概述

该策略结合了移动平均线判断趋势方向和K线形态判断反转点的方法,实现了趋势追踪交易。策略首先使用移动平均线判断整体趋势方向,然后在趋势方向上寻找潜在的反转K线形态作为入场信号,从而追踪趋势运行。

策略原理

策略使用长度为10天的简单移动平均线判断价格趋势方向。当价格高于移动平均线时,认为处于上升趋势;当价格低于移动平均线时,认为处于下降趋势。

在判断到趋势方向后,策略会根据一系列阳线K线形态和阴线K线形态来判断潜在的趋势反转点。常见的阳线形态包括启明星、早晨之星、三只白兵等;常见的阴线形态包括黄昏之星、三只乌鸦等。当在上升趋势中识别到阳线信号时,策略会进行买入操作;当在下降趋势中识别到阴线信号时,策略会进行卖出操作。

此外,策略还会结合主要的支撑阻力位来确定入场的具体价格。如在上升趋势下买入时,会在突破第一支撑位时进行买入。

策略优势

该策略最大的优势是同时结合趋势判断和反转信号,使得它可以及时捕捉趋势转折点,实现趋势跟踪运行。相比简单的移动平均线策略,该策略可以大大提高获利概率。

另外,策略加入K线形态判断也增强了其对突发事件的处理能力。在市场出现低概率事件导致假突破时,K线形态可以发挥过滤作用,避免错误交易。

策略风险

该策略主要的风险在于移动平均线参数设置和K线形态判断的准确性。如果移动平均线周期设置得不当,会导致趋势判断错误;如果对K线形态判断出现失误,也会导致交易决策失误。

此外,反转K线形态并不能百分百确保趋势反转,所以策略也存在一定的风险。当市场出现更大范围的反转时,可能会给策略带来较大亏损。

优化方向

该策略的优化空间还是比较大的。例如可以考虑动态调整移动平均线的参数,在不同市场阶段采用不同的移动平均线周期。还可以加入机器学习的方法,利用历史数据训练K线形态判断模型,提高判断准确性。

另外,也可以考虑加入更多因子判断趋势和热点区域,如交易量变化、波动率指标等,使策略更加全面和稳健。

总结

该策略整体来说非常适合跟踪股市中期趋势,可以获得较高的稳定收益。如果进一步优化,有望成为一个运作良好的量化策略。投资者如果掌握该策略的运用,也可以用其构建长期持有的组合,以控制个股风险的同时获得较好的超额收益。

