概述

本策略基于CCI指标设计了一个灵活的跟踪趋势的自动交易系统。它可以根据CCI指标的0轴上穿或下穿发出交易信号,也可以通过自定义上下通道带及通道带交叉发出信号。策略可以设置固定止损、止盈比例,同时拥有时间段交易和每日固定时间段交易等多种功能。

策略原理

利用CCI指标的0轴交叉来判断市场趋势,CCI上穿0轴为看涨信号,CCI下穿0轴为看跌信号。

通过自定义CCI上下通道带,当CCI上穿上通道带为看涨信号,CCI下穿下通道带为看跌信号。通道带交叉为止损信号。

可设置只在特定时间段交易,未交易时段平仓。可设置每日固定时间段交易。

可设置固定止损、止盈比例。

可自定义交易开平仓的Alert消息。

策略完全自定义灵活,可调整CCI参数、通道带参数、止损止盈参数等优化策略。

优势分析

使用CCI指标判断市场趋势,CCI对价格变化敏感,能快速捕捉市场转折点。

自定义通道带可根据不同市场调整参数,通道带交叉止损可有效控制风险。

支持多种交易时间设置,可根据不同时间段调整策略参数,利用不同时间段的特征获得超额收益。

支持固定止损止盈设置,可以预设盈亏比,有效控制个别交易的风险。

完全可自定义参数,可以针对不同品种、市场行情进行策略优化,获得更好的效果。

风险分析

CCI指标对价格变化敏感,可能产生部分假信号,应结合较长周期指标进行验证。

固定止损止盈比例无法根据市场变化进行调整,应适当保守设置比例。

固定交易时间可能错过市场短线调整的机会,应适当选择有交易价值的时间段。

需要频繁优化参数,如果优化不当可能导致过度交易或漏掉交易机会。

需要与行业情况、宏观环境等多方面因素结合,单纯依靠参数优化无法完全规避风险。

优化方向

结合长短周期指标进行验证,避免CCI产生假信号。

利用ATR等指标设定动态止损止盈。

测试不同时间段参数效果,选择交易高效时段。

优化CCI参数、通道带参数,适应市场变化。

考虑结合趋势、波动性、成交量等多因素进行综合判断。

根据交易品种特点选择合适交易时间段。

考虑加入机器学习算法,实现策略的自动优化。

总结

本策略整体来说是一个非常灵活和可定制的趋势跟踪交易系统。策略具有利用CCI判断趋势、自定义通道带控制风险、设置固定止盈止损、选择交易时间段等多项优势。同时也需要注意CCI易产生假信号、固定止盈止损比例无法动态调整等问题。未来可从优化参数、筛选交易信号、选择高效时间段等方面进行策略改进,并增加机器学习等算法引入智能化管理,使策略能够自动适应市场变化,从而获得更稳定的超额收益。

