概述

布林带突破策略是一个基于布林带指标的简单量化交易策略。该策略利用布林带上下轨提供的动态支撑阻力位,设定价格突破布林带上下轨时的长仓入场和平仓出场条件,以捕捉股价的突破性行情。

策略原理

布林带指标由班迪·布林(John Bollinger)在20世纪80年代提出,它由n天移动平均线及其m倍标准差构成。移动平均线可看作是价格的中轴线,而标准差可看作是价格波动的幅度。标准差数值较大时,表示价格波动较为剧烈;标准差数值较小时,表示价格波动温和。

该策略的入场条件是:当收盘价跌破布林带下轨时,做多入场;当收盘价突破布林带上轨时,做空入场。出场条件是:做多头寸存在时,收盘价突破布林带上轨后平仓;做空头寸存在时,收盘价跌破布林带下轨后平仓。

该策略属于趋势跟踪策略,通过捕捉价格突破布林带上下轨的趋势性突破,盈利模式是通过趋势行情扩大头寸盈利。

策略优势

使用布林带指标作为动态的支撑阻力位,避免使用固定的价格水平,从而适应市场的变化

策略参考了趋势和波动率, Entscheidungen 不仅基于价格水平,也基于市场波动率,可以减少假信号

突破框架简单直接,容易理解和实施

可灵活调整布林带参数,适用于不同品种和参数市场

风险分析

布林带指标参数设置不当可能导致交易信号过于频繁,产生过多不必要的交易

突破信号可能是短期的价格扰动,不能持续趋势,可能产生错误交易

策略没有考虑止损,存在一定的决策风险和损失控制风险

仅基于技术指标,没有结合基本面信息,可能错过重要的基本面趋势转折点

没有考虑到不同市场品种的特点,盈亏情况可能受特定市场影响

策略优化方向

优化布林带参数,提高参数鲁棒性

加入止损机制,控制单笔损失

结合不同时间周期的布林带,构建多周期交易决策

结合交易量,避免部分假突破信号

添加基本面因素判别,确定入场时机和头寸规模

测试不同市场品种的数据,评估策略跨品种适应性

总结

布林带突破策略是一个简单直观的趋势跟踪策略。它利用布林带指标提供的动态支撑阻力判定价格趋势性突破,构建长仓入场和平仓出场条件。策略优势是框架简单,容易实现,能捕捉价格趋势性机会。需要注意控制风险,避免产生过于频繁的交易。通过多方面测试和优化,布林带突破策略可以成为一个有效的量化交易策略选择。

