概述

本策略通过组合使用多种不同周期的SMA均线,实现对趋势的判断和跟踪。核心思路是:比较不同周期SMA的上涨和下跌方向,判断趋势;当短周期SMA上穿较长周期SMA时,做多;当短周期SMA下穿较长周期SMA时,做空。同时,结合ZeroLagEMA指标进行入场和出场的确认。

策略原理

- 使用5个不同周期的SMA均线,分别是10周期、20周期、50周期、100周期和200周期。

- 比较这5条均线的上涨和下跌方向,判断趋势方向。例如,当10周期、20周期、100周期和200周期SMA均线同时上涨时,判断为上涨趋势;当均线同时下跌时,判断为下跌趋势。

- 比较不同周期SMA的数值,形成交易信号。例如,当10周期SMA上穿20周期SMA时做多,形成入场信号;当10周期SMA下穿20周期SMA时做空,形成入场信号。

- 使用ZeroLagEMA作为入场确认和出场信号。当快速周期ZeroLagEMA上穿慢速周期时做多;下穿时平多仓。做空信号的判断方式相反。

策略优势

- 使用多种不同周期SMA均线组合,可以有效判断市场趋势方向。

- 周期SMA数值的比较可以产生交易信号,形成量化入场和出场规则。

- ZeroLagEMA滤波可以避免不必要的交易,提高策略稳定性。

- 结合趋势判断和交易信号,实现了趋势跟踪交易。

策略风险及解决方案

- 当市场进入震荡整理阶段时,SMA均线信号可能出现频繁交叉,带来较多无效交易和亏损的风险。

- 解决方法:增加ZeroLagEMA的滤波参数,避免无效信号的入场。

- 由于参考了较多周期的SMA,判断信号有一定滞后性,无法对短期剧烈价格变动做出及时反应。

- 解决方法:结合更加灵敏的指标,如MACD等,辅助判断。

策略优化方向

- 优化SMA周期参数,找到最佳参数组合。

- 增加止损策略,如跟踪止损,进一步控制单笔亏损。

- 增加仓位数管理机制,让策略在趋势较强时加大头寸,在震荡时减小头寸。

- 结合更多辅助指标判断,如MACD,KDJ等,提高策略整体稳定性。

总结

本策略通过组合多个周期SMA均线,实现了对市场趋势方向的有效判断,并产生了量化交易信号。同时,ZeroLagEMA的应用提高了策略的顺利率。总的来说,策略实现了基于趋势跟踪的量化交易思路,效果显著。通过进一步优化SMA周期参数、止损策略、头寸管理等,可以进一步增强策略效果,值得实盘验证与应用。

