概述

该策略是一种多时间周期的动态移动均线组合策略。它使用不同长度的指数移动平均线(EMA)进行趋势判断和入场退出。策略名称中的“MAX”表示使用了多个EMA,“动态”表示EMA长度是可以调整的。

策略原理

该策略使用7条不同速度的EMA,从最快到最慢分别是:3周期、15周期、19周期、50周期、100周期、150周期和200周期的EMA。这7条EMA形成一个梯形排列,判断长仓和短仓信号时,close价格要依次突破这7条EMA,这样可以确保趋势转折后的强势进入。

此外,策略还结合了价格创新高和收盘价突破历史高点这两个条件来确认长仓信号,使用创新低和收盘价突破历史低点来确认短仓信号,这样可以避免假突破。

平仓条件则要求close价格依次从快速EMA向慢速EMA突破,表示趋势反转;或者最新K线的最低价或最高价突破4条EMA,表明该交易应立即平仓。

优势分析

- 使用7条不同速度EMA形成梯形,可以更精准判断趋势转折点

- 结合创新高和历史高点判断长仓,创新低和历史低点判断短仓,避免假突破

- 双重平仓条件设定比较严格,可以及时止损

风险分析

- 没有设置止损,存在巨大亏损风险

- 双重平仓条件可能造成过早离场现象

- 短周期EMA容易形成更多噪音,增加交易频率和手续费成本

解决方法:

- 设置立竿止损和移动止损

- 调整平仓EMA的长度,降低双重平仓条件的严格性

- 增加EMA长度,减少交易频率

优化方向

- 增加止损策略,如固定百分比止损、移动止损等

- 调整EMA参数,寻找最佳参数组合

- 增加其他指标过滤,如MACD、ATR、KDJ等,提高信号质量

- 结合波段策略,在趋势中捕捉次级别波动

- 考虑加入资金管理模块

总结

该策略整体思路清晰,使用7条不同速度EMA判断趋势,并设有双重平仓条件,可以对趋势反转做出较敏感的判断。但策略本身没有设置止损,存在极大的亏损风险,此外容易造成过早离场的问题。未来需要从止损、参数优化、指标过滤等多个维度进行策略的改进,使之成为一个稳定可靠的量化交易系统。

