概述

多因子策略融合了震荡型策略、趋势跟踪策略和突破型策略三种不同类型的策略,通过组合使用来获取更好的策略效果。

策略原理

多因子策略主要基于以下几方面进行建模:

震荡策略部分采用随机指标来判断买入和卖出时机。具体来说,当随机指标%K线从超卖区上穿%D线时产生买入信号;当%K线从超买区下穿%D线时产生卖出信号。

趋势策略部分采用SMA均线的黄金交叉来判断趋势方向。当快线从下方上穿慢线时产生买入信号;当快线从上方下穿慢线时产生卖出信号。

突破策略部分监测价格是否突破指定周期内的最高价或最低价。当价格超过最高价时买入;当价格低于最低价时卖出。

结合ADX指标来判断趋势力度,只有在趋势足够强劲时才参与趋势交易。

建立止损线和止盈线,设定合理的止损止盈比例。

综合这几个部分,多因子策略主要遵循以下逻辑:

当ADX大于设定阈值时,认为趋势足够强劲,这时开始执行趋势策略;当ADX小于阈值时,认为处于盘整,这时仅执行震荡策略。

在趋势行情中,当SMA快慢线黄金交叉时买入开仓,死叉时平仓。

在震荡行情中,执行随机指标的交易信号。

突破型策略在两种市场环境下都适用,用于追踪劲道。

设置止损止盈线优化获利。

优势分析

多因子策略最大的优势在于结合不同类型策略的优点,在两种市场环境中都可以获得较好的策略效果。具体来说,主要具有以下优势:

能够顺应趋势,在趋势行情中获得较高的胜率。

能够在震荡行情中获利,不会被困在持仓中。

具有较高的盈利因子,止盈止损设置合理。

考虑了趋势力度,能减少亏损。

结合多个指标,可以形成较强的交易信号。

可以通过参数优化获得较优的参数组合。

风险分析

多因子策略也存在一定的风险,主要包括:

多因子组合不当可能会造成交易信号混乱,需要反复测试找到最佳因子组合。

需要优化多个参数,优化难度较大,需要足够的历史数据支持。

在趋势反转时,无法及时平仓止损,可能带来较大亏损。

ADX指标存在滞后,可能错过趋势转折点。

突破交易容易被套,需要设置合理的止损策略。

针对以上风险,可以从以下几点进行优化:

测试不同因子在历史数据中的稳定性,选取稳定因子。

采用遗传算法等智能优化方法寻找最优参数。

设置合理的止损线,以控制最大回撤。

结合附加指标判断趋势反转。

优化突破交易的止损策略,避免过大亏损。

优化方向

多因子策略还具有进一步优化的空间:

- 测试更多类型的因子,寻找更好的组合。可以考虑波动率、成交量等其他因子。

2.采用机器学习方法寻找最优策略权重。

3.参数优化可以采用智能算法,快速寻优。

4.可以测试不同持仓时间下的收益情况。

5.可以考虑动态调整止损线。如盈利后可适当放宽止损范围。

6.可以引入更多过滤条件,如成交量突增等,提高信号质量。

7.ADX指标可以考虑优化参数或替换为更先进的趋势判断指标。

总结

多因子策略综合考虑了趋势、震荡、突破等多种交易逻辑,在两种市场环境下都能获得较优秀的效果。相比单一策略,多因子策略可以获得更高的稳定收益,具有良好的升级扩展空间。但需要注意参数优化难度较大,需要足够的历史数据支持优化过程。总体来说,多因子策略是一种非常有效的算法交易方法,值得进一步研究优化。