策略源码

/*backtest

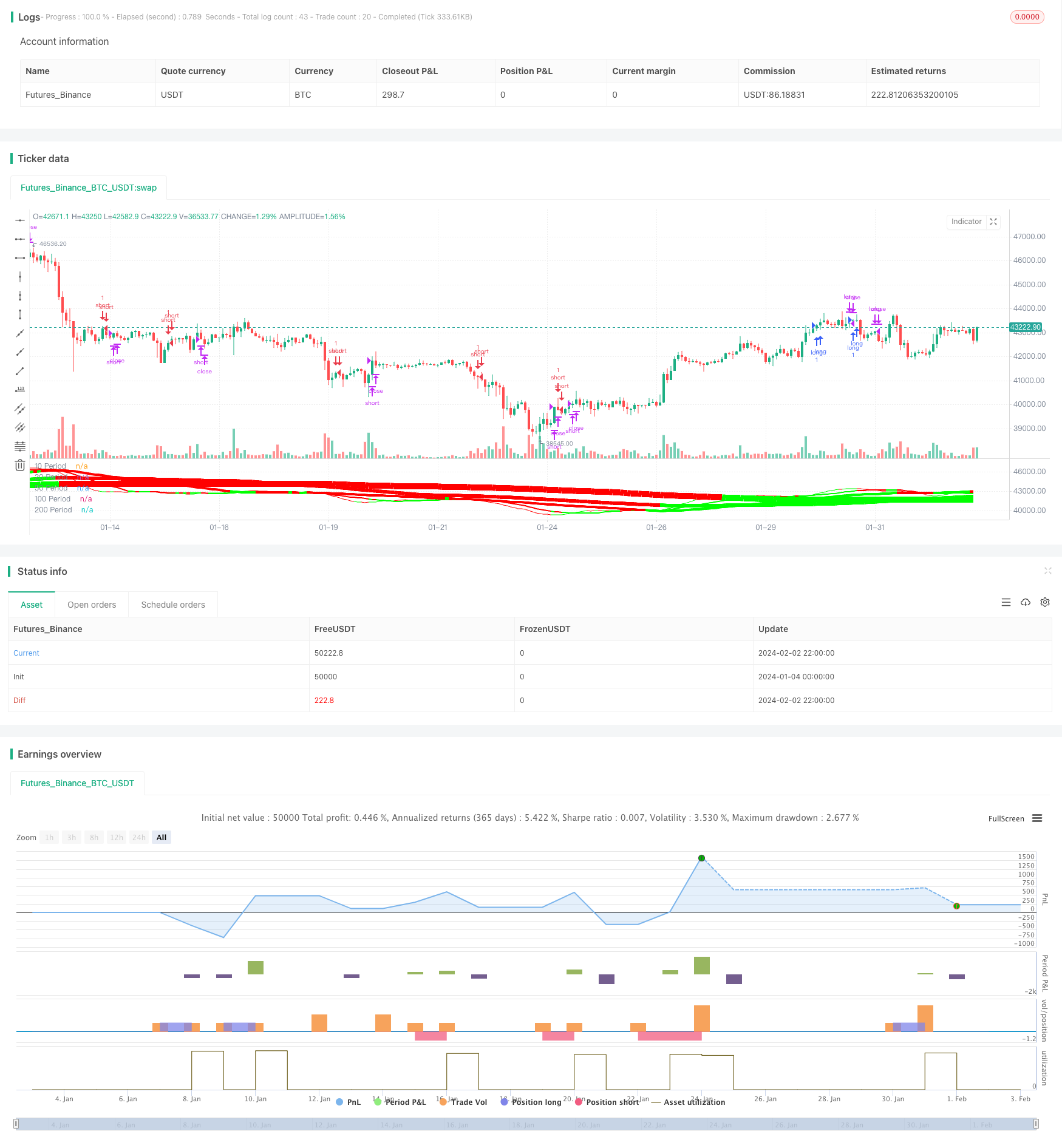

start: 2024-01-04 00:00:00

end: 2024-02-03 00:00:00

period: 2h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=2

strategy("Forex MA Racer - SMA Performance /w ZeroLag EMA Trigger", shorttitle = "FX MA Racer (5x SMA, 2x zlEMA)", overlay=false )

// === INPUTS ===

hr0 = input(defval = true, title = "=== SERIES INPUTS ===")

smaSource = input(defval = close, title = "SMA Source")

sma1Length = input(defval = 10, title = "SMA 1 Length")

sma2Length = input(defval = 20, title = "SMA 2 Length")

sma3Length = input(defval = 50, title = "SMA 3 Length")

sma4Length = input(defval = 100, title = "SMA 4 Length")

sma5Length = input(defval = 200, title = "SMA 5 Length")

smaDirSpan = input(defval = 4, title = "SMA Direction Span")

zlmaSource = input(defval = close, title = "ZeroLag EMA Source")

zlmaFastLength = input(defval = 9, title = "ZeroLag EMA Fast Length")

zlmaSlowLength = input(defval = 21, title = "ZeroLag EMA Slow Length")

hr1 = input(defval = true, title = "=== PLOT TIME LIMITER ===")

useTimeLimit = input(defval = true, title = "Use Start Time Limiter?")

