概述

该策略综合运用平均真实波动范围(ATR)、相对强弱指数(RSI)以及移动止损来实现自适应的趋势跟踪。通过ATR来计算动态止损位,利用RSI判断市场趋势方向,移动止损跟踪价格波动实现利润最大化。这是一个非常典型的趋势跟踪策略。

策略原理

计算ATR。ATR反映市场的波动性和风险水平。本策略通过ATR计算动态止损位,实现自适应止损。

计算RSI。RSI可以判断市场的超买超卖现象。当RSI大于50时为看涨,小于50时为看跌。本策略利用RSI判断价格趋势方向。

移动止损跟踪。本策略根据ATR计算的止损位以及RSI判断的趋势方向,实现移动止损不断跟踪价格波动,在保证止损的同时逐步拉大止盈位,实现利润最大化。

具体来说,当RSI大于50时开多仓,小于50时开空仓。之后利用ATR计算的止损价位移动止损,跟踪价格波动。

优势分析

利用ATR实现自适应止损,可以根据市场波动性动态调整止损幅度,避免止损过大过小的缺点。

RSI判断趋势方向准确可靠,避免交易被困在震荡市中。

移动止损跟踪价格波动,可以拉大止盈位,充分跟踪趋势获利。

风险分析

ATR和RSI参数设置需要经过回测优化,否则会影响策略效果。

虽然有止损保护,但大幅跳空难以避免会使止损被突破的风险。可以适当缩小仓位以控制风险。

策略对交易品种参数优化依赖性较大,需要针对不同品种调整参数。

优化方向

可以考虑加入机器学习算法,实现参数的自适应优化。

增加仓位控制模块,可以根据市场情况动态调整仓位规模,降低突破止损的概率。

增加趋势判断指标,避免错过顶底反转点造成损失。

总结

本策略整合运用ATR、RSI和移动止损等模块,形成一个典型的自适应趋势跟踪策略。通过参数优化可以非常灵活地适应不同交易品种,是一个值得推荐的通用趋势跟踪策略。加入更多指标判断和机器学习算法优化后,本策略的效果还可进一步提升。

