概述

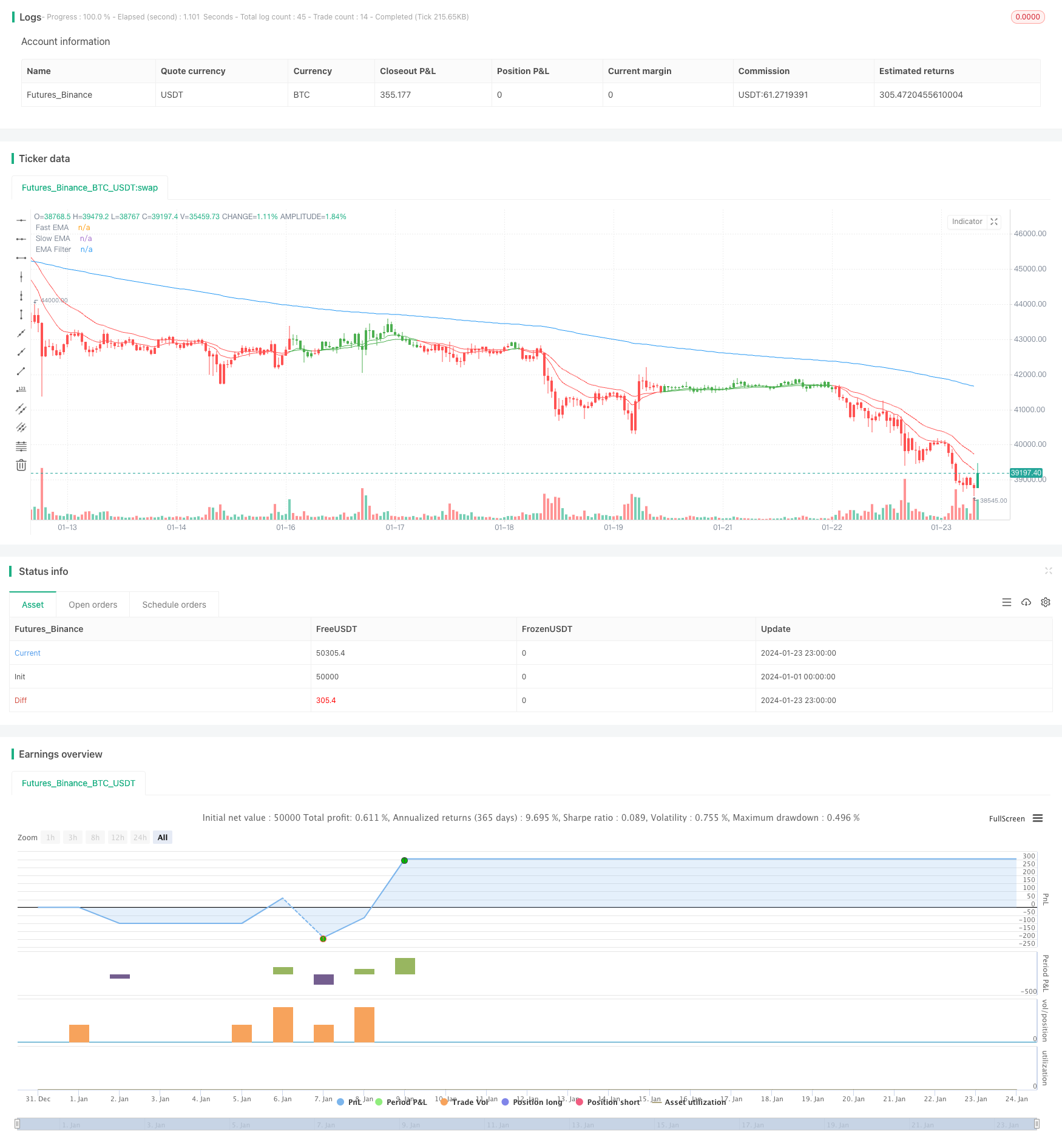

该策略联合使用双移动平均线和StochRSI指标来识别趋势方向和入场点。主要特点是可以在趋势开始阶段就进入市场,同时利用StochRSI指标的超买超卖特征来过滤假突破。

