概述

本策略采用动态的多重指数移动平均线作为入市信号,结合追踪止损和目标获利机制来管理风险和获利。该策略充分利用了EMA的平滑性质来识别趋势,通过多次DCA投入控制成本。此外,整合了动态止损和目标获利设定让整个策略更为智能化和自动化。

策略原理

指标计算

- EMA5、EMA10、EMA20、EMA50、EMA100、EMA200指数移动平均线

- ATR平均真实波动幅度

入市信号

当价格接近或穿过设定的EMA周期时产生入市信号,EMA周期可自定义,典型选用5、10、20、50、100、200周期。本策略采用价格在EMA上下1%范围内作为入市条件。

风险管理

整合多项风险管理机制: 1. ATR止损:当ATR超过设定阈值时清仓止损 2. 最大入市次数控制:避免过度投入 3. 动态追踪止损:根据价格实时波动 trailing stop

获利机制

设定目标获利水平,当价格超过目标价时退出

策略优势分析

- 利用EMA识别趋势,对短期波动过滤作用好

- DCA成本分散,避免高买低卖

- 多重EMA组合,提高入市成功率

- 动态止损REAL-TIME控制亏损

- 目标获利清晰,不浪费太多盈利

风险及改进

- EMA因子选择需要优化,不同市场不同周期组合效果差异大

- DCA次数可能过多造成资金过度占用

- 停损幅度设定需要回测优化

策略优化思路

- 利用高级EMA系统识别趋势

- 多变量优化最佳DCA次数和止损幅度

- 加入机器学习模型预测价格变化

- 整合资金管理模块控制总体投入

总结

本策略整合了EMA识别趋势、DCA成本控制、动态追踪止损、目标获利退出等多项机制。在参数调整和风险控制方面还有很多优化空间。整体而言,该策略具有很强的适应性和扩展性,能够为投资者带来稳定的超额收益。

