概述

搏浪者策略是一种通过结合不同的趋势跟随策略来实现更可靠的交易信号的组合策略。它整合了123反转策略和ECO策略,旨在在趋势确认后产生更准确的交易信号。该策略名取自“搏浪者”这一冲浪运动员的称呼,寓意着策略试图搏击市场波动的浪尖,获得超越大盘的超额收益。

策略原理

搏浪者策略融合了两个不同类型的策略:反转策略和趋势跟随策略。

首先,123反转策略属于反转策略。它利用K线信息判断价格是否出现反转信号。当昨日收盘价高于前日,且今日收盘价低于昨日,同时9日Slow K低于50时,发出买入信号;当昨日收盘价低于前日,且今日收盘价高于昨日,同时9日Fast K高于50时,发出卖出信号。

其次,ECO策略属于趋势跟随策略。它使用价格K线的实体大小和方向来计算动量,以判断趋势方向。ECO指标高于0表示上升趋势,低于0表示下跌趋势。

搏浪者策略将两者策略信号进行整合。只有当两种策略均发出同向信号时,例如ECO显示上升趋势而123反转策略也发出买入信号,才会开仓建立仓位。这样可以避免因单一策略判断错误而使交易亏损。

优势分析

相比单一策略,搏浪者策略具有以下优势:

结合反转和趋势策略,扬长避短,使交易信号更可靠。ECO确保只在趋势发生变化前反转,避免反转信号发生在趋势中途。

123反转策略采用stochastic指标判断超买超卖区域,ECO策略判断价格动量方向,两者互为补充,可以减少误判概率。

双重过滤机制确保只在两种策略均判断为同一方向时才开仓,可以大幅降低交易风险。

灵活的参数设置空间大,可针对不同市场调整参数,适应更广泛的市场环境。

采用日内反转与中长线趋势判断的多时间框架,能抓住更多交易机会。

风险分析

尽管搏浪者策略通过组合使用多个策略来减小单一策略的风险,但交易中仍存在以下风险:

123反转策略对震荡行情判断力较弱,可能产生连续反向信号导致亏损加剧。

ECO策略在量能不足时效果较差,应避免在低量环境中使用。

双策略过滤信号时,可能错过策略单独发出的部分利润信号。

参数设置不当可能导致策略发出错误信号。应调整参数使策略适应不同市场。

策略可能无法适应部分特殊市场情况,如重大黑天鹅事件出现时。

优化方向

搏浪者策略还存在进一步优化的空间:

可考虑加入止损策略,在亏损达到止损点时自动止损。

可以测试不同均线参数,寻找更稳定参数组合。

可尝试基于机器学习的参数自适应优化,使策略参数动态调整。

可以加入更多 Auxiliary Strategies 辅助判断,进一步提高信号准确率。

可测试在不同市场环境下的稳定性,调整参数适应更广泛市场。

可以开发自动执行和回测系统进行更严格的策略优化。

总结

综上所述,搏浪者策略通过整合反转策略和趋势跟随策略双重确认交易信号,在捕捉趋势变化的同时提高信号准确性,可望获得超越大盘的超额收益。虽然仍存在一定风险,但可通过持续优化适应更广泛的市场环境。该策略具有灵活性强、风险可控的特点,适用于追求长期稳定收益的投资者。