策略原理

该策略使用快速移动平均线EMA(12)和慢速移动平均线EMA(25)构建双移动平均线系统,当快速线上穿慢速线时产生买入信号,快速线下穿慢速线时产生卖出信号,用以判断大趋势方向。

同时,该策略结合StochRSI指标的交叉来进一步识别入场时机。StochRSI指标结合随机指标KDJ和RSI,当K线从超卖区上穿D线时产生买入信号,当K线从超买区下穿D线时产生卖出信号。

只有当双移动平均线产生信号,且StochRSI也产生对应的信号时,该策略才会开仓。从而能有效过滤掉部分假突破情况,避免无效交易。

优势分析

该策略最大的优势在于能够早期判断趋势方向和潜在入场点。移动平均线系统可以在趋势开始时就产生信号,而StochRSI指标的加入又可有效过滤假突破,避免错误交易。

另外,该策略同时结合了趋势分析和超买超卖判断,兼具趋势追踪和反转交易的优点。无论是追踪趋势还是逢低买进逢高卖出,该策略都可全方位捕捉机会。

风险分析

该策略的主要风险在于移动平均线体系本身的滞后性。当行情突然发生剧烈变化时,双移动平均线系统往往会晚一些才能产生信号,容易让策略错过最佳入场时机。

此外,StochRSI指标也可能会产生错误信号,引发不必要的交易。尤其是行情震荡时期,K线和D线可能频繁交叉,给策略带来过多无效操作的风险。

优化方向

该策略的优化主要集中在以下几个方面:

调整双移动平均线的参数,使用更有利于捕捉趋势的均线周期;

优化StochRSI的参数,制定更合理的超买超卖判断标准;

加大下单量或调整止损止盈水平,以追求更高收益率;

结合其他指标作为过滤条件,进一步减少无效信号。

总结

该策略整体来说非常适合捕捉中长线趋势,可在趋势初期获利潜力大。同时结合StochRSI指标作为辅助判断,可有效过滤误导信号,避免不必要的亏损。通过参数优化和风险管理的改进,该策略可以成为获取稳定收益的有力工具。

/*backtest

start: 2024-01-01 00:00:00

end: 2024-01-24 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © btc_charlie / @TheParagonGrp

//@version=5

strategy('BlackBit Trader XO Macro Trend Scanner', overlay=true)

// Variables

var ok = 0

var countBuy = 0

var countSell = 0

src = input(close, title='OHLC Type')

i_fastEMA = input(12, title='Fast EMA')

i_slowEMA = input(25, title='Slow EMA')

i_defEMA = input(25, title='Consolidated EMA')

// Allow the option to show single or double EMA

i_bothEMAs = input(title='Show Both EMAs', defval=true)

// Define EMAs

v_fastEMA = ta.ema(src, i_fastEMA)

v_slowEMA = ta.ema(src, i_slowEMA)

v_biasEMA = ta.ema(src, i_defEMA)

// Color the EMAs

emaColor = v_fastEMA > v_slowEMA ? color.green : v_fastEMA < v_slowEMA ? color.red : #FF530D

// Plot EMAs

plot(i_bothEMAs ? na : v_biasEMA, color=emaColor, linewidth=3, title='Consolidated EMA')

plot(i_bothEMAs ? v_fastEMA : na, title='Fast EMA', color=emaColor)

plot(i_bothEMAs ? v_slowEMA : na, title='Slow EMA', color=emaColor)

// Colour the bars

buy = v_fastEMA > v_slowEMA

sell = v_fastEMA < v_slowEMA

if buy

countBuy += 1

countBuy

if buy

countSell := 0

countSell

if sell

countSell += 1

countSell

if sell

countBuy := 0

countBuy

buysignal = countBuy < 2 and countBuy > 0 and countSell < 1 and buy and not buy[1]

sellsignal = countSell > 0 and countSell < 2 and countBuy < 1 and sell and not sell[1]

barcolor(buysignal ? color.green : na)

barcolor(sellsignal ? color.red : na)

bull = countBuy > 1

bear = countSell > 1

barcolor(bull ? color.green : na)

barcolor(bear ? color.red : na)

