概述

本策略名称为“基于峰峰形态的交易策略”,主要利用K线的峰峰形态来确定买入和卖出时机。该策略属于技术分析类策略。

策略原理

该策略通过定义上升峰值(upFractal)和下降峰值(downFractal)来判断K线图形的峰峰形态。

具体来说,上升峰值的判断逻辑是:当前K线的高点是最近n根K线的最高点,并且后续的K线高点都不超过当前K线的高点。

下降峰值的判断逻辑是:当前K线的低点是最近n根K线的最低点,并且后续的K线低点都不低于当前K线的低点。

这里通过布尔变量及循环来判断前n根和后n根K线与当前K线的高低点关系,最终确定上升峰值和下降峰值。

因此,该策略的核心逻辑就是:

- 判断上升峰值和下降峰值

- 上升峰值时做多,下降峰值时做空

优势分析

该策略具有以下优势:

- 峰峰形态容易识别,操作简单

- 利用技术形态,不受基本面影响

- 回撤可能比较小

风险分析

该策略也存在一些风险:

- 峰峰形态判断不准确,可能错过最佳入场时机

- 行情剧烈变动时,止损可能较难确定

- 只依靠形态,忽略了其他因素

对策:

- 调整峰峰形态的参数,优化判断逻辑

- 结合其他指标确定止损位置

- 与基本面分析或其他策略组合使用

优化方向

该策略还可以从以下几个方向进行优化:

- 增加参数调整空间,优化峰峰形态判断

- 加入止损逻辑

- 考虑交易量或波动率等其他指标

- 结合不同时间周期分析

总结

本策略基于峰峰形态原理简单易操作,回撤可能较小。但也存在一定风险,需要与其他分析方法组合使用才能发挥最大效果。下一步将从判断准确性、止损、指标优化等方面进行改进。

