概述

动量平均线交叉优化策略是一种集移动平均线交叉、位置控制、风险管理等多项功能于一体的量化交易策略。该策略运用快速移动平均线和慢速移动平均线的交叉作为买卖信号,并结合持仓规模的动态控制实现风险管理。相较于传统移动平均线交叉策略,本策略进行了多方位的功能优化,可提供更先进、更可靠的量化交易解决方案。

策略原理

本策略的核心信号来自两个移动平均线的交叉。一个短期快速移动平均线和一个长期慢速移动平均线。具体来说,当快速移动平均线从下方上穿越慢速移动平均线时,产生买入信号;当快速移动平均线从上方向下跌破慢速移动平均线时,产生卖出信号。

移动平均线作为一种趋势跟踪指标,能够有效平滑价格数据,识别出价格趋势的转折点。快速移动平均线对价格变化更为敏感,能够及时捕捉到短期趋势;而慢速移动平均线对价格波动的响应更为缓慢,能反映中长期趋势。两条平均线的交叉因而成为判断趋势转向的有效信号。

当快速移动平均线上穿时,表示短期价格已经反转为上涨,并驱动中长期价格上扬,属于追涨信号;而快速移动平均线下穿时,标志着短期价格开始下跌,中长期也将跟随走低,属于抛压信号。

本策略的另一大亮点在于风险管理。策略允许交易者设置每次交易的风险百分比,并据此动态调整头寸规模。具体来说,每次交易的头寸规模计算公式为:

头寸规模 = (账户权益 × 风险百分比) / (每次交易风险百分比 × 100)

这种根据账户资金状况和可承受风险动态调节仓位的方式,可有效控制交易风险,是本策略的一大优势。

策略优势

- 结合快慢移动平均线,交易信号更可靠

- 动态头寸控制,有效管理交易风险

- 直观的图形展现,易于操作

- 包含买卖信号警报,操作更及时

- 允许自定义参数,交易更灵活

相较于原始移动平均线交叉策略,本策略在以下几个维度进行了重要优化:

更智能的信号机制。本策略采用快速和慢速两条移动平均线,而不是单一均线,能够同时识别短期和中长期趋势,交叉信号更可靠。

更科学的风险控制。根据账户资金和可承受风险动态计算仓位,既实现盈利,也控制风险,更符合实战需求。

更人性化的操作体验。直观的信号标记、实时警报提示,无需全天盯盘,操作更便利。

更高度的灵活性。用户可以根据个人偏好,自定义移动平均线参数和风险设置,使策略更契合自己。

风险分析

尽管相对原始移动平均线交叉策略有了长足的改进,本策略在实际运用中仍可能面临以下风险:

错过价格反转点:移动平均线属于趋势跟踪型指标,对突发性的价格反转不足够敏感,可能错过关键的买卖点,无法及时止损或止盈。

不适用于盘整市:当市场处于长时间横盘整理状态时,移动平均线信号容易产生误导,应降低仓位规模,或考虑使用其他类型策略。

参数设置不当:如果移动平均线参数设置得不恰当,会产生错误信号,这需要通过反复测试来获取最佳参数。

风险配置过大:如果风险百分比设置过高,账户每次交易风险过大,极易爆仓。这需要根据自己的实际承受能力谨慎配置。

针对上述风险,我们可以从以下几个维度进行风险管理:

结合其他指标过滤信号,如成交量,KD指标等,避免错过价格转折。

根据不同市场情况切换策略或降低仓位,如使用震荡型策略。

充分回测寻找最优参数,或根据不同品种分段设置参数。

保守配置风险参数,分批建仓,控制单笔损失。

策略优化

本策略还存在可扩展的优化空间,主要包括以下几个方面:

信号过滤优化:可引入其他指标进行信号过滤,如KM指标、布林带等,使信号更加可靠。

参数自适应:通过机器学习方法,实现移动平均线参数的动态优化,使其能自动适应市场变化。

止损止盈策略:增加移动止损、固定比例止盈等功能,能够把握确定利润,有效控制亏损。

复合策略:将移动平均线策略与其他类型策略,如粘合水平面、震荡策略组合使用,能够获得更稳定的超额收益。

跨市场套利:结合不同市场的价格关系,进行 Statistical Arbitrage,以获得无风险套利。

通过不断测试与优化,我们有信心将本策略打造成一个可靠、可控、超额收益的量化交易解决方案。

总结

动量平均线交叉优化策略通过快慢均线交叉形成交易信号,并使用动态头寸调整实现风险控制,是一种功能颇为完善的量化交易策略。相较于传统移动均线策略,本策略在信号判断、风险管理、使用体验等方面都有了很大进步。随着参数优化、信号过滤、止损止盈、复合组合等方面的继续完善,本策略有望成为零售交易者盈利且可控的理想策略之一。

