概述

双ATR尾随止损策略是基于平均真实波幅(ATR)指标的一个短线交易策略。该策略同时设置快速ATR线和慢速ATR线两个止损线,根据两条止损线的交叉情况判断入场和出场。策略简单易懂,响应迅速,适合高波动的市场。

策略原理

该策略主要利用ATR指标来设置两条止损线。一条是快速ATR线,ATR周期短,乘数小,反应迅速;另一条是慢速ATR线,ATR周期长,乘数大,起到过滤的作用。当快速ATR线上穿慢速ATR线时产生买入信号;当快速ATR线下穿慢速ATR线时产生卖出信号。这样通过两条ATR线交叉决定入场出场,可以有效控制止损。

具体操作逻辑是:计算快速ATR线和慢速ATR线;快速线价格高于慢速线则用快速线尾随止损,否则用慢速线尾随止损。Kline颜色表示目前使用的止损线,绿色和蓝色表示用快速线止损,红色和黄色表示用慢速线止损。当市场价格触碰到止损线则出场。

优势分析

双ATR尾随止损策略具有以下优势:

- 操作逻辑简单清晰,容易理解实现。

- 快速响应市场变化,适合高波动的市场。

- 双ATR止损控制风险,有效止损。

- ATR指标参数化,可以调整止损幅度。

- 可视化的Kline颜色清晰表示止损情况。

风险分析

该策略也存在一些风险:

- 容易出现过频交易的情况。

- ATR指标对曲线拟合性差,可能出现放大损失。

- 无法有效过滤横盘和趋势两个市场阶段。

可以通过优化ATR周期,调整ATR乘数,结合其他指标过滤等方法来减小这些风险。

优化方向

双ATR尾随止损策略可进一步优化的方向包括:

- 优化ATR参数,调整止损幅度。

- 增加过滤指标,避免无效交易。例如增加均线指标判断趋势。

- 增加开仓条件,避免误交易。例如增加交易量能量指标。

- 增加持仓时间 exits,避免过于频繁交易。

总结

双ATR尾随止损策略整体易于理解实现,特别适合高波动率的场景,可以有效进行风险控制。优化空间也较大,可通过参数调整、加入过滤器等方法进行提升。是一种值得推荐的短线策略。