// Set Alerts

// alertcondition(ta.crossover(v_fastEMA, v_slowEMA), title='Bullish EMA Cross', message='Bullish EMA crossover')

// alertcondition(ta.crossunder(v_fastEMA, v_slowEMA), title='Bearish EMA Cross', message='Bearish EMA Crossover')

// Stoch RSI code

smoothK = input.int(3, 'K', minval=1)

smoothD = input.int(3, 'D', minval=1)

lengthRSI = input.int(14, 'RSI Length', minval=1)

lengthStoch = input.int(14, 'Stochastic Length', minval=1)

rsi1 = ta.rsi(src, lengthRSI)

k = ta.sma(ta.stoch(rsi1, rsi1, rsi1, lengthStoch), smoothK)

d = ta.sma(k, smoothD)

bandno0 = input.int(80, minval=1, title='Upper Band', group='Bands (change this instead of length in Style for Stoch RSI colour to work properly)')

bandno2 = input.int(50, minval=1, title='Middle Band', group='Bands (change this instead of length in Style for Stoch RSI colour to work properly)')

bandno1 = input.int(20, minval=1, title='Lower Band', group='Bands (change this instead of length in Style for Stoch RSI colour to work properly)')

// Alerts

crossoverAlertBgColourMidOnOff = input.bool(title='Crossover Alert Background Colour (Middle Level) [ON/OFF]', group='Crossover Alerts', defval=false)

crossoverAlertBgColourOBOSOnOff = input.bool(title='Crossover Alert Background Colour (OB/OS Level) [ON/OFF]', group='Crossover Alerts', defval=false)

crossoverAlertBgColourGreaterThanOnOff = input.bool(title='Crossover Alert >input [ON/OFF]', group='Crossover Alerts', defval=false)

crossoverAlertBgColourLessThanOnOff = input.bool(title='Crossover Alert <input [ON/OFF]', group='Crossover Alerts', defval=false)

maTypeChoice = input.string('EMA', title='MA Type', group='Moving Average', options=['EMA', 'WMA', 'SMA', 'None'])

maSrc = input.source(close, title='MA Source', group='Moving Average')

maLen = input.int(200, minval=1, title='MA Length', group='Moving Average')

maValue = if maTypeChoice == 'EMA'

ta.ema(maSrc, maLen)

else if maTypeChoice == 'WMA'

ta.wma(maSrc, maLen)

else if maTypeChoice == 'SMA'

ta.sma(maSrc, maLen)

else

0

crossupCHECK = maTypeChoice == 'None' or open > maValue and maTypeChoice != 'None'

crossdownCHECK = maTypeChoice == 'None' or open < maValue and maTypeChoice != 'None'

crossupalert = crossupCHECK and ta.crossover(k, d) and (k < bandno2 or d < bandno2)

crossdownalert = crossdownCHECK and ta.crossunder(k, d) and (k > bandno2 or d > bandno2)

crossupOSalert = crossupCHECK and ta.crossover(k, d) and (k < bandno1 or d < bandno1)

crossdownOBalert = crossdownCHECK and ta.crossunder(k, d) and (k > bandno0 or d > bandno0)

aboveBandalert = ta.crossunder(k, bandno0)

belowBandalert = ta.crossover(k, bandno1)

bgcolor(color=crossupalert and crossoverAlertBgColourMidOnOff ? #4CAF50 : crossdownalert and crossoverAlertBgColourMidOnOff ? #FF0000 : na, title='Crossover Alert Background Colour (Middle Level)', transp=70)

bgcolor(color=crossupOSalert and crossoverAlertBgColourOBOSOnOff ? #fbc02d : crossdownOBalert and crossoverAlertBgColourOBOSOnOff ? #000000 : na, title='Crossover Alert Background Colour (OB/OS Level)', transp=70)

bgcolor(color=aboveBandalert and crossoverAlertBgColourGreaterThanOnOff ? #ff0014 : crossdownalert and crossoverAlertBgColourMidOnOff ? #FF0000 : na, title='Crossover Alert - K > Upper level', transp=70)

bgcolor(color=belowBandalert and crossoverAlertBgColourLessThanOnOff ? #4CAF50 : crossdownalert and crossoverAlertBgColourMidOnOff ? #FF0000 : na, title='Crossover Alert - K < Lower level', transp=70)