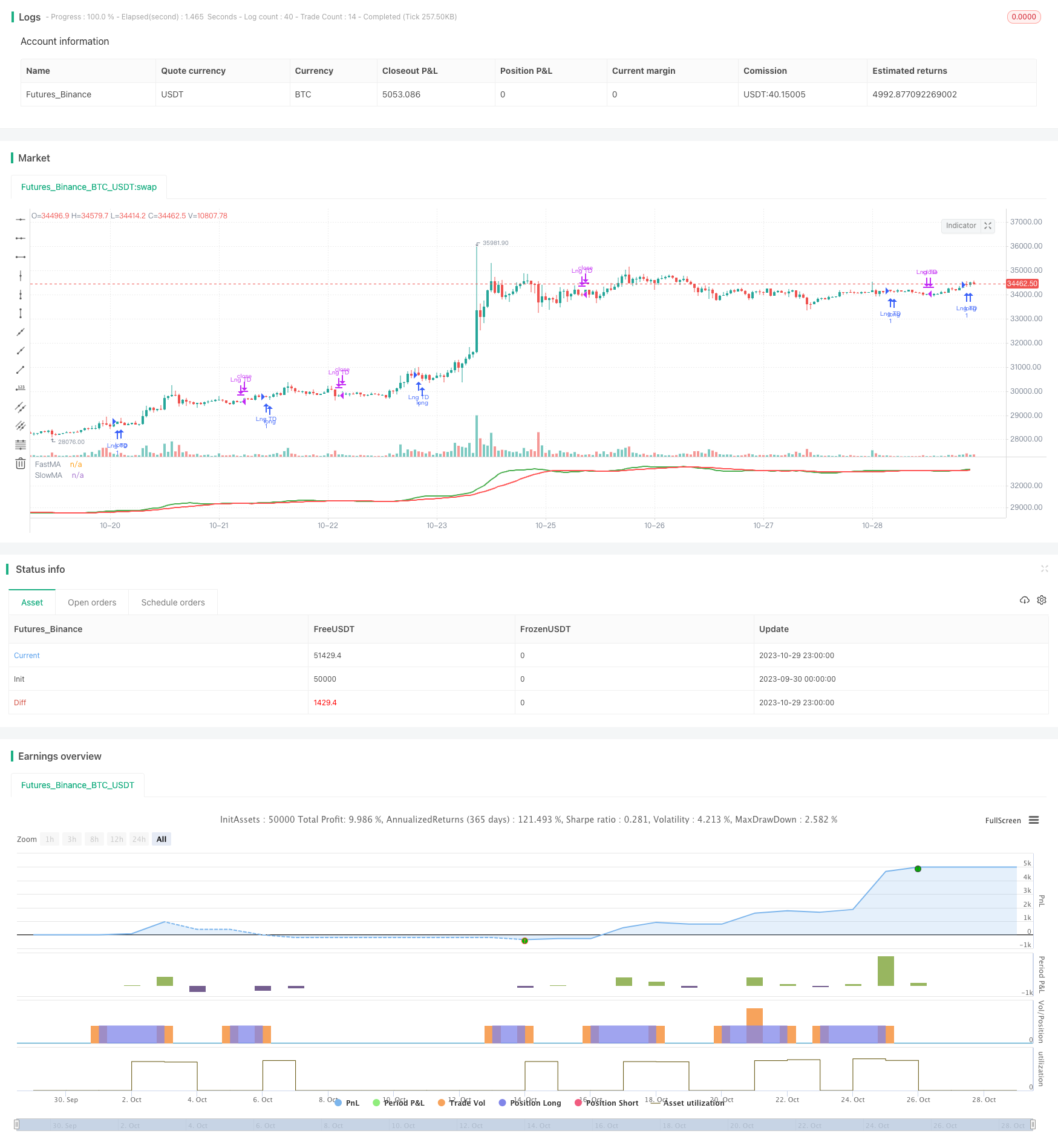

/*backtest

start: 2023-09-30 00:00:00

end: 2023-10-30 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=4

// strategy("Strategy_1", shorttitle="Strategy1",overlay=true ,pyramiding = 12, initial_capital=25000, currency='EUR', commission_type = strategy.commission.cash_per_order, commission_value = 3, default_qty_type = strategy.percent_of_equity, default_qty_value = 20)

// Revision: 1

// Author: Jonas

// === INPUT ===

// > BACKTEST RANGE <

FromMonth = input(defval=1, title="From Month", minval=1, maxval=12)

FromDay = input(defval=1, title="From Day", minval=1, maxval=31)

FromYear = input(defval=2017, title="From Year", minval=2010)

ToMonth = input(defval=1, title="To Month", minval=1, maxval=12)

ToDay = input(defval=1, title="To Day", minval=1, maxval=31)

ToYear = input(defval=9999, title="To Year", minval=2010)

// > STRATEGY SETTINGS <

bolOS = input(defval = false, type=input.bool, title="Oscillating Strategy")

bolTS = input(defval = true, type=input.bool, title="Trend Strategy")

bolBO = input(defval = false, type=input.bool, title="Breakout Strategy")

strStrategy = input(defval = "Long", type=input.string, title="Trade Strategy",options = ["Long", "Short","Long & Short"])

flStopLoss = input(defval = 2.0, title="Stop Loss %", type=input.float)/100

flTakeProfit = input(defval = 4.0, title="Take Profit %", type=input.float)/100

// > SMA <

fastMA = input(defval=8, type=input.integer, title="FastMA length", minval=1, step=1)

slowMA = input(defval=21, type=input.integer, title="SlowMA length", minval=1, step=1)

