概述

本策略基于布林带的双重均线进行趋势跟随的交易决策。其利用布林带上下轨的收敛和发散来判断趋势的变化,在布林带下轨附近买入,在上轨附近卖出,实现低买高卖,获利离场。

策略原理

该策略同时应用布林带的简单布林带和增强布林带两个版本。

简单布林带使用收盘价的SMA计算中轨,增强布林带使用收盘价的EMA计算中轨。

上下轨均通过中轨±N倍标准差计算得到。

策略根据布林带上下轨之间的距离(spread)来判断趋势,当spread小于设定阈值时,表示正在进入趋势区间,可以进行趋势跟随交易。

具体来说,当价格接近下轨时买入做多,接近上轨时卖出平仓。止损方式为固定止损百分比,同时可选择启用追踪止损。

目标利润取决于选择在中轨或上轨附近平仓。

该策略还可选择只在确保盈利的情况下卖出,防止亏损。

优势分析

该策略具有以下优势:

- 双重布林带结合,提高决策效率

应用简单布林带和增强布林带,可以比较两种布林带的效果,选择更优版本,提高决策效率。

- 根据布林带通道宽度判断趋势程度

当布林带通道收窄时,表示进入趋势行情,这时跟随趋势交易胜率更高。

- 灵活的止盈止损方式

采用固定百分比止损以控制单笔损失。同时可选择中轨或上轨附近止盈,以及启用追踪止损来锁定更多利润。

- 防止亏损的保护机制

只在确保盈利的情况下卖出,可以防止亏损的扩大。

风险分析

该策略也存在以下风险:

- 回撤风险

跟随趋势交易本身存在一定回撤风险,需要承受连续亏损的心理压力。

- 震荡行情风险

当布林带通道较宽时,表示行情可能进入震荡,此时该策略交易效果不佳,需要暂停交易等待趋势重新形成。

- 止损被触发风险

固定百分比止损可能过于激进,需要调整为更温和的止损方式如ATR止损。

优化方向

该策略可以从以下方面进行优化:

- 优化布林带参数

可以测试不同的均线参数、标准差倍数,找到更适合不同市场的布林带参数组合。

- 结合其他指标过滤

可在布林带信号基础上,加入如MACD、KD等指标的过滤,减少震荡市的交易。

- 优化止盈止损策略

可以测试不同的游动止损方式,或基于振幅、ATR等指标优化止损点。

- 优化资金管理

优化每笔交易的仓位管理,并测试不同补仓策略。

总结

本策略整合双重布林带指标的优势,根据布林带通道宽度判断趋势程度,在趋势期间进行低吸高抛的跟踪交易。同时设置科学的止损机制来控制风险。该策略可通过参数优化和结合其他指标过滤来进一步提高稳定性。

