概述

这个策略运用三种不同的技术指标进行组合,构建一个多时间框架的套利策略,通过在不同的时间周期上捕捉价格趋势,实现低风险的超额收益。

策略原理

该策略运用的三种技术指标分别是凯尔特通道(KC)、波动率止损(Vstop)和威廉聚会聚会指标(WAE)。凯尔特通道用于判断价格是否处于通道范围之外,因而发出交易信号。波动率止损用于动态调整止损位置,在保证止损的同时减少不必要的止损。威廉指标用于判断价格是否处于强势方向。具体来说:

当价格高于凯尔特通道上轨时,视为看涨信号。当价格低于凯尔特通道下轨时,视为看跌信号。

波动率止损根据价格波动率和通道宽度来设置止损位置。它能够动态调整,在保证止损的同时,避免过于保守的止损位置。

威廉指标通过计算MACD和布林带通道宽度,判断价格是否处于强势上涨或下跌趋势中。

通过组合这三种指标,不同时间周期上的信号实现互相验证。这减少了误判的概率,构建一个稳定优化的策略逻辑。

优势分析

该策略最大的优势在于多指标组合带来的精确交易信号。三种指标在不同的时间周期上作用,互相验证,可以有效降低误判概率,增强信号的准确性。此外,波动率止损设置是动态的,能够根据实时波动调整止损位置,进一步控制风险。

相比单一指标策略,该组合策略可以提供更加精准和高效率的交易信号。同时,三种指标相互配合,在多时间框架内形成交易判断,这一逻辑设计非常科学合理,值得借鉴。

风险分析

该策略的主要风险在于参数设置不当可能导致过拟合。三个指标共有8个参数,设置不当都可能对策略产生不利影响。此外,指标之间的权重关系也需要合理配置,否则信号可能相互抵消,导致无效。

为降低这些风险,参数设定过程中需要充分考虑不同市场环境的适应性,通过回测分析调整至最优参数组合。此外应适当调整指标之间权重关系,确保交易信号能够有效触发。当出现连续亏损时,也需要考虑降低仓位规模,控制损失。

优化方向

该策略的优化空间主要集中在两个方面:参数调优和止损策略改进。具体来说可以从以下几个方面入手:

更科学合理地选择指标参数,优化参数组合。可以借助算法按照收益最大化、风险最小化等目标寻找最优参数。

改进止损策略,在保证止损的前提下,进一步减少不必要的止损,提高胜率。例如结合更多指标作为止损信号,或设定止损位置的渐进回调。

优化指标的权重关系和交易信号的判断逻辑,降低误判率。可以引入更多价格行为特征,构建更稳定可靠的判断规则。

尝试引入机器学习模型,实现参数自动优化。或使用深度强化学习编程进行策略评估与改进。

总结

本策略通过凯尔特通道、波动率止损和威廉指标三者的组合运用,构建一个跨时间框架的套利系统。多指标组合提高了交易信号准确性,动态止损控制了风险。但参数设定和优化方面仍有改进空间。总体而言,该策略科学性强,值得进一步研究与应用。

