概述

该策略通过计算不同周期的EMA均线,判断目前行情处于哪个周期阶段,再结合ATR进行突破判断,实现高概率的趋势追踪交易。

策略原理

- 计算5日线、20日线、40日线3条EMA均线

- 通过比较3条均线的大小关系,判断目前行情处于6种不同的周期阶段之一

- 5日线>20日线>40日线 为第1周期

- 20日线>5日线>40日线 为第2周期 ……

- 在确定周期后,再计算ATR指标,并设定ATR倍数作为突破标准

- 当价格超过上一个BAR的ATR trailing stop时产生买入信号

- 当价格跌破上一个BAR的ATR trailing stop时产生卖出信号

- 通过这样的组合判断,实现高概率的趋势追踪交易

策略优势

- 周期判断增加了信号的可靠性

通过判断不同EMA均线的大小关系,可以有效判断市场目前所处的周期阶段,避免在不适宜的周期产生错误信号。

- ATR突破判断过滤假信号

ATR指标能够有效表达市场的波动性,设定一定倍数的ATR作为突破标准,可以过滤掉很多假突破信号。

- 组合判断形成高概率交易机会

周期判断和ATR突破判断的有机结合,使得产生信号的概率大大提高,从而也提高了交易的盈利概率。

策略风险

- 参数优化难度较大

由于策略包含多个参数,优化难度较大,不当的参数设置可能影响策略表现。

- 存在一定的滞后

在行情快速变化时,EMA均线和ATR指标都存在一定滞后,可能产生错误信号或错过机会。

- 需要严格的止损

任何技术指标都难以完全避免错误信号的产生,需要设定严格的止损来控制风险。

策略优化方向

- 进一步优化参数

通过更丰富的历史数据进行参数优化,找到最佳参数组合。

- 增加自适应能力

可以考虑根据市场波动性自动调整ATR参数,提高策略的自适应能力。

- 结合其它指标

可尝试结合波动率、成交量等其它指标来辅助判断,提高信号质量。

总结

该策略通过EMA均线判断周期和ATR指标设定动量突破标准,实现高概率的趋势追踪交易。具有判断周期、过滤假信号、提高信号质量等优势。但也存在参数优化难度大、存在滞后等风险,需要进一步优化参数、增加自适应能力等来改进策略。

策略源码

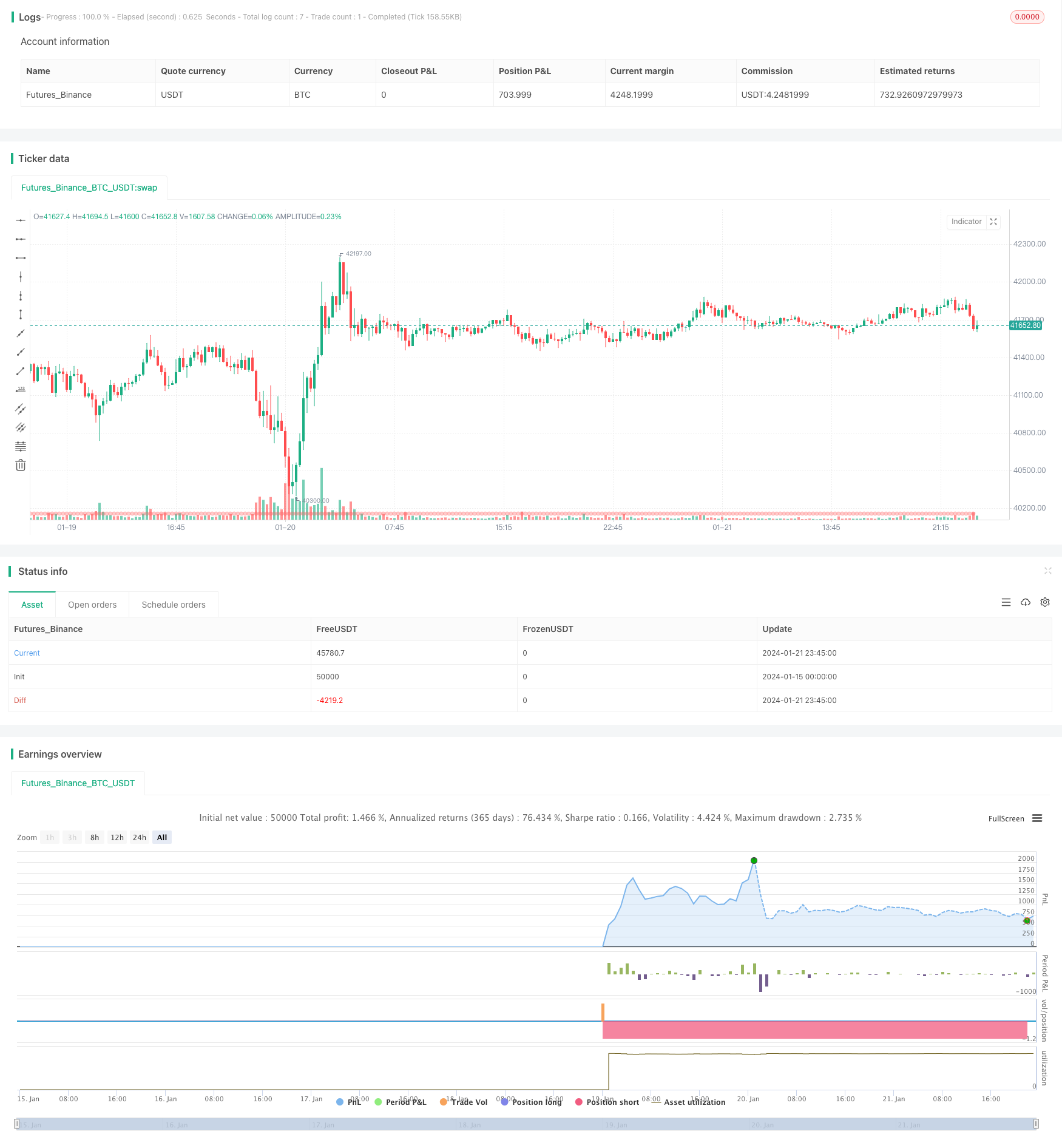

/*backtest

start: 2024-01-15 00:00:00

end: 2024-01-22 00:00:00

period: 15m

basePeriod: 5m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © kgynofomo

//@version=5

strategy(title="[Salavi] | Andy Advance Pro Strategy",overlay = true)

