概述

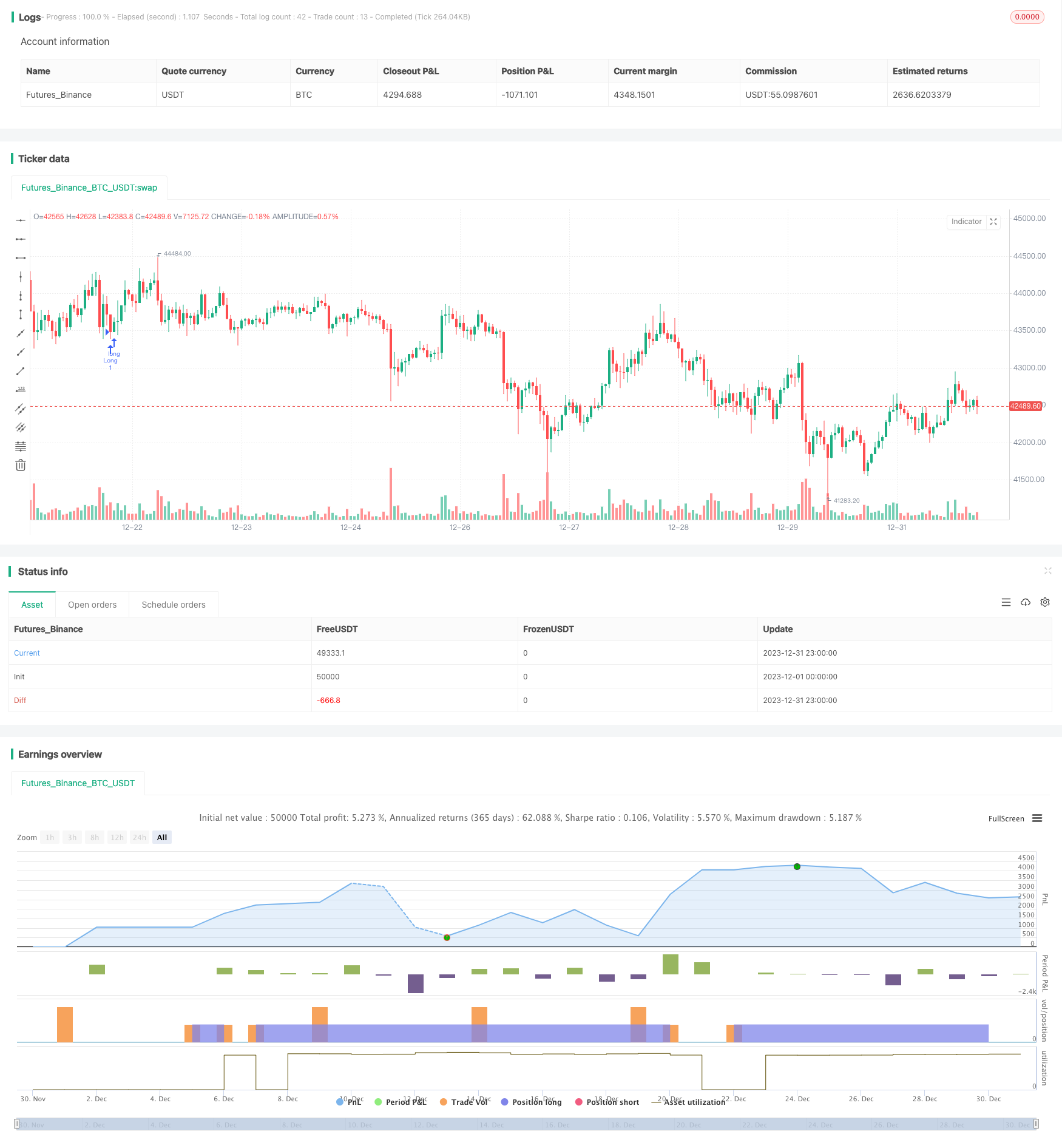

本策略是基于Bollinger Bands指标和相对强弱指数(RSI)指标的量化交易策略。该策略运用机器学习的方法,通过Python语言对近1年的历史数据进行了回测优化,找到了最优的参数组合。

策略原理

该策略的交易信号来源于双重Bollinger Bands和RSI指标的综合判断。其中,Bollinger Bands指标是根据价格的标准差带计算得到的波动通道。当价格接近或触及波动通道时产生交易信号。而RSI指标则判断价格的超买超卖情况。