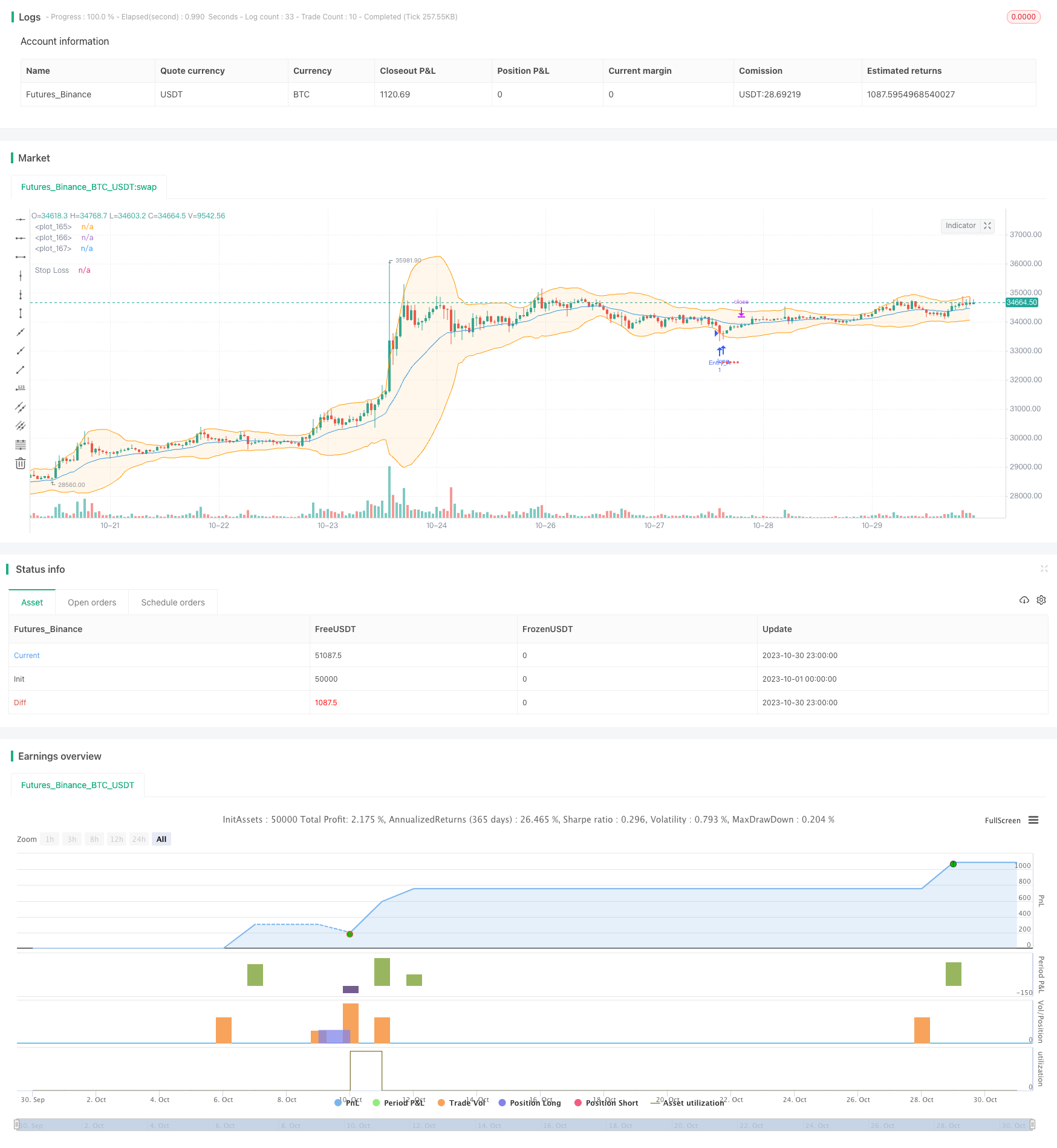

/*backtest

start: 2023-10-01 00:00:00

end: 2023-10-31 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © JCGMarkets

//@version=4

strategy("B.Bands | Augmented | Intra-range | Long-Only", shorttitle = "BB|A|IR|L", initial_capital=5000, commission_value=0.075, slippage = 1, overlay = true)

//Technical Indicators Data

show_simp = input(false, title="Trade on Simple Bollinger Bands ", type= input.bool, group="Select Strategy System")

show_augm = input(true, title="Trade on Augmented Bollinger Bands", type= input.bool, group="Select Strategy System")

periods = input(20, title="Periods for Moving Average", type =input.integer, minval = 2, step = 1, group="Technical Inputs")

std = input(2, title="Std", type = input.float, minval=0.1 , step = 0.1, group="Technical Inputs")

// Strategy data

max_spread_bb = input(20000.0, title="Max Spread Tolerance Beetween Bands", type=input.float, step=0.1, group="Strategy Inputs")

entry_source = input(close, title="Entry data source", type=input.source, group="Strategy Inputs")

exit_source = input(high, title="Exit data source", type=input.source, group="Strategy Inputs")

take_profit = input("middle", title = "Profit to band:", options = ["middle", "opposite"], group="Strategy Inputs")

stop_loss = input(3.00, title="Stop Loss %", type=input.float, step=0.05, group="Strategy Inputs")

trailing = input(false, title="Activate trailing stop?", type = input.bool, group="Strategy Inputs")

stop_perc = input(6.00, title="Trailing %", type=input.float, step=0.125, group="Strategy Inputs") * 0.01

sell_profit = input(false, title="Only sell in profit (Stop Loss still active) ", type= input.bool, group="Strategy Inputs")

var SL = 0.0

var SLT= 0.0

//Simple BB Calculation -> adapt if needed with different std for upper-lower, sma-ema, etc

middle_sim = sma(close, periods)

//Augmented BB Calculation -> adapt if needed with different std for upper lower, etc

middle_augm = ema(close, periods)

middle_upp = ema(high, periods)

middle_low = ema(low, periods)

//Multiplier

dev = stdev(close, periods) * std

//Upper & Lower Bands

upper = (middle_sim + dev)

lower = (middle_sim - dev)

//Augmented Bands

upper_augm = (middle_upp + dev)

lower_augm = (middle_low - dev)

