策略概述

该策略是一个结合Heikin Ashi蜡烛线和超级趋势指标的趋势跟踪止损策略。它利用Heikin Ashi蜡烛线过滤市场噪音,超级趋势指标判断趋势方向,并以超级趋势作为动态止损线,实现高效的趋势跟踪和风险控制。

策略原理

- 计算Heikin Ashi蜡烛线:包括开盘价、收盘价、最高价、最低价。

- 计算超级趋势指标:根据ATR和价格计算上轨和下轨。

- 结合Heikin Ashi蜡烛线和超级趋势判断趋势方向。

- 当Heikin Ashi收盘价较前一根K线收盘价更接近超级趋势的上轨时为看涨趋势;当Heikin Ashi收盘价较前一根K线收盘价更接近超级趋势的下轨时为看跌趋势。

- 在看涨趋势中,以超级趋势上轨作为追踪止损线;在看跌趋势中,以超级趋势下轨作为追踪止损线。

策略优势

- 利用Heikin Ashi过滤假突破,识别趋势信号更可靠。

- 超级趋势作为动态止损,最大程度锁定趋势获利,避免回撤过大。

- 结合不同时间周期判断多空,确认高低位信号更可靠。

- 定时平仓功能避免特定时间的非理性行情影响。

策略风险

- 趋势反转时容易止损。可适当宽松止损线降低此风险。

- 超级趋势参数设置不当可能导致止损过宽或过窄。可测试不同参数组合。

- 未考虑资金管理问题。应设置仓位控制。

- 未考虑交易成本。应测算成本影响。

策略优化方向

- 优化超级趋势参数组合,寻找最优参数。

- 增加仓位控制功能。

- 增加成本考量,如手续费、滑点等。

- 可根据趋势强弱灵活调整止损幅度。

- 考虑结合其他指标过滤入场信号。

总结

该策略整合Heikin Ashi和超级趋势两个指标的优点,能捕捉趋势方向,同时利用超级趋势实现自动化的动态跟踪止损,从而锁定趋势利润。策略风险主要来自趋势反转和参数优化,这两个方面都可通过进一步优化获得改进。总体来说,该策略利用指标整合提高了交易系统的稳定性和收益空间。

