概述

突破拉回中的隐形风暴策略(Breakback Storm Strategy)专门利用价格突破后拉回进入的机会,在短线上捕捉隐藏在拉回行情中的暴涨机会。它结合趋势判断和反转信号,在突破新高后价格回吐到前期支持位置时进入做多;在突破新低后价格回升到前期压力位置时进入做空。策略通过严格的突破过滤,避开了大部分的假突破,从而确保进入的质量。

策略原理

该策略主要基于两个触发信号:长线上的近期新高突破和短线上的拉回形态。具体来说,策略首先要求价格突破80周期的最高点,从更长线上判断目前处于上升趋势之中。其次,要求价格突破第二天的最高点,形成短线上的向上突破。当价格在突破的第二天收盘后发生回吐,回落到前一天的最低点时,就是做多信号。

做空信号的原理则是对称的,需要近期新低突破配合高点回吐。首先判断长线上处于下跌趋势,然后短线上出现向下突破,当价格回升到前一天的最高点时,形成做空信号。

这样的组合设计可以有效过滤假突破的机会,确保进入突破方向正确。而入场点则利用了短线上的拉回机会,在反转前期低点(或高点)附近进入,避开反转中期,获取后续反转行情的主体部分。

优势分析

这种策略结合多空双向交易和突破概念,具有以下显著优势:

- 突破过滤确保交易方向正确性

- 拉回进入点确保风险回报比

- 定时退出兼顾获利和风控

具体来说,80周期长线过滤避开了大部分短线市的突破假象。突破第二天高点(或低点)的方式则可靠抓取短线趋势。这样高质量的进入信号确保了交易方向的正确性。

而入场点设定在前一天反转点附近,足以给予一定空间的止损范围,同时也能捕捉反转行情中期的主体部分。这保证了策略的稳定盈利。

最后,时间退出机制也综合考虑了盈利因素和风险控制,通过事先定义盈亏结果,减少交易者主观情绪对策略实施的干扰。

风险及解决

但是,这种策略也存在一定风险:

- 进入时间节点集中,容易互相VALID

- 多空转换频繁,增加交易成本

- 反转波动可能不足,难以盈利

第一点风险主要来自于入场时机的设定。当大盘同时出现上涨和下跌两波行情时,容易产生进入定时冲突。这可能导致无法进入任何一边的机会。

可以通过调整过滤Exiting参数,以及设定最小的突破幅度,避免两边信号过于密集。

第二点风险则与频繁反转相关。当行情出现多次震荡时,买卖转换可能过于频繁。这增加了交易成本和实际亏损。

可以通过调整持仓时间参数以及止损幅度来减少不必要的买卖切换。

最后,突破后的反转波动也可能无法给予足够盈利空间。这通常发生在行情整理震荡 mehr 内。通过结合更长线上趋势判断,可以避开这类整理机会,保证交易质量。

策略优化

根据以上分析该策略还可以从以下方面进行优化:

- 增加止盈机制

- 结合波动率指标

- 关注季节性机会

首先,可以额外加入移动止盈或突破新高(或新低)止盈方式。这可以锁定大部分利润,避免反转后出现亏损。

此外,也可以结合ATR,RVI等波动率指标,判断行情震荡模式。这可以过滤掉交易机会不足的时期,减少无谓交易。

最后,也可以关注季节性更替等周期性趋势。这类长线机会可以提供更大的趋势空间,避开部分副作用。

总结

总的来说,”突破拉回中的隐形风暴策略”策略旨在捕获趋势突破后的短期趋势反转机会。通过结合长期趋势过滤器、短期反转信号、突破验证和回撤入口,它提供了一个强大的框架来交易大趋势中的回撤。当用适当的利润获取、波动性指标和季节性过滤器进行优化时,这样的框架可以在各种市场条件下产生稳定利润。