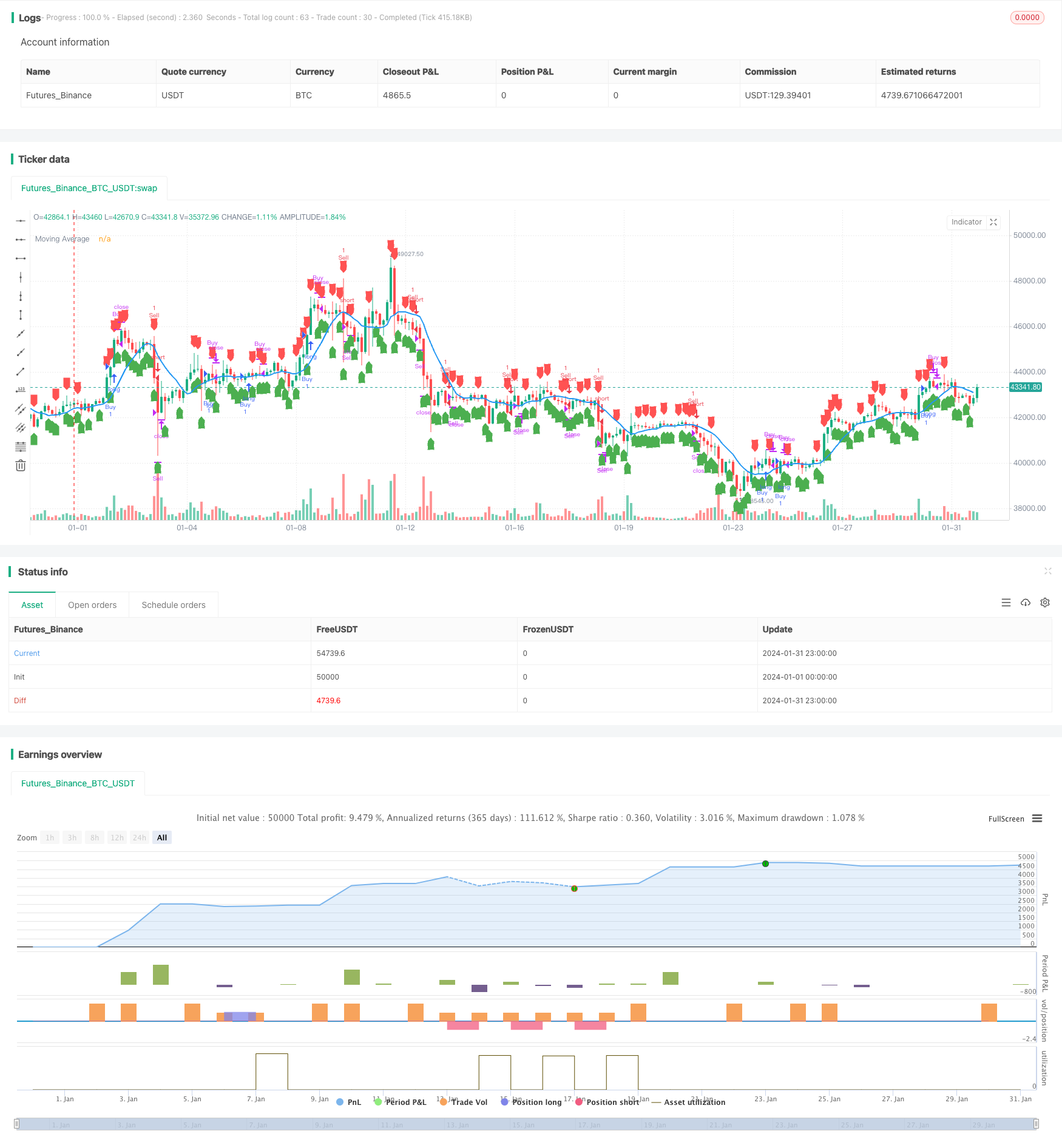

/*backtest

start: 2024-01-01 00:00:00

end: 2024-01-31 23:59:59

period: 3h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("Trend Following Strategy with Candlestick Patterns", overlay=true)

// Moving Average

ma_period = input(10, title="Moving Average Period")

moving_average = ta.sma(close, ma_period)

// Candlestick Patterns

// Custom Function

abs(x) => x >= 0 ? x : -x

// Candlestick Patterns

isDoji() =>

(close - open) <= (high - low) * 0.1

isMarubozuWhite() =>

close == high and open == low and close > open

isHammer() =>

(high - low) >= 3 * abs(open - close) and (close - low) / (0.001 + high - low) > 0.6 and (open - low) / (0.001 + high - low) > 0.6

isInvertedHammer() =>

(high - low) >= 3 * abs(open - close) and (high - close) / (0.001 + high - low) > 0.6 and (high - open) / (0.001 + high - low) > 0.6

isLongLowerShadow() =>

(low - close) > 2 * abs(open - close) and (low - open) / (0.001 + high - low) > 0.6

isUpsideTasukiGap() =>

close[1] < open[1] and open > close and open > close[1] and close < open[1]

isRisingWindow() =>

high[1] < low and close > open

isPiercing() =>

close[1] < open[1] and close > open and close > ((open + low) / 2) and close < open[1] and open < close[1]

isBullishEngulfing() =>

close[1] < open[1] and close > open and high > high[1] and low < low[1]

