概述

三内在上涨反转策略是一种通过识别特定的三根K线形态来实现低买高卖的反转交易策略。它由三根K线组成,第一根和第二根形成阳吞阴,第三根开盘价高于前一日收盘价,并且收盘价高于前两根K线的最高价。这种K线组合预示着短期跌势反转为涨势的可能,是进行反转操作的信号。

策略原理

该策略的关键判断条件有:

第一根K线:阴线,开盘价高于收盘价

第二根K线:阳线,收盘价高于开盘价,且收盘价低于上一根K线的开盘价

第三根K线:阳线,开盘价高于上一根K线的收盘价,收盘价高于前两根K线的最高价

当检测到该信号时,我们做空头仓位,并设置止盈和止损条件。具体交易逻辑如下:

检测到三内在上涨形态时,以该阳线的开盘价入场做空

设置止盈条件:若价格上涨幅度达到输入的止盈点数,则结束交易,平掉空头仓位

设置止损条件:若价格下跌幅度达到输入的止损点数,则结束交易,平掉空头仓位

当价格达到止盈或止损点时,清空仓位,等待下一轮交易信号

通过这种方式,我们在判断到上涨反转信号时及时做空,在盈利达到预期或发生超出可控范围的损失时果断止盈止损,实现低买高卖的反转交易策略。

策略优势

捕捉反转点位,实现反转交易的目的

做空高点,做多低点,符合趋势交易逻辑

具有清晰的入场、止盈、止损机制

简单的三根K线形态,容易识别实现

可自定义止盈止损点数,控制风险

代码实现简洁清晰,易于理解和优化

综上,该策略具有捕捉反转,控制风险,简单可靠的特点,是一种实用和高效的短线反转交易策略。

策略风险

反转形态判断不准确,可能成为非反转信号

止盈止损点设定不当,可能过早止损或错过更大利润

策略期望频繁交易,存在过度交易风险

买卖点识别和仓位管理等方面仍有优化空间

需谨慎选股,该策略更适用于具有波动特征的股票

需考虑手续费和滑点成本对盈利的影响

需持续优化监控,及时应对市场变化

总体来说,通过优化参数设置,严格股票选取,持续监控等措施,可以控制该策略的交易风险。

优化方向

优化K线形态参数,提高识别准确率

优化止盈止损机制,实现更好的风险收益平衡

结合其他技术指标过滤信号,提高决策准确性

增加仓位管理机制,根据市场情况动态调整仓位

优化资金管理,达到更好的盈亏平衡

测试不同持仓时间,判断最佳持仓周期

优化代码结构,增加注释使策略更清晰

添加实盘模拟对比,检验策略有效性

调整股票池,测试策略行业和个股适应性

持续追踪策略表现,及时发现问题并调整策略

总结

三内在上涨反转策略通过识别三根特定K线形态,在判断到短期跌势反转信号时做空获得利润。策略具有清晰的交易逻辑、控制风险的止盈止损机制、易于实现和优化等优点,是一种可靠、实用的短线反转交易策略。但也存在一定的不确定性风险,需要通过参数优化、风险控制和持续跟踪优化来规避风险,在实盘中获得稳定的超额收益。