具体来说,当收盘价低于1.0标准差下轨,同时RSI大于42时产生买入信号。当收盘价高于1.0标准差上轨,同时RSI大于70时产生卖出信号。此外,该策略还设置了两组BB和RSI的参数,分别用于进场和止损平仓。这些参数都是通过大量回测和机器学习获得的最优值。

优势分析

这套策略最大的优势在于参数的精确程度。通过机器学习的方法,各个参数都是经过全面回测获得最佳 Sharpe比率的。这样既确保了策略收益率,也控制了风险。此外,双重指标组合也提高了信号的准确性和胜率。

风险分析

该策略的风险主要来源于止损点的设置。如果止损点设置过大,则无法有效控制损失。此外,如果止损点与手续费、交易滑点等其他交易成本计算不当也会增加风险。为减少风险,建议调整止损幅度参数,降低交易频率,同时计算合理的止损位置。

优化方向

这套策略还有进一步优化的空间。例如可以尝试改变Bollinger Bands的长度参数,或者调整RSI的超买超卖阈值。此外也可以尝试引入其他指标,构建多指标组合。这可能会提高策略的盈利空间和稳定性。

总结

该策略结合双重BB指标和RSI指标,通过机器学习方法获得了最优参数,实现了高收益率和可控的风险水平。它具有指标组合判断和参数优化两个方面的优势。通过持续改进,这套策略有望成为一个优秀的量化交易策略。

策略源码

/*backtest

start: 2023-12-01 00:00:00

end: 2023-12-31 23:59:59

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// @version=4

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © Bunghole 2020

strategy(overlay=true, shorttitle="Flawless Victory Strategy" )

// Stoploss and Profits Inputs

v1 = input(true, title="Version 1 - Doesn't Use SL/TP")

v2 = input(false, title="Version 2 - Uses SL/TP")

stoploss_input = input(6.604, title='Stop Loss %', type=input.float, minval=0.01)/100

takeprofit_input = input(2.328, title='Take Profit %', type=input.float, minval=0.01)/100

stoploss_level = strategy.position_avg_price * (1 - stoploss_input)

takeprofit_level = strategy.position_avg_price * (1 + takeprofit_input)

//SL & TP Chart Plots

plot(v2 and stoploss_input and stoploss_level ? stoploss_level: na, color=color.red, style=plot.style_linebr, linewidth=2, title="Stoploss")

plot(v2 and takeprofit_input ? takeprofit_level: na, color=color.green, style=plot.style_linebr, linewidth=2, title="Profit")

// Bollinger Bands 1

length = 20

src1 = close

mult = 1.0

basis = sma(src1, length)

dev = mult * stdev(src1, length)

upper = basis + dev

lower = basis - dev

// Bollinger Bands 2

length2 = 17

src2 = close

mult2 = 1.0

basis2 = sma(src1, length2)

dev2 = mult2 * stdev(src2, length2)

upper2 = basis2 + dev2

lower2 = basis2 - dev2

// RSI

len = 14

src = close

up = rma(max(change(src), 0), len)

down = rma(-min(change(src), 0), len)

rsi = down == 0 ? 100 : up == 0 ? 0 : 100 - 100 / (1 + up / down)

// Strategy Parameters

RSILL= 42

RSIUL= 70

RSILL2= 42

RSIUL2= 76

rsiBuySignal = rsi > RSILL

rsiSellSignal = rsi > RSIUL

rsiBuySignal2 = rsi > RSILL2

rsiSellSignal2 = rsi > RSIUL2

BBBuySignal = src < lower

BBSellSignal = src > upper

BBBuySignal2 = src2 < lower2

BBSellSignal2 = src2 > upper2

// Strategy Long Signals

Buy = rsiBuySignal and BBBuySignal

Sell = rsiSellSignal and BBSellSignal

Buy2 = rsiBuySignal2 and BBBuySignal2

Sell2 = rsiSellSignal2 and BBSellSignal2

if v1 == true

strategy.entry("Long", strategy.long, when = Buy, alert_message = "v1 - Buy Signal!")

strategy.close("Long", when = Sell, alert_message = "v1 - Sell Signal!")

if v2 == true

strategy.entry("Long", strategy.long, when = Buy2, alert_message = "v2 - Buy Signal!")

strategy.close("Long", when = Sell2, alert_message = "v2 - Sell Signal!")

strategy.exit("Stoploss/TP", "Long", stop = stoploss_level, limit = takeprofit_level)