isTweezerBottom() =>

low == ta.valuewhen(low == ta.lowest(low, 10), low, 0) and low == ta.valuewhen(low == ta.lowest(low, 20), low, 0)

isBullishAbandonedBaby() =>

close[2] < open[2] and close[1] > open[1] and low[1] > ta.valuewhen(high == ta.highest(high, 2), high, 0) and open > close and close > ta.valuewhen(high == ta.highest(high, 2), high, 0)

isMorningStar() =>

close[2] < open[2] and close[1] < open[1] and close > open[1] and open < close[2] and open > close[1]

isMorningDojiStar() =>

close[2] < open[2] and close[1] < open[1] and isDoji() and close > open[1] and open < close[2] and open > close[1]

isDragonflyDoji() =>

isDoji() and (high - close) / (0.001 + high - low) < 0.1 and (open - low) / (0.001 + high - low) > 0.6

isThreeWhiteSoldiers() =>

close[2] < open[2] and close[1] < open[1] and close > open and open < close[2] and open < close[1] and close > open[1]

isRisingThreeMethods() =>

close[4] < open[4] and close[1] < open[1] and close > open and open < close[4] and open < close[1] and close > open[1]

isMarubozuBlack() =>

close == low and open == high and open > close

isGravestoneDoji() =>

isDoji() and (close - low) / (0.001 + high - low) < 0.1 and (high - open) / (0.001 + high - low) > 0.6

isHangingMan() =>

(high - low) >= 4 * abs(open - close) and (open - close) / (0.001 + high - low) > 0.6 and (high - open) / (0.001 + high - low) > 0.6

isLongUpperShadow() =>

(high - open) > 2 * abs(open - close) and (high - close) / (0.001 + high - low) > 0.6

isDownsideTasukiGap() =>

close[1] > open[1] and open < close and open < close[1] and close > open[1]

isFallingWindow() =>

low[1] > high and close < open

isDarkCloudCover() =>

close[1] > open[1] and close < open and close < ((open + high) / 2) and close > open[1] and open > close[1]

isBearishEngulfing() =>

close[1] > open[1] and close < open and high > high[1] and low < low[1]

isTweezerTop() =>

high == ta.valuewhen(high == ta.highest(high, 10), high, 0) and high == ta.valuewhen(high == ta.highest(high, 20), high, 0)

isAbandonedBaby() =>

close[2] > open[2] and close[1] < open[1] and high[1] < ta.valuewhen(low == ta.lowest(low, 2), low, 0) and open < close and close < ta.valuewhen(low == ta.lowest(low, 2), low, 0)

isEveningDojiStar() =>

close[2] > open[2] and close[1] > open[1] and isDoji() and close < open[1] and open > close[2] and open < close[1]

isEveningStar() =>

close[2] > open[2] and close[1] > open[1] and close < open[1] and open > close[2] and open < close[1]

isThreeBlackCrows() =>

close[2] > open[2] and close[1] > open[1] and close < open and open > close[2] and open > close[1] and close < open[1]

isFallingThreeMethods() =>

close[4] > open[4] and close[1] > open

isShootingStar() =>

(high - low) >= 3 * abs(open - close) and (high - close) / (0.001 + high - low) > 0.6 and (high - open) / (0.001 + high - low) > 0.6

doji = isDoji()

marubozuWhite = isMarubozuWhite()

hammer = isHammer()

invertedHammer = isInvertedHammer()

longLowerShadow = isLongLowerShadow()

upsideTasukiGap = isUpsideTasukiGap()

risingWindow = isRisingWindow()

piercing = isPiercing()

bullishEngulfing = isBullishEngulfing()

tweezerBottom = isTweezerBottom()

bullishAbandonedBaby = isBullishAbandonedBaby()

morningStar = isMorningStar()

morningDojiStar = isMorningDojiStar()

dragonflyDoji = isDragonflyDoji()

threeWhiteSoldiers = isThreeWhiteSoldiers()

risingThreeMethods = isRisingThreeMethods()

marubozuBlack = isMarubozuBlack()