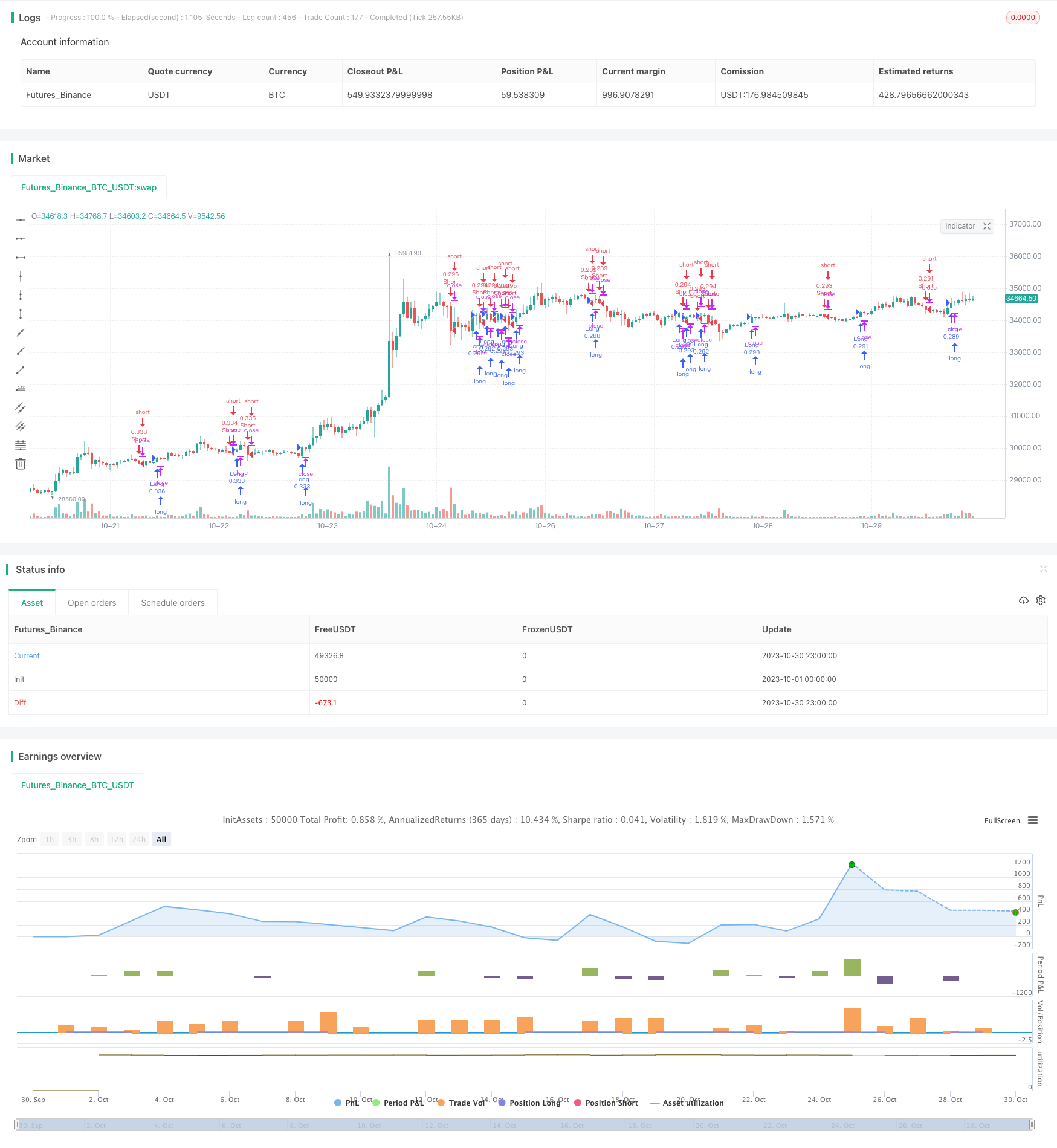

/*backtest

start: 2023-10-01 00:00:00

end: 2023-10-31 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © REV0LUTI0N

//@version=4

strategy(title="CCI Strategy", overlay=true, initial_capital = 10000, default_qty_value = 10000, default_qty_type = strategy.cash)

//CCI Code

length = input(20, minval=1, title="CCI Length")

src = input(close, title="Source")

ma = sma(src, length)

cci = (src - ma) / (0.015 * dev(src, length))

// Strategy Backtesting

startDate = input(timestamp("2099-10-01T00:00:00"), type = input.time, title='Backtesting Start Date')

finishDate = input(timestamp("9999-12-31T00:00:00"), type = input.time, title='Backtesting End Date')

time_cond = true

//Time Restriction Settings

startendtime = input("", title='Time Frame To Enter Trades')

enableclose = input(false, title='Enable Close Trade At End Of Time Frame')

timetobuy = true

timetoclose = true

//Strategy Settings

//Strategy Settings - Enable Check Boxes

enableentry = input(true, title="Enter First Trade ASAP")

enableconfirmation = input(false, title="Wait For Cross To Enter First Trade")

enablezero =input(true, title="Use CCI Simple Cross Line For Entries & Exits")

enablebands = input(false, title="Use Upper & Lower Bands For Entries & Exits")

//Strategy Settings - Band Sources

ccisource = input(0, title="CCI Simple Cross")

upperbandsource =input(100, title="CCI Enter Long Band")

upperbandexitsource =input(100, title="CCI Exit Long Band")

lowerbandsource =input(-100, title="CCI Enter Short Band")

lowerbandexitsource =input(-100, title="CCI Exit Short Band")

//Strategy Settings - Crosses

simplecrossup = crossover(cci, ccisource)

simplecrossdown = crossunder(cci, ccisource)

uppercrossup = crossover(cci, upperbandsource)

lowercrossdown = crossunder(cci, lowerbandsource)

uppercrossdown = crossunder(cci, upperbandexitsource)

lowercrossup = crossover(cci, lowerbandexitsource)

upperstop = crossunder(cci, upperbandsource)

lowerstop = crossover(cci, lowerbandsource)

