概述

休眠范围反转策略利用价格波动率降低的时期作为建仓信号,并在价格波动率重新上升时获利平仓。它通过识别价格被限制在窄幅震荡的休眠范围内的情况,来捕捉即将爆发的价格趋势。这种策略通常在目前波动率处于较低水平,但未来有爆发可能时适用。

策略原理

该策略首先识别出休眠范围,也就是价格被限制在前一个交易日价格范围之内的情况。这表示出目前的波动率较之前几日有所下降。我们通过将当前交易日的最高价与n日前(通常为4日)的最高价进行比较,以及将当前交易日的最低价与n日前的最低价进行比较来判断是否符合休眠范围的条件。

一旦确认了休眠范围,该策略会同时开两个挂单:一个买入挂单放在范围高点附近,一个卖出挂单放在范围低点附近。随后等待价格突破休眠范围继续向上运行或下跌。如果价格向上突破,买入单会被触发建立多头仓位;如果向下突破,卖出单会被触发建立空头仓位。

建立仓位后,策略会设置止损单和止盈单。止损单可限制下行风险,止盈单用于在获利后平仓。止损单距离入场价一个比例距离,这个比例由风险管理参数设定;止盈单距离入场价为休眠范围大小,因为我们预期价格移动的幅度会与此前波动率相当。

最后,该策略还包含资金管理模块。通过固定倍率法调整订单交易资金量,在盈利时增加资金利用率,在亏损时降低风险。

优势分析

这种策略具有以下几点优势:

利用波动率降低的时机作为建仓信号,可在价格趋势发生前捕捉机会。

同时设置多空双向交易订单,可捕捉上涨或下跌趋势。

采用止损止盈策略,可有效控制单次交易风险。

应用固定倍率资金管理法,可提高资金使用效率。

策略逻辑简单清晰易于实施。

风险分析

该策略也存在一些风险需要注意:

休眠范围破裂方向判断错误风险。价格可能上下突破都不明显,导致入场方向错误。

突破后无法继续方向性运行的风险。突破仅仅是短期的反转现象。

止损被击穿的风险。特大行情可能直接突破止损线。

固定倍率法加仓亏损扩大的风险。可降低固定倍率值以减小风险。

参数设定不当可能导致策略效果不佳。

优化方向

该策略还可从以下几个方面进行优化:

增加突破背离等过滤信号,避免错误突破。

改进止损策略,例如移动止损、挂单止损等。

增加趋势判断指标,避免反转入场。

优化固定倍率值,平衡盈亏比例。

结合多个时间周期分析,提高获利概率。

利用机器学习方法自动优化参数。

总结

休眠范围反转策略整体思路清晰,具有一定的获利潜力。通过参数优化、风险管理、信号过滤等手段可进一步提升策略稳定性。但任何趋势反转策略都存在一定的风险,需谨慎使用且适当调整仓位规模。该策略适合熟悉反转操作、有风险意识的交易者使用。

