概述

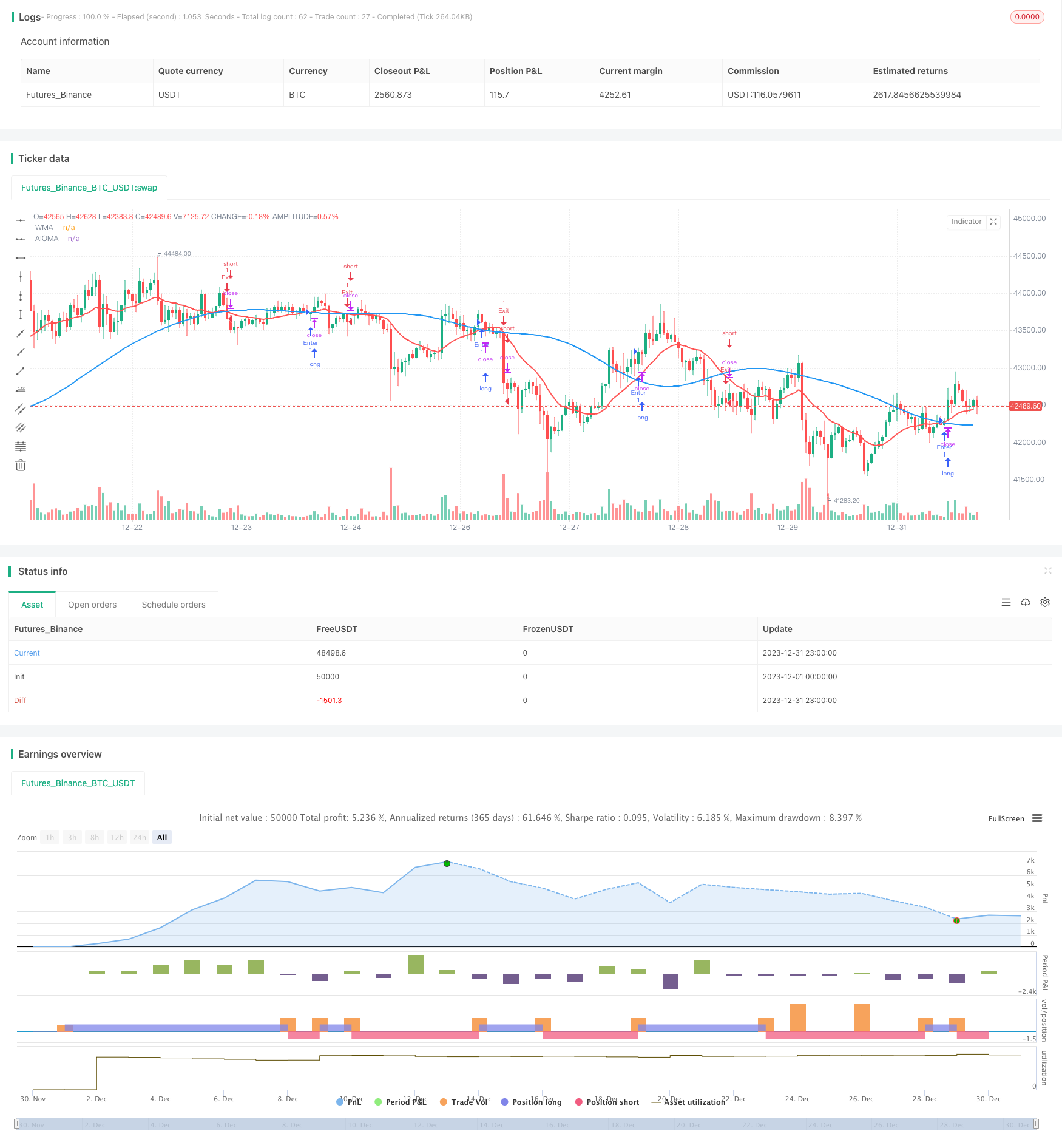

本策略基于自适应移动平均指标(AIOMA)和加权移动平均指标(WMA)实现交易信号。它通过 AIOMA 和 WMA 的交叉来产生买入和卖出信号。

策略名称

AIOMA-WMA 自适应交叉策略

策略原理

该策略主要包含以下部分:

