概述

本策略联合使用5日移动平均线带和GBS买卖点来识别趋势方向和发出交易信号。移动平均线带用于判断趋势方向和大级别支撑阻力,GBS买卖点用于在趋势方向配合的情况下寻找精确的入场时机。该策略适合中短线趋势交易,可以在震荡行情中实现超额收益。

策略原理

- 计算5日高价和低价的简单移动平均,得到5日移动平均线带

- 当收盘价突破移动平均线带时,判断趋势产生转折

- 在判断为趋势上行的时候,满足GBS买点条件就进行做多操作;在判断为趋势下行的时候,满足GBS卖点条件就进行做空操作

- 设置止损止盈退出机制,回撤超过一定比例就止损

策略优势

- 移动平均线带判断大趋势方向准确

- GBS买卖点具有较高的胜率

- 止损机制有效控制风险,亏损有限

策略风险及解决方法

- 震荡行情中可能出现多次虚假突破,从而产生交易失误

- 解决方法:适当放宽移动平均线带,确保只在趋势明确的时候操作

- 单一 Indicator 依赖风险较大

- 解决方法:增加其他 Indicator 的验证,例如MACD、RSI 等,避免错过反转信号

- 回测数据拟合风险

- 解决方法:扩大回测时间范围,增加不同品种和参数的回测对比

策略优化方向

- 增加参数优化,寻找最优参数组合

- 增加其他 Indicator 的验证信号

- 开发自适应移动平均线机制

- 根据市场信息调整止损幅度

- 增加机器学习算法,实现策略的自动优化

总结

本策略整合运用移动平均线带和 GBS 买卖点,在判断明确趋势方向的前提下进行高确定性操作,可以过滤震荡市场的噪音,在中短线获利后及时止盈。该策略简单易操作,资金效率较高,可以为量化交易者创造稳定收益。通过不断优化和迭代,进一步提升策略的胜率和盈利能力。