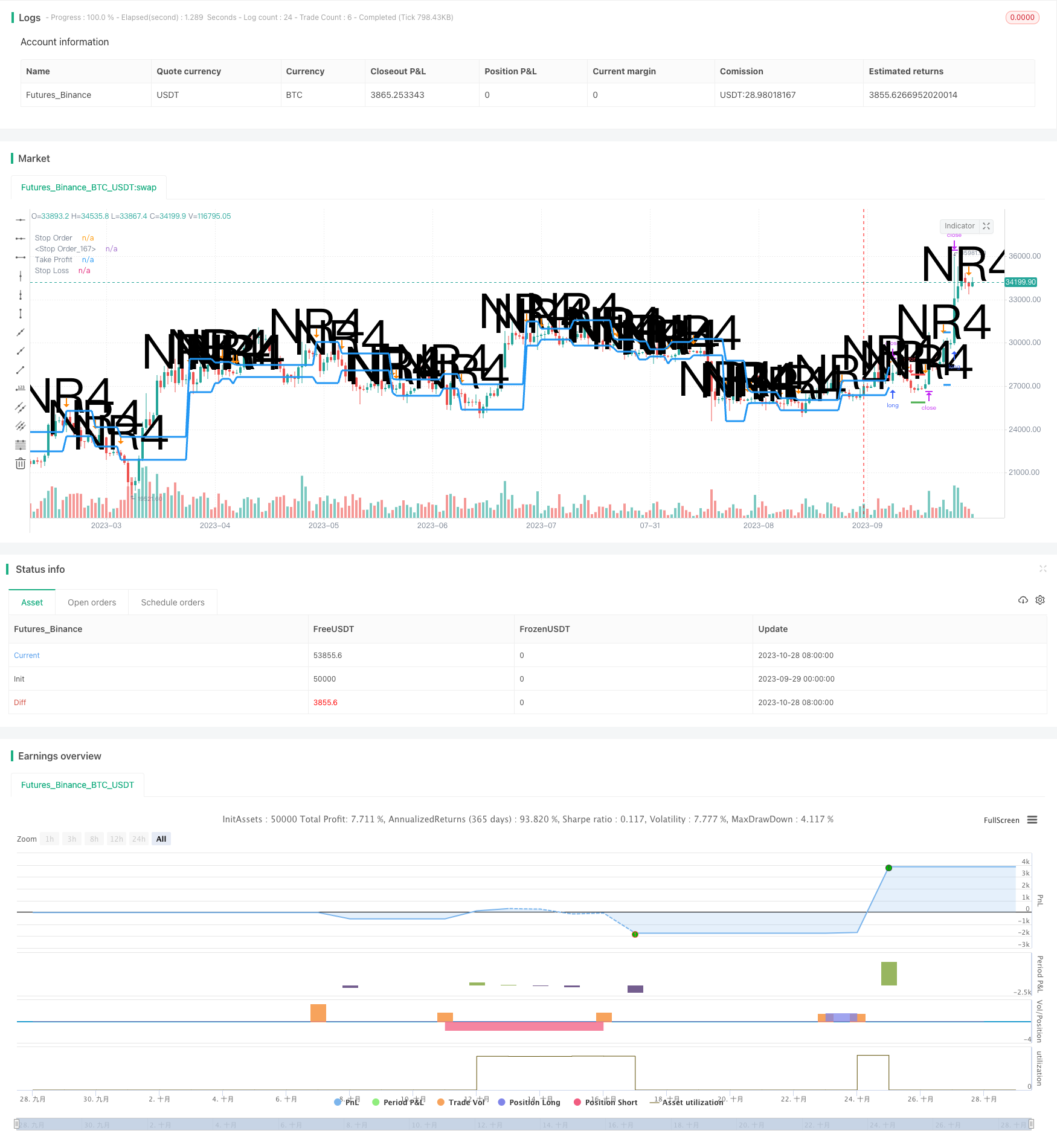

/*backtest

start: 2023-09-29 00:00:00

end: 2023-10-29 00:00:00

period: 1d

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © gsanson66

//This code is based on the Narrow Range strategy

//Interactive Broker fees are applied on this strategy

//@version=5

strategy("NARROW RANGE BACKTESTING", shorttitle="NR BACKTESTING", overlay=true, initial_capital=1000, default_qty_type=strategy.fixed, commission_type=strategy.commission.percent, commission_value=0.18)

//--------------------------------FUNCTIONS------------------------------------//

//@function to print label

debugLabel(txt, color) =>

label.new(bar_index, high, text = txt, color=color, style = label.style_label_lower_right, textcolor = color.black, size = size.small)

//@function which looks if the close date of the current bar falls inside the date range

inBacktestPeriod(start, end) => (time >= start) and (time <= end)

//--------------------------------USER INPUTS------------------------------------//

//Narrow Range Length

nrLength = input.int(4, minval=2, title="Narrow Range Length", group="Strategy parameters")

//Risk Management

stopLossInput = input.float(0.5, title="Stop Loss (in percentage of reference range)", group="Strategy parameters")

//Money Management

fixedRatio = input.int(defval=400, minval=1, title="Fixed Ratio Value ($)", group="Money Management")

increasingOrderAmount = input.int(defval=200, minval=1, title="Increasing Order Amount ($)", group="Money Management")

//Backtesting period

startDate = input(title="Start Date", defval=timestamp("1 Janv 2020 00:00:00"), group="Backtesting Period")

endDate = input(title="End Date", defval=timestamp("1 July 2024 00:00:00"), group="Backtesting Period")