ema_short = ta.ema(close,5)

ema_middle = ta.ema(close,20)

ema_long = ta.ema(close,40)

cycle_1 = ema_short>ema_middle and ema_middle>ema_long

cycle_2 = ema_middle>ema_short and ema_short>ema_long

cycle_3 = ema_middle>ema_long and ema_long>ema_short

cycle_4 = ema_long>ema_middle and ema_middle>ema_short

cycle_5 = ema_long>ema_short and ema_short>ema_middle

cycle_6 = ema_short>ema_long and ema_long>ema_middle

bull_cycle = cycle_1 or cycle_2 or cycle_3

bear_cycle = cycle_4 or cycle_5 or cycle_6

// label.new("cycle_1")

// bgcolor(color=cycle_1?color.rgb(82, 255, 148, 60):na)

// bgcolor(color=cycle_2?color.rgb(82, 255, 148, 70):na)

// bgcolor(color=cycle_3?color.rgb(82, 255, 148, 80):na)

// bgcolor(color=cycle_4?color.rgb(255, 82, 82, 80):na)

// bgcolor(color=cycle_5?color.rgb(255, 82, 82, 70):na)

// bgcolor(color=cycle_6?color.rgb(255, 82, 82, 60):na)

// Inputs

a = input(2, title='Key Vaule. \'This changes the sensitivity\'')

c = input(7, title='ATR Period')

h = false

xATR = ta.atr(c)

nLoss = a * xATR

src = h ? request.security(ticker.heikinashi(syminfo.tickerid), timeframe.period, close, lookahead=barmerge.lookahead_off) : close

xATRTrailingStop = 0.0

iff_1 = src > nz(xATRTrailingStop[1], 0) ? src - nLoss : src + nLoss

iff_2 = src < nz(xATRTrailingStop[1], 0) and src[1] < nz(xATRTrailingStop[1], 0) ? math.min(nz(xATRTrailingStop[1]), src + nLoss) : iff_1

xATRTrailingStop := src > nz(xATRTrailingStop[1], 0) and src[1] > nz(xATRTrailingStop[1], 0) ? math.max(nz(xATRTrailingStop[1]), src - nLoss) : iff_2

pos = 0

iff_3 = src[1] > nz(xATRTrailingStop[1], 0) and src < nz(xATRTrailingStop[1], 0) ? -1 : nz(pos[1], 0)

pos := src[1] < nz(xATRTrailingStop[1], 0) and src > nz(xATRTrailingStop[1], 0) ? 1 : iff_3

xcolor = pos == -1 ? color.red : pos == 1 ? color.green : color.blue

ema = ta.ema(src, 1)

above = ta.crossover(ema, xATRTrailingStop)

below = ta.crossover(xATRTrailingStop, ema)

buy = src > xATRTrailingStop and above

sell = src < xATRTrailingStop and below

barbuy = src > xATRTrailingStop

barsell = src < xATRTrailingStop

atr = ta.atr(14)

atr_length = input.int(25)

atr_rsi = ta.rsi(atr,atr_length)

atr_valid = atr_rsi>50

long_condition = buy and bull_cycle and atr_valid

short_condition = sell and bear_cycle and atr_valid

Exit_long_condition = short_condition

Exit_short_condition = long_condition

if long_condition

strategy.entry("Andy Buy",strategy.long, limit=close,comment="Andy Buy Here")

if Exit_long_condition

strategy.close("Andy Buy",comment="Andy Buy Out")

// strategy.entry("Andy fandan Short",strategy.short, limit=close,comment="Andy 翻單 short Here")

// strategy.close("Andy fandan Buy",comment="Andy short Out")

if short_condition

strategy.entry("Andy Short",strategy.short, limit=close,comment="Andy short Here")

// strategy.exit("STR","Long",stop=longstoploss)

if Exit_short_condition

strategy.close("Andy Short",comment="Andy short Out")

// strategy.entry("Andy fandan Buy",strategy.long, limit=close,comment="Andy 翻單 Buy Here")

// strategy.close("Andy fandan Short",comment="Andy Buy Out")

inLongTrade = strategy.position_size > 0

inLongTradecolor = #58D68D

notInTrade = strategy.position_size == 0

inShortTrade = strategy.position_size < 0

// bgcolor(color = inLongTrade?color.rgb(76, 175, 79, 70):inShortTrade?color.rgb(255, 82, 82, 70):na)

plotshape(close!=0,location = location.bottom,color = inLongTrade?color.rgb(76, 175, 79, 70):inShortTrade?color.rgb(255, 82, 82, 70):na)

plotshape(long_condition, title='Buy', text='Andy Buy', style=shape.labelup, location=location.belowbar, color=color.new(color.green, 0), textcolor=color.new(color.white, 0), size=size.tiny)

plotshape(short_condition, title='Sell', text='Andy Sell', style=shape.labeldown, location=location.abovebar, color=color.new(color.red, 0), textcolor=color.new(color.white, 0), size=size.tiny)

//atr > close *0.01* parameter