概述

该策略基于20日指数移动平均线(EMA)构建通道,当价格突破通道上沿时做多,当价格跌破通道下沿时做空,属于趋势跟踪策略。

策略原理

- 计算20日EMA的高点和低点,构建通道。

- 当收盘价大于20日EMA高点时,做多。

- 当收盘价小于20日EMA低点时,做空。

- 止损点为通道的另一端,如做多止损为20日EMA低点。

优势分析

- 使用EMA构建通道,可以有效跟踪趋势。

- 20日EMA参数简单实用。

- 采用突破做信号,可以减少错误交易。

- 止损点设置合理,最大程度控制风险。

风险分析

- 突破信号可能出现误报。

- 震荡行情中容易止损。

- 参数不当可能导致过于灵敏或迟钝。

风险解决方法:

- 结合其他指标过滤信号。

- 优化参数,适应不同周期。

- 谨慎操作,注意资金管理。

优化方向

- 结合量价指标过滤错误信号。

- 测试不同EMA周期参数的效果。

- 增加移动止损来锁定盈利。

- 结合波动率指标判断趋势强弱。

总结

该策略整体简单实用,基于EMA通道构建,属于典型的趋势跟踪策略。有突破做信号的特点,但也存在一定的误报风险。可以通过优化参数、增加过滤器等方式提高策略效果,值得进一步测试与优化。

策略源码

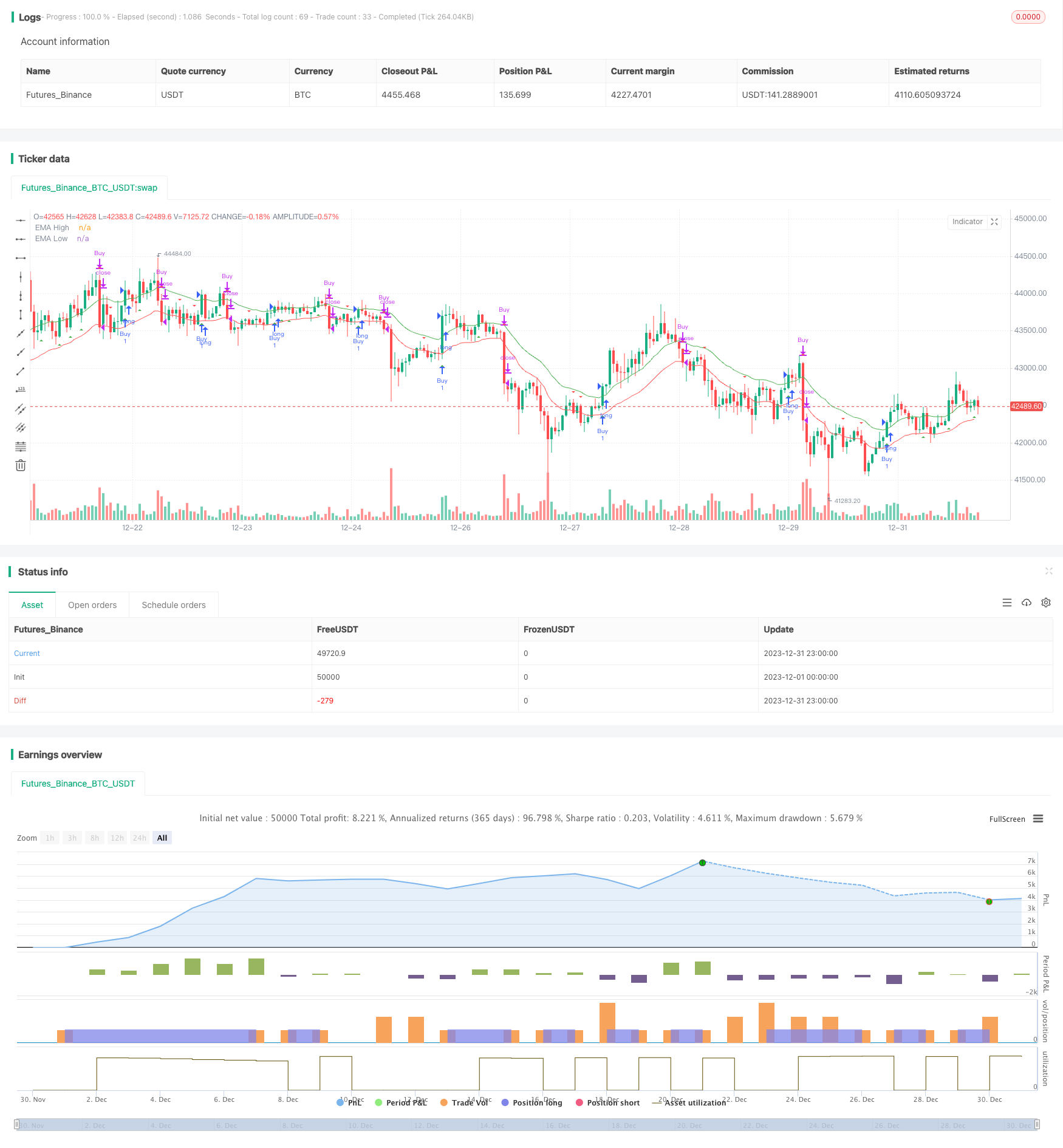

/*backtest

start: 2023-12-01 00:00:00

end: 2023-12-31 23:59:59

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=4

strategy("EMA Channel Strategy with Alerts", shorttitle="EMA Channel", overlay=true)

// Define EMA length

emaLength = 20

// Calculate EMA values

emaHigh = ema(high, emaLength)

emaLow = ema(low, emaLength)

// Define the condition for a buy signal

buyCondition = crossover(close, emaHigh)

// Define the condition for a sell signal

sellCondition = crossunder(close, emaLow)

// Plot the EMA lines

plot(emaHigh, color=color.green, title="EMA High")

plot(emaLow, color=color.red, title="EMA Low")

// Plot buy and sell signals

plotshape(buyCondition, style=shape.triangleup, location=location.belowbar, color=color.green, title="Buy Signal")

plotshape(sellCondition, style=shape.triangledown, location=location.abovebar, color=color.red, title="Sell Signal")

// Strategy

strategy.entry("Buy", strategy.long, when=buyCondition)

strategy.close("Buy", when=sellCondition)

// Define and trigger alerts

alertcondition(buyCondition, title="Buy Alert", message="Buy signal - Price crossed above EMA High")

alertcondition(sellCondition, title="Sell Alert", message="Sell signal - Price crossed below EMA Low")