概述

这是一个基于相对强弱指数(RSI)的简单密码货币交易策略。它通过计算RSI值来判断市场是否处于超买或超卖状态,从而产生交易信号。该策略适用于中短期交易。

策略原理

该策略首先计算长度为14天的RSI值。然后它判断RSI值是否低于30这个超卖线。如果低于,则产生买入信号;如果高于70这个超买线,则产生卖出信号。

当RSI值上穿超卖线时,关闭买入头寸;当RSI值下穿超买线时,关闭卖出头寸。

优势分析

- 策略逻辑简单清晰,容易理解和实现

- 利用RSI这一成熟指标判断市场状况

- 可自定义参数,适应不同市场环境

- 回撤风险较小

风险分析

- 市场突发事件可能导致暂时失效

- 固定参数可能引起过度交易

- 仅基于单一指标,容易产生假信号

可以通过动态调整参数、结合多个指标、设置止损来缓解上述风险。

优化方向

该策略可以从以下几个方面进行优化:

利用移动平均线等其他指标进行组合,形成多重确认;

添加趋势判断规则,避免音调市;

设置交易量或止损规则控制风险;

优化RSI参数,使其更符合加密货币高频交易的特点。

总结

本策略overall是一个非常基础的RSI策略,通过一个成熟指标判断超买超卖形成交易信号。优点是简单易用,实践风险也较小。但仅凭单一指标,也容易产生假信号。我们可以通过多种方式对其进行扩展与优化,使其更稳定、适应性更强。

策略源码

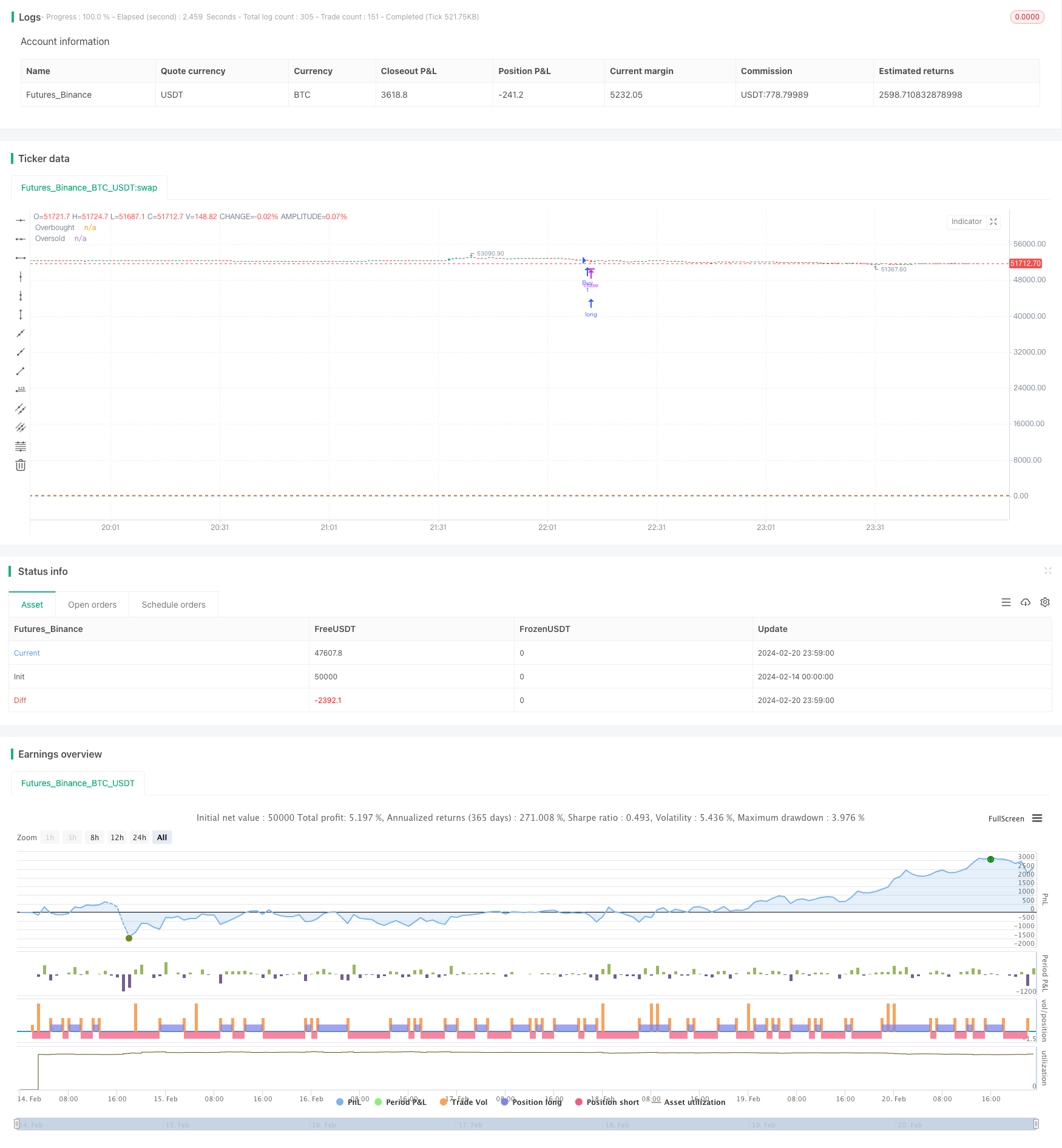

/*backtest

start: 2024-02-14 00:00:00

end: 2024-02-21 00:00:00

period: 1m

basePeriod: 1m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=4

strategy("Larry Williams Simple Crypto Strategy", overlay=true)

// Параметры стратегии

length = input(14, title="Length")

overboughtLevel = input(70, title="Overbought Level")

oversoldLevel = input(30, title="Oversold Level")

// Вычисление RSI

rsiValue = rsi(close, length)

// Определение условий для входа в позицию

enterLong = rsiValue < oversoldLevel

enterShort = rsiValue > overboughtLevel

// Открытие позиции

if enterLong

strategy.entry("Buy", strategy.long)

if enterShort

strategy.entry("Sell", strategy.short)

// Закрытие позиции

if enterLong and rsiValue > oversoldLevel

strategy.close("Buy")

if enterShort and rsiValue < overboughtLevel

strategy.close("Sell")

// Отрисовка уровней

hline(overboughtLevel, "Overbought", color=color.red)

hline(oversoldLevel, "Oversold", color=color.green)