概述

本策略利用CCI指标的枢纽点来计算动态的支撑位和阻力位,结合趋势判断来寻找买入和卖出信号。该策略融合了CCI的反转特征以及趋势跟踪能力,旨在抓住中期趋势中的反转点来实现盈利。

策略原理

CCI指标能够显示市场是否过于疲弱或过于强势,80和-80这两个极限值可以用来判断市场是否进入超买超卖状态。本策略利用CCI的这个特性,通过计算左右两边各50根K线的枢纽点,得到上枢纽点和下枢纽点,然后在枢纽点的基础上加减缓冲区构建动态的阻力线和支撑线。

当收盘价高于开盘价且低于上支撑线时生成买入信号;当收盘价低于开盘价且高于下阻力线时生成卖出信号。为了过滤掉非主流趋势方向的交易信号,策略还结合EMA和斜率指标来判断目前的主流趋势方向。只有当趋势判断为多头时,才会进行买入操作;只有当趋势判断为空头时,才会进行卖出操作。

止损和止盈基于ATR指标动态计算,使得本策略的风险控制也比较合理。

优势分析

- 利用CCI指标的反转特征,选取反转点附近进行买卖,增加获利概率。

- 结合趋势判断,避免逆势操作,减少损失。

- 动态止损止盈设定让风险控制更合理。

- 可自定义参数如CCI周期、缓冲区大小等,适应更多市场环境。

风险分析

- CCI指标容易产生虚假信号,需结合趋势过滤。

- 反转不一定成功,存在一定概率亏损的风险。

- 参数设置不当可能导致过于频繁交易或错过交易机会。

可以通过优化参数,调整止损幅度等方法来减少风险。此外,本策略也可作为其它指标的辅助工具,而不必完全依赖其交易信号。

优化方向

- 优化缓冲区大小,适应不同波动率市场。

- 优化ATR周期参数,以取得更准确的动态止损止盈。

- 尝试不同的CCI参数设置。

- 测试其它类型的趋势判断指标的效果。

总结

本策略整合了CCI指标的多空筛选能力与趋势判断的过滤确认,具有一定的实战价值。动态止损止盈也使得策略在实际应用中风险可控。通过参数优化和改进,可望获得更好的效果。

