概述

本策略通过结合123反转和MACD指标,实现了跨时间框架的动量追踪。123反转判断短期趋势反转点,MACD判断中长期趋势,两者结合实现在短期反转的同时锁定中长期趋势的多空信号。

策略原理

该策略由两部分组成:

123反转部分:当前两根K线形成高点/低点,并且随机指标低于/高于50时产生买入/卖出信号。

MACD部分:快线上穿慢线时产生买入信号,快线下穿慢线时产生卖出信号。

最后将两者结合,即在123反转的同时MACD也产生同向信号时,发出最终信号。

优势分析

该策略结合了短期反转和中长期趋势,可以在短期波动中锁定中长期趋势,从而获得更高的胜率。特别是在震荡行情中,可以通过123反转过滤掉部分噪音,从而提高稳定性。

另外通过调整参数,可以平衡反转信号和趋势信号的比例,适应不同市场环境。

风险分析

该策略有一定的时间滞后,特别是使用长周期MACD时,可能错过短期行情。此外,反转信号本身就存在一定程度的随机性,容易被套住。

可以适当缩短MACD周期,或增加止损来控制风险。

优化方向

该策略可以从以下几个方面进行优化:

调整123反转参数,优化反转效果

调整MACD参数,优化趋势判断

增加其它辅助指标过滤,提高效果

增加止损策略,控制风险

总结

本策略整合多种参数和多个时间框架的技术指标,通过跨时间框架动量追踪,平衡了反转交易和趋势交易的优点。可通过参数调整平衡效果,并可引入更多指标或止损来进行优化,是一个非常有潜力的策略思路。