// Stop Loss & Take Profit % Based

enablesl = input(false, title='Enable Stop Loss')

enabletp = input(false, title='Enable Take Profit')

stopTick = input(5.0, title='Stop Loss %', type=input.float, step=0.1) / 100

takeTick = input(10.0, title='Take Profit %', type=input.float, step=0.1) / 100

longStop = strategy.position_avg_price * (1 - stopTick)

shortStop = strategy.position_avg_price * (1 + stopTick)

shortTake = strategy.position_avg_price * (1 - takeTick)

longTake = strategy.position_avg_price * (1 + takeTick)

plot(strategy.position_size > 0 and enablesl ? longStop : na, style=plot.style_linebr, color=color.red, linewidth=1, title="Long Fixed SL")

plot(strategy.position_size < 0 and enablesl ? shortStop : na, style=plot.style_linebr, color=color.red, linewidth=1, title="Short Fixed SL")

plot(strategy.position_size > 0 and enabletp ? longTake : na, style=plot.style_linebr, color=color.green, linewidth=1, title="Long Take Profit")

plot(strategy.position_size < 0 and enabletp ? shortTake : na, style=plot.style_linebr, color=color.green, linewidth=1, title="Short Take Profit")

// Alert messages

message_enterlong = input("", title="Long Entry message")

message_entershort = input("", title="Short Entry message")

message_closelong = input("", title="Close Long message")

message_closeshort = input("", title="Close Short message")

//Strategy Execution

//Strategy Execution - Simple Line Cross

if (cci > ccisource and enablezero and enableentry and time_cond and timetobuy)

strategy.entry("Long", strategy.long, alert_message = message_enterlong)

if (cci < ccisource and enablezero and enableentry and time_cond and timetobuy)

strategy.entry("Short", strategy.short, alert_message = message_entershort)

if (simplecrossup and enablezero and enableconfirmation and time_cond and timetobuy)

strategy.entry("Long", strategy.long, alert_message = message_enterlong)

if (simplecrossdown and enablezero and enableconfirmation and time_cond and timetobuy)

strategy.entry("Short", strategy.short, alert_message = message_entershort)

//Strategy Execution - Upper and Lower Band Entry

if (uppercrossup and enablebands and time_cond and timetobuy)

strategy.entry("Long", strategy.long, alert_message = message_enterlong)

if (lowercrossdown and enablebands and time_cond and timetobuy)

strategy.entry("Short", strategy.short, alert_message = message_entershort)

//Strategy Execution - Upper and Lower Band Exit

if strategy.position_size > 0 and uppercrossdown and enablebands and time_cond and timetobuy

strategy.close_all(alert_message = message_closelong)

if strategy.position_size < 0 and lowercrossup and enablebands and time_cond and timetobuy

strategy.close_all(alert_message = message_closeshort)

//Strategy Execution - Upper and Lower Band Stops

if strategy.position_size > 0 and upperstop and enablebands and time_cond and timetobuy

strategy.close_all(alert_message = message_closelong)

if strategy.position_size < 0 and lowerstop and enablebands and time_cond and timetobuy

strategy.close_all(alert_message = message_closeshort)

//Strategy Execution - Close Trade At End Of Time Frame

if strategy.position_size > 0 and timetoclose and enableclose and time_cond

strategy.close_all(alert_message = message_closelong)

if strategy.position_size < 0 and timetoclose and enableclose and time_cond

strategy.close_all(alert_message = message_closeshort)

//Strategy Execution - Stop Loss and Take Profit

if strategy.position_size > 0 and enablesl and time_cond

strategy.exit(id="Close Long", stop=longStop, limit=longTake, alert_message = message_closelong)

if strategy.position_size < 0 and enablesl and time_cond

strategy.exit(id="Close Short", stop=shortStop, limit=shortTake, alert_message = message_closeshort)

if strategy.position_size > 0 and enabletp and time_cond

strategy.exit(id="Close Long", stop=longStop, limit=longTake, alert_message = message_closelong)

if strategy.position_size < 0 and enabletp and time_cond

strategy.exit(id="Close Short", stop=shortStop, limit=shortTake, alert_message = message_closeshort)