// set up where we want to run from

startYear = input(defval = 2018, title = "Start From Year", minval = 0, step = 1)

startMonth = input(defval = 02, title = "Start From Month", minval = 0,step = 1)

startDay = input(defval = 01, title = "Start From Day", minval = 0,step = 1)

startHour = input(defval = 00, title = "Start From Hour", minval = 0,step = 1)

startMinute = input(defval = 00, title = "Start From Minute", minval = 0,step = 1)

hr2 = input(defval = true, title = "=== TRAILING STOP ===")

useStop = input(defval = false, title = "Use Trailing Stop?")

slPoints = input(defval = 200, title = "Stop Loss Trail Points", minval = 1)

slOffset = input(defval = 400, title = "Stop Loss Trail Offset", minval = 1)

// === /INPUTS ===

// === SERIES SETUP ===

// Fast ZeroLag EMA

zema1=ema(zlmaSource, zlmaFastLength)

zema2=ema(zema1, zlmaFastLength)

d1=zema1-zema2

zlemaFast=zema1+d1

// Slow ZeroLag EMA

zema3=ema(zlmaSource, zlmaSlowLength)

zema4=ema(zema3, zlmaSlowLength)

d2=zema3-zema4

zlemaSlow=zema3+d2

// Simple Moving Averages

period10 = sma(close, sma1Length)

period20 = sma(close, sma2Length)

period50 = sma(close, sma3Length)

period100 = sma(close, sma4Length)

period200 = sma(close, sma5Length)

// === /SERIES SETUP ===

// === PLOT ===

// colors of plotted MAs

p1 = (close < period10) ? #FF0000 : #00FF00

p2 = (close < period20) ? #FF0000 : #00FF00

p3 = (close < period50) ? #FF0000 : #00FF00

p4 = (close < period100) ? #FF0000 : #00FF00

p5 = (close < period200) ? #FF0000 : #00FF00

plot(period10, title='10 Period', color = p1, linewidth=1)

plot(period20, title='20 Period', color = p2, linewidth=2)

plot(period50, title='50 Period', color = p3, linewidth=4)

plot(period100, title='100 Period', color = p4, linewidth=6)

plot(period200, title='200 Period', color = p5, linewidth=10)

// === /PLOT ===

//BFR = BRFIB ? (maFast+maSlow)/2 : abs(maFast - maSlow)

// === STRATEGY ===

// calculate SMA directions

direction10 = rising(period10, smaDirSpan) ? +1 : falling(period10, smaDirSpan) ? -1 : 0

direction20 = rising(period20, smaDirSpan) ? +1 : falling(period20, smaDirSpan) ? -1 : 0

direction50 = rising(period50, smaDirSpan) ? +1 : falling(period50, smaDirSpan) ? -1 : 0

direction100 = rising(period100, smaDirSpan) ? +1 : falling(period100, smaDirSpan) ? -1 : 0

direction200 = rising(period200, smaDirSpan) ? +1 : falling(period200, smaDirSpan) ? -1 : 0

// conditions

// SMA Direction Trigger

dirUp = direction10 > 0 and direction20 > 0 and direction100 > 0 and direction200 > 0

dirDn = direction10 < 0 and direction20 < 0 and direction100 < 0 and direction200 < 0

longCond = (period10>period20) and (period20>period50) and (period50>period100) and dirUp//and (close > period10) and (period50>period100) //and (period100>period200)

shortCond = (period10<period20) and (period20<period50) and dirDn//and (period50<period100) and (period100>period200)

longExit = crossunder(zlemaFast, zlemaSlow) or crossunder(period10, period20)

shortExit = crossover(zlemaFast, zlemaSlow) or crossover(period10, period20)

// entries and exits

startTimeOk() =>

// get our input time together

inputTime = timestamp(syminfo.timezone, startYear, startMonth, startDay, startHour, startMinute)

// check the current time is greater than the input time and assign true or false

timeOk = time > inputTime ? true : false

// last line is the return value, we want the strategy to execute if..

// ..we are using the limiter, and the time is ok -OR- we are not using the limiter

r = (useTimeLimit and timeOk) or not useTimeLimit

if( true )

// entries

strategy.entry("long", strategy.long, when = longCond)

strategy.entry("short", strategy.short, when = shortCond)

// trailing stop

if (useStop)

strategy.exit("XL", from_entry = "long", trail_points = slPoints, trail_offset = slOffset)

strategy.exit("XS", from_entry = "short", trail_points = slPoints, trail_offset = slOffset)

// exits

strategy.close("long", when = longExit)

strategy.close("short", when = shortExit)

// === /STRATEGY ===