策略源码

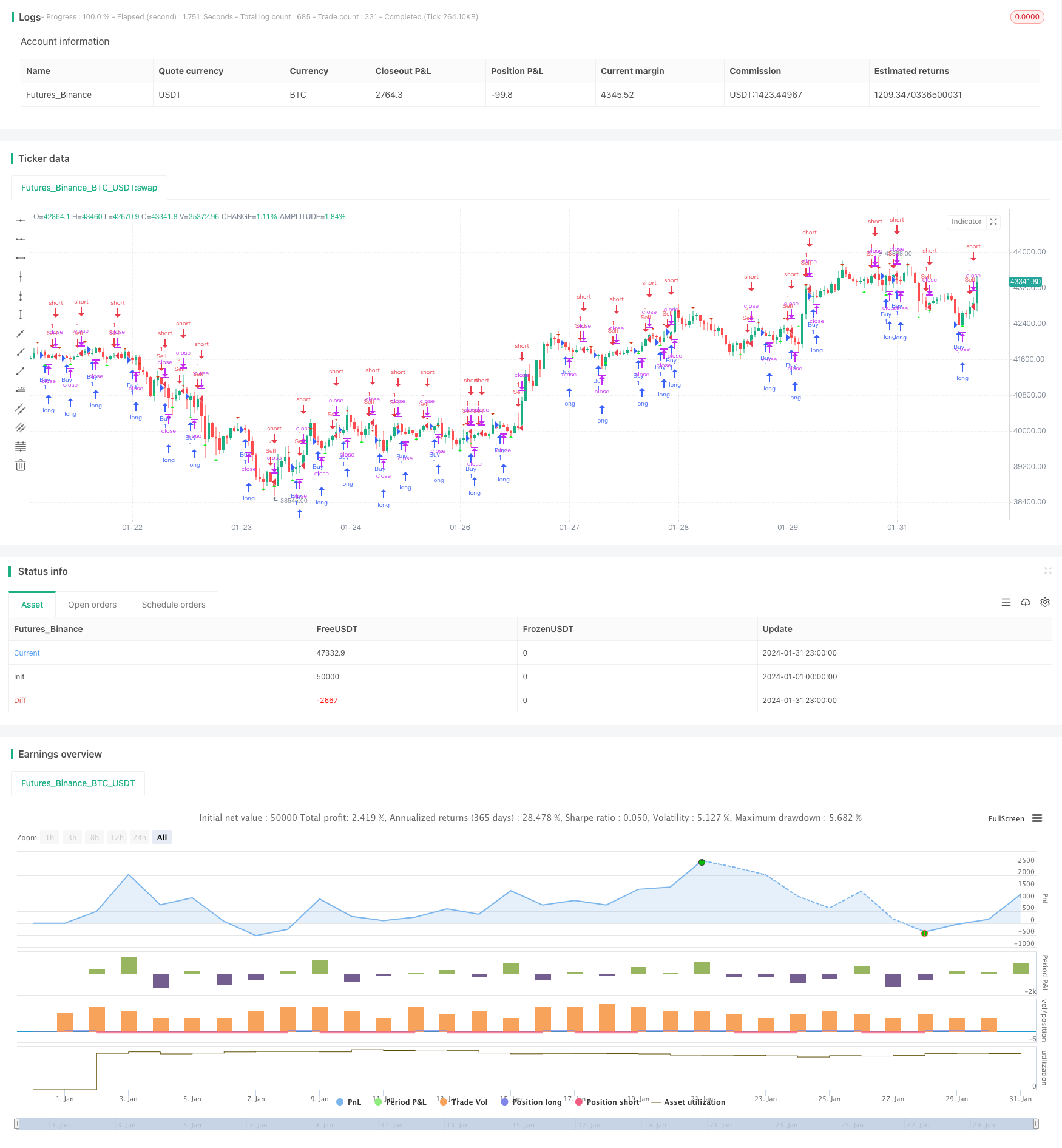

/*backtest

start: 2024-01-01 00:00:00

end: 2024-01-31 23:59:59

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("sanju parmar", shorttitle="sanju trading empire", overlay=true)

// Define "n" as the number of periods and keep a minimum value of 2 for error handling.

n = input.int(title="Periods", defval=2, minval=2)

// UpFractal

bool upflagDownFrontier = true

bool upflagUpFrontier0 = true

bool upflagUpFrontier1 = true

bool upflagUpFrontier2 = true

bool upflagUpFrontier3 = true

bool upflagUpFrontier4 = true

for i = 1 to n

upflagDownFrontier := upflagDownFrontier and (high[n-i] < high[n])

upflagUpFrontier0 := upflagUpFrontier0 and (high[n+i] < high[n])

upflagUpFrontier1 := upflagUpFrontier1 and (high[n+1] <= high[n] and high[n+i + 1] < high[n])

upflagUpFrontier2 := upflagUpFrontier2 and (high[n+1] <= high[n] and high[n+2] <= high[n] and high[n+i + 2] < high[n])

upflagUpFrontier3 := upflagUpFrontier3 and (high[n+1] <= high[n] and high[n+2] <= high[n] and high[n+3] <= high[n] and high[n+i + 3] < high[n])

upflagUpFrontier4 := upflagUpFrontier4 and (high[n+1] <= high[n] and high[n+2] <= high[n] and high[n+3] <= high[n] and high[n+4] <= high[n] and high[n+i + 4] < high[n])

flagUpFrontier = upflagUpFrontier0 or upflagUpFrontier1 or upflagUpFrontier2 or upflagUpFrontier3 or upflagUpFrontier4

upFractal = (upflagDownFrontier and flagUpFrontier)

// downFractal

bool downflagDownFrontier = true

bool downflagUpFrontier0 = true

bool downflagUpFrontier1 = true

bool downflagUpFrontier2 = true

bool downflagUpFrontier3 = true

bool downflagUpFrontier4 = true

for i = 1 to n

downflagDownFrontier := downflagDownFrontier and (low[n-i] > low[n])

downflagUpFrontier0 := downflagUpFrontier0 and (low[n+i] > low[n])

downflagUpFrontier1 := downflagUpFrontier1 and (low[n+1] >= low[n] and low[n+i + 1] > low[n])

downflagUpFrontier2 := downflagUpFrontier2 and (low[n+1] >= low[n] and low[n+2] >= low[n] and low[n+i + 2] > low[n])

downflagUpFrontier3 := downflagUpFrontier3 and (low[n+1] >= low[n] and low[n+2] >= low[n] and low[n+3] >= low[n] and low[n+i + 3] > low[n])

downflagUpFrontier4 := downflagUpFrontier4 and (low[n+1] >= low[n] and low[n+2] >= low[n] and low[n+3] >= low[n] and low[n+4] >= low[n] and low[n+i + 4] > low[n])

flagDownFrontier = downflagUpFrontier0 or downflagUpFrontier1 or downflagUpFrontier2 or downflagUpFrontier3 or downflagUpFrontier4

downFractal = (downflagDownFrontier and flagDownFrontier)

plotshape(downFractal, style=shape.triangleup, location=location.belowbar, offset=-n, color=#18f523, size = size.small)

plotshape(upFractal, style=shape.triangledown, location=location.abovebar, offset=-n, color=#cf3d11, size = size.small)

// Strategy Conditions

longCondition = upFractal

shortCondition = downFractal

// Strategy Entry and Exit

if (longCondition)

strategy.entry("Buy", strategy.long)

if (shortCondition)

strategy.entry("Sell", strategy.short)