策略源码

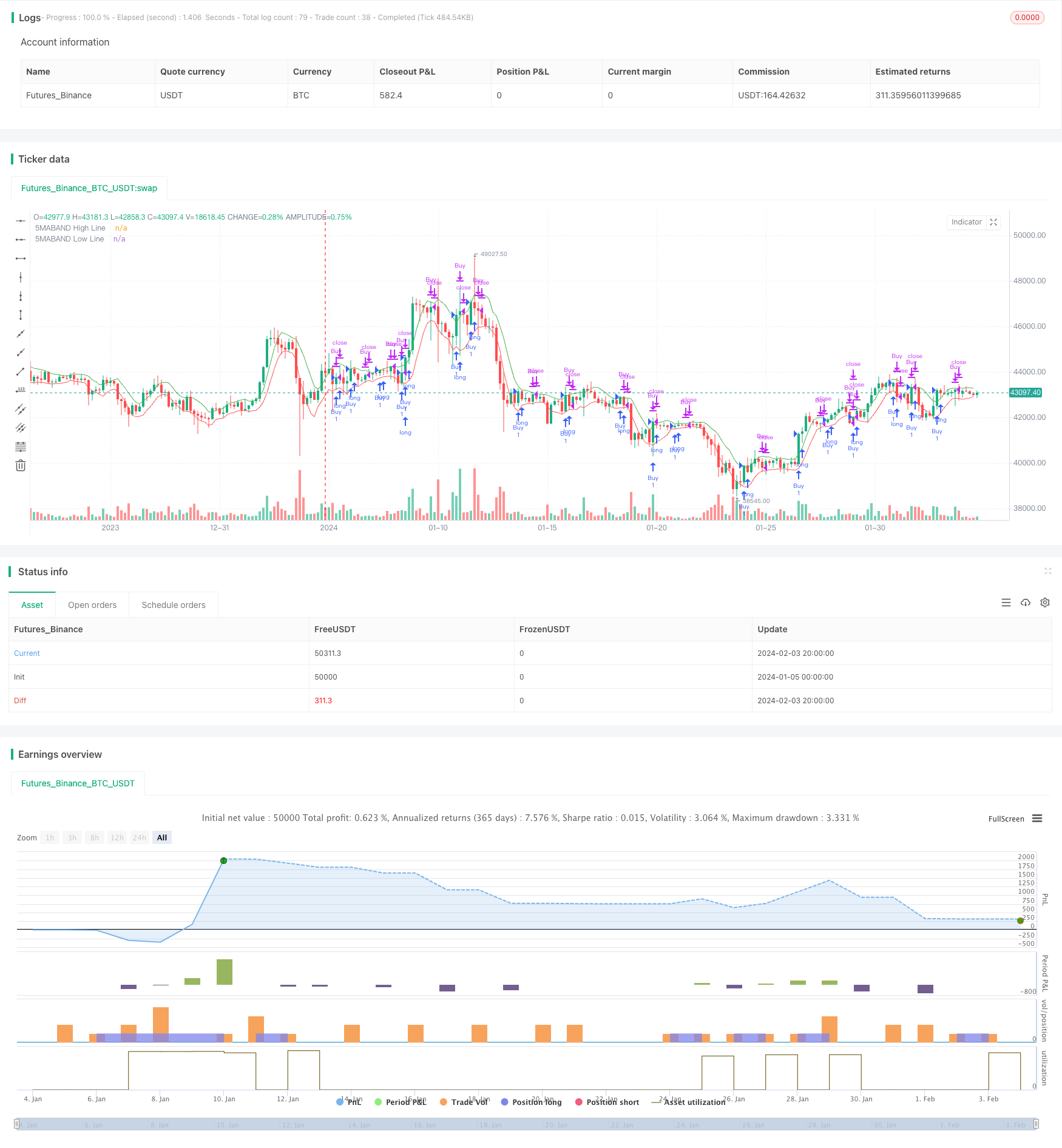

/*backtest

start: 2024-01-05 00:00:00

end: 2024-02-04 00:00:00

period: 4h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("5MABAND + GBS Buy & Sell Strategy", overlay=true)

// Command 1 - 5MABAND Calculation

length = input(5, title="Number of Candles for Average")

avgHigh = ta.sma(high, length)

avgLow = ta.sma(low, length)

// Plotting 5MABAND Bands

plot(avgHigh, color=color.green, title="5MABAND High Line", linewidth=1)

plot(avgLow, color=color.red, title="5MABAND Low Line", linewidth=1)

// Command 2 - GBS concept Buy Entry

gbsBuyCondition = close > open and high - close < close - open and open - low < close - open and close - open > close[1] - open[1] and close - open > close[2] - open[2] and close - open > close[3] - open[3] and close[1] < avgHigh and close[2] < avgHigh and close[3] < avgHigh and open[1] < avgHigh and open[2] < avgHigh and open[3] < avgHigh

// Command 3 - GBS Concept Sell Entry

gbsSellCondition = open - close > open[1] - close[1] and open - close > open[2] - close[2] and open - close > open[3] - close[3] and open[1] > avgLow and open[2] > avgLow and open[3] > avgLow and open - close > open - low and open - close > high - open

// Command 6 - 5MABAND Exit Trigger

exitTriggerCandle_5MABAND_Buy = low < avgLow

exitTriggerCandle_5MABAND_Sell = high > avgHigh

// Exit Signals for 5MABAND

exitBuySignal_5MABAND = close < avgLow

exitSellSignal_5MABAND = close > avgHigh

// Execute Buy and Sell Orders

strategy.entry("Buy", strategy.long, when = gbsBuyCondition)

strategy.close("Buy", when = exitBuySignal_5MABAND)

strategy.entry("Sell", strategy.short, when = gbsSellCondition)

strategy.close("Sell", when = exitSellSignal_5MABAND)

// Exit Buy and Sell Orders for 5MABAND

strategy.close("Buy", when = exitTriggerCandle_5MABAND_Buy)

strategy.close("Sell", when = exitTriggerCandle_5MABAND_Sell)