// > ADX <

adx_len = input(defval=10, type=input.integer, title="ADX length", minval=1, step=1)

adx_trend = input(defval=30, type=input.integer, title="ADX Tr", minval=1, step=1)

adx_choppy = adx_trend

adx_limit = adx_trend

// > TRENDSCORE <

ts_fromIndex = input(title="From", type=input.integer, minval=1, defval=10)

ts_toIndex = input(title="To", type=input.integer, minval=1, defval=14)

ts_src = input(title="Source", type=input.source, defval=close)

// > Oscillator <

stoch_length = 14

stoch_OverBought = 75

stoch_OverSold = 25

stoch_smoothK = 3

stoch_smoothD = 3

// === BACK TEST RANGE FUNCTION ===

window_start = timestamp(FromYear, FromMonth, FromDay, 00, 00) // backtest start window

window_finish = timestamp(ToYear, ToMonth, ToDay, 23, 59) // backtest finish window

window() => // create function "within window of time"

time >= window_start and time <= window_finish ? true : false

//plot(stop_level_Long, title="TEST",color=color.red, style=plot.style_linebr, linewidth=2)

//plot(take_level_Long, color=color.green, style=plot.style_linebr, linewidth=2)

// === ADX ===

adx_up = change(high)

adx_down = -change(low)

adx_trur = rma(tr, adx_len)

adx_plus = fixnan(100 * rma(adx_up > adx_down and adx_up > 0 ? adx_up : 0, adx_len) / adx_trur)

adx_minus = fixnan(100 * rma(adx_down > adx_up and adx_down > 0 ? adx_down : 0, adx_len) / adx_trur)

adx_sum = adx_plus + adx_minus

ADX = 100 * rma(abs(adx_plus - adx_minus) / (adx_sum == 0 ? 1 : adx_sum), adx_len)

//=== TRENDSCORE ===

trendscore(ts_src, ts_fromIndex, ts_toIndex) =>

ts_sum = 0.0

for i = ts_fromIndex to ts_toIndex

ts_sum := ts_sum + (ts_src >= nz(ts_src[i]) ? 1 : -1)

ts_sum

intTS = trendscore(ts_src, ts_fromIndex, ts_toIndex)

// Long if TrendDirection = 1, Short if TrendDirection = -1; Indifferent if TrendDirection = 0

intTrendDirection = (intTS > (ts_toIndex-ts_fromIndex)) ? 1 : (intTS < (ts_fromIndex-ts_toIndex)) ? -1 : 0

// > TREND CONDITION <

adx_growing = ADX > highest(ADX[1],3)

intTrend = ((ADX >= adx_limit) and (ADX[1] >= adx_limit) and adx_growing) ? intTrendDirection : 0

// === ATR ===

ATR = sma(tr,10)

ATR_100 = ATR /abs(high - low)

// === STOCHASTICS ===

stoch_k = sma(stoch(close, high, low, stoch_length), stoch_smoothK)

stoch_d = sma(stoch_k, stoch_smoothD)

// === FILTER & CONDITIONS ===

// > STOCHASTICS <

bolFilter_OS1 = close[1] > hl2[1]

bolSigOsc_long_1 = (na(stoch_k) or na(stoch_d)) ? false : (crossover(stoch_d,stoch_OverSold) and stoch_k > stoch_d) ? true:false

bolSigOsc_short_1 = (na(stoch_k) or na(stoch_d)) ? false : (crossunder(stoch_d,stoch_OverBought) and stoch_k < stoch_d) ? true:false

bolLongOpenOS = bolSigOsc_long_1 and bolFilter_OS1

bolLongCloseOS = bolSigOsc_short_1

bolShortOpenOS = bolSigOsc_short_1 and bolFilter_OS1

bolShortCloseOS = bolSigOsc_long_1

// > TREND <

bolFilter_TS1 = close[1] > hl2[1] and open[1] < hl2[1]

bolFilter_TS2 = sma(close,50)>sma(close,50)[10]

bolFilter_TS3 = close[1] < hl2[1] and open[1] > hl2[1]

bolSigTrendLO1 = sma(close, fastMA) > sma(close, slowMA)

bolSigTrendLO2 = close > sma(close,fastMA)

bolSigTrendLO3 = bolSigTrendLO1 and bolSigTrendLO2

bolSigTrendLC1 = sma(close, fastMA) < sma(close, slowMA)

bolSigTrendLC2 = close < sma(close, fastMA)

bolSigTrendLC3 = bolSigTrendLC1 and bolSigTrendLC2

bolSigTrendSO1 = bolSigTrendLC3

bolSigTrendSC1 = bolSigTrendLO1

bolLongOpenTS = bolSigTrendLO3 and bolFilter_TS1

bolLongCloseTS = bolSigTrendLC3 and bolFilter_TS3

bolShortOpenTS = bolSigTrendSO1 and bolFilter_TS3

bolShortCloseTS = bolLongOpenTS and bolFilter_TS1

plot(sma(close, fastMA), title='FastMA', color=color.green, linewidth=2, style=plot.style_line) // plot FastMA

plot(sma(close, slowMA), title='SlowMA', color=color.red, linewidth=2, style=plot.style_line) // plot SlowMA