策略源码

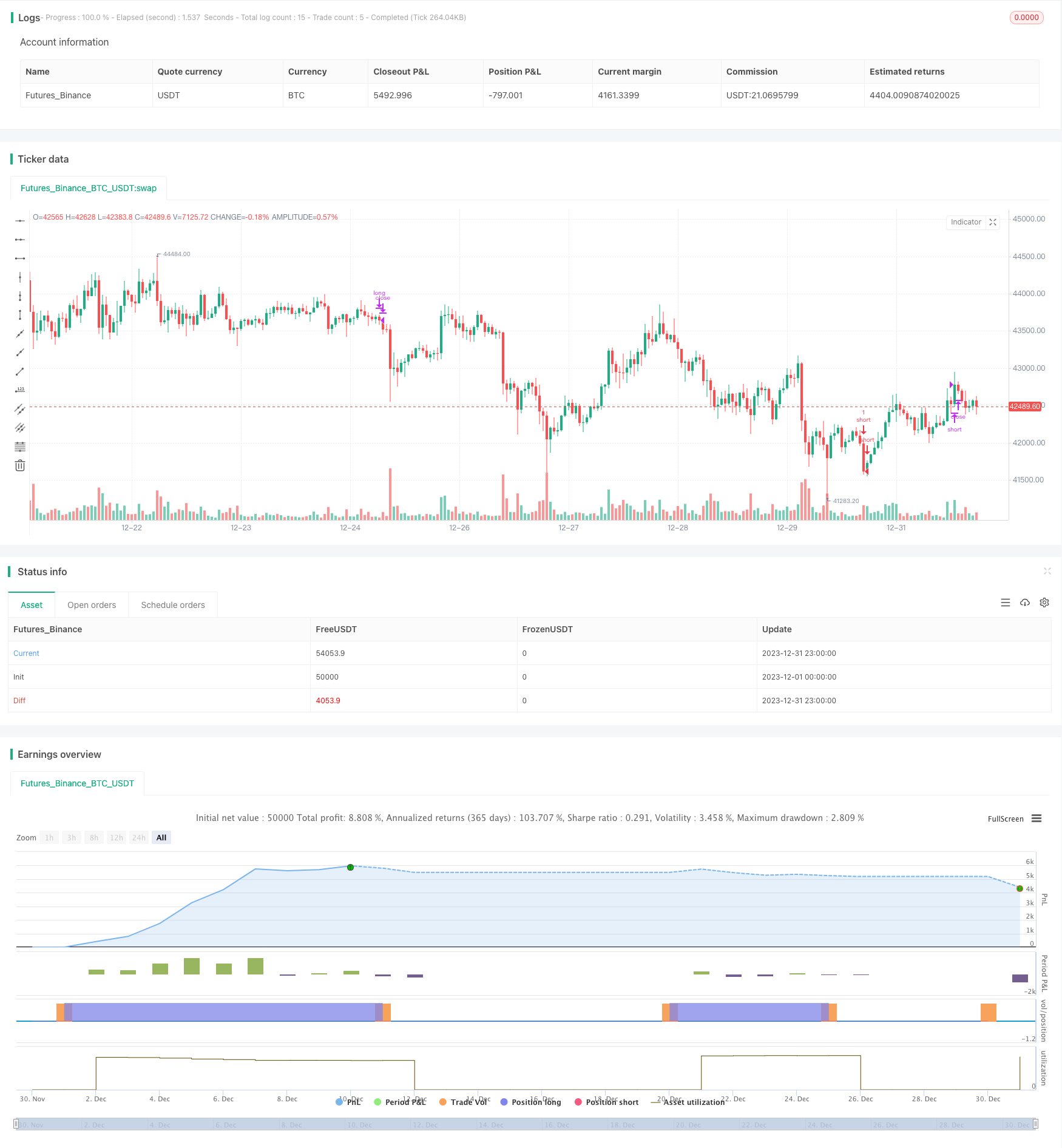

/*backtest

start: 2023-12-01 00:00:00

end: 2023-12-31 23:59:59

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=4

strategy(title="Crypto MAX Trend", shorttitle="Crypto MAX", overlay = true )

Length = input(3, minval=1)

Length2 = input(15, minval=1)

Length3 = input(19, minval=1)

//Length33 = input(25, minval=1)

Length4 = input(50, minval=1)

Length44 = input(100, minval=1)

Length5 = input(150, minval=1)

Length6 = input(171, minval=1)

Length66 = input(172, minval=1)

xPrice = input(close)

xEMA1 = ema(xPrice, Length)

xEMA2 = ema(xPrice, Length2)

xEMA3 = ema(xPrice, Length3)

//xEMA33 = ema(xPrice, Length33)

xEMA4 = ema(xPrice, Length4)

xEMA44 = ema(xPrice, Length44)

xEMA5 = ema(xPrice, Length5)

xEMA6 = ema(xPrice, Length6)

xEMA66 = ema(xPrice, Length66)

// plot(xEMA1, color=color.white)

// plot(xEMA2, color=color.red)

// plot(xEMA3, color=color.green)

// plot(xEMA4, color=color.purple)

// plot(xEMA44, color=color.gray)

// plot(xEMA5, color=color.maroon)

// plot(xEMA6, color=color.blue)

// plot(xEMA66, color=color.orange)

fromDay = input(defval = 1, title = "From Day", minval = 1, maxval = 31)

fromMonth = input(defval = 1, title = "From Month", minval = 1, maxval = 12)

fromYear = input(defval = 2000, title = "From Year", minval = 1970)

//monday and session

// To Date Inputs

toDay = input(defval = 31, title = "To Day", minval = 1, maxval = 31)

toMonth = input(defval = 12, title = "To Month", minval = 1, maxval = 12)

toYear = input(defval = 2020, title = "To Year", minval = 1970)

startDate = timestamp(fromYear, fromMonth, fromDay, 00, 00)

finishDate = timestamp(toYear, toMonth, toDay, 00, 00)

time_cond = true

long = close > xEMA1 and xEMA1 > xEMA2 and xEMA2 > xEMA3 and xEMA3 > xEMA4 and xEMA4 > xEMA44 and xEMA44 > xEMA5 and xEMA5> xEMA6 and xEMA6> xEMA66 and close > high[1] and high[1] > high[2] and close > high[3] and close > high[4] and close > high[5] and high[5] > high[6] and time_cond

short = close < xEMA1 and xEMA1 < xEMA2 and xEMA2 < xEMA3 and xEMA3 < xEMA4 and xEMA4 < xEMA44 and xEMA44 < xEMA5 and xEMA5< xEMA6 and xEMA6< xEMA66 and close < low[1] and low[1] < low[2] and close < low[3] and close < low[4] and close< low[5] and low[5] < low[6] and time_cond

notlong = close < xEMA1

strategy.entry("long",1,when=long)

strategy.entry("short",0,when=short)

exitlong1 = xEMA1 < xEMA2 and xEMA2 < xEMA3 and xEMA3 < xEMA4

exitlong2 = crossunder(low,xEMA1) and crossunder(low,xEMA2) and crossunder(low,xEMA3) and crossunder(low,xEMA4)

exitshort1 = xEMA1 > xEMA2 and xEMA2 > xEMA3 and xEMA3 > xEMA4

exitshort2 = crossover(high,xEMA1) and crossover(high,xEMA2) and crossover(high,xEMA3) and crossover(high,xEMA4)

strategy.close("long", when = exitlong1 or exitlong2)

strategy.close("short", when= exitshort1 or exitshort2)