//--------------------------------VARIABLES INITIALISATION--------------------------//

strategy.initial_capital = 50000

bool nr = na

var bool long = na

var bool short = na

var float stopPriceLong = na

var float stopLossLong = na

var float takeProfitLong = na

var float stopPriceShort = na

var float stopLossShort = na

var float takeProfitShort = na

var float takeProfit = na

var float stopLoss = na

bool inRange = na

int closedtrades = strategy.closedtrades

equity = math.abs(strategy.equity - strategy.openprofit)

var float capital_ref = strategy.initial_capital

var float cashOrder = strategy.initial_capital * 0.95

//------------------------------CHECKING SOME CONDITIONS ON EACH SCRIPT EXECUTION-------------------------------//

//Checking if the date belong to the range

inRange := true

//Checking performances of the strategy

if equity > capital_ref + fixedRatio

spread = (equity - capital_ref)/fixedRatio

nb_level = int(spread)

increasingOrder = nb_level * increasingOrderAmount

cashOrder := cashOrder + increasingOrder

capital_ref := capital_ref + nb_level*fixedRatio

if equity < capital_ref - fixedRatio

spread = (capital_ref - equity)/fixedRatio

nb_level = int(spread)

decreasingOrder = nb_level * increasingOrderAmount

cashOrder := cashOrder - decreasingOrder

capital_ref := capital_ref - nb_level*fixedRatio

//We check if a trade has been closed to cancel all previous orders

if closedtrades > closedtrades[1]

strategy.cancel("Long")

strategy.cancel("Short")

stopPriceLong := na

stopPriceShort := na

//Checking if we close all trades in case where we exit the backtesting period

if strategy.position_size!=0 and not inRange

debugLabel("END OF BACKTESTING PERIOD : we close the trade", color=color.rgb(116, 116, 116))

strategy.close_all()

long := na

short := na

stopPriceLong := na

stopLossLong := na

takeProfitLong := na

stopPriceShort := na

stopLossShort := na

takeProfitShort := na

takeProfit := na

stopLoss := na

//----------------------------------FINDING NARROW RANGE DAY------------------------------------------//

// We find the Narrow Range Day

if low > low[nrLength] and high < high[nrLength]

nr := true

//------------------------------------STOP ORDERS--------------------------------------------//

// We handle plotting of stop orders and cancellation of other side order if one order is triggered

if strategy.position_size > 0 and not na(stopPriceLong) and not na(stopPriceShort)

long := true

strategy.cancel("Short")

stopPriceLong := na

stopPriceShort := na

takeProfit := takeProfitLong

stopLoss := stopLossLong

if strategy.position_size < 0 and not na(stopPriceLong) and not na(stopPriceShort)

short := true

strategy.cancel("Long")

stopPriceLong := na

stopPriceShort := na

takeProfit := takeProfitShort

stopLoss := stopLossShort

//------------------------------------STOP LOSS & TAKE PROFIT--------------------------------//

// If an order is triggered we plot TP and SL

if not na(takeProfit) and not na(stopLoss) and long

if high >= takeProfit and closedtrades == closedtrades[1] + 1

takeProfit := na

stopLoss := na

long := na

if low <= stopLoss and closedtrades == closedtrades[1] + 1

takeProfit := na

stopLoss := na

long := na

if not na(takeProfit) and not na(stopLoss) and short

if high >= stopLoss and closedtrades == closedtrades[1] + 1

takeProfit := na

stopLoss := na

short := na

if low <= takeProfit and closedtrades == closedtrades[1] + 1

takeProfit := na

stopLoss := na

short := na

//-----------------------------LONG/SHORT CONDITION-------------------------//

// Conditions to create two stop orders (one for Long and one for Short) and SL & TP calculation

if nr and inRange and strategy.position_size == 0

stopPriceLong := high[4]

takeProfitLong := high[4] + (high[4] - low[4])

stopLossLong := high[4] - (high[4] - low[4])*stopLossInput

qtyLong = cashOrder/stopPriceLong

strategy.entry("Long", strategy.long, qtyLong, stop=stopPriceLong)

strategy.exit("Exit Long", "Long", limit=takeProfitLong ,stop=stopLossLong)

stopPriceShort := low[4]

takeProfitShort := low[4] - (high[4] - low[4])

stopLossShort := low[4] + (high[4] - low[4])*stopLossInput

qtyShort = cashOrder/stopPriceShort

strategy.entry("Short", strategy.short, qtyShort, stop=stopPriceShort)

strategy.exit("Exit Short", "Short", limit=takeProfitShort ,stop=stopLossShort)

//--------------------------PLOTTING ELEMENT----------------------------//

plotshape(nr, "NR", shape.arrowdown, location.abovebar, color.rgb(255, 132, 0), text= "NR4", size=size.huge)

plot(stopPriceLong, "Stop Order", color.blue, 3, plot.style_linebr)

plot(stopPriceShort, "Stop Order", color.blue, 3, plot.style_linebr)

plot(takeProfit, "Take Profit", color.green, 3, plot.style_linebr)

plot(stopLoss, "Stop Loss", color.red, 3, plot.style_linebr)