策略源码

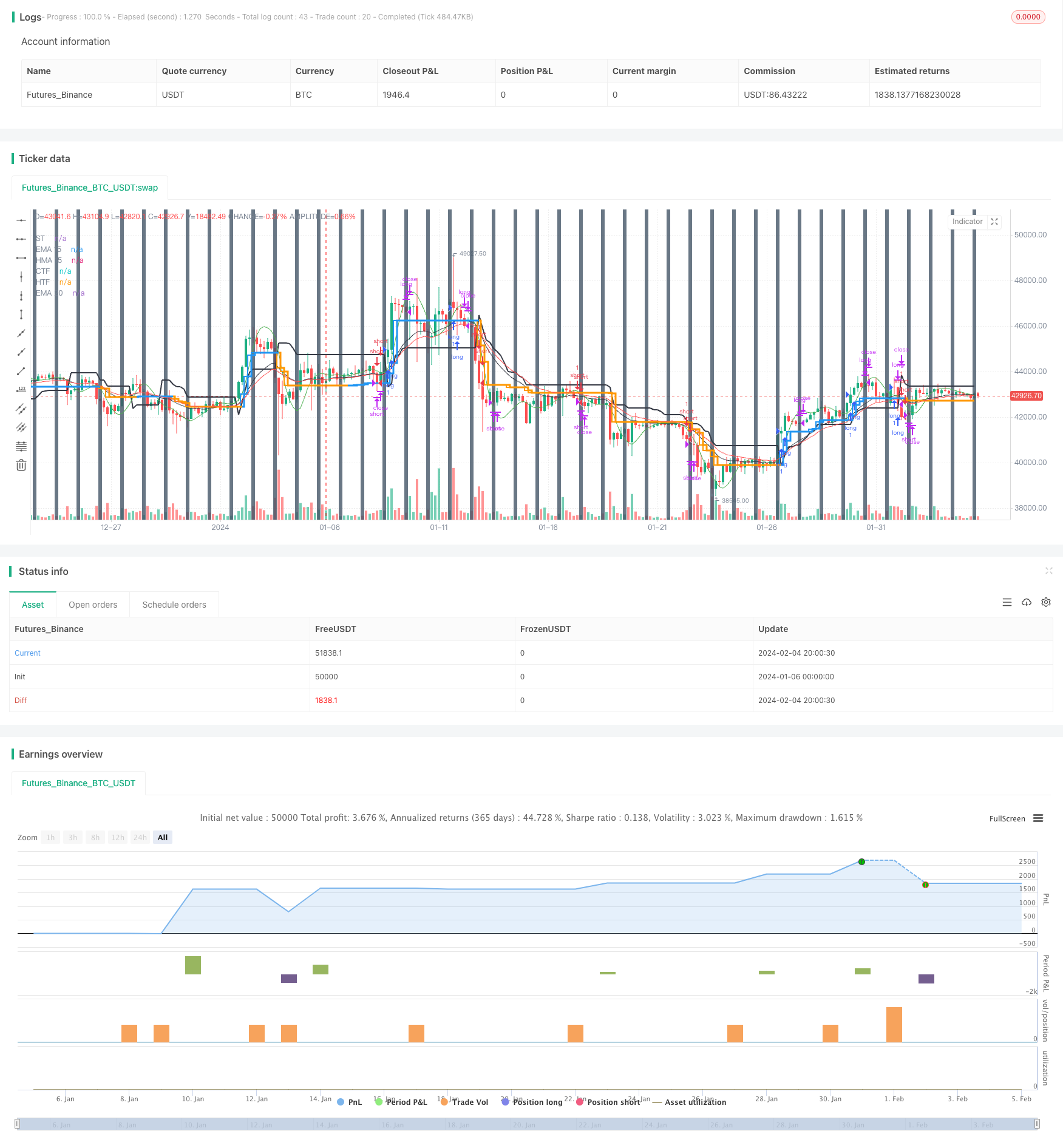

/*backtest

start: 2024-01-06 00:00:00

end: 2024-02-05 00:00:00

period: 4h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © ringashish

//@version=4

strategy("sa-strategy with HTF-TSL", overlay=true)

Pd = input(title="ATR Period", type=input.integer, defval=4)

Factor = input(title="ATR Multiplier", type=input.float, step=0.1, defval=2)

ST= supertrend(Factor, Pd)

heikinashi_close = security(heikinashi(syminfo.tickerid), timeframe.period, close)

heikinashi_low = security(heikinashi(syminfo.tickerid), timeframe.period, low)

heikinashi_open = security(heikinashi(syminfo.tickerid), timeframe.period, open)

heikinashi_high = security(heikinashi(syminfo.tickerid), timeframe.period, high)

heikinashi_close30 = security(heikinashi(syminfo.tickerid), "30", close)

//res1 = input("30", type=input.resolution, title="higher Timeframe")

//CCI TSL

res = input("240",type=input.resolution,title = "Higher Time Frame")

CCI = input(20)

ATR = input(5)

Multiplier=input(1,title='ATR Multiplier')

original=input(false,title='original coloring')

thisCCI = cci(close, CCI)

lastCCI = nz(thisCCI[1])

calcx()=>

bufferDn= high + Multiplier * sma(tr,ATR)

bufferUp= low - Multiplier * sma(tr,ATR)

if (thisCCI >= 0 and lastCCI < 0)

bufferUp := bufferDn[1]

if (thisCCI <= 0 and lastCCI > 0)

bufferDn := bufferUp[1]

if (thisCCI >= 0)

if (bufferUp < bufferUp[1])

bufferUp := bufferUp[1]

else

if (thisCCI <= 0)

if (bufferDn > bufferDn[1])

bufferDn := bufferDn[1]

x = 0.0

x := thisCCI >= 0 ?bufferUp:thisCCI <= 0 ?bufferDn:x[1]

x

tempx = calcx()

calcswap() =>

swap = 0.0

swap := tempx>tempx[1]?1:tempx<tempx[1]?-1:swap[1]

swap

tempswap = calcswap()

swap2=tempswap==1?color.blue:color.orange

swap3=thisCCI >=0 ?color.blue:color.orange

swap4=original?swap3:swap2

//display current timeframe's Trend

plot(tempx,"CTF",color=swap4,transp=0,linewidth=2, style = plot.style_stepline)

htfx = security(syminfo.tickerid,res,tempx[1],lookahead = barmerge.lookahead_on)

htfswap4 = security(syminfo.tickerid,res,swap4[1],lookahead = barmerge.lookahead_on)

plot(htfx,"HTF",color=htfswap4,transp=0,linewidth=3,style = plot.style_stepline)

//supertrend

Supertrend(Factor, Pd) =>

Up=hl2-(Factor*atr(Pd))

Dn=hl2+(Factor*atr(Pd))

TrendUp = 0.0

TrendUp := heikinashi_close[1]>TrendUp[1] ? max(Up,TrendUp[1]) : Up

TrendDown = 0.0

TrendDown := heikinashi_close[1]<TrendDown[1]? min(Dn,TrendDown[1]) : Dn

Trend = 0.0

Trend := heikinashi_close > TrendDown[1] ? 1: heikinashi_close< TrendUp[1]? -1: nz(Trend[1],1)