AIOMA 指标计算

- 指定长度参数,计算一系列指数移动平均线(EMA)

- 将这些 EMA 平滑连接,形成平滑序列

- 最终的 AIOMA 是最后一个平滑值的 EMA

WMA 指标计算

- 指定长度参数,计算 WMA

交易信号生成

- WMA 上穿 AIOMA 时,产生买入信号

- WMA 下穿 AIOMA 时,产生卖出信号

交易逻辑

- 买入信号时,进入多头仓位

- 卖出信号时,进入空头仓位

- 平仓信号时,关闭对应方向的仓位

策略优势

- 使用两种不同类型的移动平均线,可以提高交易信号的准确性

- AIOMA 通过多次指数平滑,可以减少假信号

- WMA 作为主要指标,对价格变化更为敏感,可以提早捕捉趋势

- 简单的交易逻辑,容易理解和实施

策略风险

- 多次 EMA 平滑可能导致过度滞后

- WMA 容易受到短期价格震荡的影响产生错误信号

- 未考虑止损逻辑,可能导致较大亏损

可以通过适当优化参数,设置止损点,或结合其他指标过滤来减少风险。

策略优化方向

- 测试不同长度参数的组合,寻找最佳参数

- 在买入/卖出信号时同时触发止损单

- 结合市场波动性指标过滤假信号

- 增加仓位管理策略

总结

本策略整合 AIOMA 和 WMA 两个指标的优势,通过交叉产生交易信号。相比单一移动平均线,可以提高信号质量。通过参数优化、止损策略和波动性过滤等进一步完善,可以成为一个稳定可靠的交易系统。

策略源码

/*backtest

start: 2023-12-01 00:00:00

end: 2023-12-31 23:59:59

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This Pine Script™ code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © SDTA

//@version=5

strategy("AIOMA-WMA Strategy", overlay=true)

// Parametreler

aioma_length = input(14, "AIOMA Length")

wma_length = input(21, "WMA Length")

// AIOMA hesaplama

length1 = aioma_length

ema1 = ta.ema(close, length1)

length2 = aioma_length

ema2 = ta.ema(ema1, length2)

length3 = aioma_length

ema3 = ta.ema(ema2, length3)

length4 = aioma_length

ema4 = ta.ema(ema3, length4)

aioma = ta.ema(ema4, aioma_length)

// WMA hesaplama

wma = ta.wma(close, wma_length)

// Kesişim kontrolü

cross_up = ta.crossover(wma, aioma)

cross_down = ta.crossunder(wma, aioma)

// İşlem fonksiyonu

enterTrade(dir, price, signalText, color) =>

if dir

strategy.entry("Enter", strategy.long)

label.new(x = bar_index, y = price, text = signalText, color = color, textcolor = color, style = label.style_label_up, size = size.small, tooltip = "Entry Signal")

else if not dir

strategy.entry("Exit", strategy.short)

label.new(x = bar_index, y = price, text = signalText, color = color, textcolor = color, style = label.style_label_down, size = size.small, tooltip = "Exit Signal")

// Long pozisyon girişi

if cross_up

enterTrade(true, low, "Buy Signal", color.green)

// Short pozisyon girişi

if cross_down

enterTrade(false, high, "Sell Signal", color.red)

// Pozisyon kapatma

if cross_up and strategy.position_size > 0

strategy.close("Enter")

if cross_down and strategy.position_size < 0

strategy.close("Exit")

// Grafiğe plot

plot(aioma, color=color.blue, linewidth=2, title="AIOMA")

plot(wma, color=color.red, linewidth=2, title="WMA")