概述

EMA跟踪策略是一种利用EMA指标进行跟踪的趋势策略。该策略通过计算价格的EMA值,并结合设置的比例带,来判断价格趋势并产生交易信号。

策略原理

该策略的核心指标是EMA。EMA代表指数移动平均线,是一种趋势跟踪指标。EMA根据历史价格及设置的时间周期,计算出当前的平均价格。EMA还具有平滑价格的作用。

该策略首先计算出价格的50周期EMA值,作为主要的判断指标。然后根据EMA值的一定比例,设置上轨和下轨。这里设置为EMA值的正负0.3%。当价格上扫EMA轨时产生买入信号;当价格下破EMA轨时产生卖出信号。这样可以跟踪EMA周期内的价格趋势变化。

优势分析

- 使用EMA指标判断趋势,可避免价格震荡的干扰

- EMA平滑价格,将随机波动转为清晰趋势,利于判断

- 设置EMA上下轨,形成范围带,可减少错误信号

- 策略思路清晰易理解,参数调整也较为简单

风险分析

- EMA指标存在滞后,在趋势转折点时信号较晚

- 固定比例的上下轨容易在震荡阶段产生错误信号

- 回测数据拟合风险,实盘价格震荡可能更大

- 没有止损设置,无法控制损失

优化方向

- 增加参数优化,寻找最佳参数组合

- 添加止损机制,控制策略最大回撤

- 优化上下轨的计算方式,降低错误信号率

- 增加条件过滤,避免震荡行情的误入场

- 结合其他指标确认,提高策略稳定性

总结

EMA跟踪策略整体思路清晰,通过EMA指标判断价格趋势,并设置范围带产生交易信号。优点是规则简单易于理解,可避免部分噪音。但也存在参数调整空间有限,信号滞后,回撤控制差等问题。下一步可通过多指标结合、止损优化等手段进行改进,使策略更实用稳定。

策略源码

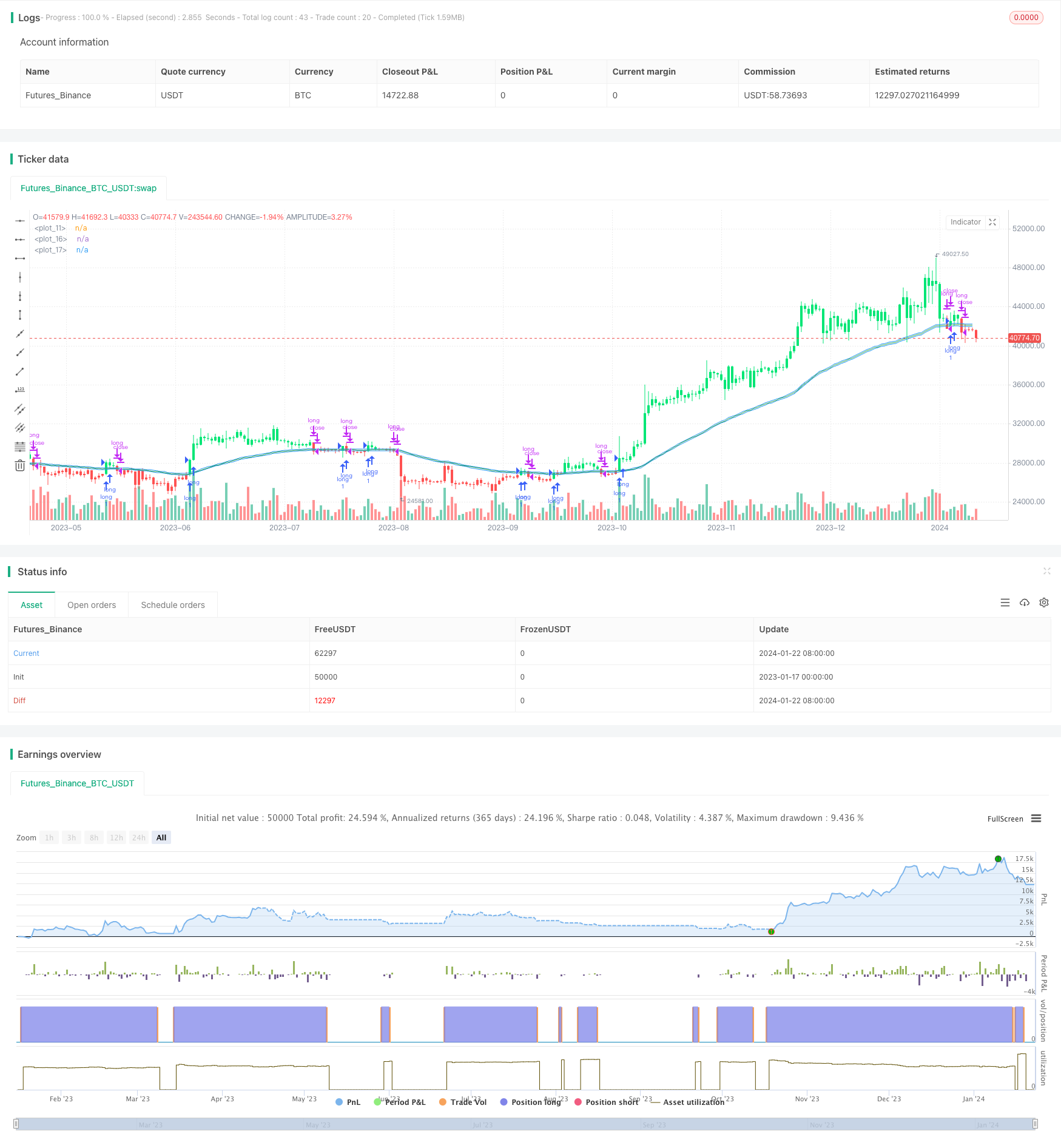

/*backtest

start: 2023-01-17 00:00:00

end: 2024-01-23 00:00:00

period: 1d

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=3

strategy(title="PingEMA50V.3 Piw", shorttitle="EMA50 Piw", overlay=true)

// input

src = input(title="Data Array",defval=close)

ema_period = input(title="EMA period", defval=50)

percent = input(title="Band %", type=float,defval=0.003)

// ema

ema50 = ema(src, ema_period)

plot(ema50, color=green)

// upper lower

upper = ema50 + (ema50*percent)

lower = ema50 - (ema50*percent)

plot(upper, color=blue)

plot(lower, color=blue)

// signal

buy = src > upper

sell = src < lower

// bar color

bcolor = buy ? lime : red

barcolor(color=bcolor)

// trade

if (buy)

strategy.entry("long", strategy.long)

if (sell)

strategy.close("long")