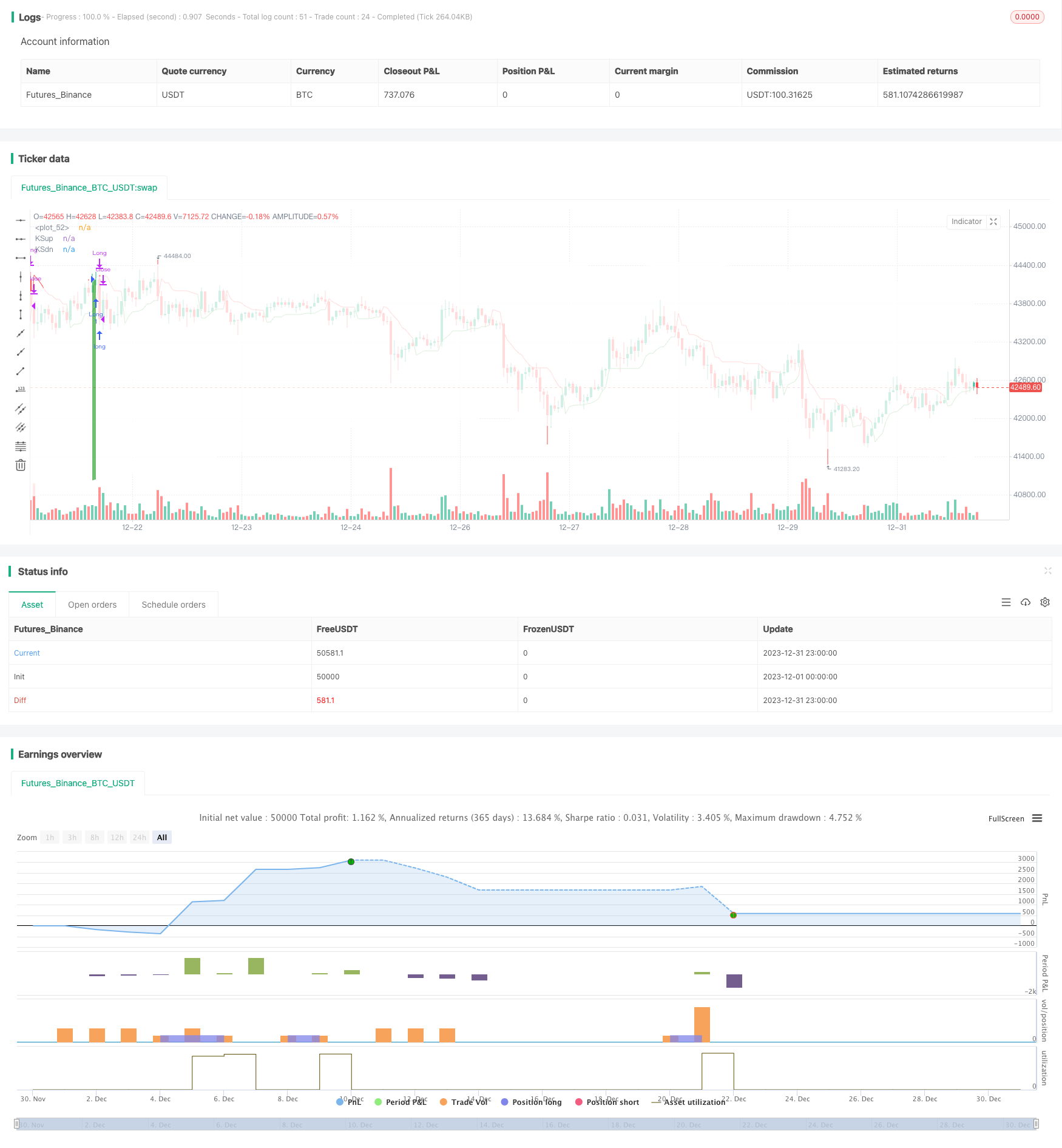

/*backtest

start: 2023-12-01 00:00:00

end: 2023-12-31 23:59:59

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=4

strategy("QuarryLake", overlay=true) ///Ultilized modified full kelly for this strategy = 36%

///Keltner channel///

nPeriod = input(title="Keltner Period", type=input.integer, defval=200, minval=1)

Mult = input(title="Keltner Mult", type=input.integer, defval=5, minval=1)

xPrice = ema(hlc3, nPeriod)

xMove = ema(high - low, nPeriod)

xMoveMult = xMove * Mult

xUpper = xPrice + xMoveMult

xLower = xPrice - xMoveMult

// plot(xPrice, color=red, title="KSmid")

p1 = plot(xUpper, color=color.white, title="KSup")

p2 = plot(xLower, color=color.white, title="KSdn")

fill(p1, p2, color=close > xUpper ? color.green : close < xLower ? color.red : color.white)

kclongcondition = close > xUpper

kcshortcondition = close < xLower

kccloselongcondition = crossunder(close, xUpper)

kccloseshortcondition = crossover(close, xLower)