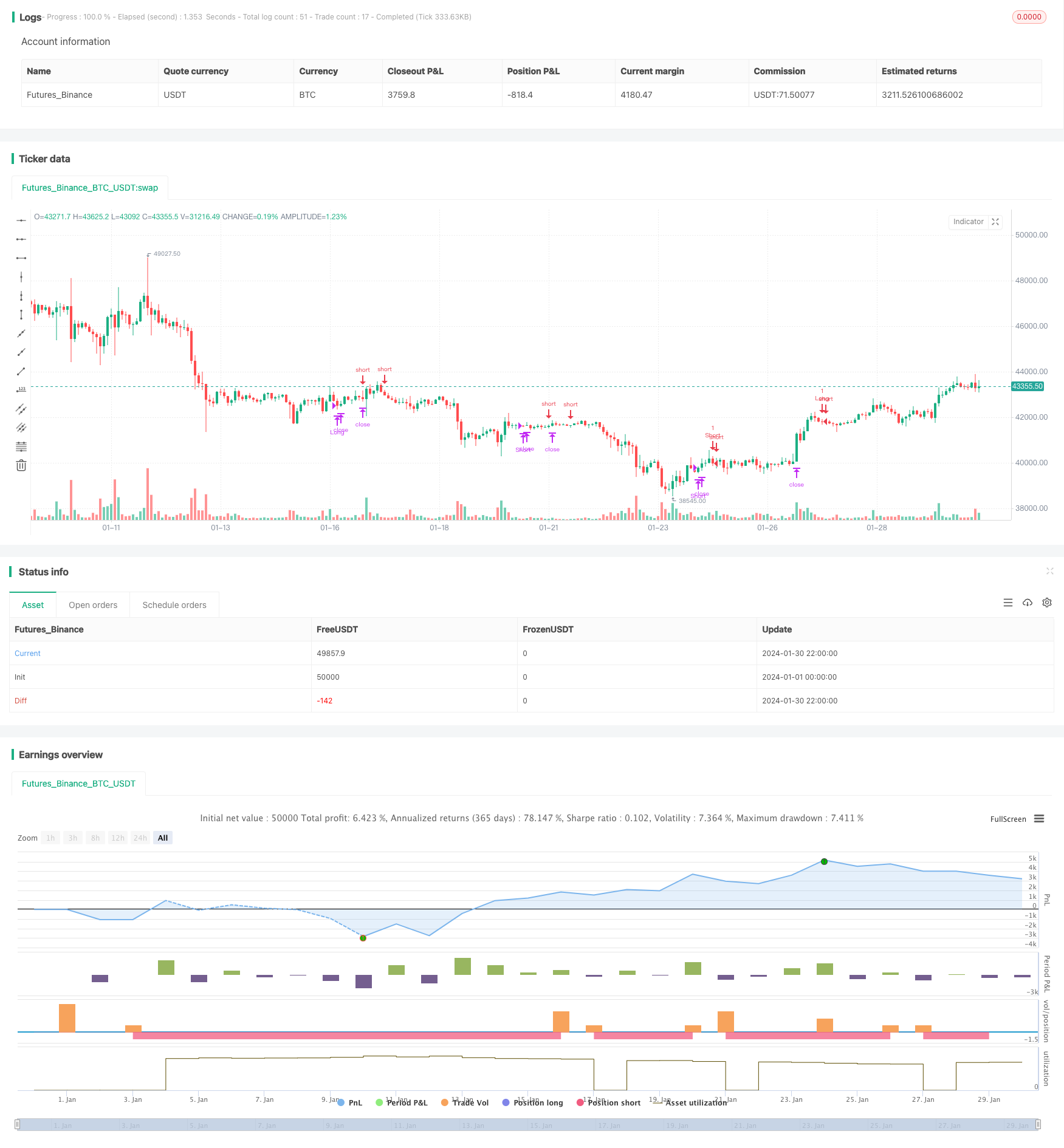

/*backtest

start: 2024-01-01 00:00:00

end: 2024-01-31 00:00:00

period: 2h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=3

strategy("Smash Day Pattern (Type B)", overlay=true, default_qty_type = strategy.fixed, default_qty_value = 1, initial_capital = 10000)

in1 = input(40, "Max Days to Hold") - 1

isLong = strategy.position_size > 0

isShort = strategy.position_size < 0

longTrigger = close[1]<low[2]

shortTrigger = close[1]>high[2]

longFilter = close[1] > close[80]

shortFilter = close[1] < close[80]

longEntry = (not isLong) and longTrigger and longFilter

shortEntry = (not isShort) and shortTrigger and shortFilter

longStop = valuewhen(longEntry, low[1], 0)

longPrice = valuewhen(longEntry, high[1], 0)

shortStop = valuewhen(shortEntry, high[1],0)

shortPrice = valuewhen(shortEntry, low[1], 0)

strategy.entry(id = "Long", long = true, stop = longPrice+.001, when = longEntry)

strategy.exit(id = "Stop Long", from_entry = "Long", stop = longStop, when = isLong)

strategy.close("Long", barssince(longEntry==true)>=in1)

strategy.entry(id = "Short", long = false, stop = shortPrice-.001, when = shortEntry)

strategy.exit(id = "Stop Short", from_entry = "Short", stop = shortStop, when = isShort)

strategy.close("Short", barssince(shortEntry==true)>=in1)