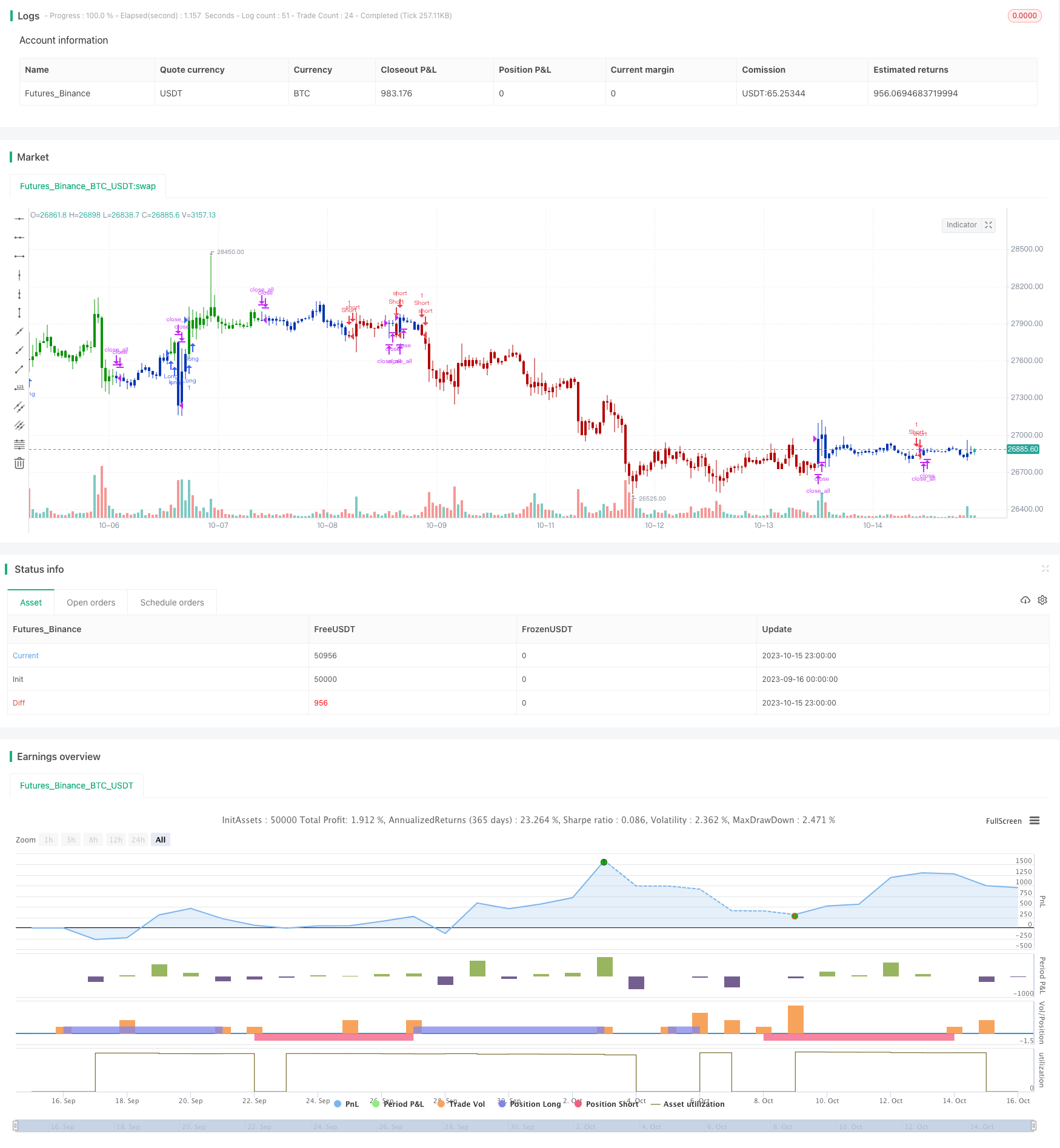

/*backtest

start: 2023-09-16 00:00:00

end: 2023-10-16 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=4

////////////////////////////////////////////////////////////

// Copyright by HPotter v1.0 16/04/2020

// This is combo strategies for get a cumulative signal.

//

// First strategy

// This System was created from the Book "How I Tripled My Money In The

// Futures Market" by Ulf Jensen, Page 183. This is reverse type of strategies.

// The strategy buys at market, if close price is higher than the previous close

// during 2 days and the meaning of 9-days Stochastic Slow Oscillator is lower than 50.

// The strategy sells at market, if close price is lower than the previous close price

// during 2 days and the meaning of 9-days Stochastic Fast Oscillator is higher than 50.

//

// Second strategy

// We call this one the ECO for short, but it will be listed on the indicator list

// at W. Blau’s Ergodic Candlestick Oscillator. The ECO is a momentum indicator.

// It is based on candlestick bars, and takes into account the size and direction

// of the candlestick "body". We have found it to be a very good momentum indicator,

// and especially smooth, because it is unaffected by gaps in price, unlike many other

// momentum indicators.

// We like to use this indicator as an additional trend confirmation tool, or as an

// alternate trend definition tool, in place of a weekly indicator. The simplest way

// of using the indicator is simply to define the trend based on which side of the "0"

// line the indicator is located on. If the indicator is above "0", then the trend is up.

// If the indicator is below "0" then the trend is down. You can add an additional

// qualifier by noting the "slope" of the indicator, and the crossing points of the slow

// and fast lines. Some like to use the slope alone to define trend direction. If the

// lines are sloping upward, the trend is up. Alternately, if the lines are sloping

// downward, the trend is down. In this view, the point where the lines "cross" is the

// point where the trend changes.

// When the ECO is below the "0" line, the trend is down, and we are qualified only to

// sell on new short signals from the Hi-Lo Activator. In other words, when the ECO is

// above 0, we are not allowed to take short signals, and when the ECO is below 0, we

// are not allowed to take long signals.

//

// WARNING:

// - For purpose educate only

// - This script to change bars colors.

////////////////////////////////////////////////////////////

Reversal123(Length, KSmoothing, DLength, Level) =>

vFast = sma(stoch(close, high, low, Length), KSmoothing)

vSlow = sma(vFast, DLength)

pos = 0.0

pos := iff(close[2] < close[1] and close > close[1] and vFast < vSlow and vFast > Level, 1,

iff(close[2] > close[1] and close < close[1] and vFast > vSlow and vFast < Level, -1, nz(pos[1], 0)))

pos

ECO(r,s) =>

pos = 0

xCO = close - open

xHL = high - low

xEMA = ema(ema(xCO, r), s)

xvEMA = ema(ema(xHL, r), s)

nRes = 100 * (xEMA / xvEMA)

pos := iff(nRes > 0, 1,

iff(nRes <= 0, -1, nz(pos[1], 0)))

pos

strategy(title="Combo Backtest 123 Reversal & ECO Strategy", shorttitle="Combo", overlay = true)

Length = input(14, minval=1)

KSmoothing = input(1, minval=1)

DLength = input(3, minval=1)

Level = input(50, minval=1)

//-------------------------

r = input(32, minval=1)

s = input(12, minval=1)

reverse = input(false, title="Trade reverse")

posReversal123 = Reversal123(Length, KSmoothing, DLength, Level)

posECO = ECO(r,s)

pos = iff(posReversal123 == 1 and posECO == 1 , 1,

iff(posReversal123 == -1 and posECO == -1, -1, 0))

possig = iff(reverse and pos == 1, -1,

iff(reverse and pos == -1 , 1, pos))

if (possig == 1)

strategy.entry("Long", strategy.long)

if (possig == -1)

strategy.entry("Short", strategy.short)

if (possig == 0)

strategy.close_all()

barcolor(possig == -1 ? #b50404: possig == 1 ? #079605 : #0536b3 )