//Bands Spread

spread = upper - lower

spread_augm = upper_augm - lower_augm

//From date

filter_from = input( true, title="===> From", group="Date Control")

from_y = input( 2010, title = "from year", group="Date Control")

from_m = input( 1, title = "from month", minval =1, maxval=12, group="Date Control")

from_d = input( 1, title = "from day", minval=1, maxval=31, group="Date Control")

//To date

filter_to = input( true, title="===> To", group="Date Control")

to_y = input( 2030, title = "To year", group="Date Control")

to_m = input( 1, title = "To month", minval =1, maxval=12, group="Date Control")

to_d = input( 1, title = "To day", minval=1, maxval=31, group="Date Control")

// Date Condition

In_date() => true

in_position = strategy.position_size > 0

// Trailing stop

SLT := if in_position and In_date()

stop_inicial = entry_source * (1 - stop_perc)

max(stop_inicial, SLT[1])

else

0

slts = (low <= SLT) and (trailing == true)

//Essential Trade logics

entry_long = (entry_source <= lower) and (spread < max_spread_bb)

entry_long_augm = (entry_source <= lower_augm) and (spread_augm < max_spread_bb)

// Simple Bollinger Conditions

if (not in_position and show_simp and In_date())

if entry_long

// Trigger buy order

position_size = round( strategy.equity / close ) // All available equity for this strategy example

strategy.entry("Entry", strategy.long, qty = position_size )

SL := close * (1 - (stop_loss / 100)) // You could determine wether or not implement stop loss with bool input and if condition here.

if in_position and show_simp and not sell_profit and In_date()

//Exits if not sell in profit

if take_profit == "middle"

strategy.exit("Target", "Entry", limit = middle_sim, stop = SL, comment="Exit")

if take_profit == "opposite"

strategy.exit("Target", "Entry", limit = upper, stop = SL, comment="Exit")

if in_position and show_simp and sell_profit and In_date()

//Exits if sell in profit

if take_profit == "middle"

strategy.exit("Target", "Entry", limit = (strategy.openprofit > 0 ? middle_sim: na), stop = SL, comment="Exit")

if take_profit == "opposite"

strategy.exit("Target", "Entry", limit = (strategy.openprofit > 0 ? upper: na), stop = SL, comment="Exit")

if in_position and show_simp and slts and In_date()

//Trailing activation

strategy.close("Entry", comment="SLT")

if not In_date()

//Exit due out of date range

strategy.close("Entry", comment="Out of date range")

// Augmented Bollinger Conditions

if (not in_position and show_augm and In_date())

if entry_long_augm

// Trigger buy order

position_size = round( strategy.equity / close )

strategy.entry("Entry_A", strategy.long, qty = position_size )

SL := close * (1 - (stop_loss / 100) )

if in_position and show_augm and not sell_profit and In_date()

//Exits and not sell in profit

if take_profit == "middle"

strategy.exit("Target", "Entry_A", limit = middle_augm, stop = SL, comment="Exit")

if take_profit == "opposite"

strategy.exit("Target", "Entry_A", limit = upper_augm, stop = SL, comment="Exit")

if in_position and show_augm and sell_profit and In_date()

//Exit only in profit

if take_profit == "middle"

strategy.exit("Target", "Entry_A", limit = (strategy.openprofit > 0 ? middle_augm:na), stop = SL, comment="Exit")

if take_profit == "opposite"

strategy.exit("Target", "Entry_A", limit = (strategy.openprofit > 0 ? upper_augm: na) , stop = SL, comment="Exit")

if in_position and show_augm and slts and In_date()

//Trigger trailing

strategy.close("Entry_A", comment="SLT")

if not In_date()

//Out of date trigger

strategy.close("Entry_A", comment= "Out of date range")

// Plotting

plot(in_position ? SL > 0 ? SL : na : na , style = plot.style_circles, color = color.red, title = "Stop Loss")

plot(in_position ? trailing ? SLT > 0 ? SLT : na : na : na , style = plot.style_circles, color = color.blue, title = "Trailing Stop" )

s = plot(show_simp ? upper : na , color = color.aqua)

plot(show_simp ? middle_sim : na , color=color.red)

i = plot(show_simp ? lower : na , color = color.aqua)

fill(s,i, color=color.new(color.aqua,90))

plot(show_augm ? middle_augm : na , color=color.blue)

s_a = plot( show_augm ? upper_augm : na, color=color.orange)

i_a = plot( show_augm ? lower_augm : na, color= color.orange)

fill(s_a,i_a, color=color.new(color.orange, 90))