概述

该策略是一个利用多种技术指标进行量化交易的策略。主要使用了EMA均线交叉、SuperTrend指标、RSI指标、MACD指标等多种指标进行配合,形成交易信号。

策略原理

该策略的核心交易逻辑基于以下几个方面:

EMA均线交叉:计算快线EMA1和慢线EMA2,当快线上穿慢线时生成买入信号,快线下穿慢线时生成卖出信号。

VWMA均线:计算VWMA均线,当收盘价上穿该均线时视为买入信号,下穿该均线时视为卖出信号。

SuperTrend指标:根据ATR和multiplier参数计算SuperTrend的上下轨,并确定趋势方向。在上升趋势中产生买入信号,在下降趋势中产生卖出信号。

RSI指标:计算RSI指标,RSI高于超买线时视为卖出信号,RSI低于超卖区时视为买入信号。

MACD指标:计算MACD的快线、慢线和信号线,快线上穿信号线时产生买入信号,快线下穿信号线时产生卖出信号。

在获得上述多个指标的交易信号后,策略采用“AND”逻辑进行判断,即多个指标同时 emit 信号时才生成最终的买入和卖出信号。

策略优势

该策略综合多种指标判断市场,可以有效减少假信号。主要优势包括:

利用多种指标进行复合过滤,可以减少单一指标造成的错误信号。

结合趋势指标和震荡指标,可以在趋势行情中获得额外利润。

采用完善的止损逻辑,可以有效控制单笔交易的最大亏损。

倍投逻辑使得亏损后可以通过加仓获得回本机会。

策略风险

该策略主要存在以下风险:

多重指标组合可能过于保守,错过部分交易机会。可以适当简化指标组合。

倍投加仓逻辑可能导致亏损扩大。应该合理设置加仓次数限制。

止损位置设定不当可能导致不必要的止损。应定制自适应式止损位置。

指标参数设置不当可能导致产生过多错误信号。应该优化参数以得到最佳参数组合。

策略优化方向

该策略可以从以下几个方面进行进一步优化:

