts

// use a plotshape to check if there is a breakout and the show breakout option is selected. If both requirements are met plot a shape at the breakout bar

plotshape(plotBO and showBO and showF, 'Breakout', shape.triangleup, location.belowbar, color.green)

// use a plotshape to check if there is a breakout and the show breakout option is selected. If both requirements are met plot a shape at the breakout bar

plotshape(plotBD and showBD and showBF, 'Breakout', shape.triangledown, location.abovebar, color.red)

// Define entry and exit conditions based on the indicator

bullishEntryFlag = plotBO and showBO and showF

bearishEntryFlag = plotBD and showBD and showBF

// Calculate Supertrend

[supertrend, direction] = ta.supertrend(SupertrendFactor, SupertrendPeriod)

bodyMiddle = plot((open + close) / 2, display=display.none)

upTrend = plot(direction < 0 ? supertrend : na, "Up Trend", color = color.green, style=plot.style_linebr)

downTrend = plot(direction < 0? na : supertrend, "Down Trend", color = color.red, style=plot.style_linebr)

fill(bodyMiddle, upTrend, color.new(color.green, 90), fillgaps=false)

fill(bodyMiddle, downTrend, color.new(color.red, 90), fillgaps=false)

// Define entry and exit conditions based on the indicator

bullishEntryST = direction < 0

bearishEntryST = direction > 0

// Entry

bullishEntry = bullishEntryFlag and bullishEntryST

bearishEntry = bearishEntryFlag and bearishEntryST

// Modify entry and exit conditions based on the selected trading direction

if (bullishEntry and (tradingDirection == "Long" or tradingDirection == "Both"))

strategy.entry("Buy", strategy.long)

strategy.exit("Sell", "Buy", stop=supertrend)

if (bearishEntry and (tradingDirection == "Short" or tradingDirection == "Both"))

strategy.entry("Sell", strategy.short)

strategy.exit("Cover", "Sell", stop=supertrend)

// Exit conditions

if (strategy.position_size > 0 and bearishEntry and (tradingDirection == "Long" or tradingDirection == "Both")) // If in a long position and bearish entry condition is met

strategy.close("Buy")

if (strategy.position_size < 0 and bullishEntry and (tradingDirection == "Short" or tradingDirection == "Both")) // If in a short position and bullish entry condition is met

strategy.close("Sell")

- ڈبل بولنگر بینڈ بریک آؤٹ حکمت عملی

- Keltner چینل ٹریکنگ کی حکمت عملی

- قیمت حجم رجحان کی حکمت عملی

- KST کی حکمت عملی

- تین ایس ایم اے کراس اوور رفتار کی حکمت عملی

- دوہری ریورس مومنٹم انڈیکس ٹریڈنگ کی حکمت عملی

- دوہری بولنگر بینڈ Volatility ٹریکنگ کی حکمت عملی

- آر ایس آئی کی ایم اے سی ڈی ہسٹوگرام حکمت عملی

- RSI اشارے اور چلتی اوسط پر مبنی مقداری تجارتی حکمت عملی

- بی بی ایم اے کی اہم حکمت عملی

- متحرک فلٹر کوانٹم ٹریڈنگ کی حکمت عملی

- ڈبل ایم اے کراس اوور حکمت عملی

- ہائکن آشی پرسنٹیل انٹرپولیشن ٹریڈنگ کی حکمت عملی

- ڈونچیان چینلز پر مبنی کچھی ٹریڈنگ حکمت عملی

- ای ایم اے کراس اوور انٹرا ڈے ٹریڈنگ حکمت عملی اے او آسکیلیٹر پر مبنی

- Ichimoku Oscillator [چارٹ پرائم] اشارے

- FRAMA اور دوہری چلتی اوسط پر مبنی چلتی اوسط کراس اوور ٹریڈنگ کی حکمت عملی

- چلتی اوسط کراس اوور طویل مختصر ٹریڈنگ کی حکمت عملی

- فاسٹ اسکیلپنگ آر ایس آئی سوئچنگ حکمت عملی v1.7

- منتقل اوسط کراس اوور مقداری حکمت عملی