// > BREAKOUT <

flFilter_BS1 = 0.5 * stdev(close,slowMA)[1]

bolFilter_BS2 = volume > sma(volume,slowMA)*1.25

bolSigBreakoutLO1 = close > (highestbars(high,slowMA)[1] + flFilter_BS1)

bolSigBreakoutLC1 = barssince(bolSigBreakoutLO1)==5

bolSigBreakoutSO1 = close < lowestbars(low,slowMA)[1] - flFilter_BS1

bolSigBreakoutSC1 = barssince(bolSigBreakoutSO1)==5

bolLongOpenBO = bolSigBreakoutLO1 and bolFilter_BS2

bolLongCloseBO = bolSigBreakoutLC1

bolShortOpenBO = bolSigBreakoutSO1 and bolFilter_BS2

bolShortCloseBO = bolSigBreakoutSC1

//=== STRATEGIES ENTRIES & EXITS ===

// > STOPS & LIMITS <

stop_level_Long = strategy.position_avg_price * (1 - flStopLoss)

take_level_Long = strategy.position_avg_price * (1 + flTakeProfit)

stop_level_Short = strategy.position_avg_price * (1 + flStopLoss)

take_level_Short = strategy.position_avg_price * (1 - flTakeProfit)

// > ENTRIES / CLOSES / EXITS <

if window() //only in backtest-window

if (bolOS == true)

if (intTrend == 0)

if(strStrategy == "Long" or strStrategy == "Long & Short")

strategy.entry("Lng Osc", strategy.long, when=bolLongOpenOS) // buy long when "within window of time" AND crossover

if(strStrategy == "Short" or strStrategy == "Long & Short")

strategy.entry("Short Osc", strategy.short, when=bolShortOpenOS)

strategy.close("Lng Osc", when=(bolLongCloseOS))

//strategy.exit("Exit L OS/STD", "Lng Osc", stop = strategy.position_avg_price - 2*stdev(close,10))

strategy.exit("Exit L OS/%", "Lng Osc", stop=stop_level_Long)

strategy.close("Short Osc", when=(bolShortCloseOS))

//strategy.exit("Exit S OS/STD", "Short Osc", stop = strategy.position_avg_price + 2*stdev(strategy.position_avg_price,10))

strategy.exit("Exit S OS/%", "Short Osc", stop=stop_level_Short)

if (bolTS == true)

if (not(intTrend == 0))

if((strStrategy == "Long") or (strStrategy == "Long & Short"))

strategy.entry("Lng TD", strategy.long, when=bolLongOpenTS) // buy long when "within window of time" AND crossover

if((strStrategy == "Short") or (strStrategy == "Long & Short"))

strategy.entry("Short TD", strategy.short, when=(bolShortOpenTS and bolTS)) // buy long when "within window of time" AND crossover

strategy.exit("Exit L TD", "Lng TD", stop=stop_level_Long)

strategy.close("Lng TD", when=bolLongCloseTS)

strategy.exit("Exit S TD", "Short TD", stop=stop_level_Short)

strategy.close("Short TD", when=bolShortCloseTS)

if (bolBO == true)

if((strStrategy == "Long") or (strStrategy == "Long & Short"))

strategy.entry("Lng BO", strategy.long, when=bolLongOpenBO) // buy long when "within window of time" AND crossover

strategy.close("Lng BO", when=bolLongCloseBO)

//strategy.exit("Exit L BO/STD", "Lng BO", stop = strategy.position_avg_price - 2*stdev(strategy.position_avg_price,10))

strategy.exit("Exit L BO/2.5%", "Lng BO", stop=stop_level_Long)

if((strStrategy == "Short") or (strStrategy == "Long & Short"))

strategy.entry("Short BO", strategy.short, when=bolShortOpenBO) // buy long when "within window of time" AND crossover

strategy.close("Short BO", when=bolShortCloseBO)

//strategy.exit("Exit S BO/STD", "Short BO", stop = strategy.position_avg_price - 2*stdev(strategy.position_avg_price,10))

strategy.exit("Exit S BO/%", "Short BO", stop=stop_level_Short)