评估不同参数组合指标的效果,选取指标权重。

测试不同的指标参数设置。

添加自适应止损逻辑。

加入动态仓位管理机制。

利用机器学习方法对参数和模型进行优化。

总结

该策略overall是一个非常实用的量化交易策略。它融合了多种经典技术指标的优势,可以有效进行市场判断。通过参数优化和模型迭代,该策略可以获得更好的交易效果。

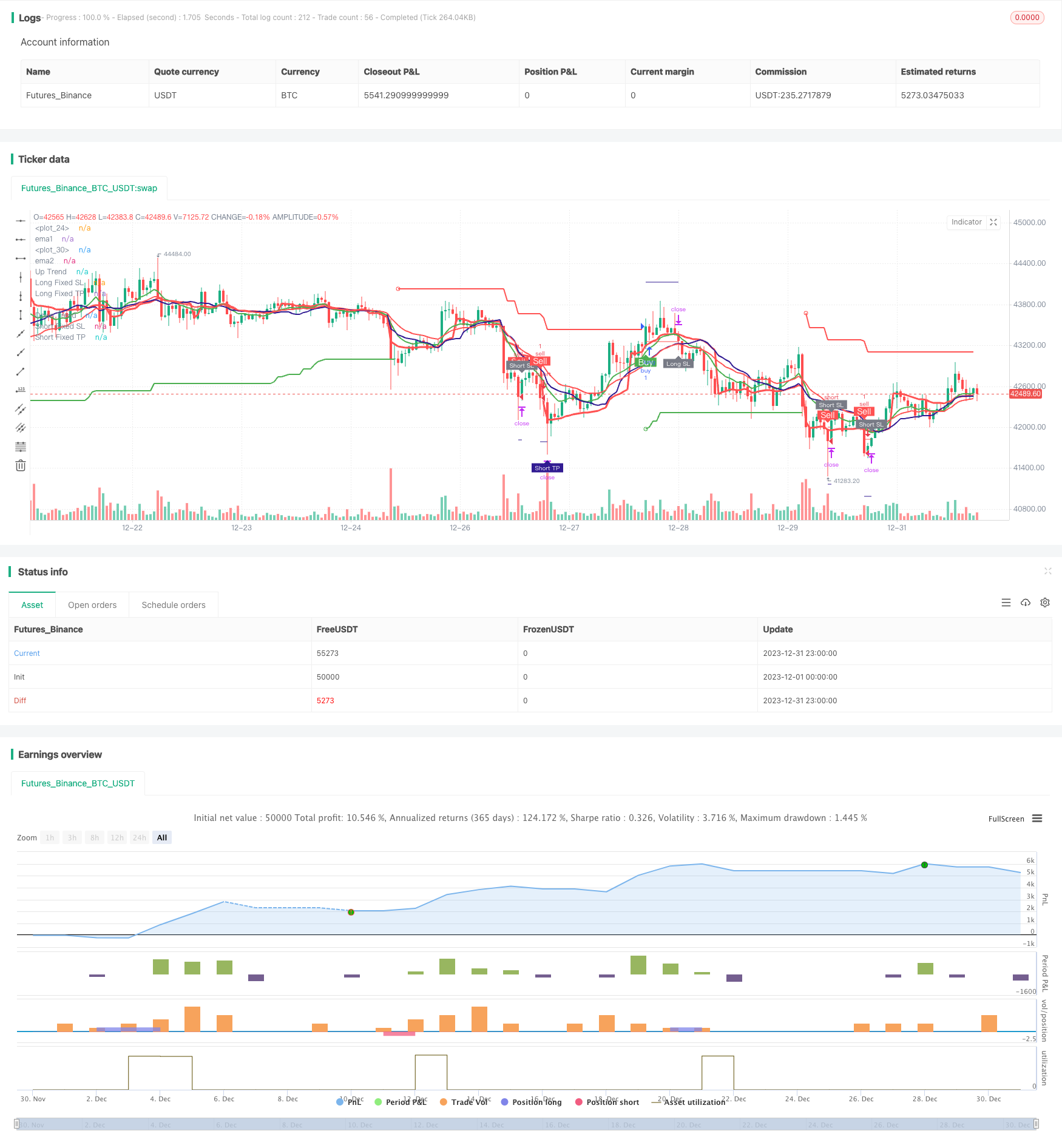

/*backtest

start: 2023-12-01 00:00:00

end: 2023-12-31 23:59:59

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy(title='Pinku Buy', overlay=true)

fromMonth = input.int(defval=1, title='From Month', minval=1, maxval=12)

fromDay = input.int(defval=1, title='From Day', minval=1, maxval=31)

fromYear = input.int(defval=2021, title='From Year', minval=1970)

thruMonth = input.int(defval=1, title='Thru Month', minval=1, maxval=12)

thruDay = input.int(defval=1, title='Thru Day', minval=1, maxval=31)

thruYear = input.int(defval=2112, title='Thru Year', minval=1970)

showDate = input(defval=true, title='Show Date Range')

start = timestamp(fromYear, fromMonth, fromDay, 00, 00)

finish = timestamp(thruYear, thruMonth, thruDay, 23, 59)

window() => true

// ema crossover

length1 = input.int(10)

length2 = input.int(20)

ema1 = ta.ema(close , length1)

ema2 = ta.ema(close , length2)

//vwap

VWAP = ta.vwap(hlc3)

plot(VWAP, color=color.new(color.red, 0), linewidth=3)

buy_1 = close > VWAP

sell_1 = close < VWAP

//vwma

len = input.int(20, 'VWMA_len', minval=1)

ma = ta.vwma(close, len)

plot(ma, color=color.new(color.navy, 0), linewidth=2)

buy_2 = close > ma

sell_2 = close < ma

//super trend

//inputs

Periods = input(title='STR Period', defval=22)

Source = input(hl2, title='Source')

Multiplier = input.float(title='STR Multiplier', step=0.1, defval=5.0)

//Compute ATR Levels

atr = ta.atr(Periods)

//Creating Upper Channel

up = Source - Multiplier * atr

up1 = nz(up[1], up)

up := close[1] > up1 ? math.max(up, up1) : up

//Creating Down Channel

dn = Source + Multiplier * atr

dn1 = nz(dn[1], dn)

dn := close[1] < dn1 ? math.min(dn, dn1) : dn

//Compute the Trend Stream +1/-1

trend = 1

trend := nz(trend[1], trend)

trend := trend == -1 and close > dn1 ? 1 : trend == 1 and close < up1 ? -1 : trend

//Create Stoploss for Longs

upPlot = plot(trend == 1 ? up : na, title='Up Trend', style=plot.style_linebr, linewidth=2, color=color.new(color.green, 0))

//buy_a = close > upPlot

//Buy Signal

buy_3 = trend == 1 and trend[1] == -1

plotshape(buy_3 ? up : na, title='Go Long', location=location.absolute, style=shape.circle, size=size.tiny, color=color.new(color.green, 0))

dnPlot = plot(trend == 1 ? na : dn, title='Down Trend', style=plot.style_linebr, linewidth=2, color=color.new(color.red, 0))

//sell_a = close < dnPlot

//Sell Signal

sell_3 = trend == -1 and trend[1] == 1

plotshape(sell_3 ? dn : na, title='Go Short', location=location.absolute, style=shape.circle, size=size.tiny, color=color.new(color.red, 0))

// //paraboloic sar

// start = input(0.02)

// increment = input(0.02)

// maximum = input(0.2, 'Max Value')

