概述

三重叠加随机动量策略是一种典型的短线交易策略。它通过计算三条不同参数设置的随机动量指标,并进行多重叠加,形成交易信号。当三条随机动量指标同时显示超买或超卖信号时,进行买入或卖出。该策略结合了多时间周期分析的优势,可以有效过滤市场噪音,提高信号质量。

策略原理

该策略的核心指标是随机动量指标(SMI)。SMI指标的计算公式如下:

SMI = 100 * EMA(EMA(收盘价-最高价和最低价的中点,N1),N2) / 0.5 * EMA(EMA(最高价-最低价,N1),N2)

其中,N1和N2分别是参数长度。SMI指标的取值范围在-100到100之间,当SMI高于0时表示收盘价位于当日价格范围的上半段,低于0时表示收盘价位于价格范围的下半段。

和传统stoch指标类似,SMI指标超过预设的超买线(如40)和超卖线(如-40)时,表明可能形成反转信号。当SMI指标上穿其移动平均线时,产生买入信号;当SMI指标下穿其移动平均线时,产生卖出信号。

该策略采用三组不同参数设置的SMI指标进行叠加,分别設定为:

- SMI1: %K长度10周期,%K平滑周期3周期

- SMI2: %K长度20周期,%K平滑周期3周期

- SMI3: %K长度5周期,%K平滑周期3周期

当三条SMI指标同时显示超买或超卖时,发出交易信号。这可以有效过滤假Signals,提高信号质量。

策略优势

- 多时间周期分析,综合判断,有效过滤噪声

- SMI指标增强了stoch指标的易用性

- 采用三重叠加,可靠性较单一指标高

- 参数设置灵活,可调整

- 适用于高频短线交易

策略风险

- 多重指标叠加,存在一定滞后

- 短线操作频繁,交易成本较高

- 回测数据拟合风险

- 市场结构变化后参数失效风险

风险缓解措施:

- 优化参数,降低滞后

- 适当调整持仓时间,降低交易成本

- 增加统计检验,检验稳健性

- 动态调整参数

策略优化

- 测试不同的SMI参数组合

- 增加统计指标,评估参数稳定性

- 结合其他辅助指标,如成交量,布林带等

- 根据市场环境动态切换参数

- 优化止损策略

总结

三重叠加随机动量策略通过采用三组不同参数设置的SMI指标,在多个时间周期上进行综合判断,形成高质量的超买超卖交易信号。相比单一指标,该策略可过滤更多噪声,提升稳定性。下一步可通过参数优化、统计检验、辅助指标等方法进行改进,使策略更具鲁棒性。

