概述

春秋叠加动量策略主要是通过计算不同周期的变化率ROC,并按比例赋权叠加,形成一个综合动量指标,以判断行情趋势方向的策略。该策略将短期、中期和长期的动量指标进行叠加,能够平衡短期和长期趋势,避免产生假信号。

策略原理

该策略首先计算10日、15日、20日等不同周期的ROC指标,然后对ROC进行平滑处理,并按照1-4的比例进行赋权叠加,计算公式如下:

roc1 = (sma(roc(close,10),10)*1)

roc2 = (sma(roc(close,15),10)*2)

...

osc = roc1+roc2+roc3+roc4+...

其中,roc1-roc12代表不同周期ROC的计算,分别对应10日、15日至530日周期。 Computes the Rate of Change (ROC) over the specified period.

接着对osc进行a天(默认10天)的SMA平滑处理,得到oscsmt。

然后比较osc与oscsmt的大小关系,当osc上穿oscsmt时为看涨信号,进入做多方向;当osc下穿oscsmt时为看跌信号,进入做空方向。

最后,可选择反转交易方向。

策略优势

将短期和长期动量指标进行叠加,能够同时捕捉短期和长期趋势,避免产生假信号。

通过差价比较osc和oscsmt,可以减少平盘区域的无谓交易。

可自定义参数,调整计算ROC的周期参数,以及SMA的平滑参数。

可选择反转交易方向,满足不同交易风格。

可视化指标,直观判断买卖点。

策略风险及优化

ROC指标对突发异常价格非常敏感,可能产生错误信号。可适当增大SMA平滑参数a,降低ROC指标的灵敏度。

默认参数可能不适用于所有品种,需要根据不同品种特点优化参数,找到最佳参数组合。

仅基于osc和oscsmt的差价比较产生交易信号,可结合其他指标过滤信号,降低错误交易概率。

本策略更适合中长线交易,短线交易效果可能不佳。可调整ROC的计算周期,优化本策略的使用场景。

总结

春秋叠加动量策略通过计算多个周期的ROC指标,并进行叠加得到综合动量指标,能够同时兼顾短期和长期趋势,避免产生假信号。相比单一ROC指标,该策略可大大提高信号质量和可靠性。但本策略也存在一定监控风险,需优化参数并结合其他指标使用,方能发挥最大效用。