// out = ta.sar(start, increment, maximum)

buy_4 = ema1 > ema2

//buy_4 = buy1 and not buy1[1]

//plotshape(buy_4 , color = color.green , text = "Buy" , location = location.belowbar , textcolor = color.white , style = shape.labelup , size = size.small)

sell_4 = close < ema2

//sell_4 = sell1 and not sell1[1]

//plotshape(sell_4, color = color.red , text = "Sell" , location = location.abovebar , textcolor = color.white , style = shape.labeldown , size = size.small)

plot(ema1, 'ema1', color=color.new(color.green, 0), linewidth=2)

plot(ema2, 'ema2', color=color.new(color.red, 0), linewidth=2)

// rsi

lenr = input(14, title='Rsi Period')

rs = ta.rsi(close, lenr)

over_sold = input(44)

over_bought = input(56)

buy_5 = rs > over_bought

sell_5 = rs < over_sold

// macd

slow_len_macd = input.int(12)

fast_len_macd = input.int(26)

signal_len_macd = input.int(9)

ema3 = ta.ema(close , slow_len_macd)

ema4 = ta.ema(close , fast_len_macd)

ema5 = ta.ema(close , signal_len_macd)

buy_6 = ema5 > ema4

sell_6 = ema5 < ema4

// adx

adxlen = input(14, title="ADX Smoothing")

dilen = input(14, title="DI Length")

dirmov(len) =>

up = ta.change(high)

down = -ta.change(low)

plusDM = na(up) ? na : (up > down and up > 0 ? up : 0)

minusDM = na(down) ? na : (down > up and down > 0 ? down : 0)

truerange = ta.rma(ta.tr, len)

plus = fixnan(100 * ta.rma(plusDM, len) / truerange)

minus = fixnan(100 * ta.rma(minusDM, len) / truerange)

[plus, minus]

adx(dilen, adxlen) =>

[plus, minus] = dirmov(dilen)

sum = plus + minus

adx = 100 * ta.rma(math.abs(plus - minus) / (sum == 0 ? 1 : sum), adxlen)

sig = adx(dilen, adxlen)

//plot(sig, color=color.red, title="ADX")

adx_Greater_than = input.int(25)

signal = sig > adx_Greater_than

// volume ema

volume_ema = input.int(10)

vema = ta.ema(volume,volume_ema)

signal_2 = volume > vema

//define buy sell

g = buy_1 and buy_2 and buy_4 and trend == 1 and buy_5 and buy_6 and signal and signal_2 and window()

r = sell_1 and sell_2 and sell_4 and trend == -1 and sell_5 and sell_6 and signal and signal_2 and window()

rg = 0

rg := r ? 1 : g ? 2 : nz(rg[1])

buy11 = 0

buy11 := r ? 0 : g ? 1 : nz(buy11[1])

sell11 = 0

sell11 := r ? 1 : g ? 0 : nz(sell11[1])

buy = buy11 and not buy11[1]

sell = sell11 and not sell11[1]

multiple_signals = input(true)

if multiple_signals

buy := g and not g[1] and window()

sell := r and not r[1] and window()

sell

else

buy := buy and window()

sell := sell and window()

sell

//plotshape(long , color = color.green , text = "Buy" , location = location.belowbar , textcolor = color.white , style = shape.labelup , size = size.small)

//plotshape(short , color = color.red , text = "Sell" , location = location.abovebar , textcolor = color.white , style = shape.labeldown , size = size.small)

Stop = input(0.5, title='StopLoss') / 100

ProfitPerc = input(defval=1.5, title='Profit') / 100

rev = input(1024,title = "Reverse Limit")

Averaging_position_ = input(true , title = "Averaging position ? ")

qn = 1

qn := nz(qn[1])

long_short = 0

long_last = buy and (nz(long_short[1]) == 0 or nz(long_short[1]) == -1)

short_last = sell and (nz(long_short[1]) == 0 or nz(long_short[1]) == 1)

long_short := long_last ? 1 : short_last ? -1 : long_short[1]

long_entered = false

long_entered := long_entered[1]

short_entered = false

short_entered := short_entered[1]

longPrice = ta.valuewhen(long_last, close, 0)

shortPrice = ta.valuewhen(short_last, close, 0)

longStop = longPrice * (1 - Stop)

shortStop = shortPrice * (1 + Stop)

longTake = longPrice * (1 + ProfitPerc)

shortTake = shortPrice * (1 - ProfitPerc)

plot(long_short == 1 ? longStop : na, style=plot.style_linebr, color=color.new(color.red, 0), linewidth=1, title='Long Fixed SL')

plot(long_short == -1 ? shortStop : na, style=plot.style_linebr, color=color.new(color.red, 0), linewidth=1, title='Short Fixed SL')

