概述

本策略通过结合线性回归指标与双指数移动平均线,实现短线跟踪操作。策略基于价格突破上下轨时建仓做空,在价格重新突破时平仓。同时,该策略还利用双指数移动平均线判断价格趋势,作为建仓的辅助条件。

策略原理

本策略主要通过线性回归指标来判断价格的突破。线性回归指标是根据一定周期内的最高价和最低价,采用线性回归法计算出的上下轨。当价格从上轨下穿或从下轨上穿时,我们认为是一个交易信号。

另外,该策略还引入双指数移动平均线判断中间趋势。双指数移动平均线可以更快响应价格变化。当价格从上轨下穿,如果此时双指数移动平均线已经位于价格上方,表明目前处于下跌趋势,这时我们建立做空仓位。当价格重新突破上轨或突破双指数移动平均线时,我们平掉仓位。

具体来说,策略主要包括以下几个要点:

- 计算线性回归上轨和下轨

- 计算双指数移动平均线

- 当价格从上轨下穿,且双指数移动平均线高于价格时,建立做空仓位

- 当价格重新突破上轨或高于双指数移动平均线时,平掉做空仓位

优势分析

相比传统移动平均线等指标,该策略具有以下几点优势:

- 线性回归指标可以更快速捕捉价格变化,作为建仓信号更有效

- 双指数移动平均线判断趋势更加敏感,可避免假突破

- 结合双重指标和条件,可以过滤掉一些噪音,使交易更加稳定

风险分析

该策略也存在一些风险需要注意:

- 线性回归指标对参数敏感,不同周期可能产生不同结果

- 双指数移动平均线可能出现背离,判断失误

- 突破类策略可能增加滑点风险

- 震荡行情中可能出现频繁开平仓

对于以上风险,我们可以通过参数优化、严格止损、适当放宽突破幅度等方法来解决。

优化方向

该策略还可从以下几个方面进行优化:

- 对线性回归周期和双指数移动平均线周期进行优化,找到最佳参数组合

- 加入价格震荡幅度判断,避免价格微量突破造成错误信号

- 增加成交量等辅助条件,确保突破有效性

- 设置止损层次缩小单笔损失

- 针对特定品种调整参数

总结

本策略综合运用线性回归指标和双指数移动平均线,在理论和实践上均有一定优势。通过不断优化调整,可以进一步提高稳定性和策略效果。该策略适合短线操作,可为量化交易者带来较好的alpha。