策略源码

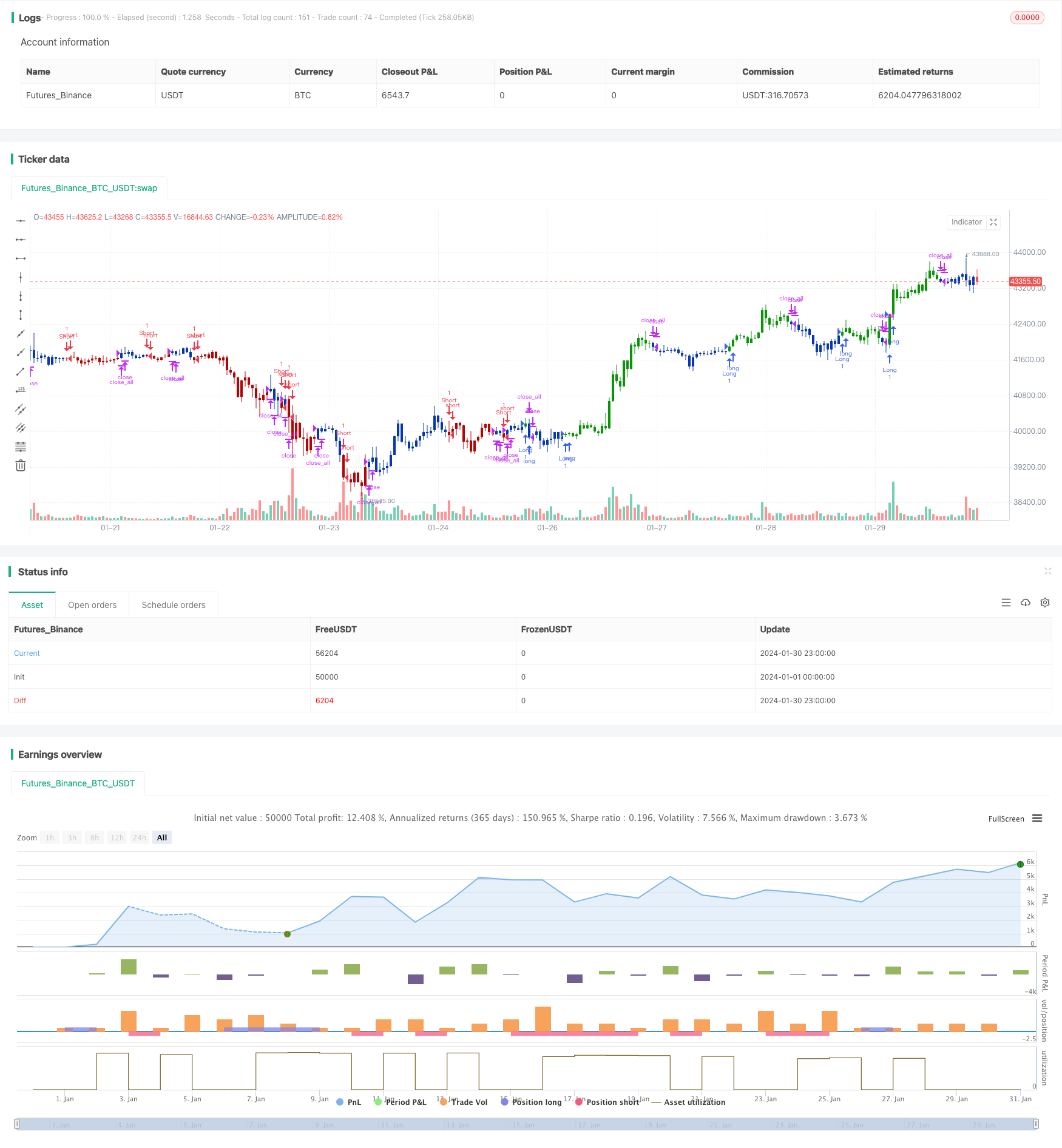

/*backtest

start: 2024-01-01 00:00:00

end: 2024-01-31 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=4

////////////////////////////////////////////////////////////

// Copyright by HPotter v1.0 28/01/2021

// This is combo strategies for get a cumulative signal.

//

// First strategy

// This System was created from the Book "How I Tripled My Money In The

// Futures Market" by Ulf Jensen, Page 183. This is reverse type of strategies.

// The strategy buys at market, if close price is higher than the previous close

// during 2 days and the meaning of 9-days Stochastic Slow Oscillator is lower than 50.

// The strategy sells at market, if close price is lower than the previous close price

// during 2 days and the meaning of 9-days Stochastic Fast Oscillator is higher than 50.

//

// Second strategy

// MACD – Moving Average Convergence Divergence. The MACD is calculated

// by subtracting a 26-day moving average of a security's price from a

// 12-day moving average of its price. The result is an indicator that

// oscillates above and below zero. When the MACD is above zero, it means

// the 12-day moving average is higher than the 26-day moving average.

// This is bullish as it shows that current expectations (i.e., the 12-day

// moving average) are more bullish than previous expectations (i.e., the

// 26-day average). This implies a bullish, or upward, shift in the supply/demand

// lines. When the MACD falls below zero, it means that the 12-day moving average

// is less than the 26-day moving average, implying a bearish shift in the

// supply/demand lines.

// A 9-day moving average of the MACD (not of the security's price) is usually

// plotted on top of the MACD indicator. This line is referred to as the "signal"

// line. The signal line anticipates the convergence of the two moving averages

// (i.e., the movement of the MACD toward the zero line).

// Let's consider the rational behind this technique. The MACD is the difference

// between two moving averages of price. When the shorter-term moving average rises

// above the longer-term moving average (i.e., the MACD rises above zero), it means

// that investor expectations are becoming more bullish (i.e., there has been an

// upward shift in the supply/demand lines). By plotting a 9-day moving average of

// the MACD, we can see the changing of expectations (i.e., the shifting of the

// supply/demand lines) as they occur.

//

// WARNING:

// - For purpose educate only

// - This script to change bars colors.

////////////////////////////////////////////////////////////

Reversal123(Length, KSmoothing, DLength, Level) =>

vFast = sma(stoch(close, high, low, Length), KSmoothing)

vSlow = sma(vFast, DLength)

pos = 0.0

pos := iff(close[2] < close[1] and close > close[1] and vFast < vSlow and vFast > Level, 1,

iff(close[2] > close[1] and close < close[1] and vFast > vSlow and vFast < Level, -1, nz(pos[1], 0)))

pos

MACD(fastLength,slowLength,signalLength) =>

pos = 0.0

fastMA = ema(close, fastLength)

slowMA = ema(close, slowLength)

macd = fastMA - slowMA

signal = sma(macd, signalLength)

pos:= iff(signal < macd , 1,

iff(signal > macd, -1, nz(pos[1], 0)))

pos

strategy(title="Combo Backtest 123 Reversal & MACD Crossover", shorttitle="Combo", overlay = true)

line1 = input(true, "---- 123 Reversal ----")

Length = input(14, minval=1)

KSmoothing = input(1, minval=1)

DLength = input(3, minval=1)

Level = input(50, minval=1)

//-------------------------

fastLength = input(8, minval=1)

slowLength = input(16,minval=1)

signalLength=input(11,minval=1)

xSeria = input(title="Source", type=input.source, defval=close)

reverse = input(false, title="Trade reverse")

posReversal123 = Reversal123(Length, KSmoothing, DLength, Level)

posMACD = MACD(fastLength,slowLength, signalLength)

pos = iff(posReversal123 == 1 and posMACD == 1 , 1,

iff(posReversal123 == -1 and posMACD == -1, -1, 0))

possig = iff(reverse and pos == 1, -1,

iff(reverse and pos == -1 , 1, pos))

if (possig == 1)

strategy.entry("Long", strategy.long)

if (possig == -1)

strategy.entry("Short", strategy.short)

if (possig == 0)

strategy.close_all()

barcolor(possig == -1 ? #b50404: possig == 1 ? #079605 : #0536b3 )