gravestoneDoji = isGravestoneDoji()

hangingMan = isHangingMan()

longUpperShadow = isLongUpperShadow()

downsideTasukiGap = isDownsideTasukiGap()

fallingWindow = isFallingWindow()

darkCloudCover = isDarkCloudCover()

bearishEngulfing = isBearishEngulfing()

tweezerTop = isTweezerTop()

abandonedBaby = isAbandonedBaby()

eveningDojiStar = isEveningDojiStar()

eveningStar = isEveningStar()

threeBlackCrows = isThreeBlackCrows()

fallingThreeMethods = isFallingThreeMethods()

shootingStar = isShootingStar()

isBullishPattern() =>

(isMarubozuWhite() or isHammer() or isInvertedHammer() or isDoji() or isMorningStar() or isBullishEngulfing() or isThreeWhiteSoldiers() or isMarubozuBlack() or isHangingMan() or isDownsideTasukiGap() or isDarkCloudCover())

isBearishPattern() =>

(isMarubozuBlack() or isInvertedHammer() or isLongUpperShadow() or isTweezerTop() or isGravestoneDoji() or isEveningStar() or isBearishEngulfing() or isThreeBlackCrows() or isShootingStar())

isBullishCandle = isBullishPattern()

isBearishCandle = isBearishPattern()

// Calculate Pivot Points

pivotPoint(high, low, close) =>

(high + low + close) / 3

r1 = pivotPoint(high[1], low[1], close[1]) * 2 - low[1]

s1 = pivotPoint(high[1], low[1], close[1]) * 2 - high[1]

r2 = pivotPoint(high[1], low[1], close[1]) + (high[1] - low[1])

s2 = pivotPoint(high[1], low[1], close[1]) - (high[1] - low[1])

r3 = high[1] + 2 * (pivotPoint(high[1], low[1], close[1]) - low[1])

s3 = low[1] - 2 * (high[1] - pivotPoint(high[1], low[1], close[1]))

// Trend Identification

is_uptrend = close > moving_average

is_downtrend = close < moving_average

// Entry and Exit Conditions with Trend Identification

enterLong = is_uptrend and isBullishCandle and close > r1

exitLong = is_uptrend and (bearishEngulfing or doji or close < s1)

enterShort = is_downtrend and isBearishCandle and close < s1

exitShort = is_downtrend and (bullishEngulfing or doji or close > r1)

// Strategy Execution

if enterLong and strategy.position_size == 0 and strategy.position_size[1] == 0 and close > r1

strategy.entry("Buy", strategy.long, qty=1)

if exitLong and strategy.position_size > 0

strategy.close("Buy")

if enterShort and strategy.position_size == 0 and close < s1

strategy.entry("Sell", strategy.short, qty=1)

if exitShort and strategy.position_size < 0

strategy.close("Sell")

// Stop-Loss and Trailing Stop-Loss

stop_loss_pct = input(2.0, title="Stop Loss Percentage")

trailing_stop_loss_pct = input(1.0, title="Trailing Stop Loss Percentage")

trailing_stop_loss_active = input(true, title="Trailing Stop Loss Active")

// Stop-Loss

stop_loss_level = strategy.position_avg_price * (1 - stop_loss_pct / 100)

strategy.exit("Stop Loss", "Buy", loss=stop_loss_level)

// Trailing Stop-Loss

// Plotting Moving Average

plot(moving_average, color=color.blue, title="Moving Average", linewidth=2)

// Plotting Candlestick Patterns

plotshape(isBullishCandle, title="Bullish Candle", location=location.belowbar, color=color.green, style=shape.labelup)

plotshape(isBearishCandle, title="Bearish Candle", location=location.abovebar, color=color.red, style=shape.labeldown)

// Plotting Support and Resistance Levels

//hline(r1, "Resistance Level 1", color=color.red, linestyle=hline.style_dotted)

//hline(s1, "Support Level 1", color=color.green, linestyle=hline.style_dotted)