策略源码

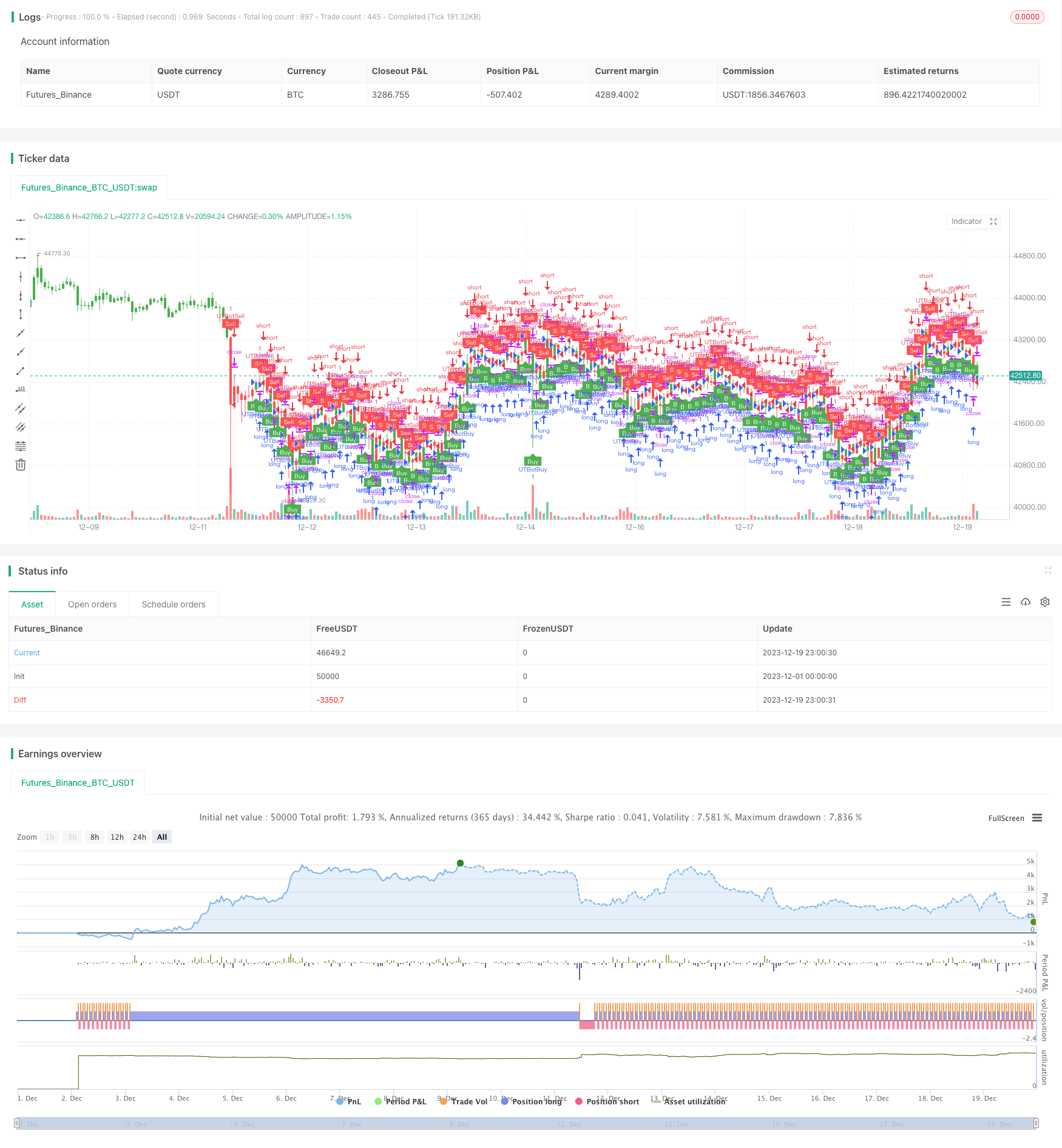

/*backtest

start: 2023-12-01 00:00:00

end: 2023-12-19 23:59:59

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=2

strategy(title="UTBot Strategy", overlay = true )

// CREDITS to @HPotter for the orginal code.

// CREDITS to @Yo_adriiiiaan for recently publishing the UT Bot study based on the original code -

// CREDITS to @TradersAITradingPlans for making this Strategy.

// Strategy fixed with Time period by Kirk65.

// I am using this UT bot with 2 hours time frame with god resultss. Alert with "Once per bar" and stoploss 1.5%. If Alerts triggered and price goes against Alert. Stoploss will catch it. Wait until next Alert.

// While @Yo_adriiiiaan mentions it works best on a 4-hour timeframe or above, witch is a lot less risky, but less profitable.

testStartYear = input(2019, "BACKTEST START YEAR", minval = 1980, maxval = 2222)

testStartMonth = input(01, "BACKTEST START MONTH", minval = 1, maxval = 12)

testStartDay = input(01, "BACKTEST START DAY", minval = 1, maxval = 31)

testPeriodStart = timestamp(testStartYear,testStartMonth,testStartDay,0,0)

testStopYear = input(2222, "BACKTEST STOP YEAR", minval=1980, maxval = 2222)

testStopMonth = input(12, "BACKTEST STOP MONTH", minval=1, maxval=12)

testStopDay = input(31, "BACKTEST STOP DAY", minval=1, maxval=31)

testPeriodStop = timestamp(testStopYear, testStopMonth, testStopDay, 0, 0)

testPeriod = true

SOURCE = input(hlc3)

RSILENGTH = input(14, title = "RSI LENGTH")

RSICENTERLINE = input(52, title = "RSI CENTER LINE")

MACDFASTLENGTH = input(7, title = "MACD FAST LENGTH")

MACDSLOWLENGTH = input(12, title = "MACD SLOW LENGTH")

MACDSIGNALSMOOTHING = input(12, title = "MACD SIGNAL SMOOTHING")

a = input(10, title = "Key Vaule. 'This changes the sensitivity'")

SmoothK = input(3)

SmoothD = input(3)

LengthRSI = input(14)

LengthStoch = input(14)

RSISource = input(close)

c = input(10, title="ATR Period")

xATR = atr(c)

nLoss = a * xATR

xATRTrailingStop = iff(close > nz(xATRTrailingStop[1], 0) and close[1] > nz(xATRTrailingStop[1], 0), max(nz(xATRTrailingStop[1]), close - nLoss),

iff(close < nz(xATRTrailingStop[1], 0) and close[1] < nz(xATRTrailingStop[1], 0), min(nz(xATRTrailingStop[1]), close + nLoss),

iff(close > nz(xATRTrailingStop[1], 0), close - nLoss, close + nLoss)))

pos = iff(close[1] < nz(xATRTrailingStop[1], 0) and close > nz(xATRTrailingStop[1], 0), 1,

iff(close[1] > nz(xATRTrailingStop[1], 0) and close < nz(xATRTrailingStop[1], 0), -1, nz(pos[1], 0)))

color = pos == -1 ? red: pos == 1 ? green : blue

ema= ema(close,1)

above = crossover(ema,xATRTrailingStop )

below = crossover(xATRTrailingStop,ema)

buy = close > xATRTrailingStop and above

sell = close < xATRTrailingStop and below

barbuy = close > xATRTrailingStop

barsell = close < xATRTrailingStop

plotshape(buy, title = "Buy", text = 'Buy', style = shape.labelup, location = location.belowbar, color= green,textcolor = white, transp = 0, size = size.tiny)

plotshape(sell, title = "Sell", text = 'Sell', style = shape.labeldown, location = location.abovebar, color= red,textcolor = white, transp = 0, size = size.tiny)

barcolor(barbuy? green:na)

barcolor(barsell? red:na)

//alertcondition(buy, title='Buy', message='Buy')

//alertcondition(sell, title='Sell', message='Sell')

if (buy)

strategy.entry("UTBotBuy",strategy.long, when=testPeriod)

if (sell)

strategy.entry("UTBotSell",strategy.short, when=testPeriod)