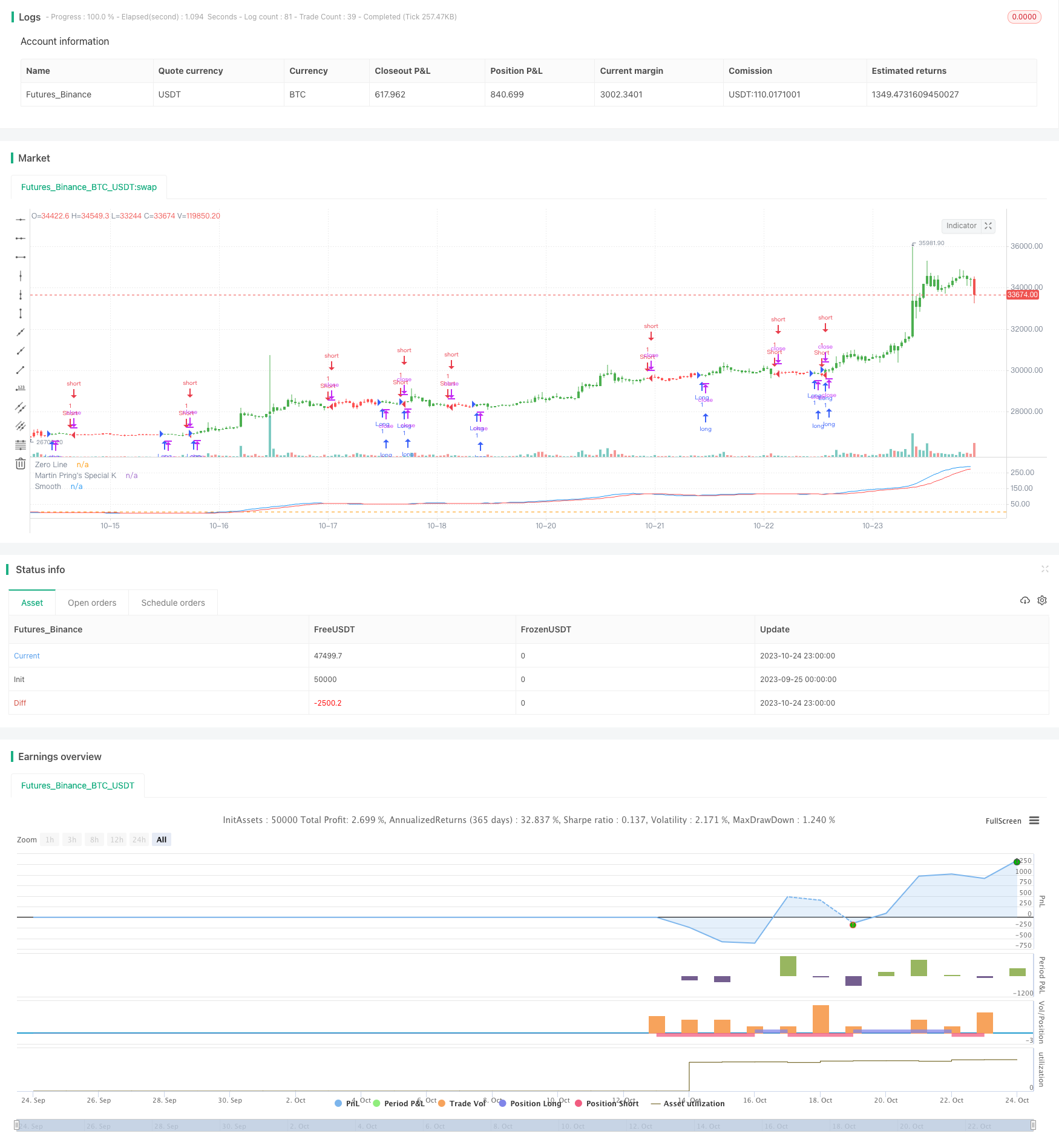

/*backtest

start: 2023-09-25 00:00:00

end: 2023-10-25 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=2

////////////////////////////////////////////////////////////

// Copyright by HPotter 08/08/2017

// Pring's Special K is a cyclical indicator created by Martin Pring.

// His method combines short-term, intermediate and long-term velocity

// into one complete series. Useful tool for Long Term Investors

// Modified for any source.

//

// You can change long to short in the Input Settings

// Please, use it only for learning or paper trading. Do not for real trading.

////////////////////////////////////////////////////////////

strategy(title="Martin Pring's Special K Backtest", shorttitle="UCS_Pring_sK")

a = input(10, title = "Smooth" )

sources = input(title="Source", defval=close)

reverse = input(false, title="Trade reverse")

roc1 = (sma(roc(sources,10),10)*1)

roc2 = (sma(roc(sources,15),10)*2)

roc3 = (sma(roc(sources,20),10)*3)

roc4 = (sma(roc(sources,30),15)*4)

roc5 = (sma(roc(sources,40),50)*1)

roc6 = (sma(roc(sources,65),65)*2)

roc7 = (sma(roc(sources,75),75)*3)

roc8 = (sma(roc(sources,100),100)*4)

roc9 = (sma(roc(sources,195),130)*1)

roc10 = (sma(roc(sources,265),130)*2)

roc11 = (sma(roc(sources,390),130)*3)

roc12 = (sma(roc(sources,530),195)*4)

osc = roc1+roc2+roc3+roc4+roc5+roc6+roc7+roc8+roc9+roc10+roc11+roc12

oscsmt = sma(osc,a)

pos = iff(osc > oscsmt, 1,

iff(osc < oscsmt, -1, nz(pos[1], 0)))

possig = iff(reverse and pos == 1, -1,

iff(reverse and pos == -1, 1, pos))

if (possig == 1)

strategy.entry("Long", strategy.long)

if (possig == -1)

strategy.entry("Short", strategy.short)

barcolor(possig == -1 ? red: possig == 1 ? green : blue )

plot(osc, color=blue, title="Martin Pring's Special K")

plot(oscsmt, color = red, title = "Smooth")

hline(0, title="Zero Line")