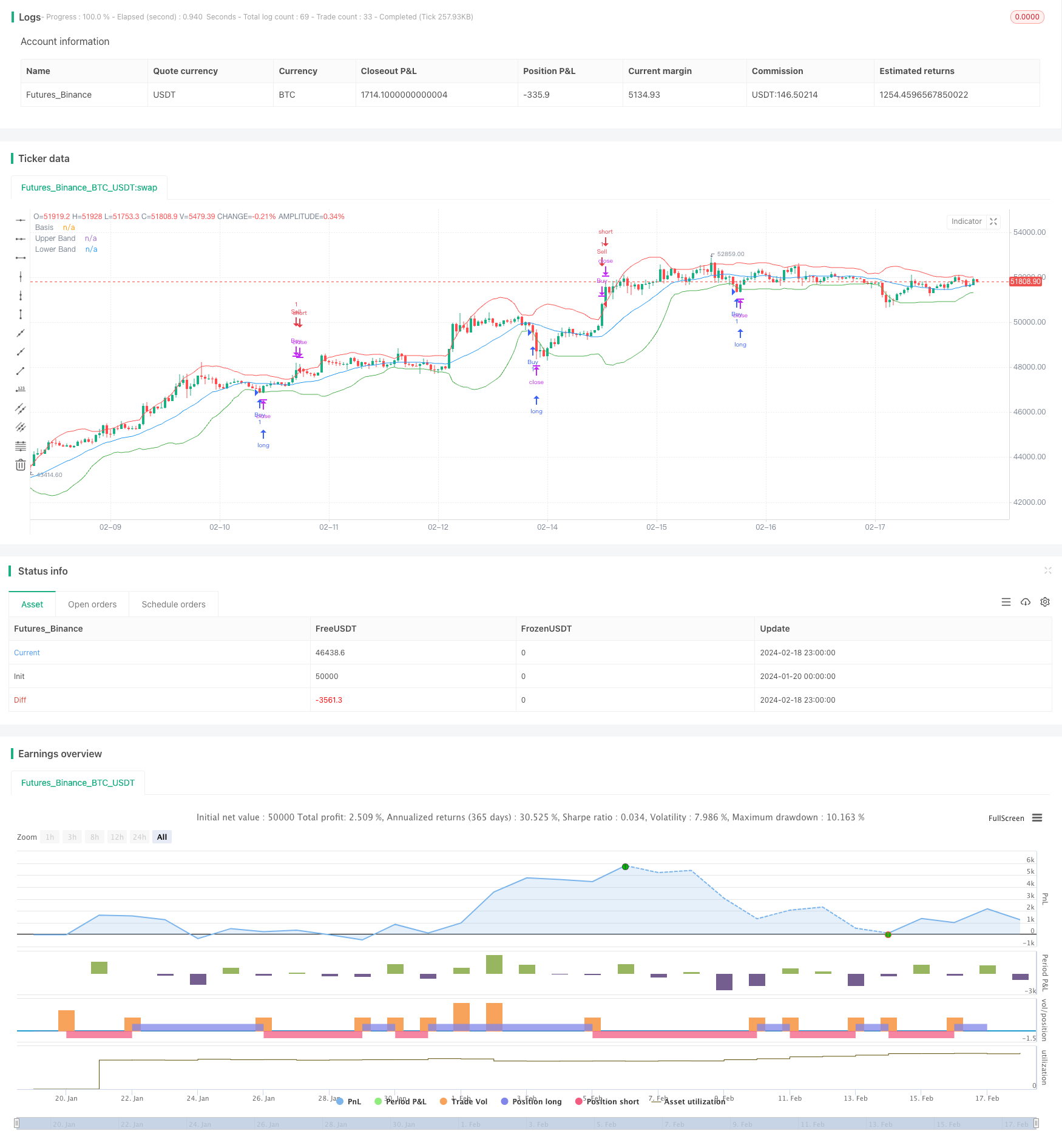

/*backtest

start: 2024-01-20 00:00:00

end: 2024-02-19 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("Bollinger Bands Strategy", overlay=true)

length = input.int(20, title="Bollinger Bands Length", minval=1)

maType = input.string("SMA", title="Basis MA Type", options=["SMA", "EMA", "SMMA (RMA)", "WMA", "VWMA"])

src = input(close, title="Source")

mult = input.float(2.0, title="StdDev Multiplier", minval=0.001, maxval=50)

offset = input.int(0, title="Offset", minval=-500, maxval=500)

ma(source, length, _type) =>

switch _type

"SMA" => ta.sma(source, length)

"EMA" => ta.ema(source, length)

"SMMA (RMA)" => ta.rma(source, length)

"WMA" => ta.wma(source, length)

"VWMA" => ta.vwma(source, length)

basis = ma(src, length, maType)

dev = mult * ta.stdev(src, length)

upper = basis + dev + offset

lower = basis - dev - offset

// Define strategy entry and exit conditions

strategy.entry("Buy", strategy.long, when=close < lower)

strategy.close("Buy", when=close > upper)

strategy.entry("Sell", strategy.short, when=close > upper)

strategy.close("Sell", when=close < lower)

// Plotting the Bollinger Bands

plot(basis, color=color.blue, title="Basis")

plot(upper, color=color.red, title="Upper Band")

plot(lower, color=color.green, title="Lower Band")