策略源码

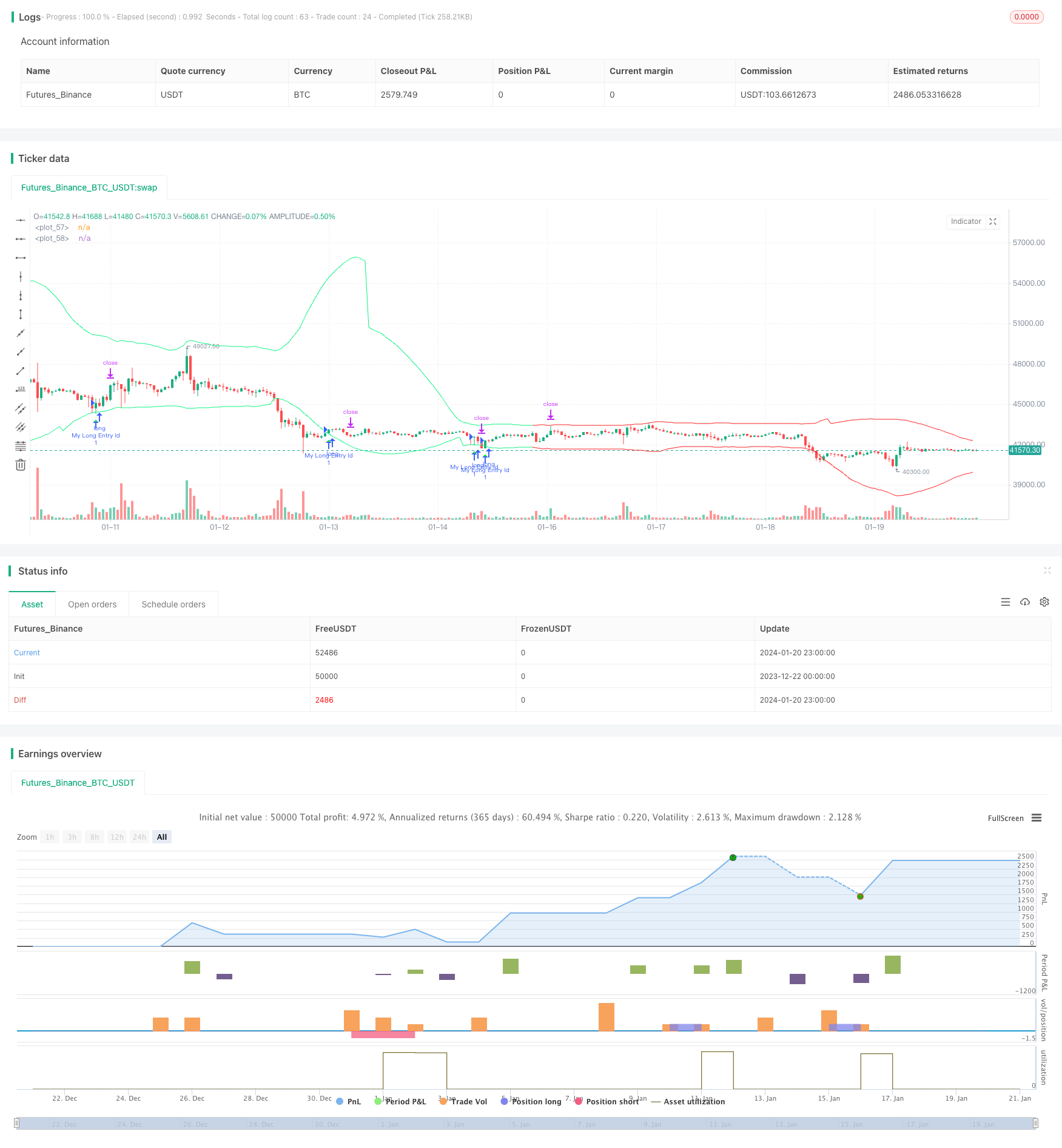

/*backtest

start: 2023-12-22 00:00:00

end: 2024-01-21 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This Pine Script™ code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © AliSignals

//@version=5

strategy("CCI based support and resistance strategy", overlay=true )

cci_length = input.int(50, "cci length")

right_pivot = input.int(50, "right pivot")

left_pivot = input.int(50, "left pivot")

buffer = input.float(10.0, "buffer")

trend_matter = input.bool(true, "trend matter?")

showmid = input.bool ( false , "show mid?")

trend_type = input.string("cross","trend type" ,options = ["cross","slope"])

slowma_l = input.int(100, "slow ma length")

fastma_l = input.int(50, "fast ma length")

slope_l = input.int(5, "slope's length for trend detection")

ksl = input.float(1.1)

ktp = input.float(2.2)

restf = input.timeframe(title="Time Frame of Last Period for Calculating max" , defval="D")

// Calculating Upper and Lower CCI

cci = ta.cci(hlc3,cci_length)

uppercci = 0.0

lowercci = 0.0

uppercci := fixnan(ta.pivothigh(cci, left_pivot, right_pivot)) - buffer

lowercci := fixnan(ta.pivotlow (cci, left_pivot, right_pivot)) + buffer

midccci = math.avg(uppercci,lowercci)

// Support and Resistance based on CCI

res = uppercci*(0.015*ta.dev(hlc3,cci_length))+ ta.sma(hlc3,cci_length)

sup = lowercci*(0.015*ta.dev(hlc3,cci_length))+ ta.sma(hlc3,cci_length)

mid = midccci*(0.015*ta.dev(hlc3,cci_length))+ ta.sma(hlc3,cci_length)

// Calculating trend

t_cross = 0

t_cross := ta.ema(close,fastma_l) > ta.ema(close,slowma_l) ? 1 : ta.ema(close,fastma_l) < ta.ema(close,slowma_l) ? -1 : t_cross[1]

t_slope = 0

t_slope := ta.ema(close,slowma_l) > ta.ema(close,slowma_l)[slope_l] ? 1 : ta.ema(close,slowma_l) < ta.ema(close,slowma_l)[slope_l] ? -1 : t_slope[1]

t = 0

t := trend_type == "cross" ? t_cross : trend_type == "slope" ? t_slope : na

colort = trend_matter == false ? color.rgb(201, 251, 0) : t == 1 ? color.rgb(14, 243, 132) : t == -1 ? color.rgb(255, 34, 34) : na

bull_t = trend_matter == false or t == 1

bear_t = trend_matter == false or t == -1

plot(res, color = colort)

plot(sup, color = colort)

plot(showmid == true ? mid : na)

// Long and Short enter condition

buy = bull_t == 1 and ta.lowest (2) < sup and close > open and close > sup

sell = bear_t == 1 and ta.highest(2) > res and close < open and close < res

plotshape( buy , color=color.rgb(6, 255, 23) , location = location.belowbar, style = shape.triangleup , size = size.normal)

plotshape( sell, color=color.rgb(234, 4, 4) , location = location.abovebar, style = shape.triangledown, size = size.normal)

atr = ta.atr(100)

CLOSE=request.security(syminfo.tickerid, restf, close)

max = 0.0

max := CLOSE == CLOSE[1] ? math.max(max[1], atr) : atr

act_atr = 0.0

act_atr := CLOSE == CLOSE[1] ? act_atr[1] : max[1]

atr1 = math.max(act_atr, atr)

dis_sl = atr1 * ksl

dis_tp = atr1 * ktp

var float longsl = open[1] - dis_sl

var float shortsl = open[1] + dis_sl

var float longtp = open[1] + dis_tp

var float shorttp = open[1] - dis_tp

longCondition = buy

if (longCondition)

strategy.entry("My Long Entry Id", strategy.long)

shortCondition = sell

if (shortCondition)

strategy.entry("My Short Entry Id", strategy.short)

longsl := strategy.position_size > 0 ? longsl[1] : close - dis_sl

shortsl := strategy.position_size < 0 ? shortsl[1] : close + dis_sl

longtp := strategy.position_size > 0 ? longtp[1] : close + dis_tp

shorttp := strategy.position_size < 0 ? shorttp[1] : close - dis_tp

if strategy.position_size > 0

strategy.exit(id="My Long close Id", from_entry ="My Long Entry Id" , stop=longsl, limit=longtp)

if strategy.position_size < 0

strategy.exit(id="My Short close Id", from_entry ="My Short Entry Id" , stop=shortsl, limit=shorttp)