Tsl = Trend==1? TrendUp: TrendDown

S_Buy = Trend == 1 ? 1 : 0

S_Sell = Trend != 1 ? 1 : 0

[Trend, Tsl]

[Trend,Tsl] = Supertrend(Factor, Pd)

// Security

//ST1_Trend_MTF = security(syminfo.tickerid, res1, Tsl,barmerge.lookahead_on)

//plot(ST1_Trend_MTF, "higher ST")

crossdn = crossunder(heikinashi_close,Tsl) or crossunder(heikinashi_close[1],Tsl) or crossunder(heikinashi_close[2],Tsl) or heikinashi_close < Tsl

crossup = crossover(heikinashi_close,Tsl) or crossover(heikinashi_close[1],Tsl) or crossover(heikinashi_close[2],Tsl) or heikinashi_close > Tsl

plot(Tsl,"ST",color = color.black,linewidth =2)

plot(ema(heikinashi_close,20),"EMA 20",color=color.red)

plot(hma(heikinashi_close,15),"HMA 15",color=color.green)

plot(ema(heikinashi_close,15),"EMA 15",color=color.black)

closedown = (heikinashi_close < hma(heikinashi_close,15) and heikinashi_high > hma(heikinashi_close,15)) or(heikinashi_close < ema(heikinashi_close,20) and heikinashi_high > ema(heikinashi_close,20))

closeup = (heikinashi_close > hma(heikinashi_close,15) and heikinashi_low < hma(heikinashi_close,15)) or (heikinashi_close > ema(heikinashi_close,20) and heikinashi_low < ema(heikinashi_close,20))

buy = heikinashi_open == heikinashi_low and closeup and crossup and close > htfx

//buy = heikinashi_open == heikinashi_low and heikinashi_close > ema(close,20) and heikinashi_low < ema(close,20) and crossup

buyexit = cross(close,tempx) //heikinashi_open == heikinashi_high //and heikinashi_close < ema(close,15) and heikinashi_high > ema(close,15)

//if heikinashi_close30[1] < ST1_Trend_MTF

//sell = heikinashi_open == heikinashi_high and heikinashi_close < ema(close,20) and heikinashi_high > ema(close,20) and rsi(close,14)<60 and crossdn

sell = heikinashi_open == heikinashi_high and closedown and rsi(close,14)<55 and crossdn and close < htfx

sellexit = cross(close,tempx) //heikinashi_open == heikinashi_low //and heikinashi_close > ema(close,15) and heikinashi_low < ema(close,15)

rg = 0

rg := buy ? 1 : buyexit ? 2 : nz(rg[1])

longLogic = rg != rg[1] and rg == 1

longExit = rg != rg[1] and rg == 2

//plotshape(longExit,"exit buy",style = shape.arrowup,location = location.belowbar,color = color.red, text ="buy exit", textcolor = color.red)

//plotshape(longLogic,"BUY",style = shape.arrowup,location = location.belowbar,color = color.green, text ="buy", textcolor= color.green)

nm = 0

nm := sell ? 1 : sellexit ? 2 : nz(nm[1])

shortLogic = nm != nm[1] and nm == 1

shortExit = nm != nm[1] and nm == 2

//plotshape(shortExit,"exit sell",style = shape.arrowup,location = location.belowbar,color = color.red, text ="sell exit", textcolor = color.red)

//plotshape(shortLogic,"SELL",style = shape.arrowup,location = location.belowbar,color = color.green, text ="sell", textcolor= color.green)

//Exit at particular time

ExitHour = input(title="Exit Hour Of Day", type=input.integer, defval=15, step = 5, maxval = 24, minval = 0)

ExitMint = input(title="Exit Minute Of Day", type=input.integer, defval=15, step = 5, maxval = 24, minval = 0)

bgc = input(title="Highlight Background Color?", type=input.bool, defval=true)

mRound(num,rem) => (floor(num/rem)*rem)

exitTime = (hour(time) >= ExitHour and (minute == mRound(ExitMint, timeframe.multiplier))) ? 1 : 0

exitTime := exitTime == 0 ? (hour(time) >= ExitHour and (minute + timeframe.multiplier >= ExitMint)) ? 1 : 0 : exitTime

MarketClose = exitTime and not exitTime[1]

alertcondition(exitTime and not exitTime[1], title="Intraday Session Close Time", message="Close All Positions")

bgcolor(exitTime and not exitTime[1] and bgc ? #445566 : na, transp =40)

longCondition = longLogic

if (longCondition)

strategy.entry("long", strategy.long)

shortCondition = shortLogic

if (shortCondition)

strategy.entry("short", strategy.short)

strategy.close("short", when =cross(close,tempx) or MarketClose)

strategy.close( "long", when =cross(close,tempx) or MarketClose )