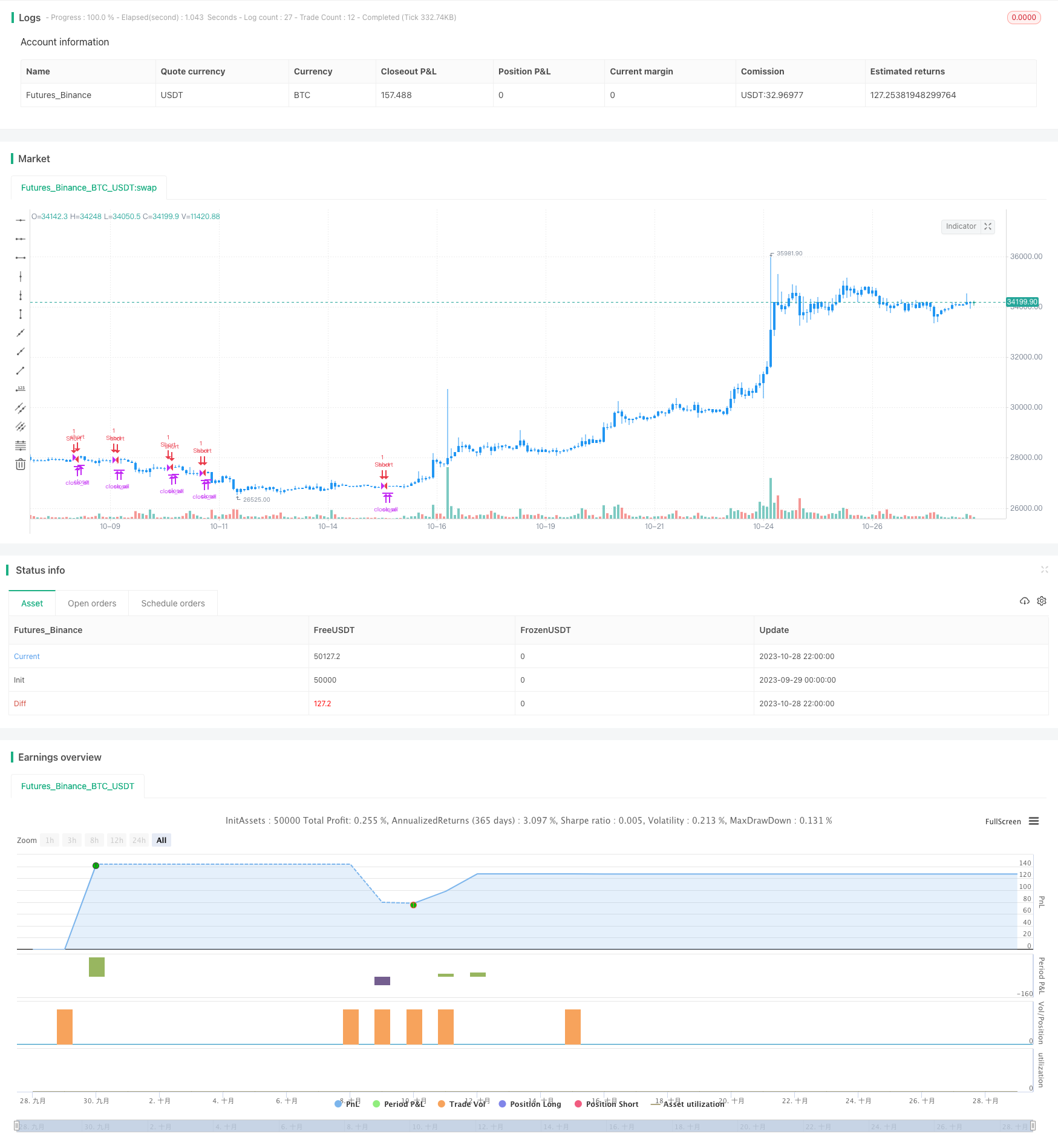

/*backtest

start: 2023-09-29 00:00:00

end: 2023-10-29 00:00:00

period: 2h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=3

////////////////////////////////////////////////////////////

// Copyright by HPotter v1.0 12/02/2019

// This is a three candlestick bullish reversal pattern consisting of a

// bullish harami pattern formed by the first 2 candlesticks then followed

// by up candlestick with a higher close than the prior candlestick.

// WARNING:

// - For purpose educate only

// - This script to change bars colors.

////////////////////////////////////////////////////////////

strategy(title = "Three Inside Up Backtest", overlay = true)

input_takeprofit = input(20, title="Take Profit pip", step=0.01)

input_stoploss = input(20, title="Stop Loss pip", step=0.01)

barcolor(open[2] > close[2] ? close[1] > open[1] ? close[1] <= open[2] ? close[2] <= open[1] ? close[1] - open[1] < open[2] - close[2] ? close > open ? close > close[1] ? open > open[1] ? close > open[2] ? yellow :na :na : na : na : na:na : na : na : na)

posprice = 0.0

pos = 0.0

barcolor(nz(pos[1], 0) == -1 ? red: nz(pos[1], 0) == 1 ? green : blue )

posprice := open[2] > close[2] ? close[1] > open[1] ? close[1] <= open[2] ? close[2] <= open[1] ? close[1] - open[1] < open[2] - close[2] ? close > open ? close > close[1] ? open > open[1] ? close > open[2] ? close :nz(posprice[1], 0) :nz(posprice[1], 0) : nz(posprice[1], 0) : nz(posprice[1], 0) :nz(posprice[1], 0):nz(posprice[1], 0):nz(posprice[1], 0):nz(posprice[1], 0):nz(posprice[1], 0)

pos := iff(posprice > 0, -1, 0)

if (pos == 0)

strategy.close_all()

if (pos == -1)

strategy.entry("Short", strategy.short)

posprice := iff(low <= posprice - input_takeprofit and posprice > 0, 0 , nz(posprice, 0))

posprice := iff(high >= posprice + input_stoploss and posprice > 0, 0 , nz(posprice, 0))