策略源码

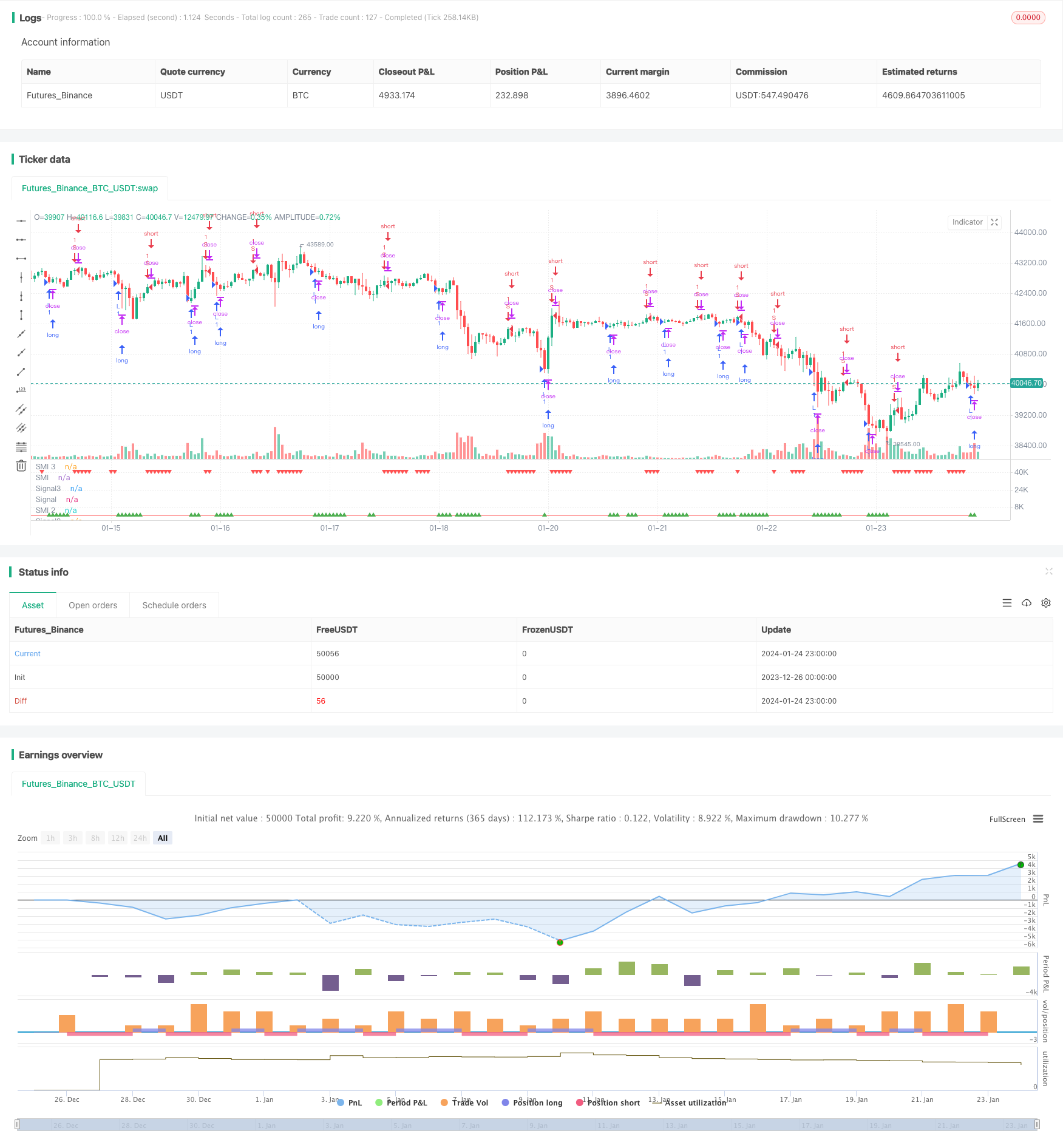

/*backtest

start: 2023-12-26 00:00:00

end: 2024-01-25 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=2

strategy("Stochastic Momentum multi strategy", "Stochastic Momentum Index multi strategy", overlay=false)

q = input(10, title="%K Length")

r = input(3, title="%K Smoothing Length")

s = input(3, title="%K Double Smoothing Length")

nsig = input(10, title="Signal Length")

matype = input("ema", title="Signal MA Type") // possible: ema, sma, wma, trima, hma, dema, tema, zlema

overbought = input(40, title="Overbought Level", type=float)

oversold = input(-40, title="Oversold Level", type=float)

trima(src, length) => sma(sma(src,length),length)

hma(src, length) => wma(2*wma(src, length/2)-wma(src, length), round(sqrt(length)))

dema(src, length) => 2*ema(src,length) - ema(ema(src,length),length)

tema(src, length) => (3*ema(src,length) - 3*ema(ema(src,length),length)) + ema(ema(ema(src,length),length),length)

zlema(src, length) => ema(src,length) + (ema(src,length) - ema(ema(src,length),length))

smi = 100 * ema(ema(close-0.5*(highest(q)+lowest(q)),r),s) / (0.5 * ema(ema(highest(q)-lowest(q),r),s))

sig = matype=="ema" ? ema(smi,nsig) : matype=="sma" ? sma(smi,nsig) : matype=="wma" ? wma(smi,nsig) : matype=="trima" ? trima(smi,nsig) : matype=="hma" ? hma(smi,nsig) : matype=="dema" ? dema(smi,nsig) : matype=="tema" ? tema(smi,nsig) : matype=="zlema" ? zlema(smi,nsig) : ema(smi,nsig)

p_smi = plot(smi, title="SMI", color=aqua)

p_sig = plot(sig, title="Signal", color=red)

// plotchar(crossover(smi, sig), title= "low", location=location.bottom, color=green, char="▲", size= size.tiny)

// plotchar(crossunder(smi, sig), title= "high", location=location.top, color=red, char="▼", size= size.tiny)

/////////////////////////////2

q2 = input(20, title="%K Length 2")

r2 = input(3, title="%K Smoothing Length 2")

s2 = input(3, title="%K Double Smoothing Length 2")

nsig2 = input(10, title="Signal Length 2")

matype2 = input("ema", title="Signal MA Type 2") // possible: ema, sma, wma, trima, hma, dema, tema, zlema

overbought2 = input(40, title="Overbought Level 2", type=float)

oversold2 = input(-40, title="Oversold Level 2", type=float)

trima2(src2, length2) => sma(sma(src2,length2),length2)

hma2(src2, length2) => wma(2*wma(src2, length2/2)-wma(src2, length2), round(sqrt(length2)))

dema2(src2, length2) => 2*ema(src2,length2) - ema(ema(src2,length2),length2)

tema2(src2, length2) => (3*ema(src2,length2) - 3*ema(ema(src2,length2),length2)) + ema(ema(ema(src2,length2),length2),length2)

zlema2(src2, length2) => ema(src2,length2) + (ema(src2,length2) - ema(ema(src2,length2),length2))

smi2 = 100 * ema(ema(close-0.5*(highest(q2)+lowest(q2)),r2),s2) / (0.5 * ema(ema(highest(q2)-lowest(q2),r2),s2))

sig2 = matype2=="ema" ? ema(smi2,nsig2) : matype2=="sma 2" ? sma(smi2,nsig2) : matype2=="wma 2" ? wma(smi2,nsig2) : matype2=="trima 2" ? trima2(smi2,nsig2) : matype2=="hma 2" ? hma2(smi2,nsig2) : matype=="dema 2" ? dema2(smi2,nsig2) : matype2=="tema 2" ? tema2(smi2,nsig2) : matype2=="zlema 2" ? zlema2(smi2,nsig2) : ema(smi2,nsig2)

p_smi2 = plot(smi2, title="SMI 2", color=aqua)

p_sig2 = plot(sig2, title="Signal2", color=red)