策略源码

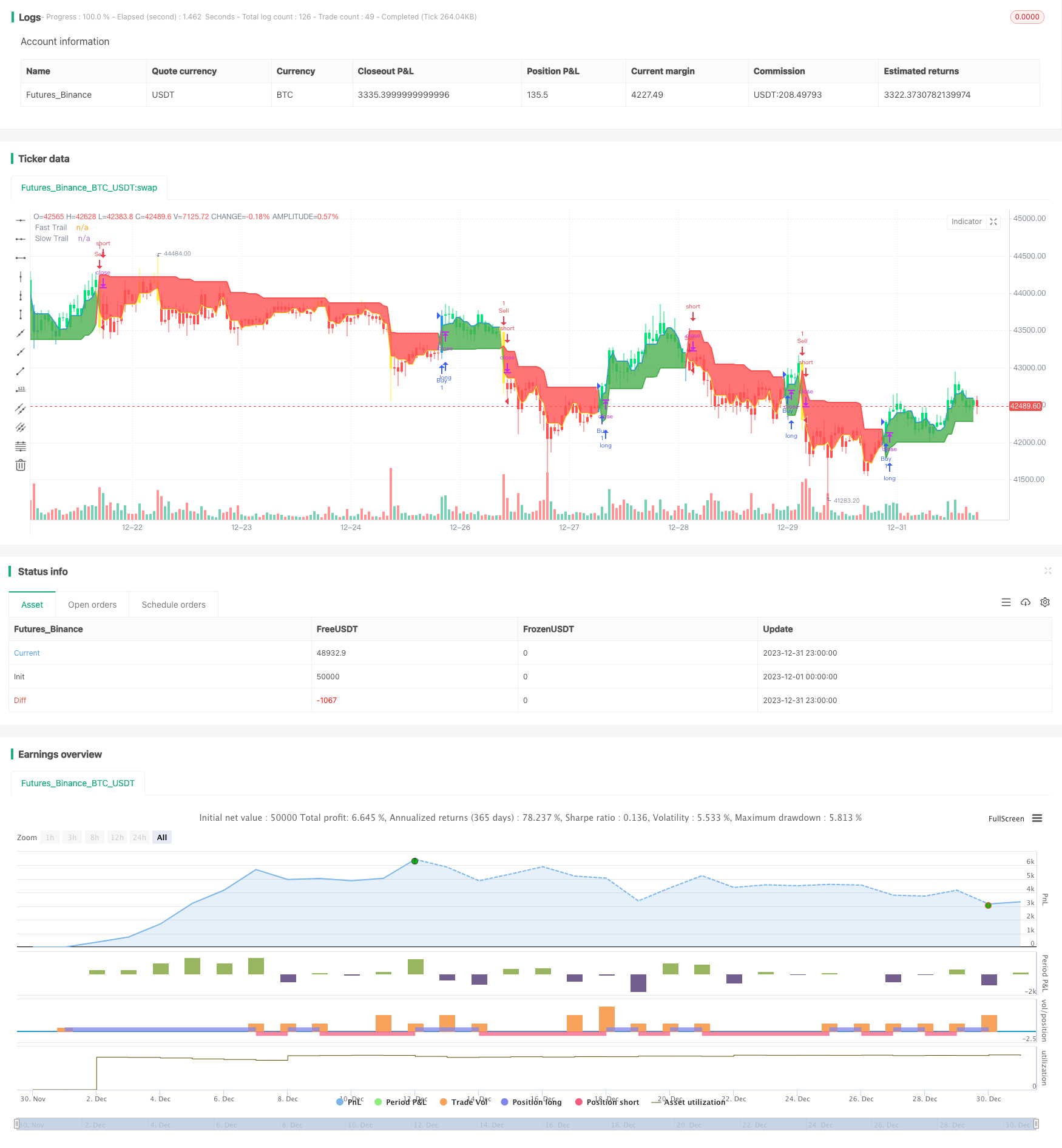

/*backtest

start: 2023-12-01 00:00:00

end: 2023-12-31 23:59:59

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © ceyhun

//@version=4

strategy("ATR Trailing Stop Strategy by ceyhun", overlay=true)

/////////notes////////////////////////////////////////

// This is based on the ATR trailing stop indicator //

// width addition of two levels of stops and //

// different interpretation. //

// This is a fast-reacting system and is better //

// suited for higher volatility markets //

//////////////////////////////////////////////////////

SC = input(close, "Source", input.source)

// Fast Trail //

AP1 = input(5, "Fast ATR period", input.integer) // ATR Period

AF1 = input(0.5, "Fast ATR multiplier", input.float) // ATR Factor

SL1 = AF1 * atr(AP1) // Stop Loss

Trail1 = 0.0

Trail1 := iff(SC > nz(Trail1[1], 0) and SC[1] > nz(Trail1[1], 0), max(nz(Trail1[1], 0), SC - SL1), iff(SC < nz(Trail1[1], 0) and SC[1] < nz(Trail1[1], 0), min(nz(Trail1[1], 0), SC + SL1), iff(SC > nz(Trail1[1], 0), SC - SL1, SC + SL1)))

// Slow Trail //

AP2 = input(10, "Slow ATR perod", input.integer) // ATR Period

AF2 = input(2, "Slow ATR multiplier", input.float) // ATR Factor

SL2 = AF2 * atr(AP2) // Stop Loss

Trail2 = 0.0

Trail2 := iff(SC > nz(Trail2[1], 0) and SC[1] > nz(Trail2[1], 0), max(nz(Trail2[1], 0), SC - SL2), iff(SC < nz(Trail2[1], 0) and SC[1] < nz(Trail2[1], 0), min(nz(Trail2[1], 0), SC + SL2), iff(SC > nz(Trail2[1], 0), SC - SL2, SC + SL2)))

// Bar color for trade signal //

Green = Trail1 > Trail2 and close > Trail2 and low > Trail2

Blue = Trail1 > Trail2 and close > Trail2 and low < Trail2

Red = Trail2 > Trail1 and close < Trail2 and high < Trail2

Yellow = Trail2 > Trail1 and close < Trail2 and high > Trail2

// Signals //

Bull = barssince(Green) < barssince(Red)

Bear = barssince(Red) < barssince(Green)

Buy = crossover(Trail1, Trail2)

Sell = crossunder(Trail1, Trail2)

TS1 = plot(Trail1, "Fast Trail", style=plot.style_line,color=Trail1 > Trail2 ? color.blue : color.yellow, linewidth=2)

TS2 = plot(Trail2, "Slow Trail", style=plot.style_line,color=Trail1 > Trail2 ? color.green : color.red, linewidth=2)

fill(TS1, TS2, Bull ? color.green : color.red, transp=90)

plotcolor = input(true, "Paint color on chart", input.bool)

bcl = iff(plotcolor == 1, Blue ? color.blue : Green ? color.lime : Yellow ? color.yellow : Red ? color.red : color.white, na)

barcolor(bcl)

if Buy

strategy.entry("Buy", strategy.long, comment="Buy")

if Sell

strategy.entry("Sell", strategy.short, comment="Sell")