plot(long_short == 1 ? longTake : na, style=plot.style_linebr, color=color.new(color.navy, 0), linewidth=1, title='Long Fixed TP')

plot(long_short == -1 ? shortTake : na, style=plot.style_linebr, color=color.new(color.navy, 0), linewidth=1, title='Short Fixed TP')

longBar1 = ta.barssince(long_last)

longBar2 = longBar1 >= 1 ? true : false

shortBar1 = ta.barssince(short_last)

shortBar2 = shortBar1 >= 1 ? true : false

longSLhit = long_short == 1 and longBar2 and low < longStop

if long_entered and sell

longSLhit := true

longSLhit

plotshape(longSLhit and not(sell and not short_entered and long_entered), style=shape.labelup, location=location.belowbar, color=color.new(color.gray, 0), size=size.tiny, title='Stop Loss', text='Long SL', textcolor=color.new(color.white, 0))

shortSLhit = long_short == -1 and shortBar2 and high > shortStop

if short_entered and buy

shortSLhit := true

shortSLhit

plotshape(shortSLhit and not(buy and not long_entered and short_entered), style=shape.labeldown, location=location.abovebar, color=color.new(color.gray, 0), size=size.tiny, title='Stop Loss', text='Short SL', textcolor=color.new(color.white, 0))

longTPhit = long_short == 1 and longBar2 and high > longTake

plotshape(longTPhit, style=shape.labeldown, location=location.abovebar, color=color.new(color.navy, 0), size=size.tiny, title='Target', text='Long TP', textcolor=color.new(color.white, 0))

shortTPhit = long_short == -1 and shortBar2 and low < shortTake

plotshape(shortTPhit, style=shape.labelup, location=location.belowbar, color=color.new(color.navy, 0), size=size.tiny, title='Target', text='Short TP', textcolor=color.new(color.white, 0))

long_short := (long_short == 1 or long_short == 0) and longBar2 and (longSLhit or longTPhit) ? 0 : (long_short == -1 or long_short == 0) and shortBar2 and (shortSLhit or shortTPhit) ? 0 : long_short

if(shortSLhit or longSLhit or (long_entered[1] and sell) or (short_entered[1] and buy ))

qn := qn*2

if(longTPhit or shortTPhit or qn > rev)

qn := 1

if Averaging_position_

qn := 1

plotshape(buy and not long_entered, color=color.new(color.green, 0), style=shape.labelup, text='Buy', textcolor=color.new(color.white, 0), location=location.belowbar)

plotshape(sell and not short_entered, color=color.new(color.red, 0), style=shape.labeldown, text='Sell', textcolor=color.new(color.white, 0), location=location.abovebar)

// plotshape(buy and not(long_entered) and (short_entered), color = color.green , style = shape.labelup , text = "FA Buy" , textcolor = color.white , location = location.belowbar)

// plotshape(sell and not(short_entered) and (long_entered), color = color.red , style = shape.labeldown , text = "FA Sell" , textcolor = color.white , location = location.abovebar)

// alertcondition(condition=buy and not(long_entered) and (short_entered), title="Fully Algo Buy")

// alertcondition(condition=sell and not(short_entered) and (long_entered), title="Fully Algo sell")

alertcondition(condition=buy and not long_entered, title='Buy')

alertcondition(condition=sell and not short_entered, title='Sell')

if long_last

long_entered := true

short_entered := false

short_entered

if short_last

short_entered := true

long_entered := false

long_entered

alertcondition(condition=longSLhit and not(sell and not short_entered and long_entered), title='Long SL')

alertcondition(condition=shortSLhit and not(buy and not long_entered and short_entered), title='Short SL')

alertcondition(condition=longTPhit, title='Long TP')

alertcondition(condition=shortTPhit, title='Short TP')

if longSLhit or longTPhit

long_entered := false

long_entered

if shortSLhit or shortTPhit

short_entered := false

short_entered

// if buy

// strategy.entry('buy', strategy.long)

// strategy.exit('exit', 'buy', limit=longTake, stop=longStop)

// if sell

// strategy.entry('sell', strategy.short)

// strategy.exit('exit', 'sell', limit=shortTake, stop=shortStop)

if(buy)

strategy.entry("buy",strategy.long,qty = qn)

strategy.exit("Stop","buy",limit = longTake,stop = longStop)

if(sell)

strategy.entry("sell",strategy.short,qty = qn)

strategy.exit("Stop","sell",limit = shortTake,stop = shortStop)

strategy.close("buy",when = longTPhit or sell or longSLhit, comment = "Target")

strategy.close("sell",when = shortSLhit or shortTPhit or buy , comment = "Stop Loss")

strategy.cancel("buy",when = longTPhit or sell or longSLhit)

strategy.cancel("sell",when = shortSLhit or shortTPhit or buy )