// plotchar(crossover(smi2, sig2), title= "low2", location=location.bottom, color=green, char="▲", size= size.tiny)

// plotchar(crossunder(smi2, sig2), title= "high2", location=location.top, color=red, char="▼", size= size.tiny)

/////////////////////////////3

q3 = input(5, title="%K Length 3")

r3 = input(3, title="%K Smoothing Length 3")

s3 = input(3, title="%K Double Smoothing Length 3")

nsig3 = input(10, title="Signal Length 3")

matype3 = input("ema", title="Signal MA Type 3") // possible: ema, sma, wma, trima, hma, dema, tema, zlema

overbought3 = input(40, title="Overbought Level 3", type=float)

oversold3 = input(-40, title="Oversold Level 3", type=float)

trima3(src3, length3) => sma(sma(src3,length3),length3)

hma3(src3, length3) => wma(2*wma(src3, length3/2)-wma(src3, length3), round(sqrt(length3)))

dema3(src3, length3) => 2*ema(src3,length3) - ema(ema(src3,length3),length3)

tema3(src3, length3) => (3*ema(src3,length3) - 3*ema(ema(src3,length3),length3)) + ema(ema(ema(src3,length3),length3),length3)

zlema3(src3, length3) => ema(src3,length3) + (ema(src3,length3) - ema(ema(src3,length3),length3))

smi3 = 100 * ema(ema(close-0.5*(highest(q3)+lowest(q3)),r3),s3) / (0.5 * ema(ema(highest(q3)-lowest(q3),r3),s3))

sig3 = matype3=="ema" ? ema(smi3,nsig3) : matype3=="sma 3" ? sma(smi3,nsig3) : matype3=="wma 3" ? wma(smi3,nsig3) : matype3=="trima 3" ? trima3(smi3,nsig3) : matype3=="hma 3" ? hma3(smi3,nsig3) : matype=="dema 3" ? dema3(smi3,nsig3) : matype3=="tema 3" ? tema3(smi3,nsig3) : matype3=="zlema 3" ? zlema3(smi3,nsig3) : ema(smi3,nsig3)

p_smi3 = plot(smi3, title="SMI 3", color=aqua)

p_sig3 = plot(sig3, title="Signal3", color=red)

// plotchar(crossover(smi3, sig3) and crossover(smi2, sig2) and crossover(smi, sig), title= "low3", location=location.bottom, color=green, char="▲", size= size.tiny)

// plotchar(crossunder(smi3, sig3) and crossunder(smi2, sig2) and crossunder(smi, sig), title= "high3", location=location.top, color=red, char="▼", size= size.tiny)

plotchar (((smi3 < sig3) and (smi2 < sig2) and (smi < sig)), title= "low3", location=location.bottom, color=green, char="▲", size= size.tiny)

plotchar (((smi3 > sig3) and (smi2 > sig2) and (smi > sig)), title= "high3", location=location.top, color=red, char="▼", size= size.tiny)

// === BACKTEST RANGE ===

FromMonth = input(defval = 8, title = "From Month", minval = 1, maxval = 12)

FromDay = input(defval = 1, title = "From Day", minval = 1, maxval = 31)

FromYear = input(defval = 2018, title = "From Year", minval = 2014)

ToMonth = input(defval = 12, title = "To Month", minval = 1, maxval = 12)

ToDay = input(defval = 31, title = "To Day", minval = 1, maxval = 31)

ToYear = input(defval = 2018, title = "To Year", minval = 2014)

longCondition = ((smi3 < sig3) and (smi2 < sig2) and (smi < sig))

shortCondition = ((smi3 > sig3) and (smi2 > sig2) and (smi > sig))

// buy = longCondition == 1 and longCondition[1] == 1 ? longCondition : na

buy = longCondition == 1 ? longCondition : na

sell = shortCondition == 1? shortCondition : na

// === ALERTS ===

strategy.entry("L", strategy.long, when=buy)

strategy.entry("S", strategy.short, when=sell)

alertcondition(((smi3 < sig3) and (smi2 < sig2) and (smi < sig)), title='Low Fib.', message='Low Fib. Buy')

alertcondition(((smi3 > sig3) and (smi2 > sig2) and (smi > sig)), title='High Fib.', message='High Fib. Low')