策略源码

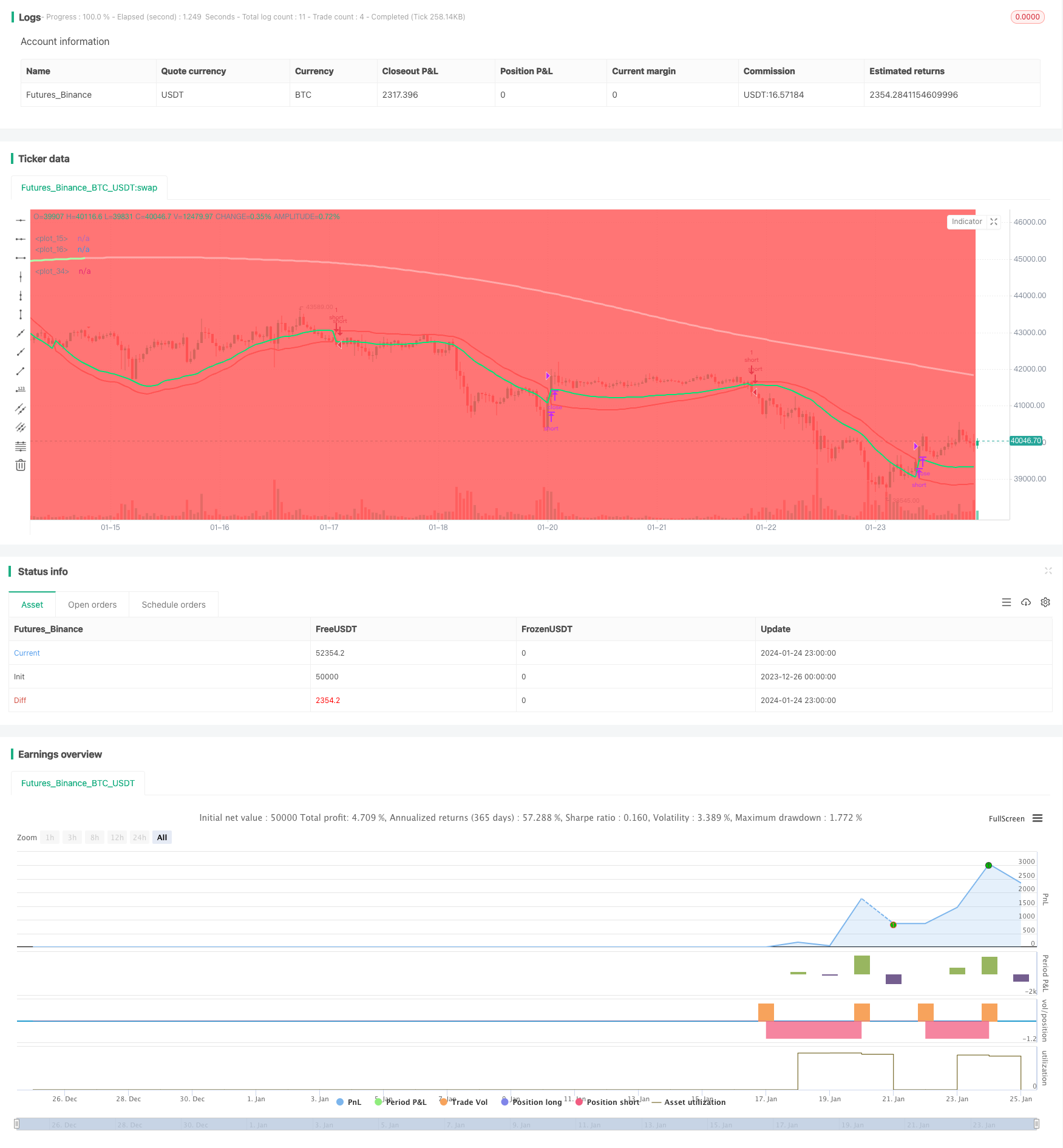

/*backtest

start: 2023-12-26 00:00:00

end: 2024-01-25 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=4

strategy('LR&SSL_Short', overlay=true)

startP = timestamp(input(2017, "Start Year"), input(12, "Month"), input(17, "Day"), 0, 0)

end = timestamp(9999,1,1,0,0)

_testPeriod() => true

len = input(title="Period", defval=89)

smaHigh = linreg(high, len, 0)

smaLow = linreg(low, len, -1)

Hlv = 0.0

Hlv := close > smaHigh ? 1 : close < smaLow ? -1 : Hlv[1]

sslDown = Hlv < 0 ? smaHigh : smaLow

sslUp = Hlv < 0 ? smaLow : smaHigh

plot(sslDown, linewidth=2, color=color.red)

plot(sslUp, linewidth=2, color=color.lime)

length = input(200, title="DEMA")

d1 = ema(close, length)

d2 = 2 * d1 - ema(d1, length)

trendColour = d2 > d1 ? #AAFFAA : #FFAAAA

dema=sma(d2,length)

turnGreen = d2 > d1 and d2[1] <= d1[1]

turnRed = d2 <= d1 and d2[1] > d1[1]

up =turnGreen

down=turnRed

plotshape(down, title="down", style=shape.triangledown,location=location.abovebar, color=color.red, transp=0, size=size.small)

plotshape(up, title="up", style=shape.triangleup,location=location.belowbar, color=color.green, transp=0, size=size.small)

plot(dema, color = trendColour,linewidth=3 ,transp = 0)

bgcolor(close > dema ? color.green : color.red)

strategy.entry("short", strategy.short, when= crossunder(sslUp, sslDown) and dema > close and _testPeriod())

strategy.close("short", when = crossover(sslUp, sslDown) or crossover(close, dema))