策略源码

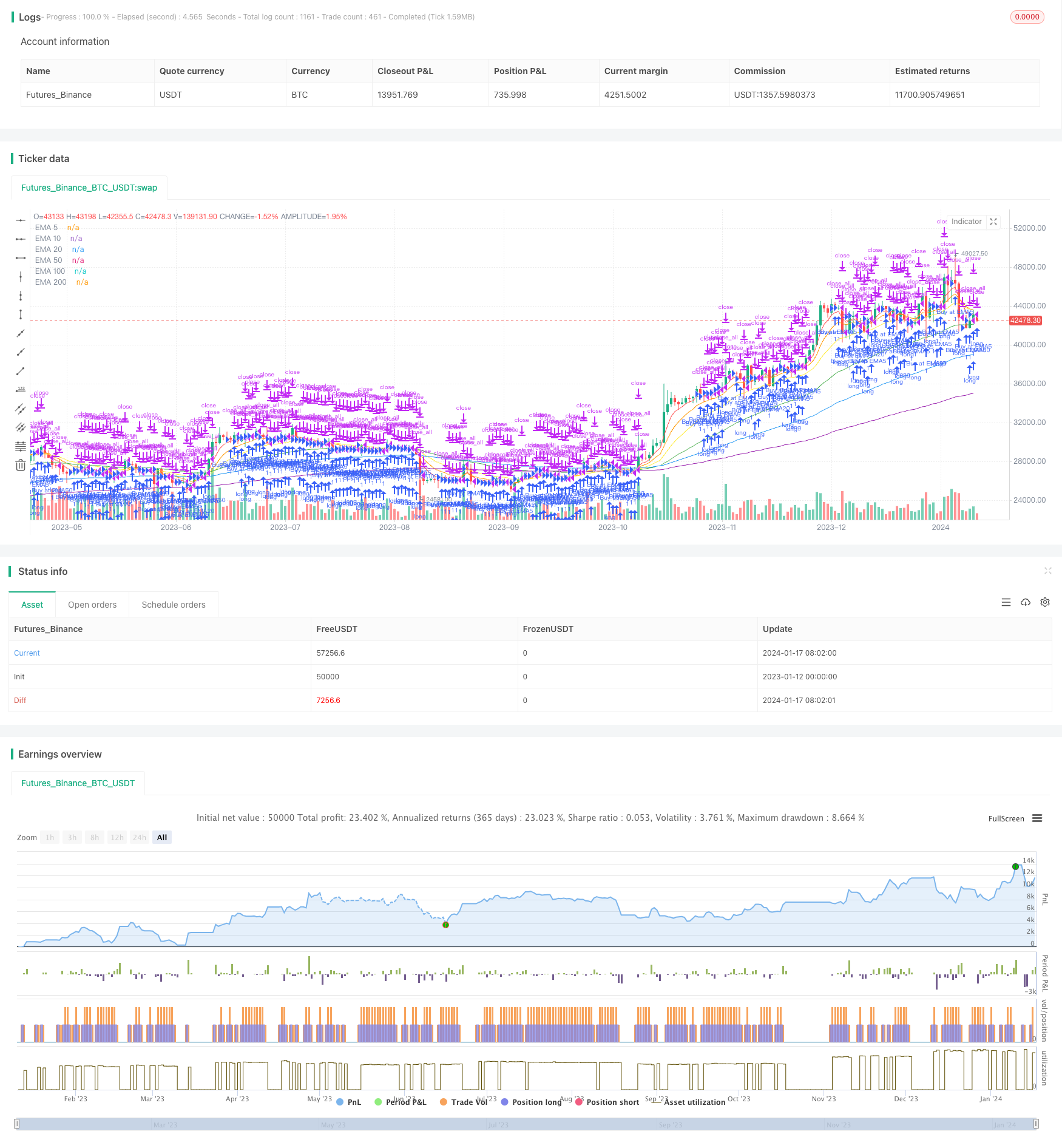

/*backtest

start: 2023-01-12 00:00:00

end: 2024-01-18 00:00:00

period: 1d

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=4

strategy("EMA DCA Strategy with Trailing Stop and Profit Target", overlay=true )

// Define the investment amount for when the condition is met

investment_per_condition = 6

// Define the EMAs

ema5 = ema(close, 5)

ema10 = ema(close, 10)

ema20 = ema(close, 20)

ema50 = ema(close, 50)

ema100 = ema(close, 100)

ema200 = ema(close, 200)

// Define ATR sell threshold

atr_sell_threshold = input(title="ATR Sell Threshold", type=input.integer, defval=10, minval=1)

// Helper function to find if the price is within 1% of the EMA

isWithin1Percent(price, ema) =>

ema_min = ema * 0.99

ema_max = ema * 1.01

price >= ema_min and price <= ema_max

// Control the number of buys

var int buy_count = 0

buy_limit = input(title="Buy Limit", type=input.integer, defval=3000)

// Calculate trailing stop and profit target levels

trail_percent = input(title="Trailing Stop Percentage", type=input.integer, defval=1, minval=0, maxval=10)

profit_target_percent = input(title="Profit Target Percentage", type=input.integer, defval=3, minval=1, maxval=10)

// Determine if the conditions are met and execute the strategy

checkConditionAndBuy(emaValue, emaName) =>

var int local_buy_count = 0 // Create a local mutable variable

if isWithin1Percent(close, emaValue) and local_buy_count < buy_limit

strategy.entry("Buy at " + emaName, strategy.long, qty=investment_per_condition / close, alert_message ="Buy condition met for " + emaName)

local_buy_count := local_buy_count + 1

// alert("Buy Condition", "Buy condition met for ", freq_once_per_bar_close)

local_buy_count // Return the updated local_buy_count

// Add ATR sell condition

atr_condition = atr(20) > atr_sell_threshold

if atr_condition

strategy.close_all()

buy_count := 0 // Reset the global buy_count when selling

// Strategy execution

buy_count := checkConditionAndBuy(ema5, "EMA5")

buy_count := checkConditionAndBuy(ema10, "EMA10")

buy_count := checkConditionAndBuy(ema20, "EMA20")

buy_count := checkConditionAndBuy(ema50, "EMA50")

buy_count := checkConditionAndBuy(ema100, "EMA100")

buy_count := checkConditionAndBuy(ema200, "EMA200")

// Calculate trailing stop level

trail_offset = close * trail_percent / 100

trail_level = close - trail_offset

// Set profit target level

profit_target_level = close * (1 + profit_target_percent / 100)

// Exit strategy: Trailing Stop and Profit Target

strategy.exit("TrailingStop", from_entry="Buy at EMA", trail_offset=trail_offset, trail_price=trail_level)

strategy.exit("ProfitTarget", from_entry="Buy at EMA", when=close >= profit_target_level)

// Plot EMAs

plot(ema5, title="EMA 5", color=color.red)

plot(ema10, title="EMA 10", color=color.orange)

plot(ema20, title="EMA 20", color=color.yellow)

plot(ema50, title="EMA 50", color=color.green)

plot(ema100, title="EMA 100", color=color.blue)

plot(ema200, title="EMA 200", color=color.purple)