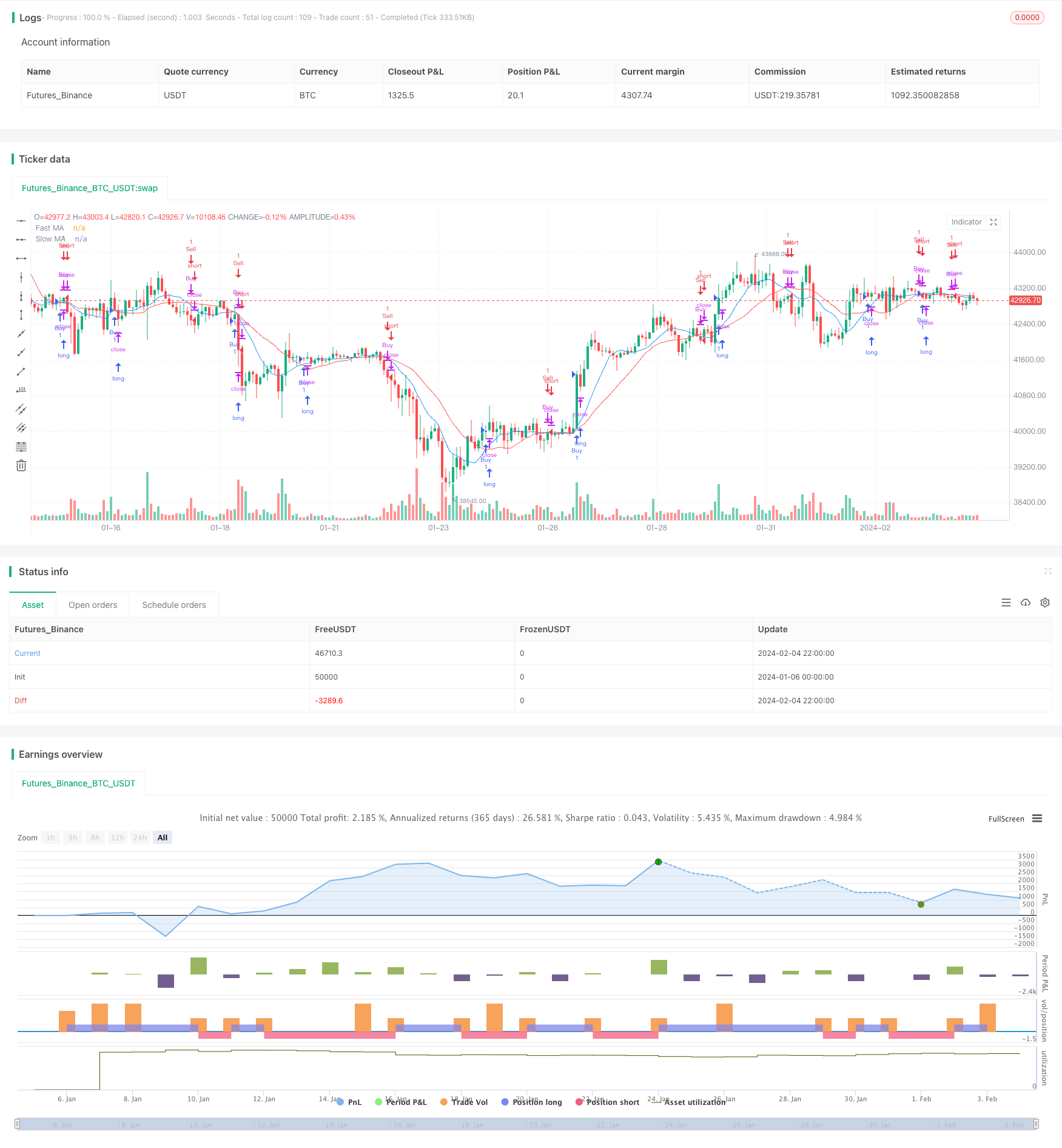

/*backtest

start: 2024-01-06 00:00:00

end: 2024-02-05 00:00:00

period: 2h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=4

strategy("Improved Moving Average Crossover", overlay=true)

// Input parameters

fastLength = input(10, title="Fast MA Length")

slowLength = input(20, title="Slow MA Length")

riskPercentage = input(1, title="Risk Percentage", minval=0.1, maxval=5, step=0.1)

// Calculate moving averages

fastMA = sma(close, fastLength)

slowMA = sma(close, slowLength)

// Plot moving averages on the chart

plot(fastMA, color=color.blue, title="Fast MA")

plot(slowMA, color=color.red, title="Slow MA")

// Trading signals

longCondition = crossover(fastMA, slowMA)

shortCondition = crossunder(fastMA, slowMA)

// Position sizing based on percentage risk

riskPerTrade = input(2, title="Risk Per Trade (%)", minval=1, maxval=10, step=0.5)

equity = strategy.equity

lotSize = (equity * riskPercentage) / (riskPerTrade * 100)

strategy.entry("Buy", strategy.long, when=longCondition)

strategy.close("Buy", when=shortCondition)

strategy.entry("Sell", strategy.short, when=shortCondition)

strategy.close("Sell", when=longCondition)

// Plot trades on the chart using plotshape

plotshape(series=longCondition, color=color.green, style=shape.triangleup, location=location.belowbar, size=size.small, title="Buy Signal")

plotshape(series=shortCondition, color=color.red, style=shape.triangledown, location=location.abovebar, size=size.small, title="Sell Signal")

// Alerts

alertcondition(longCondition, title="Buy Signal", message="Buy Signal!")

alertcondition(shortCondition, title="Sell Signal", message="Sell Signal!")