概述

这是一个基于 LazyBear 的动量挤压指标开发的量化交易策略。该策略集成了布林带、卡尔金通道以及动量指标,通过多种技术指标的组合,实现高胜率的动量突破交易。

策略原理

该策略的核心指标是 LazyBear 的动量挤压指标。该指标判断布林带是否被卡尔金通道所“挤压”,当挤压发生时,代表着市场进入一个潜在的爆发点。配合动量指标判断方向后,可以在挤压释放的时候捕捉市场的爆发行情。

具体来说,该策略首先计算 21 周期的布林带,带宽为价格标准差的 2 倍。同时计算 20 周期的卡尔金通道,带宽为价格振幅的 1.5 倍。当布林带被卡尔金通道“挤压”时,发出挤压信号。此外,该策略还计算一段时间内价格相对其自身价格通道中点的动量。当挤压发生时,结合动量指标的方向性,判断买入还是卖出。

在出场上,当动量指标颜色变为灰色,平掉仓位,代表挤压状态结束,趋势可能反转。

策略优势

- 集成多种技术指标,提高交易决策的准确性

该策略集成了布林带、卡尔金通道以及动量指标,通过判断这些指标的综合关系,可以提高交易决策的准确性,降低错误交易的概率。

- 动量挤压点位准确,潜在获利空间大

动量挤压策略可以捕捉到市场爆发的关键点位,这些点位往往是市场做出重要方向判断的拐点,如果判断正确,那么随后的行情运行会比较长,因此策略的潜在获利空间很大。

- 实现高成功率的突破交易

相比随机的突破交易,该策略选择的入场点位处于布林带与卡尔金通道的挤压点,通过指标集成判断,交易成功率很高。

策略风险

- 布林带和卡尔金通道参数设置风险

布林带和卡尔金通道的周期参数及带宽参数设置会对策略交易结果有很大影响。如果参数设置不当,会导致误判。这需要通过大量回测找到最佳参数。

- 突破失败风险

任何突破交易都有失败的风险,当价格突破该策略选择的点位后,还有可能再次回调,造成损失。这需要严格止损来控制。

- 趋势反转风险

当挤压状态结束时,该策略会平掉所有仓位。但是有时价格趋势仍然可能会延续,这会造成策略提前离场的风险。这需要优化出场判断逻辑。

策略优化方向

- 优化参数设置

可以通过更大量的回测数据试错,寻找布林带和卡尔金通道更佳的参数周期及带宽设置,以提高策略效果。

- 增加止损策略

可以设置移动止损或者振荡止损,在价格反转时快速止损,以控制策略最大回撤。

- 增加再入场条件

当策略退出仓位后,可以设置一定的再入场条件,在趋势继续延续时,可以再次进入场内。

- 结合更多指标

可以尝试结合更多不同类型的指标,如其他波动性指标、成交量指标等,建立一个指标集成的复合策略,以提高决策的准确性。

总结

该策略集成布林带、卡尔金通道及动量指标,通过判断这些指标关系,选择高成功率的突破点位入场。在参数优化、止损策略、再入场条件以及复合指标集成等多个方面都有优化空间,可以进一步提升策略效果。