// alertcondition(crossupalert or crossdownalert, title='Stoch RSI Crossover', message='STOCH RSI CROSSOVER')

// Calculate start/end date and time condition

startDate = input(timestamp('2000-12-24T00:00:00'),group = "---------TIME RANGE SETTINGS---------")

finishDate = input(timestamp('2029-02-26T00:00:00'),group = "---------TIME RANGE SETTINGS---------")

time_cond = true

//ema filter

emalen = input(200,"EMA Filter Length",group = "EMA FILTER SETTINGS")

emasource = input(close,"EMA Filter Source",group = "EMA FILTER SETTINGS")

ema_fil = ta.ema(emasource,emalen)

plot(ema_fil,"EMA Filter")

//macd

fast_length = input(title="Fast Length", defval=26,group = "MACD FILTER SETTINGS")

slow_length = input(title="Slow Length", defval=100,group = "MACD FILTER SETTINGS")

src_macd = input(title="Source", defval=close,group = "MACD FILTER SETTINGS")

signal_length = input.int(title="Signal Smoothing", minval = 1, maxval = 50, defval = 9,group = "MACD FILTER SETTINGS")

sma_source = input.string(title="Oscillator MA Type", defval="EMA", options=["SMA", "EMA"],group = "MACD FILTER SETTINGS")

sma_signal = input.string(title="Signal Line MA Type", defval="EMA", options=["SMA", "EMA"],group = "MACD FILTER SETTINGS")

// Calculating

fast_ma = sma_source == "SMA" ? ta.sma(src_macd, fast_length) : ta.ema(src_macd, fast_length)

slow_ma = sma_source == "SMA" ? ta.sma(src_macd, slow_length) : ta.ema(src_macd, slow_length)

macd = fast_ma - slow_ma

signal = sma_signal == "SMA" ? ta.sma(macd, signal_length) : ta.ema(macd, signal_length)

hist = macd - signal

//tpsl

takeprofit=input.float(defval=0.3,title="Enter The Take Profit %",group="TP/SL CONDITION INPUTS HERE")/100

stoploss=input.float(defval=0.16,title="Enter The Stop %",group="TP/SL CONDITION INPUTS HERE")/100

tp = strategy.opentrades.entry_price(0)*takeprofit/syminfo.mintick

sl = strategy.opentrades.entry_price(0)*stoploss/syminfo.mintick

lg_rule = buysignal and hist > 0 and close > ema_fil

sh_rule = sellsignal and hist < 0 and close < ema_fil

// Plot Bull/Bear

plotshape(lg_rule, title='Bull', text='Bull', style=shape.triangleup, location=location.belowbar, color=color.new(color.green, 0), textcolor=color.new(color.black, 0), size=size.tiny)

plotshape(sh_rule, title='Bear', text='Bear', style=shape.triangledown, location=location.abovebar, color=color.new(color.red, 0), textcolor=color.new(color.black, 0), size=size.tiny)

//alert

lg_entryal = input("Long entry","Long entry alert",group = "ALERT MESSAGE SETTINGS")

sh_entryal = input("Short entry","Short entry alert",group = "ALERT MESSAGE SETTINGS")

if lg_rule and time_cond and barstate.isconfirmed

strategy.entry("LONG",strategy.long)

alert(lg_entryal,alert.freq_once_per_bar_close)

if strategy.position_size > 0

strategy.exit("LONG EX","LONG",loss = sl,profit = tp,comment_loss = "LONG SL",comment_profit = "LONG TP")

if sh_rule and time_cond and barstate.isconfirmed

strategy.entry("SHORT",strategy.short)

alert(sh_entryal,alert.freq_once_per_bar_close)

if strategy.position_size < 0

strategy.exit("SHORT EX","SHORT",loss = sl,profit = tp,comment_loss = "SHORT SL",comment_profit = "SHORT TP")

//end