///Volatility Stop///

length = input(title="Vstop length", type=input.integer, defval=3, minval=1)

mult1 = 1.5

atr_ = atr(length)

max1 = 0.0

min1 = 0.0

is_uptrend_prev = false

stop = 0.0

vstop_prev = 0.0

vstop1 = 0.0

is_uptrend = false

is_trend_changed = false

max_ = 0.0

min_ = 0.0

vstop = 0.0

max1 := max(nz(max_[1]), close)

min1 := min(nz(min_[1]), close)

is_uptrend_prev := nz(is_uptrend[1], true)

stop := is_uptrend_prev ? max1 - mult1 * atr_ : min1 + mult1 * atr_

vstop_prev := nz(vstop[1])

vstop1 := is_uptrend_prev ? max(vstop_prev, stop) : min(vstop_prev, stop)

is_uptrend := close - vstop1 >= 0

is_trend_changed := is_uptrend != is_uptrend_prev

max_ := is_trend_changed ? close : max1

min_ := is_trend_changed ? close : min1

vstop := is_trend_changed ? is_uptrend ? max_ - mult1 * atr_ : min_ + mult1 * atr_ :

vstop1

plot(vstop, color=is_uptrend ? color.green : color.red, style=plot.style_line, linewidth=1)

vstoplongcondition = close > vstop

vstoplongclosecondition = crossunder(close, vstop)

vstopshortcondition = close < vstop

vstopshortclosecondition = crossover(close, vstop)

///Waddah Attar Explosion///

sensitivity = input(150, title="Sensitivity")

fastLength = input(20, title="FastEMA Length")

slowLength = input(40, title="SlowEMA Length")

channelLength = input(20, title="BB Channel Length")

mult = input(2.0, title="BB Stdev Multiplier")

DEAD_ZONE = nz(rma(tr(true), 100)) * 3.7

calc_macd(source, fastLength, slowLength) =>

fastMA = ema(source, fastLength)

slowMA = ema(source, slowLength)

fastMA - slowMA

calc_BBUpper(source, length, mult) =>

basis = sma(source, length)

dev = mult * stdev(source, length)

basis + dev

calc_BBLower(source, length, mult) =>

basis = sma(source, length)

dev = mult * stdev(source, length)

basis - dev

t1 = (calc_macd(close, fastLength, slowLength) -

calc_macd(close[1], fastLength, slowLength)) * sensitivity

t2 = (calc_macd(close[2], fastLength, slowLength) -

calc_macd(close[3], fastLength, slowLength)) * sensitivity

e1 = calc_BBUpper(close, channelLength, mult) -

calc_BBLower(close, channelLength, mult)

trendUp = t1 >= 0 ? t1 : 0

trendDown = t1 < 0 ? -1 * t1 : 0

waelongcondition = trendUp and trendUp > DEAD_ZONE and trendUp > e1

waeshortcondition = trendDown and trendDown > DEAD_ZONE and trendDown > e1

///Long Entry///

longcondition = kclongcondition and vstoplongcondition and waelongcondition

if longcondition

strategy.entry("Long", strategy.long)

///Long exit///

closeconditionlong = kccloselongcondition or vstoplongclosecondition

if closeconditionlong

strategy.close("Long")

///Short Entry///

shortcondition = kcshortcondition and vstopshortcondition and waeshortcondition

if shortcondition

strategy.entry("Short", strategy.short)

///Short exit///

closeconditionshort = kccloseshortcondition or vstopshortclosecondition

if closeconditionshort

strategy.close("Short")

///Free Hong Kong, the revolution of our time///