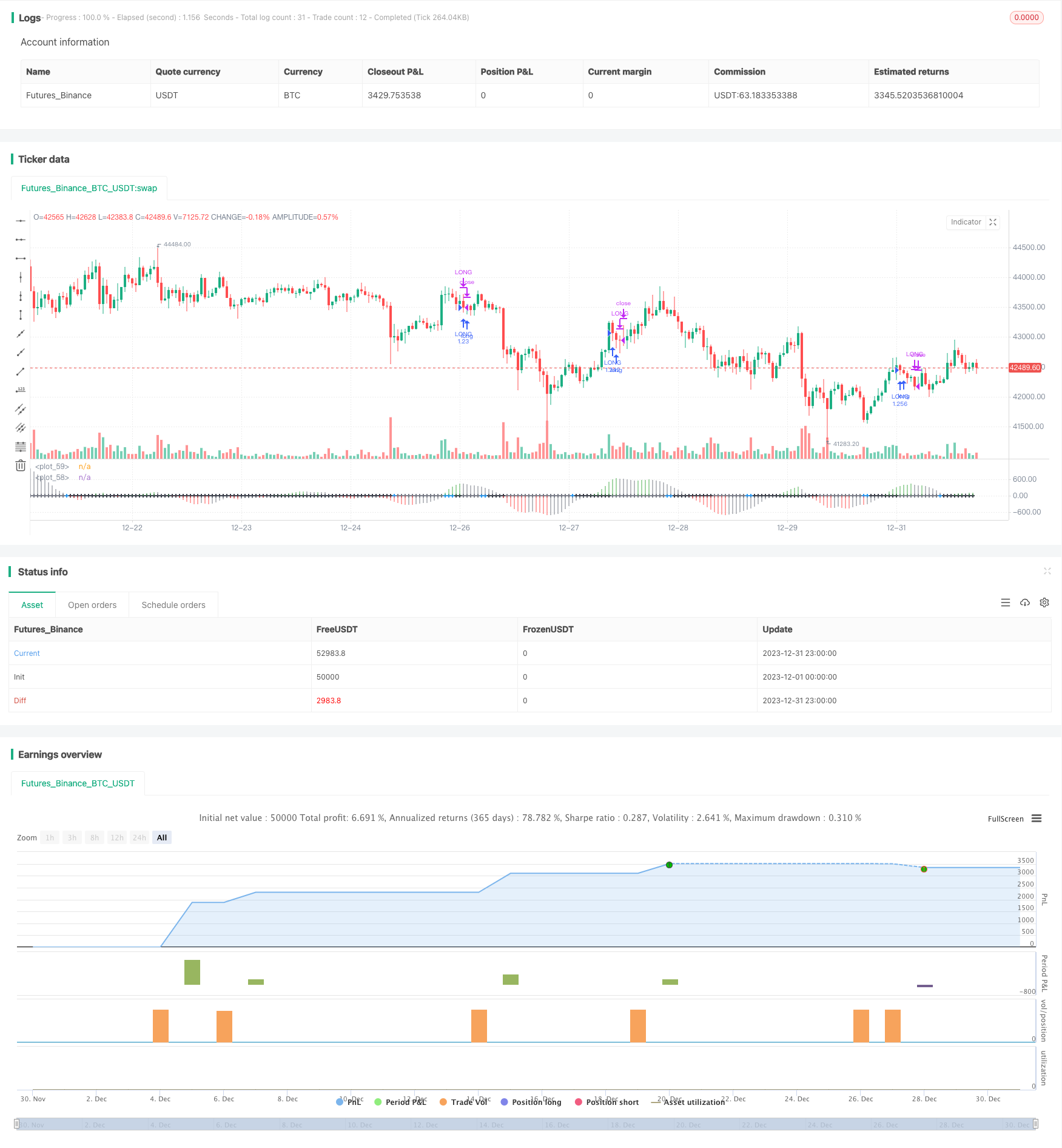

/*backtest

start: 2023-12-01 00:00:00

end: 2023-12-31 23:59:59

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=4

//All credits to LazyBear. All I did was turn it into a strategy!

strategy(title = "SQZMOM STRAT", overlay=false)

// --- GENERAL INPUTS ---

FromMonth = input(defval = 4, title = "From Month", minval = 1, maxval = 12)

FromYear = input(defval = 2020, title = "From Year", minval = 2012)

ToMonth = input(defval = 1, title = "To Month", minval = 1, maxval = 12)

ToYear = input(defval = 9999, title = "To Year", minval = 2017)

FromDay = 1

ToDay = 1

start = timestamp(FromYear, FromMonth, FromDay, 00, 00) // backtest start window

finish = timestamp(ToYear, ToMonth, ToDay, 23, 59) // backtest finish window

window() => true

get_round(value, precision) => round(value * (pow(10, precision))) / pow(10, precision)

trade_leverage = input(1, title = "Trade - Leverage", step = 0.25)

trade_risk = input(100, title = "Trade - Risk Percent", type = input.float, step = 0.1, minval = 0.1, maxval = 100)

tradeType = input("LONG", title="What trades should be taken : ", options=["LONG", "SHORT", "BOTH"])

// --- SQZMOM CODE

length = input(21, title="BB Length")

mult = input(2.0,title="BB MultFactor")

lengthKC=input(20, title="KC Length")

multKC = input(1.5, title="KC MultFactor")

useTrueRange = input(true, title="Use TrueRange (KC)", type=input.bool)

// Calculate BB

source = close

basis = sma(source, length)

dev = multKC * stdev(source, length)

upperBB = basis + dev

lowerBB = basis - dev

// Calculate KC

ma = sma(source, lengthKC)

range = useTrueRange ? tr : (high - low)

rangema = sma(range, lengthKC)

upperKC = ma + rangema * multKC

lowerKC = ma - rangema * multKC

sqzOn = (lowerBB > lowerKC) and (upperBB < upperKC)

sqzOff = (lowerBB < lowerKC) and (upperBB > upperKC)

noSqz = (sqzOn == false) and (sqzOff == false)

val = linreg(source - avg(avg(highest(high, lengthKC), lowest(low, lengthKC)),sma(close,lengthKC)), lengthKC,0)

bcolor = color.gray

if (val > 0 and val > nz(val[1]))

bcolor := color.green

if (val < 0 and val < nz(val[1]))

bcolor := color.red

scolor = noSqz ? color.blue : sqzOn ? color.black : color.gray

plot(val, color=bcolor, style=plot.style_histogram, linewidth=4)

plot(0, color=scolor, style=plot.style_cross, linewidth=2)

// --- VWMA CODE ---

useVWMA = input(false, title = "Use VWMA to selectively long/short?", type = input.bool)

lengthVWMA=input(42, title = "VWMA Length", step = 1, minval = 1)

useCV=input(false, type=input.bool, title="Use Cumulative Volume for VWMA?")

nbfs = useCV ? cum(volume) : sum(volume, lengthVWMA)

medianSrc=close

calc_evwma(price, lengthVWMA, nb_floating_shares) => data = (nz(close[1]) * (nb_floating_shares - volume)/nb_floating_shares) + (volume*price/nb_floating_shares)

m=calc_evwma(medianSrc, lengthVWMA, nbfs)

// ---STRATEGY---

if ((tradeType == "LONG" or tradeType == "BOTH") and (m>0 or useVWMA == false))

longCondition = (val > 0 and noSqz == 0 and sqzOn == 0 and sqzOn[1] == 1)

if (longCondition)

contracts = get_round((strategy.equity * trade_leverage / close) * (trade_risk / 100), 4)

strategy.entry("LONG", strategy.long, qty = contracts, when = window())

if((tradeType == "SHORT" or tradeType == "BOTH") and (m<0 or useVWMA == false))

shortCondition = (val < 0 and noSqz == 0 and sqzOn == 0 and sqzOn[1] == 1)

if (shortCondition)

contracts = get_round((strategy.equity * trade_leverage / close) * (trade_risk / 100), 4)

strategy.entry("SHORT", strategy.short, qty = contracts, when = window())

if (bcolor == color.gray)

strategy.close("LONG")

strategy.close("SHORT")